Annual Report 2005-2006 - Gammon India

Annual Report 2005-2006 - Gammon India

Annual Report 2005-2006 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

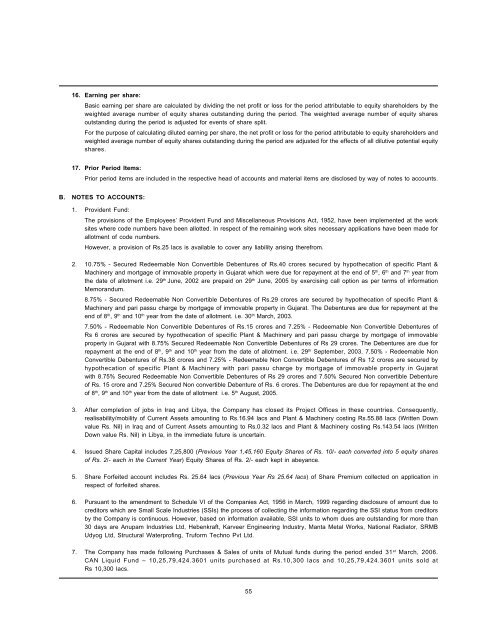

16. Earning per share:<br />

Basic earning per share are calculated by dividing the net profit or loss for the period attributable to equity shareholders by the<br />

weighted average number of equity shares outstanding during the period. The weighted average number of equity shares<br />

outstanding during the period is adjusted for events of share split.<br />

For the purpose of calculating diluted earning per share, the net profit or loss for the period attributable to equity shareholders and<br />

weighted average number of equity shares outstanding during the period are adjusted for the effects of all dilutive potential equity<br />

shares.<br />

17. Prior Period Items:<br />

Prior period items are included in the respective head of accounts and material items are disclosed by way of notes to accounts.<br />

B. NOTES TO ACCOUNTS:<br />

1. Provident Fund:<br />

The provisions of the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952, have been implemented at the work<br />

sites where code numbers have been allotted. In respect of the remaining work sites necessary applications have been made for<br />

allotment of code numbers.<br />

However, a provision of Rs.25 lacs is available to cover any liability arising therefrom.<br />

2. 10.75% - Secured Redeemable Non Convertible Debentures of Rs.40 crores secured by hypothecation of specific Plant &<br />

Machinery and mortgage of immovable property in Gujarat which were due for repayment at the end of 5th , 6th and 7th year from<br />

the date of allotment i.e. 29th June, 2002 are prepaid on 29th June, <strong>2005</strong> by exercising call option as per terms of information<br />

Memorandum.<br />

8.75% - Secured Redeemable Non Convertible Debentures of Rs.29 crores are secured by hypothecation of specific Plant &<br />

Machinery and pari passu charge by mortgage of immovable property in Gujarat. The Debentures are due for repayment at the<br />

end of 8th , 9th and 10th year from the date of allotment. i.e. 30th March, 2003.<br />

7.50% - Redeemable Non Convertible Debentures of Rs.15 crores and 7.25% - Redeemable Non Convertible Debentures of<br />

Rs 6 crores are secured by hypothecation of specific Plant & Machinery and pari passu charge by mortgage of immovable<br />

property in Gujarat with 8.75% Secured Redeemable Non Convertible Debentures of Rs 29 crores. The Debentures are due for<br />

repayment at the end of 8th , 9th and 10th year from the date of allotment. i.e. 29th September, 2003. 7.50% - Redeemable Non<br />

Convertible Debentures of Rs.38 crores and 7.25% - Redeemable Non Convertible Debentures of Rs 12 crores are secured by<br />

hypothecation of specific Plant & Machinery with pari passu charge by mortgage of immovable property in Gujarat<br />

with 8.75% Secured Redeemable Non Convertible Debentures of Rs 29 crores and 7.50% Secured Non convertible Debenture<br />

of Rs. 15 crore and 7.25% Secured Non convertible Debenture of Rs. 6 crores. The Debentures are due for repayment at the end<br />

of 8th , 9th and 10th year from the date of allotment i.e. 5th August, <strong>2005</strong>.<br />

3. After completion of jobs in Iraq and Libya, the Company has closed its Project Offices in these countries. Consequently,<br />

realisability/mobility of Current Assets amounting to Rs.16.94 lacs and Plant & Machinery costing Rs.55.88 lacs (Written Down<br />

value Rs. Nil) in Iraq and of Current Assets amounting to Rs.0.32 lacs and Plant & Machinery costing Rs.143.54 lacs (Written<br />

Down value Rs. Nil) in Libya, in the immediate future is uncertain.<br />

4. Issued Share Capital includes 7,25,800 (Previous Year 1,45,160 Equity Shares of Rs. 10/- each converted into 5 equity shares<br />

of Rs. 2/- each in the Current Year) Equity Shares of Rs. 2/- each kept in abeyance.<br />

5. Share Forfeited account includes Rs. 25.64 lacs (Previous Year Rs 25.64 lacs) of Share Premium collected on application in<br />

respect of forfeited shares.<br />

6. Pursuant to the amendment to Schedule VI of the Companies Act, 1956 in March, 1999 regarding disclosure of amount due to<br />

creditors which are Small Scale Industries (SSIs) the process of collecting the information regarding the SSI status from creditors<br />

by the Company is continuous. However, based on information available, SSI units to whom dues are outstanding for more than<br />

30 days are Anupam Industries Ltd, Hebenkraft, Karveer Engineering Industry, Manta Metal Works, National Radiator, SRMB<br />

Udyog Ltd, Structural Waterprofing, Truform Techno Pvt Ltd.<br />

7. The Company has made following Purchases & Sales of units of Mutual funds during the period ended 31 st March, <strong>2006</strong>.<br />

CAN Liquid Fund – 10,25,79,424.3601 units purchased at Rs.10,300 lacs and 10,25,79,424.3601 units sold at<br />

Rs 10,300 lacs.<br />

55