Dear Homeowner, Firstly, we would like to thank you for contacting us

Dear Homeowner, Firstly, we would like to thank you for contacting us

Dear Homeowner, Firstly, we would like to thank you for contacting us

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Dear</strong> <strong>Homeowner</strong>,<br />

<strong>Firstly</strong>, <strong>we</strong> <strong>would</strong> <strong>like</strong> <strong>to</strong> <strong>thank</strong> <strong>you</strong> <strong>for</strong> <strong>contacting</strong> <strong>us</strong>; <strong>we</strong> understand the burden being behind on<br />

mortgage payments creates <strong>for</strong> <strong>you</strong> and <strong>you</strong>r family. Your file will be assigned <strong>to</strong> one of our<br />

<strong>for</strong>eclosure prevention counselors once <strong>we</strong> receive the enclosed application. We are here <strong>to</strong> help, if <strong>you</strong><br />

have any questions <strong>you</strong> can reach <strong>us</strong> at 843-735-7862.<br />

So that <strong>we</strong> may serve <strong>you</strong> in a timely manner, please complete and return the enclosed documents as<br />

soon as possible, with signature(s) where indicated. Please also be sure <strong>to</strong> include the required<br />

supporting documents requested on the packet instruction <strong>for</strong>m. Until <strong>we</strong> receive a complete packet<br />

our counselors are unable <strong>to</strong> fully assist with lender negotiation. You may return <strong>to</strong> our attention either<br />

by fax at (843) 735-5898 or by mail at the address at the <strong>to</strong>p of this letter.<br />

The <strong>Homeowner</strong>ship Resource Center, a division of Family Services, Inc., has been assisting<br />

homeowners in the Low Country since 2003 and now serves the entire state of South Carolina. We are<br />

a Non-Profit HUD Counseling Agency. The <strong>Homeowner</strong>ship Resource Center (HRC) never<br />

charges a fee <strong>for</strong> assisting homeowners <strong>to</strong> remain in their home.<br />

This agency <strong>would</strong> <strong>like</strong> <strong>to</strong> again <strong>thank</strong> <strong>you</strong> <strong>for</strong> the opportunity <strong>to</strong> help <strong>you</strong> save <strong>you</strong>r home from<br />

<strong>for</strong>eclosure sale. We are experienced and relentless in negotiating with a lender <strong>to</strong> modify the mortgage<br />

payment <strong>to</strong> one that the homeowner can af<strong>for</strong>d. There are numero<strong>us</strong> fac<strong>to</strong>rs involved that determine<br />

the ultimate outcome of negotiations with <strong>you</strong>r lender and the HRC stands ready <strong>to</strong> help.<br />

Call our office <strong>for</strong> further in<strong>for</strong>mation at 843-735-7862 or visit our <strong>we</strong>bsite at www.fsisc.org <strong>for</strong><br />

additional instruction on completing the application enclosed.<br />

Remember NEVER pay a fee <strong>to</strong> anyone <strong>to</strong> help <strong>you</strong> negotiate a modification agreement with<br />

<strong>you</strong>r lender.<br />

Our experienced and confident staff looks <strong>for</strong>ward <strong>to</strong> working with <strong>you</strong> soon.<br />

Sincerely,<br />

Debbie Kidd, Direc<strong>to</strong>r

DIRECTIONS FOR DEFAULT FORM PACKET<br />

COST:<br />

We do not charge any fees <strong>for</strong> our default counseling services.<br />

FORMS:<br />

Please fill out the following <strong>for</strong>ms completely and return <strong>to</strong> The <strong>Homeowner</strong>ship Resource Center. Along with<br />

<strong>you</strong>r <strong>for</strong>ms, please submit the following:<br />

1) Your mortgage statement and any other correspondence from <strong>you</strong>r lender or at<strong>to</strong>rney<br />

2) Two (2) pay stubs <strong>for</strong> everyone in the ho<strong>us</strong>ehold along with proof of any other <strong>for</strong>m of income<br />

3) Two (2) of <strong>you</strong>r most current bank statements<br />

4) Most Recent Tax Return with W-2’s<br />

5) Recent Utility Bill<br />

Please be certain <strong>you</strong>r name is on EVERYTHING <strong>you</strong> submit <strong>to</strong> <strong>us</strong>. All <strong>for</strong>ms m<strong>us</strong>t be signed and all<br />

supporting in<strong>for</strong>mation m<strong>us</strong>t be received be<strong>for</strong>e <strong>we</strong> can begin working <strong>you</strong>r case.<br />

Questions? Call (843) 735.7862<br />

Return completed <strong>for</strong>ms and all supporting documentation <strong>to</strong>:<br />

Via Mail or In Person: Via Fax:<br />

The <strong>Homeowner</strong>ship Resource Center (843) 735-5898<br />

Family Services, Inc. Attn: The <strong>Homeowner</strong>ship Resource Center<br />

4925 Lacross Road, Suite 215<br />

North Charles<strong>to</strong>n, SC 29406<br />

Via Email:<br />

Scan completed documents and email <strong>to</strong>: trivers@fsisc.org<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Misc Forms\Default Form Packet Directions.docx Version: March11

SUPPLEMENTAL CLIENT INFORMATION | PRE-FORECLOSURE PARTICIPANT PROFILE<br />

Education:<br />

(Highest Level<br />

Completed)<br />

Employer<br />

Name:<br />

How Long have <strong>you</strong> been in home? When did <strong>you</strong> start current loan?<br />

Estimated Value of Home: Balance on Mortgage:<br />

Interest Rate:<br />

Fixed Rate under 8%<br />

Fixed Rate over 8%<br />

Adj<strong>us</strong>table Rate Mortgage under 8%<br />

Adj<strong>us</strong>table Rate Mortgage over 8%<br />

Have <strong>you</strong> been contacted by an at<strong>to</strong>rney? YES NO<br />

If Yes – Provide At<strong>to</strong>rney Name:<br />

Phone Number:<br />

Borro<strong>we</strong>r<br />

Elementary / Middle School<br />

High School / GED<br />

Technical Degree / Associates Degree<br />

Bachelors Degree<br />

Graduate School<br />

How long have <strong>you</strong> been with this employer?<br />

Position:<br />

Are <strong>you</strong> self-employed? YES NO<br />

Are <strong>you</strong> a veteran? YES NO<br />

Ho<strong>us</strong>ehold<br />

Stat<strong>us</strong>:<br />

(Check One)<br />

Single<br />

Female Single Parent Ho<strong>us</strong>ehold<br />

Male Single Parent Ho<strong>us</strong>ehold<br />

Married without Dependent<br />

Married with Dependents<br />

Two or More Unrelated Adults<br />

Other: Check any that apply<br />

Separated<br />

Divorced<br />

Wido<strong>we</strong>d<br />

Please indicate Number of Dependents in<br />

Ho<strong>us</strong>ehold: ________<br />

Which county is the property in?<br />

Education:<br />

(Highest Level<br />

Completed)<br />

Employer<br />

Name:<br />

Months Past Due:<br />

Co-Borro<strong>we</strong>r<br />

Elementary / Middle School<br />

High School / GED<br />

Technical Degree / Associates Degree<br />

Bachelors Degree<br />

Graduate School<br />

How long have <strong>you</strong> been with this employer?<br />

Position:<br />

Are <strong>you</strong> self-employed? YES NO<br />

Are <strong>you</strong> a veteran? YES NO<br />

Ho<strong>us</strong>ehold Yearly<br />

Income Range:<br />

(Check One)<br />

COMPLETE ALL QUESTION ON THIS PAGE<br />

May <strong>we</strong> contact <strong>you</strong> by phone? YES / NO Best Time <strong>to</strong> call? Best Number <strong>to</strong> call?<br />

Ho<strong>us</strong>ehold In<strong>for</strong>mation<br />

Loan In<strong>for</strong>mation<br />

Under $10,000<br />

$11,000 - $15,000<br />

$16,000 - $20,000<br />

$21,000 - $25,000<br />

$26,000 - $30,000<br />

$31,000 - $35,000<br />

$36,000 - $40,000<br />

$41,000 - $45,000<br />

$46,000 - $50,000<br />

$51,000 - $55,000<br />

$56,000 - $60,000<br />

Over $60,000<br />

If over $60,000, Please Indicate<br />

Estimated Ho<strong>us</strong>ehold Income:<br />

$<br />

Current<br />

30 – 60 Days<br />

61 – 90 Days<br />

90 – 120 Days<br />

120 + Days<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\profile supplement.docx Version: March11<br />

Page 1a of 3

SUPPLEMENTAL HARDSHIP AFFIDAVIT | EXPLANATION OF FINANCIAL DIFFICULTIES<br />

Please <strong>us</strong>e below space <strong>to</strong> write a brief description of financial hardship<br />

_______________________________________________________________ _________________<br />

Borro<strong>we</strong>r (signature) Date<br />

_______________________________________________________________ _________________<br />

Co-Borro<strong>we</strong>r (signature) Date<br />

COMPLETE ALL QUESTIONS ON THIS PAGE<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\hardship affidavit.docx Version: March11<br />

Page 3a of 3

Dodd-Frank Certification<br />

The following in<strong>for</strong>mation is requested by the federal government in accordance with the Dodd-<br />

Frank Wall Street Re<strong>for</strong>m and Consumer Protection Act (Pub. L. 111-203). You are required<br />

<strong>to</strong> furnish this in<strong>for</strong>mation. The law provides that no person shall be eligible <strong>to</strong> receive<br />

assistance from the Making Home Af<strong>for</strong>dable Program, authorized under the Emergency<br />

Economic Stabilization Act of 2008 (12 U.S.C. 5201 et seq.), or any other mortgage assistance<br />

program authorized or funded by that Act, if such person, in connection with a mortgage or real<br />

estate transaction, has been convicted, within the last 10 years, of any one of the following: (A)<br />

felony larceny, theft, fraud or <strong>for</strong>gery, (B) money laundering or (C) tax evasion.<br />

Borro<strong>we</strong>r Co-Borro<strong>we</strong>r<br />

I have not been convicted within the last<br />

10 years of any one of the following in<br />

connection with a mortgage or real<br />

estate transaction:<br />

(a) felony larceny, theft, fraud or <strong>for</strong>gery,<br />

(b) money laundering or<br />

(c) tax evasion<br />

I have not been convicted within the last<br />

10 years of any one of the following in<br />

connection with a mortgage or real<br />

estate transaction:<br />

(a) felony larceny, theft, fraud or <strong>for</strong>gery,<br />

(b) money laundering or<br />

(c) tax evasion<br />

In making this certification, I/<strong>we</strong> certify under penalty of perjury that all of the in<strong>for</strong>mation in this<br />

document is truthful and that I/<strong>we</strong> understand that the Servicer, the U.S. Department of the<br />

Treasury, or their agents may investigate the accuracy of my statements by per<strong>for</strong>ming routine<br />

background checks, including au<strong>to</strong>mated searches of federal, state and county databases, <strong>to</strong><br />

confirm that I/<strong>we</strong> have not been convicted of such crimes. I/<strong>we</strong> also understand that knowingly<br />

submitting false in<strong>for</strong>mation may violate Federal law.<br />

______________________________________ ___________<br />

Borro<strong>we</strong>r Signature Date<br />

______________________________________ ___________<br />

Co-Borro<strong>we</strong>r Signature Date

AUTHORIZATION TO RELEASE INFORMATION<br />

To: _____________________________________________________________________<br />

RE: Account Number: ______________________________________________________<br />

(To be completed by staff)<br />

Borro<strong>we</strong>r’s Name: _________________________________________________________<br />

Address: _________________________________________________________________<br />

_________________________________________________________________________<br />

<strong>Dear</strong> Sir or Madam:<br />

I am currently working with The <strong>Homeowner</strong>ship Resource Center, a division of Family<br />

Services, Inc. I herby authorize <strong>you</strong> <strong>to</strong> release any and all in<strong>for</strong>mation concerning my<br />

financial in<strong>for</strong>mation, verbally, written and otherwise, <strong>to</strong> Family Services, Inc at the<br />

counselors’ request.<br />

• I give Family Services, Inc., permission <strong>to</strong> share my personal & financial<br />

in<strong>for</strong>mation with outside resources that the counselor feels <strong>would</strong> be helpful in<br />

saving my home from <strong>for</strong>eclosure. (i.e. – lenders, inves<strong>to</strong>rs, real<strong>to</strong>rs and/or credit<br />

counselors.) I understand that I am not obligated <strong>to</strong> <strong>us</strong>e any of the services offered<br />

<strong>to</strong> me.<br />

• I understand that Family Services, Inc. is a HUD-approved non-profit agency and,<br />

as such, may be required <strong>to</strong> provide upon request personal and financial<br />

in<strong>for</strong>mation related <strong>to</strong> my case <strong>to</strong> outside agencies. (i.e. – HUD, NeighborWorks®<br />

America, National Foreclosure Mitigation Counseling Program and other gran<strong>to</strong>rs.)<br />

• I give permission <strong>for</strong> NFMC program administra<strong>to</strong>rs and/or evalua<strong>to</strong>rs <strong>to</strong> follow-up<br />

with me <strong>for</strong> up <strong>to</strong> three (3) years from the date of this signed <strong>for</strong>m <strong>for</strong> the purposes<br />

of program evaluation.<br />

Sincerely,<br />

_____________________________ __________________________ _____________<br />

Sign name here Print name here Last 4 of Social<br />

________________________________ ____________________________ ______________<br />

Sign name here (co-applicant) Print name here (co-applicant) Last 4 of Social<br />

Date: ___________________________<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\Authorization <strong>to</strong> Release In<strong>for</strong>mation.docx Version: March11

AUTHORIZATION TO RELEASE INFORMATION<br />

To: _____________________________________________________________________<br />

RE: Account Number: ______________________________________________________<br />

(To be completed by staff)<br />

Borro<strong>we</strong>r’s Name: _________________________________________________________<br />

Address: _________________________________________________________________<br />

_________________________________________________________________________<br />

<strong>Dear</strong> Sir or Madam:<br />

I am currently working with The <strong>Homeowner</strong>ship Resource Center, a division of Family<br />

Services, Inc. I herby authorize <strong>you</strong> <strong>to</strong> release any and all in<strong>for</strong>mation concerning my<br />

financial in<strong>for</strong>mation, verbally, written and otherwise, <strong>to</strong> Family Services, Inc at the<br />

counselors’ request.<br />

• I give Family Services, Inc., permission <strong>to</strong> share my personal & financial<br />

in<strong>for</strong>mation with outside resources that the counselor feels <strong>would</strong> be helpful in<br />

saving my home from <strong>for</strong>eclosure. (i.e. – lenders, inves<strong>to</strong>rs, real<strong>to</strong>rs and/or credit<br />

counselors.) I understand that I am not obligated <strong>to</strong> <strong>us</strong>e any of the services offered<br />

<strong>to</strong> me.<br />

• I understand that Family Services, Inc. is a HUD-approved non-profit agency and,<br />

as such, may be required <strong>to</strong> provide upon request personal and financial<br />

in<strong>for</strong>mation related <strong>to</strong> my case <strong>to</strong> outside agencies. (i.e. – HUD, NeighborWorks®<br />

America, National Foreclosure Mitigation Counseling Program and other gran<strong>to</strong>rs.)<br />

• I give permission <strong>for</strong> NFMC program administra<strong>to</strong>rs and/or evalua<strong>to</strong>rs <strong>to</strong> follow-up<br />

with me <strong>for</strong> up <strong>to</strong> three (3) years from the date of this signed <strong>for</strong>m <strong>for</strong> the purposes<br />

of program evaluation.<br />

Sincerely,<br />

_____________________________ __________________________ _____________<br />

Sign name here Print name here Last 4 of Social<br />

________________________________ ____________________________ ______________<br />

Sign name here (co-applicant) Print name here (co-applicant) Last 4 of Social<br />

Date: ___________________________<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\Authorization <strong>to</strong> Release In<strong>for</strong>mation.docx Version: March11

FOR OFFICE USE ONLY: Counselor: ____________________________________________ No. _________________<br />

MORTGAGE DEFAULT AND FORECLOSURE COUNSELING<br />

CONTRACT, AUTHORIZATIONS AND DISCLOSURES<br />

CONTRACT START DATE: ___________________________________________________________________ (Note: Contract valid <strong>for</strong> 1 year from start date)<br />

CANCELLATION<br />

You may cancel this contract without penalty or obligation <strong>for</strong> any reason and at any time by giving ten (10) day’s written notice of rescission <strong>to</strong> Family Services, Inc.<br />

PAYMENTS<br />

Family Services, Inc. cannot predict what, if any, <strong>you</strong>r payment arrangement will be with <strong>you</strong>r mortgage lender. With <strong>you</strong>r permission <strong>we</strong> will negotiate with <strong>you</strong>r mortgage lender and hope <strong>to</strong> achieve a<br />

positive outcome that <strong>you</strong> will be able <strong>to</strong> af<strong>for</strong>d. We can never guarantee that <strong>we</strong> will be able <strong>to</strong> help <strong>you</strong>r situation. Family Services, Inc. and our counselors do not charge a fee <strong>to</strong> <strong>you</strong> <strong>for</strong> <strong>for</strong>eclosure<br />

counseling services.<br />

DESCRIPTION OF SERVICES<br />

Family Services, Inc. will work with <strong>you</strong> <strong>to</strong> prepare a budget and the results of that budget, and <strong>you</strong>r specific mortgage issues, will determine what action <strong>you</strong>r counselor will recommend. Your<br />

counselor will explain the vario<strong>us</strong> options that he or she thinks might work <strong>for</strong> <strong>you</strong>r situation. With <strong>you</strong>r permission, <strong>you</strong>r counselor will negotiate with <strong>you</strong>r mortgage lender if that is a feasible option<br />

<strong>for</strong> <strong>you</strong>r situation. We can never guarantee that <strong>we</strong> will be able <strong>to</strong> help <strong>you</strong>r situation.<br />

All contracts are valid <strong>for</strong> one year from the start date as listed above. All negotiations depend on <strong>you</strong> providing requested in<strong>for</strong>mation and on <strong>you</strong>r mortgage lender responding. Some lenders are 5 <strong>to</strong> 6<br />

months behind in reviewing modification packages. After one year, the contract may be extended upon consent of both parties.<br />

DISCLOSURES<br />

• Credit counseling services are not suitable <strong>for</strong> all consumers and <strong>you</strong> may request in<strong>for</strong>mation about other ways, including bankruptcy, <strong>to</strong> deal with indebtedness.<br />

• We, Family Services, Inc. may receive grant funds from vario<strong>us</strong> sources <strong>for</strong> providing <strong>for</strong>eclosure prevention counseling services <strong>to</strong> <strong>you</strong>.<br />

• We cannot require a voluntary contribution from <strong>you</strong> <strong>for</strong> a service provided by <strong>us</strong> <strong>to</strong> <strong>you</strong>.<br />

• If <strong>you</strong> have any complaints about the credit counseling services received <strong>you</strong> may contact the South Carolina Department of Consumer Affairs at 1-800-922-1594 or 803-734-4200<br />

• You are in no way obligated <strong>to</strong> receive any other services offered by Family Services, Inc. or any of our service providers or partners.<br />

AUTHORIZATION TO ACCESS CREDIT REPORT INFORMATION<br />

I/We hereby authorize Consumer Credit Counseling Services (CCCS), a division of Family Services, Inc., <strong>to</strong> access my/our credit in<strong>for</strong>mation s<strong>to</strong>red at one or more credit reposi<strong>to</strong>ries. I fully<br />

understand the following:<br />

• This will appear on my credit bureau report as an inquiry.<br />

• The Credit Bureau Reposi<strong>to</strong>ries will NOT allow a copy of this report <strong>to</strong> be given <strong>to</strong> me personally, but I/<strong>we</strong> may request a free copy from the reposi<strong>to</strong>ries.<br />

• CCCS does not guarantee the accuracy of the in<strong>for</strong>mation reported on the credit report nor the analysis done by the counselor.<br />

• I/We agree that any disputes regarding the accuracy or completeness of said in<strong>for</strong>mation will be directed <strong>to</strong> the source Reposi<strong>to</strong>ry (Transunion, Experian, Equifax).<br />

• I/We give permission <strong>for</strong> NFMC program administra<strong>to</strong>rs and/or evalua<strong>to</strong>rs <strong>to</strong> follow-up with me <strong>for</strong> up <strong>to</strong> three (3) years from the date of this signed <strong>for</strong>m <strong>for</strong> the purposes of program<br />

evaluation.<br />

FRAUD POLICY<br />

Family Services, Inc. (the Company) is committed <strong>to</strong> preventing, identifying, and reporting any fraudulent activity related <strong>to</strong> the Company’s services, activities and administration of grants. Fraud may<br />

include but is not limited <strong>to</strong> false statements provided by or <strong>to</strong> staff, contrac<strong>to</strong>rs, clients, beneficiaries and stakeholders. Fraudulent activities may include but are not limited <strong>to</strong> knowingly<br />

misrepresenting income or expenses, assisting or counseling anyone <strong>to</strong> misrepresent facts or circumstances related <strong>to</strong> eligibility <strong>for</strong> programs or benefits, bribery, kickbacks, theft or embezzlement,<br />

<strong>for</strong>gery or alteration of documents, destruction or concealment of records, profiting from insider knowledge, or a conflict of interest. The Company will investigate any reports of fraud. The Company<br />

reserves the right <strong>to</strong> involve law en<strong>for</strong>cement authorities in its investigation. Any documented fraudulent activity may result in administrative or criminal action being taken against those involved<br />

including termination from any program sponsored by the Company or termination from employment by the Company. The Company will not retaliate against any party who reports fraud, criminal<br />

activities or other program irregularities. Any s<strong>us</strong>pected fraudulent activity should be reported <strong>to</strong> the Company’s currently appointed Risk Manager with sufficient specificity <strong>to</strong> facilitate an<br />

investigation.<br />

PRIVACY POLICY<br />

Our agency is committed <strong>to</strong> assuring the privacy of individuals and/or families who have contacted <strong>us</strong> <strong>for</strong> assistance. We realize that the concerns <strong>you</strong> bring <strong>us</strong> are highly personal in nature. We assure<br />

<strong>you</strong> that all in<strong>for</strong>mation shared both orally and in writing will be managed within legal and ethical considerations. The following are examples of how this data may be <strong>us</strong>ed:<br />

ALL CLIENTS<br />

1. To assist <strong>us</strong> in our work with <strong>you</strong>, our staff may seek supervision/consultation with professional colleagues within the agency and, where appropriate and necessary, with other resources in<br />

the community.<br />

2. For the purpose of evaluating our services, gathering valuable research in<strong>for</strong>mation and designing future programs, <strong>we</strong> may report case file in<strong>for</strong>mation <strong>to</strong> vario<strong>us</strong> gran<strong>to</strong>rs and stakeholders.<br />

COUNSELING ONLY<br />

3. For counseling only clients, <strong>we</strong> will confirm with <strong>you</strong>r credi<strong>to</strong>rs if asked:<br />

a. Verification of appointment<br />

b. Date of counseling<br />

c. Disposition: i.e.,<br />

1) Client will handle affairs on their own<br />

2) Pending action<br />

MORTGAGE DEFAULT/DEBT MANAGEMENT<br />

4. For clients needing our intervention on <strong>you</strong>r behalf through Mortgage Default or Debt Management, <strong>we</strong> will disclose the following in<strong>for</strong>mation <strong>to</strong> <strong>you</strong>r lender/credi<strong>to</strong>rs:<br />

• Your address and home phone number, if published<br />

• Total debt in<strong>for</strong>mation<br />

• Income, net and gross<br />

• Living expenses<br />

• A list of <strong>you</strong>r credi<strong>to</strong>rs<br />

• Personal in<strong>for</strong>mation concerning <strong>you</strong>r financial circumstances, but not lifestyle or personal habits<br />

• Place of employment will be verified only<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\Contract Authorizations and Disclosures.doc Version March11

MORTGAGE DEFAULT AND FORECLOSURE COUNSELING<br />

CONTRACT, AUTHORIZATIONS AND DISCLOSURES – PAGE 2<br />

5. We collect nonpublic personal in<strong>for</strong>mation about <strong>you</strong> from the following sources:<br />

• In<strong>for</strong>mation <strong>we</strong> received from <strong>you</strong> on our applications or other <strong>for</strong>ms <strong>you</strong> provide<br />

• In<strong>for</strong>mation about <strong>you</strong>r transactions with <strong>us</strong>, <strong>you</strong>r credi<strong>to</strong>rs, or others, and<br />

• In<strong>for</strong>mation <strong>we</strong> receive from a credit reporting agency<br />

In all other situations, <strong>you</strong>r in<strong>for</strong>mation may be released <strong>to</strong> appropriate individuals or agencies ONLY UPON YOUR SIGNATURE BELOW PERMITTING US TO DO SO, OR when our staff has<br />

been served by a valid subpoena.<br />

The following PRIVACY POLICIES detail circumstances under which <strong>we</strong> will release <strong>you</strong>r in<strong>for</strong>mation <strong>to</strong> a third party:<br />

6. We may disclose some or all of the in<strong>for</strong>mation that <strong>we</strong> collect, as described below, <strong>to</strong> credi<strong>to</strong>rs, or third parties who need this in<strong>for</strong>mation in order <strong>for</strong> <strong>us</strong> <strong>to</strong> assist <strong>you</strong> after a counseling<br />

session. In<strong>for</strong>mation includes but is not limited <strong>to</strong>:<br />

• In<strong>for</strong>mation <strong>we</strong> receive from <strong>you</strong>r applications or other <strong>for</strong>ms, such as <strong>you</strong>r name, address, social security number, assets, and income<br />

• In<strong>for</strong>mation about <strong>you</strong>r transactions with <strong>us</strong>, <strong>you</strong>r credi<strong>to</strong>rs, or others, such as <strong>you</strong>r account balance, payment his<strong>to</strong>ry, parties <strong>to</strong> transactions and credit card <strong>us</strong>age<br />

• In<strong>for</strong>mation <strong>we</strong> receive from a credit reporting agency, such as <strong>you</strong>r credit his<strong>to</strong>ry<br />

7. We may disclose all of the in<strong>for</strong>mation that <strong>we</strong> collect, as described above, <strong>to</strong> credi<strong>to</strong>rs and related financial institutions who need this in<strong>for</strong>mation in order <strong>to</strong> put <strong>you</strong> on a debt management<br />

plan (DMP) or mortgage workout.<br />

8. We restrict access <strong>to</strong> nonpublic personal in<strong>for</strong>mation about <strong>you</strong> <strong>to</strong> those employees who need <strong>to</strong> know that in<strong>for</strong>mation <strong>to</strong> provide services <strong>to</strong> <strong>you</strong>. We maintain physical, electronic, and<br />

procedural safeguards that comply with federal regulations <strong>to</strong> guard <strong>you</strong>r nonpublic personal in<strong>for</strong>mation. Ho<strong>we</strong>ver, several of our gran<strong>to</strong>rs require that <strong>we</strong> provide some nonpublic<br />

in<strong>for</strong>mation about <strong>you</strong> in order <strong>to</strong> provide proof of counseling services provided and outcomes achieved.<br />

9. Unless earlier revoked by client, this authorization will expire one year from the date signed. Ho<strong>we</strong>ver, I/We give permission <strong>for</strong> NFMC program administra<strong>to</strong>rs and/or evalua<strong>to</strong>rs <strong>to</strong><br />

follow-up with me <strong>for</strong> up <strong>to</strong> three (3) years from the date of this signed <strong>for</strong>m <strong>for</strong> the purposes of program evaluation. Additionally, I/We give permission <strong>to</strong> FSI, their gran<strong>to</strong>rs/stakeholders<br />

and their representative agents <strong>to</strong> follow-up with me as necessary <strong>for</strong> purposes of program compliance and/or evaluation.<br />

By signing below, I/<strong>we</strong> agree that I/<strong>we</strong> have read and understand the Family Services, Inc. Privacy Policy and understand my nonpublic in<strong>for</strong>mation may be released <strong>to</strong> appropriate<br />

individuals or agencies as necessary <strong>to</strong> assist me.<br />

AFFILIATED BUSINESS ARRANGEMENT DISCLOSURE<br />

Complete Action Real Estate Services, Inc. (CARES Real Estate Sales) is a <strong>for</strong>-profit wholly owned subsidiary of Family Services, Inc. Additionally, Family Services, Inc., a non-profit 501(c)(3)<br />

organization, has several non profit divisions doing b<strong>us</strong>iness as Consumer Credit Counseling Services (CCCS), <strong>Homeowner</strong>ship Resource Center (HRC), Behavioral Health Services (BHS), Financial<br />

Management Services, (FMS), Representative Payee Services (Rep Payee) and Conserva<strong>to</strong>r Services. CARES Real Estate Sales provides real estate brokerage services <strong>for</strong> which it and its licensed real<br />

estate agents typically earn a commission. Family Services, Inc. provides vario<strong>us</strong> counseling, granting, lending and educational services <strong>for</strong> free or <strong>for</strong> cost of service fees.<br />

Set <strong>for</strong>th below is the estimated charge or range of charges <strong>for</strong> the settlement services listed. Family Services, Inc. will NOT require <strong>you</strong> <strong>to</strong> <strong>us</strong>e the services of CARES Real Estate Sales or any affiliates<br />

as a condition <strong>for</strong> its services.<br />

CARES Real Estate Sales will NOT require <strong>you</strong> <strong>to</strong> <strong>us</strong>e the services of Family Services, Inc. as a condition of its brokerage services. THERE ARE FREQUENTLY OTHER SETTLEMENT<br />

SERVICE PROVIDERS AVAILABLE WITH SIMILAR SERVICES. YOU ARE FREE TO SHOP AROUND TO DETERMINE THAT YOU ARE RECEIVING THE BEST SERVICES<br />

AND THE BEST RATE FOR THESE SERVICES.<br />

Provider Settlement Service Charge or Range of Charges<br />

Family Services, Inc., CCCS, HRC, BHS, FMS, Rep Payee,<br />

Conserva<strong>to</strong>r<br />

Credit and Financial Counseling<br />

Homebuyer Education and Counseling<br />

Grant and Loan Application Assistance<br />

Neighborhood Revitalization LLC Development Buyer’s purchase price<br />

Free <strong>to</strong> $150 or monthly $30<br />

Free <strong>to</strong> $150<br />

$990 or less, depending on grant or loan program<br />

CARES Real Estate Sales Real Estate Brokerage Real Estate Sales Commission and/or Fees<br />

By signing below, I/<strong>we</strong> agree that I/<strong>we</strong> have read the Affiliated B<strong>us</strong>iness Arrangement Disclosure, and understand that if CARES Real Estate Sales is referring me/<strong>us</strong> <strong>to</strong> Family Services, Inc.<br />

and/or if Family Services, Inc. is referring me/<strong>us</strong> <strong>to</strong> CARES Real Estate Sales <strong>to</strong> purchase the above-described settlement service(s) and they may receive a financial or other benefit as the<br />

result of this referral.<br />

The Affiliated B<strong>us</strong>iness Arrangement Disclosure portion of this <strong>for</strong>m is prepared and provided in compliance RESPA Section 8(c)(4). If <strong>you</strong> have questions or concerns <strong>you</strong> may direct them <strong>to</strong>: Caprice<br />

Atterbury, Family Services, Inc. 4925 Lacross Rd. #215, N. Charles<strong>to</strong>n, SC, 29406 Phone: 843 735 7808.<br />

Should <strong>you</strong> decide <strong>to</strong> pursue the option of selling <strong>you</strong>r home, Family Services, Inc. does not recommend or intend <strong>to</strong> influence <strong>you</strong>r choice of service providers. You may choose any service<br />

provider <strong>you</strong> want <strong>to</strong> <strong>us</strong>e and in no way will <strong>you</strong>r choice affect the services provided <strong>to</strong> <strong>you</strong> by Family Services, Inc.<br />

By signing below, I/<strong>we</strong> agree that I/<strong>we</strong> have read, understand and agree <strong>to</strong> all contract provisions, authorizations and disclosures listed above (page 1 and page 2).<br />

Client Signature:___________________________________________________________________________________ Date:_____________________________________<br />

Client Signature:___________________________________________________________________________________ Date:_____________________________________<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\Contract Authorizations and Disclosures.doc Version March11

attachment B<br />

LEGAL SERVICES INCOME CERTIFICATION, DECLARATION OF CITIZENSHIP<br />

AND REFERRAL AUTHORIZATION<br />

NAME: DATE:<br />

(Please Print)<br />

INCOME CERTIFICATION<br />

I HEREBY CERTIFY that the in<strong>for</strong>mation I have given about my income and assets is<br />

correct. I further consent <strong>to</strong> release of in<strong>for</strong>mation required or requested by funders of<br />

__________________________________.<br />

legal services provider<br />

________________________________________<br />

Signature<br />

DECLARATION OF CITIZENSHIP<br />

I HEREBY DECLARE, that I am a citizen of the United States of America.<br />

________________________________________<br />

Signature<br />

AUTHORIZATION TO REFER TO PRO BONO OR PAI<br />

I HEREBY AUTHORIZE ________________________________________________ <strong>to</strong><br />

refer my case <strong>to</strong> the Pro Bono Program or the Private At<strong>to</strong>rney Involvement (PAI) Program,<br />

when appropriate, and <strong>to</strong> send any documents and records related <strong>to</strong> my case <strong>to</strong> either.<br />

________________________________________<br />

Signature<br />

CONSENT TO POSSIBLE LIMITATION OF SERVICE<br />

I UNDERSTAND, AND AGREE, that this intake may be denied or accepted <strong>for</strong> counsel<br />

and advice or brief service.<br />

________________________________________<br />

Signature<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\Legal Income Certification 2009.doc Version: March11

Attachment A<br />

WAIVER / RELEASE<br />

<strong>for</strong> National Foreclosure Mitigation Counseling<br />

Legal Assistance Program<br />

I understand that under the terms of the National Foreclosure Mitigation Grant funded by NeighborWorks, the<br />

U. S. Department of Ho<strong>us</strong>ing and Urban Development (“HUD”) and/or other funding sources, Family Services, Inc.<br />

(“FSI”) may refer me <strong>to</strong> an at<strong>to</strong>rney <strong>for</strong> legal advice and counseling regarding my current mortgage situation. I<br />

understand that FSI will pay <strong>for</strong> only the first five hours of counseling and legal services <strong>to</strong> be provided <strong>to</strong> me by an<br />

at<strong>to</strong>rney <strong>to</strong> whom I may be referred. If I desire additional legal services or representation beyond that initial five hour<br />

period, it will be my sole responsibility <strong>to</strong> contract <strong>for</strong> those services with an at<strong>to</strong>rney of my choice which may include the<br />

at<strong>to</strong>rney <strong>to</strong> whom I am referred by FSI.<br />

I acknowledge that FSI is not responsible <strong>for</strong> any advice or any aspect of the legal services <strong>to</strong> be provided by any<br />

at<strong>to</strong>rney <strong>to</strong> whom I may be referred. In consideration of FSI funding the initial five hours of legal services <strong>to</strong> be provided<br />

<strong>to</strong> me, I release FSI and all other grant funding sources, from any liability whatsoever which might arise from the<br />

provision of those legal services <strong>to</strong> me.<br />

I understand and agree that FSI cannot pay <strong>for</strong> legal services related <strong>to</strong> any civil litigation arising from my<br />

mortgage situation including any <strong>for</strong>eclosure proceedings. If, during the provision of legal services by any<br />

at<strong>to</strong>rney <strong>to</strong> whom I am referred, a law suit is initiated against me or my at<strong>to</strong>rney recommends that I initiate a law<br />

suit, the services funded by FSI will terminate. I further understand and agree that if civil litigation occurs,<br />

neither I nor the at<strong>to</strong>rney <strong>to</strong> whom I am referred will be required <strong>to</strong> continue the client/at<strong>to</strong>rney relationship. It<br />

shall be my sole responsibility <strong>to</strong> arrange <strong>for</strong> further representation during any civil litigation.<br />

I hereby give FSI permission <strong>to</strong> share my personal and financial in<strong>for</strong>mation with<br />

___________________________(_______). I understand and agree that Family Services, Inc., NeighborWorks, the U. S.<br />

Department of Ho<strong>us</strong>ing and Urban Development (HUD) and/or other funders may review my mortgage counseling case<br />

file as a component of their moni<strong>to</strong>ring of __________________ <strong>for</strong> the legal counseling services provision in<br />

accordance with the Grant and federal regulations under which this service is provided. I hereby authorize allow<br />

representatives of FSI, NeighborWorks, HUD and/or other funding sources <strong>to</strong> review my file <strong>for</strong> program compliance.<br />

Borro<strong>we</strong>r’s Name: __________________________________________________<br />

Borro<strong>we</strong>r’s Address__________________________________________________<br />

__________________________________________________________________<br />

__________________________________________________________________<br />

Borro<strong>we</strong>r’s Signature: ________________________________________________<br />

Date: _____________________________________________<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\CLIENT Waiver Release.doc Version: March11

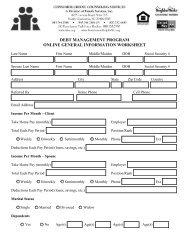

The <strong>Homeowner</strong>ship Resource Center<br />

a division of Family Services, Inc.<br />

4925 Lacross Road - Suite 215, N. Charles<strong>to</strong>n, SC 29406<br />

Telephone: (843) 744-1348 ext. 25 or 800-232-6489 ext. 25<br />

General In<strong>for</strong>mation Worksheet<br />

Last Name First Middle/Maiden Date of Birth Social Security Number<br />

Spo<strong>us</strong>e Last Name First Middle/Maiden Date of Birth Social Security Number<br />

Address No. / Street City, State, Zip Code County<br />

Referred by: Race: Residence Telephone<br />

Email Cell Phone<br />

Gross Income:<br />

Gross Income:<br />

How often do <strong>you</strong> receive a paycheck?<br />

Every Week<br />

Every Two Weeks<br />

Two Times a Month (i.e. on the 15th and the 30th)<br />

Once a Month<br />

Complete as much in<strong>for</strong>mation as possible. Please print.<br />

PERSONAL INFORMATION<br />

INCOME PER PAY PERIOD (ONE PAY CHECK) - BORROWER<br />

Every Week<br />

Every Two Weeks<br />

Two Times a Month (i.e. on the 15th and the 30th)<br />

Once a Month<br />

Employer:________________________________________<br />

Position/Rank:____________________________________<br />

Telephone:_____________________________ Ext:______<br />

Total Net Income:<br />

INCOME PER PAY PERIOD (ONE PAY CHECK) - CO-BORROWER<br />

Employer:________________________________________<br />

Position/Rank:____________________________________<br />

Telephone:_____________________________ Ext:______<br />

Total Net Income:<br />

OTHER INCOME<br />

Notes: Total: $0<br />

Source Amount<br />

Total Gross Income<br />

Total Net Income<br />

Total Income<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\DOC's\Right Side\budget worksheet.xls Version:March11

Client Name: _________________________________<br />

Instructions: Fill in <strong>you</strong>r estimated monthly expenses in the column marked "estimate". For <strong>you</strong>r expenses,<br />

<strong>us</strong>e recent monthly bills <strong>to</strong> average <strong>you</strong>r expenses.<br />

Monthly Living Expenses<br />

Fixed Expenses<br />

ESTIMATE<br />

Vehicle In<strong>for</strong>mation<br />

Rent or Mortgage Payment $<br />

$ $ $<br />

Second Mortgage $<br />

$ $ $ Make Year<br />

Real Estate Taxes<br />

<strong>Homeowner</strong> Insurance<br />

only fill in if not<br />

included in mtg<br />

payment $<br />

$ $ $<br />

<strong>Homeowner</strong>s Association Fee $<br />

$ $ $ Model<br />

Car Payment #1 $<br />

$ $ $<br />

Car Payment #2<br />

$<br />

$ $ $<br />

Child Support Paid $<br />

$ $ $ Condition: Good Fair Poor<br />

Childcare<br />

Total Fixed Expenses<br />

$<br />

$ $ $<br />

Flexible Expenses<br />

Yes No<br />

Groceries / Toiletries $<br />

$ $ $<br />

Electricity /Natural Gas $<br />

$ $ $<br />

Trash/Sewage/Garbage $<br />

$ $ $<br />

Water $<br />

$ $ $ Make Year<br />

Home Telephone $<br />

$ $ $<br />

Cell Phone $<br />

$ $ $ Model<br />

Gasoline $<br />

$ $ $<br />

Medical / Dental $<br />

$ $ $<br />

Prescription Medication $<br />

$ $ $ Condition: Good Fair Poor<br />

Cable TV/Internet<br />

$<br />

$ $ $<br />

Other Expenses<br />

Total Flexible Expenses<br />

$<br />

$ $ $<br />

Yes No<br />

Periodic Expenses Dependents<br />

Life Insurance (If not taken from pay) $<br />

$ $ $<br />

Health Insurance (if not taken from pay) $<br />

$ $ $<br />

Au<strong>to</strong> Insurance $<br />

$ $ $<br />

Total Expenses<br />

Total Periodic Expenses<br />

List current balances and account numbers <strong>for</strong> all debts. If <strong>you</strong> need additional space, please <strong>us</strong>e a separate sheet.<br />

Credit Card Debt<br />

Credi<strong>to</strong>r<br />

Credi<strong>to</strong>r<br />

Balance<br />

Balance<br />

Client Signature Date<br />

Monthly Payment<br />

Pay Day Lenders/Cash Advance /Title Loan/Other<br />

Monthly Payment<br />

Current Y/N<br />

Current Y/N<br />

Section Totals<br />

Add all income and subtract all judgements,<br />

garnishments and expenses <strong>to</strong> come <strong>to</strong> a<br />

<strong>to</strong>tal monthly overage or shortage.<br />

Monthly Take Home<br />

Income (pg1)<br />

Monthly Living<br />

Expenses (pg2)<br />

Total Credit<br />

Expenses<br />

Total Over (+) or<br />

Short (-)<br />

Counselor Signature Date

Form 4506T-EZ<br />

(Oc<strong>to</strong>ber 2009)<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Short Form Request <strong>for</strong> Individual Tax Return Transcript<br />

Request may not be processed if the <strong>for</strong>m is incomplete or illegible.<br />

Tip: Use Form 4506T-EZ <strong>to</strong> order a 1040 series tax return transcript free of charge.<br />

OMB No. 1545-2154<br />

1a Name shown on tax return. If a joint return, enter the name shown first. 1b First social security number on tax return<br />

2a If a joint return, enter spo<strong>us</strong>e’s name shown on tax return. 2b Second social security number if joint tax return<br />

3 Current name, address (including apt., room, or suite no.), city, state, and ZIP code<br />

4 Previo<strong>us</strong> address shown on the last return filed if different from line 3<br />

5 If the transcript is <strong>to</strong> be mailed <strong>to</strong> a third party (such as a mortgage company), enter the third party’s name, address, and telephone number. The<br />

IRS has no control over what the third party does with the tax in<strong>for</strong>mation.<br />

Third party name Telephone number<br />

Address (including apt., room, or suite no.), city, state, and ZIP code<br />

6 Year(s) requested. Enter the year(s) of the return transcript <strong>you</strong> are requesting (<strong>for</strong> example, “2008”). Most requests will be processed within<br />

10 b<strong>us</strong>iness days.<br />

Caution. If the transcript is being mailed <strong>to</strong> a third party, ensure that <strong>you</strong> have filled in line 6 be<strong>for</strong>e signing. Sign and date the <strong>for</strong>m once <strong>you</strong> have<br />

filled in line 6. Completing these steps helps <strong>to</strong> protect <strong>you</strong>r privacy.<br />

Note. If the IRS is unable <strong>to</strong> locate a return that matches the taxpayer identity in<strong>for</strong>mation provided above, or if IRS records indicate that the return has<br />

not been filed, the IRS may notify <strong>you</strong> or the third party that it was unable <strong>to</strong> locate a return, or that a return was not filed, whichever is applicable.<br />

Signature of taxpayer(s). I declare that I am either the taxpayer whose name is shown on line 1a or 2a. If the request applies <strong>to</strong> a joint return, either<br />

h<strong>us</strong>band or wife m<strong>us</strong>t sign.<br />

Note. This <strong>for</strong>m m<strong>us</strong>t be received within 60 days of signature date.<br />

Sign<br />

Here<br />

Signature (see instructions) Date<br />

Spo<strong>us</strong>e’s signature Date<br />

Telephone number of<br />

taxpayer on line 1a or 2a<br />

For Privacy Act and Paperwork Reduction Act Notice, see page 2. Cat. No. 54185S Form 4506T-EZ (10-2009)

Form 4506T-EZ (10-2009) Page 2<br />

Purpose of <strong>for</strong>m. Individuals can <strong>us</strong>e Form<br />

4506T-EZ <strong>to</strong> request a tax return transcript<br />

that includes most lines of the original tax<br />

return. The tax return transcript will not<br />

show payments, penalty assessments, or<br />

adj<strong>us</strong>tments made <strong>to</strong> the originally filed<br />

return. You can also designate a third party<br />

(such as a mortgage company) <strong>to</strong> receive a<br />

transcript on line 5. Form 4506T-EZ cannot<br />

be <strong>us</strong>ed by taxpayers who file Form 1040<br />

based on a fiscal tax year (that is, a tax<br />

year beginning in one calendar year and<br />

ending in the following year). Taxpayers<br />

<strong>us</strong>ing a fiscal tax year m<strong>us</strong>t file Form<br />

4506-T, Request <strong>for</strong> Transcript of Tax<br />

Return, <strong>to</strong> request a return transcript.<br />

Use Form 4506-T <strong>to</strong> request the following.<br />

● A transcript of a b<strong>us</strong>iness return<br />

(including estate and tr<strong>us</strong>t returns).<br />

● An account transcript (contains<br />

in<strong>for</strong>mation on the financial stat<strong>us</strong> of the<br />

account, such as payments made on the<br />

account, penalty assessments, and<br />

adj<strong>us</strong>tments made by <strong>you</strong> or the IRS after<br />

the return was filed).<br />

● A record of account, which is a<br />

combination of line item in<strong>for</strong>mation and<br />

later adj<strong>us</strong>tments <strong>to</strong> the account.<br />

● A verification of nonfiling, which is proof<br />

from the IRS that <strong>you</strong> did not file a return<br />

<strong>for</strong> the year.<br />

● A Form W-2, Form 1099 series, Form<br />

1098 series, or Form 5498 series transcript.<br />

Form 4506-T can also be <strong>us</strong>ed <strong>for</strong><br />

requesting tax return transcripts.<br />

Au<strong>to</strong>mated transcript request. You can<br />

call 1-800-829-1040 <strong>to</strong> order a tax return<br />

transcript through the au<strong>to</strong>mated self-help<br />

system. You cannot have a transcript sent<br />

<strong>to</strong> a third party through the au<strong>to</strong>mated<br />

system.<br />

Where <strong>to</strong> file. Mail or fax Form 4506T-EZ<br />

<strong>to</strong> the address below <strong>for</strong> the state <strong>you</strong> lived<br />

in when that return was filed.<br />

If <strong>you</strong> are requesting more than one<br />

transcript or other product and the chart<br />

below shows two different RAIVS teams,<br />

send <strong>you</strong>r request <strong>to</strong> the team based on<br />

the address of <strong>you</strong>r most recent return.<br />

Where <strong>to</strong> mail . . .<br />

If <strong>you</strong> filed an<br />

individual return<br />

and lived in:<br />

Alabama, Delaware,<br />

Florida, Georgia,<br />

North Carolina,<br />

Rhode Island, South<br />

Carolina, Virginia<br />

Kentucky, Louisiana,<br />

Mississippi,<br />

Tennessee, Texas, a<br />

<strong>for</strong>eign country, or<br />

A.P.O. or F.P.O.<br />

address<br />

Alaska, Arizona,<br />

Cali<strong>for</strong>nia, Colorado,<br />

District of Columbia,<br />

Hawaii, Idaho, Iowa,<br />

Kansas, Maine,<br />

Maryland,<br />

Massach<strong>us</strong>etts,<br />

Minnesota, Montana,<br />

New Hampshire, New<br />

Mexico, New York,<br />

North Dakota,<br />

Oklahoma, Oregon,<br />

South Dakota, Utah,<br />

Vermont,<br />

Washing<strong>to</strong>n,<br />

Wisconsin, Wyoming<br />

Arkansas,<br />

Connecticut, Illinois,<br />

Indiana, Michigan,<br />

Missouri, New Jersey,<br />

Ohio, Pennsylvania,<br />

West Virginia<br />

Mail or fax <strong>to</strong> the<br />

“Internal Revenue<br />

Service” at:<br />

RAIVS Team<br />

P.O. Box 47-421<br />

S<strong>to</strong>p 91<br />

Doraville, GA 30362<br />

770-455-2335<br />

RAIVS Team<br />

S<strong>to</strong>p 6716 AUSC<br />

A<strong>us</strong>tin, TX 73301<br />

512-460-2272<br />

RAIVS Team<br />

S<strong>to</strong>p 37106<br />

Fresno, CA 93888<br />

559-456-5876<br />

RAIVS Team<br />

S<strong>to</strong>p 6705-B41<br />

Kansas City, MO<br />

64999<br />

816-292-6102<br />

Signature and date. Form 4506T-EZ m<strong>us</strong>t<br />

be signed and dated by the taxpayer listed<br />

on line 1a or 2a. If <strong>you</strong> completed line 5<br />

requesting the in<strong>for</strong>mation be sent <strong>to</strong> a<br />

third party, the IRS m<strong>us</strong>t receive Form<br />

4506T-EZ within 60 days of the date signed<br />

by the taxpayer or it will be rejected.<br />

Transcripts of jointly filed tax returns<br />

may be furnished <strong>to</strong> either spo<strong>us</strong>e. Only<br />

one signature is required. Sign Form<br />

4506T-EZ exactly as <strong>you</strong>r name appeared<br />

on the original return. If <strong>you</strong> changed <strong>you</strong>r<br />

name, also sign <strong>you</strong>r current name.<br />

Privacy Act and Paperwork Reduction<br />

Act Notice. We ask <strong>for</strong> the in<strong>for</strong>mation on<br />

this <strong>for</strong>m <strong>to</strong> establish <strong>you</strong>r right <strong>to</strong> gain<br />

access <strong>to</strong> the requested tax in<strong>for</strong>mation<br />

under the Internal Revenue Code. We<br />

need this in<strong>for</strong>mation <strong>to</strong> properly identify<br />

the tax in<strong>for</strong>mation and respond <strong>to</strong> <strong>you</strong>r<br />

request. Sections 6103 and 6109 require<br />

<strong>you</strong> <strong>to</strong> provide this in<strong>for</strong>mation, including<br />

<strong>you</strong>r SSN. If <strong>you</strong> do not provide this<br />

in<strong>for</strong>mation, <strong>we</strong> may not be able <strong>to</strong> process<br />

<strong>you</strong>r request. Providing false or fraudulent<br />

in<strong>for</strong>mation may subject <strong>you</strong> <strong>to</strong> penalties.<br />

Routine <strong>us</strong>es of this in<strong>for</strong>mation include<br />

giving it <strong>to</strong> the Department of J<strong>us</strong>tice <strong>for</strong><br />

civil and criminal litigation, and cities,<br />

states, and the District of Columbia <strong>for</strong> <strong>us</strong>e<br />

in administering their tax laws. We may<br />

also disclose this in<strong>for</strong>mation <strong>to</strong> other<br />

countries under a tax treaty, <strong>to</strong> federal and<br />

state agencies <strong>to</strong> en<strong>for</strong>ce federal nontax<br />

criminal laws, or <strong>to</strong> federal law en<strong>for</strong>cement<br />

and intelligence agencies <strong>to</strong> combat<br />

terrorism.<br />

You are not required <strong>to</strong> provide the<br />

in<strong>for</strong>mation requested on a <strong>for</strong>m that is<br />

subject <strong>to</strong> the Paperwork Reduction Act<br />

unless the <strong>for</strong>m displays a valid OMB<br />

control number. Books or records relating<br />

<strong>to</strong> a <strong>for</strong>m or its instructions m<strong>us</strong>t be<br />

retained as long as their contents may<br />

become material in the administration of<br />

any Internal Revenue law. Generally, tax<br />

returns and return in<strong>for</strong>mation are<br />

confidential, as required by section 6103.<br />

The time needed <strong>to</strong> complete and file<br />

Form 4506T-EZ will vary depending on<br />

individual circumstances. The estimated<br />

average time is: Learning about the law<br />

or the <strong>for</strong>m, 9 min.; Preparing the <strong>for</strong>m,<br />

18 min.; and Copying, assembling, and<br />

sending the <strong>for</strong>m <strong>to</strong> the IRS, 20 min.<br />

If <strong>you</strong> have comments concerning the<br />

accuracy of these time estimates or<br />

suggestions <strong>for</strong> making Form 4506T-EZ<br />

simpler, <strong>we</strong> <strong>would</strong> be happy <strong>to</strong> hear from<br />

<strong>you</strong>. You can write <strong>to</strong> the Internal Revenue<br />

Service, Tax Products Coordinating<br />

Committee, SE:W:CAR:MP:T:T:SP, 1111<br />

Constitution Ave. NW, IR-6526,<br />

Washing<strong>to</strong>n, DC 20224. Do not send the<br />

<strong>for</strong>m <strong>to</strong> this address. Instead, see Where <strong>to</strong><br />

file on this page.

Family Services, Inc.<br />

C<strong>us</strong><strong>to</strong>mer Satisfaction Survey<br />

Name: ____________________________________ (Optional) Date: _________________<br />

Who was <strong>you</strong>r counselor/facilita<strong>to</strong>r? ___________________________________________<br />

Service or class attended (Optional): ___________________________________________<br />

Thank <strong>you</strong> <strong>for</strong> <strong>us</strong>ing Family Services, Inc.! We look <strong>for</strong>ward <strong>to</strong> assisting <strong>you</strong> with <strong>you</strong>r specific needs and<br />

goals. We <strong>would</strong> <strong>like</strong> <strong>you</strong> <strong>to</strong> tell <strong>us</strong> about <strong>you</strong>r initial contact with <strong>us</strong>. Please take a moment <strong>to</strong> complete this<br />

survey and let <strong>us</strong> know how <strong>we</strong> are doing. Please place in the box located in lobby when completed. Please<br />

circle one below. NA = Not applicable <strong>for</strong> <strong>you</strong>r visit.<br />

1. Was <strong>you</strong>r counselor/facilita<strong>to</strong>r knowledgeable and helpful? Yes No N/A<br />

2. Did <strong>you</strong>r session begin on time? Yes No N/A<br />

3. Did <strong>you</strong> reach a “live person” with <strong>you</strong>r initial phone call? Yes No N/A<br />

4. Was <strong>you</strong>r phone call or e-mail <strong>for</strong> an appointment returned promptly? Yes No N/A<br />

5. Did <strong>you</strong> receive an appointment within 5 b<strong>us</strong>iness days? Yes No N/A<br />

6. Was the staff helpful, respectful and supportive? Yes No N/A<br />

7. Was the receptionist friendly when <strong>you</strong> made <strong>you</strong>r appointment? Yes No N/A<br />

8. Was the receptionist friendly when <strong>you</strong> checked in? Yes No N/A<br />

9. During <strong>you</strong>r initial appt/assessment <strong>we</strong>re <strong>you</strong> asked if <strong>you</strong> <strong>would</strong> <strong>like</strong> referral info? Yes No N/A<br />

10. Did <strong>you</strong> receive a statement explaining the services offered and what is expected Yes No N/A<br />

of <strong>you</strong> as a client?<br />

11. Were <strong>you</strong> in<strong>for</strong>med of <strong>you</strong>r legal rights or privacy rights? Yes No N/A<br />

12. Were <strong>you</strong> given in<strong>for</strong>mation regarding <strong>you</strong>r options (if applicable)? Yes No N/A<br />

13. Is the help <strong>you</strong> are receiving in this program appropriate <strong>for</strong> <strong>you</strong>r problem? Yes No N/A<br />

14. Would <strong>you</strong> recommend Family Services, Inc. <strong>to</strong> a friend? Yes No N/A<br />

15. Was our <strong>we</strong>bsite helpful and in<strong>for</strong>mative? Yes No N/A<br />

16. How <strong>would</strong> <strong>you</strong> rate <strong>you</strong>r overall experience? (Please circle one)<br />

Poor Fair Good Excellent Outstanding<br />

17. How did <strong>you</strong> hear about <strong>us</strong>? (Please circle one), Name of station or show _________________________<br />

TV Radio Newspaper Flyer Website/Online Referral from: _____________________<br />

Your feedback is critical <strong>to</strong> the success of our agency. If <strong>you</strong>r experience with <strong>us</strong> was beneficial <strong>to</strong> <strong>you</strong>, please<br />

let <strong>us</strong> know! Ho<strong>we</strong>ver, if <strong>you</strong> feel otherwise, please let <strong>us</strong> know why and what <strong>you</strong> think <strong>we</strong> could have done <strong>to</strong><br />

better serve <strong>you</strong>.<br />

__________________________________________________________________________________________<br />

H:\Ho<strong>us</strong>ing\default program\HRC Master Forms\Intake Packet_Email\C<strong>us</strong><strong>to</strong>mer satisfaction survey_electronic.docx - CCCS=green, BHS=purple,<br />

Ho<strong>us</strong>ing=Blue 10/1/2008 12:50 PM