Dear Homeowner, Firstly, we would like to thank you for contacting us

Dear Homeowner, Firstly, we would like to thank you for contacting us

Dear Homeowner, Firstly, we would like to thank you for contacting us

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FOR OFFICE USE ONLY: Counselor: ____________________________________________ No. _________________<br />

MORTGAGE DEFAULT AND FORECLOSURE COUNSELING<br />

CONTRACT, AUTHORIZATIONS AND DISCLOSURES<br />

CONTRACT START DATE: ___________________________________________________________________ (Note: Contract valid <strong>for</strong> 1 year from start date)<br />

CANCELLATION<br />

You may cancel this contract without penalty or obligation <strong>for</strong> any reason and at any time by giving ten (10) day’s written notice of rescission <strong>to</strong> Family Services, Inc.<br />

PAYMENTS<br />

Family Services, Inc. cannot predict what, if any, <strong>you</strong>r payment arrangement will be with <strong>you</strong>r mortgage lender. With <strong>you</strong>r permission <strong>we</strong> will negotiate with <strong>you</strong>r mortgage lender and hope <strong>to</strong> achieve a<br />

positive outcome that <strong>you</strong> will be able <strong>to</strong> af<strong>for</strong>d. We can never guarantee that <strong>we</strong> will be able <strong>to</strong> help <strong>you</strong>r situation. Family Services, Inc. and our counselors do not charge a fee <strong>to</strong> <strong>you</strong> <strong>for</strong> <strong>for</strong>eclosure<br />

counseling services.<br />

DESCRIPTION OF SERVICES<br />

Family Services, Inc. will work with <strong>you</strong> <strong>to</strong> prepare a budget and the results of that budget, and <strong>you</strong>r specific mortgage issues, will determine what action <strong>you</strong>r counselor will recommend. Your<br />

counselor will explain the vario<strong>us</strong> options that he or she thinks might work <strong>for</strong> <strong>you</strong>r situation. With <strong>you</strong>r permission, <strong>you</strong>r counselor will negotiate with <strong>you</strong>r mortgage lender if that is a feasible option<br />

<strong>for</strong> <strong>you</strong>r situation. We can never guarantee that <strong>we</strong> will be able <strong>to</strong> help <strong>you</strong>r situation.<br />

All contracts are valid <strong>for</strong> one year from the start date as listed above. All negotiations depend on <strong>you</strong> providing requested in<strong>for</strong>mation and on <strong>you</strong>r mortgage lender responding. Some lenders are 5 <strong>to</strong> 6<br />

months behind in reviewing modification packages. After one year, the contract may be extended upon consent of both parties.<br />

DISCLOSURES<br />

• Credit counseling services are not suitable <strong>for</strong> all consumers and <strong>you</strong> may request in<strong>for</strong>mation about other ways, including bankruptcy, <strong>to</strong> deal with indebtedness.<br />

• We, Family Services, Inc. may receive grant funds from vario<strong>us</strong> sources <strong>for</strong> providing <strong>for</strong>eclosure prevention counseling services <strong>to</strong> <strong>you</strong>.<br />

• We cannot require a voluntary contribution from <strong>you</strong> <strong>for</strong> a service provided by <strong>us</strong> <strong>to</strong> <strong>you</strong>.<br />

• If <strong>you</strong> have any complaints about the credit counseling services received <strong>you</strong> may contact the South Carolina Department of Consumer Affairs at 1-800-922-1594 or 803-734-4200<br />

• You are in no way obligated <strong>to</strong> receive any other services offered by Family Services, Inc. or any of our service providers or partners.<br />

AUTHORIZATION TO ACCESS CREDIT REPORT INFORMATION<br />

I/We hereby authorize Consumer Credit Counseling Services (CCCS), a division of Family Services, Inc., <strong>to</strong> access my/our credit in<strong>for</strong>mation s<strong>to</strong>red at one or more credit reposi<strong>to</strong>ries. I fully<br />

understand the following:<br />

• This will appear on my credit bureau report as an inquiry.<br />

• The Credit Bureau Reposi<strong>to</strong>ries will NOT allow a copy of this report <strong>to</strong> be given <strong>to</strong> me personally, but I/<strong>we</strong> may request a free copy from the reposi<strong>to</strong>ries.<br />

• CCCS does not guarantee the accuracy of the in<strong>for</strong>mation reported on the credit report nor the analysis done by the counselor.<br />

• I/We agree that any disputes regarding the accuracy or completeness of said in<strong>for</strong>mation will be directed <strong>to</strong> the source Reposi<strong>to</strong>ry (Transunion, Experian, Equifax).<br />

• I/We give permission <strong>for</strong> NFMC program administra<strong>to</strong>rs and/or evalua<strong>to</strong>rs <strong>to</strong> follow-up with me <strong>for</strong> up <strong>to</strong> three (3) years from the date of this signed <strong>for</strong>m <strong>for</strong> the purposes of program<br />

evaluation.<br />

FRAUD POLICY<br />

Family Services, Inc. (the Company) is committed <strong>to</strong> preventing, identifying, and reporting any fraudulent activity related <strong>to</strong> the Company’s services, activities and administration of grants. Fraud may<br />

include but is not limited <strong>to</strong> false statements provided by or <strong>to</strong> staff, contrac<strong>to</strong>rs, clients, beneficiaries and stakeholders. Fraudulent activities may include but are not limited <strong>to</strong> knowingly<br />

misrepresenting income or expenses, assisting or counseling anyone <strong>to</strong> misrepresent facts or circumstances related <strong>to</strong> eligibility <strong>for</strong> programs or benefits, bribery, kickbacks, theft or embezzlement,<br />

<strong>for</strong>gery or alteration of documents, destruction or concealment of records, profiting from insider knowledge, or a conflict of interest. The Company will investigate any reports of fraud. The Company<br />

reserves the right <strong>to</strong> involve law en<strong>for</strong>cement authorities in its investigation. Any documented fraudulent activity may result in administrative or criminal action being taken against those involved<br />

including termination from any program sponsored by the Company or termination from employment by the Company. The Company will not retaliate against any party who reports fraud, criminal<br />

activities or other program irregularities. Any s<strong>us</strong>pected fraudulent activity should be reported <strong>to</strong> the Company’s currently appointed Risk Manager with sufficient specificity <strong>to</strong> facilitate an<br />

investigation.<br />

PRIVACY POLICY<br />

Our agency is committed <strong>to</strong> assuring the privacy of individuals and/or families who have contacted <strong>us</strong> <strong>for</strong> assistance. We realize that the concerns <strong>you</strong> bring <strong>us</strong> are highly personal in nature. We assure<br />

<strong>you</strong> that all in<strong>for</strong>mation shared both orally and in writing will be managed within legal and ethical considerations. The following are examples of how this data may be <strong>us</strong>ed:<br />

ALL CLIENTS<br />

1. To assist <strong>us</strong> in our work with <strong>you</strong>, our staff may seek supervision/consultation with professional colleagues within the agency and, where appropriate and necessary, with other resources in<br />

the community.<br />

2. For the purpose of evaluating our services, gathering valuable research in<strong>for</strong>mation and designing future programs, <strong>we</strong> may report case file in<strong>for</strong>mation <strong>to</strong> vario<strong>us</strong> gran<strong>to</strong>rs and stakeholders.<br />

COUNSELING ONLY<br />

3. For counseling only clients, <strong>we</strong> will confirm with <strong>you</strong>r credi<strong>to</strong>rs if asked:<br />

a. Verification of appointment<br />

b. Date of counseling<br />

c. Disposition: i.e.,<br />

1) Client will handle affairs on their own<br />

2) Pending action<br />

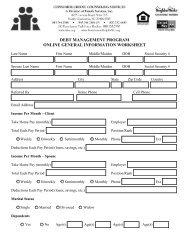

MORTGAGE DEFAULT/DEBT MANAGEMENT<br />

4. For clients needing our intervention on <strong>you</strong>r behalf through Mortgage Default or Debt Management, <strong>we</strong> will disclose the following in<strong>for</strong>mation <strong>to</strong> <strong>you</strong>r lender/credi<strong>to</strong>rs:<br />

• Your address and home phone number, if published<br />

• Total debt in<strong>for</strong>mation<br />

• Income, net and gross<br />

• Living expenses<br />

• A list of <strong>you</strong>r credi<strong>to</strong>rs<br />

• Personal in<strong>for</strong>mation concerning <strong>you</strong>r financial circumstances, but not lifestyle or personal habits<br />

• Place of employment will be verified only<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\Contract Authorizations and Disclosures.doc Version March11