Annual Report 2005-2006 - Gammon India

Annual Report 2005-2006 - Gammon India

Annual Report 2005-2006 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

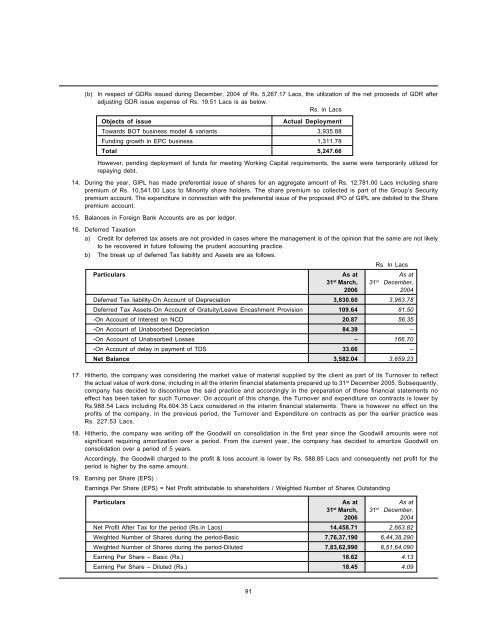

(b) In respect of GDRs issued during December, 2004 of Rs. 5,267.17 Lacs, the utilization of the net proceeds of GDR after<br />

adjusting GDR issue expense of Rs. 19.51 Lacs is as below.<br />

Rs. in Lacs<br />

Objects of issue Actual Deployment<br />

Towards BOT business model & variants 3,935.88<br />

Funding growth in EPC business 1,311.78<br />

Total 5,247.66<br />

However, pending deployment of funds for meeting Working Capital requirements, the same were temporarily utilized for<br />

repaying debt.<br />

14. During the year, GIPL has made preferential issue of shares for an aggregate amount of Rs. 12,781.00 Lacs including share<br />

premium of Rs. 10,541.00 Lacs to Minority share holders. The share premium so collected is part of the Group’s Security<br />

premium account. The expenditure in connection with the preferential issue of the proposed IPO of GIPL are debited to the Share<br />

premium account.<br />

15. Balances in Foreign Bank Accounts are as per ledger.<br />

16. Deferred Taxation<br />

a) Credit for deferred tax assets are not provided in cases where the management is of the opinion that the same are not likely<br />

to be recovered in future following the prudent accounting practice.<br />

b) The break up of deferred Tax liability and Assets are as follows.<br />

Rs. In Lacs<br />

Particulars As at As at<br />

31st March, 31st December,<br />

<strong>2006</strong> 2004<br />

Deferred Tax liability-On Account of Depreciation 3,830.60 3,963.78<br />

Deferred Tax Assets-On Account of Gratuity/Leave Encashment Provision 109.64 81.50<br />

-On Account of Interest on NCD 20.87 56.35<br />

-On Account of Unabsorbed Depreciation 84.39 –<br />

-On Account of Unabsorbed Losses – 166.70<br />

-On Account of delay in payment of TDS 33.66 –<br />

Net Balance 3,582.04 3,659.23<br />

17. Hitherto, the company was considering the market value of material supplied by the client as part of its Turnover to reflect<br />

the actual value of work done, including in all the interim financial statements prepared up to 31st December <strong>2005</strong>. Subsequently,<br />

company has decided to discontinue the said practice and accordingly in the preparation of these financial statements no<br />

effect has been taken for such Turnover. On account of this change, the Turnover and expenditure on contracts is lower by<br />

Rs.988.54 Lacs including Rs.604.35 Lacs considered in the interim financial statements. There is however no effect on the<br />

profits of the company. In the previous period, the Turnover and Expenditure on contracts as per the earlier practice was<br />

Rs. 227.53 Lacs.<br />

18. Hitherto, the company was writing off the Goodwill on consolidation in the first year since the Goodwill amounts were not<br />

significant requiring amortization over a period. From the current year, the company has decided to amortize Goodwill on<br />

consolidation over a period of 5 years.<br />

Accordingly, the Goodwill charged to the profit & loss account is lower by Rs. 588.85 Lacs and consequently net profit for the<br />

period is higher by the same amount.<br />

19. Earning per Share (EPS) :<br />

Earnings Per Share (EPS) = Net Profit attributable to shareholders / Weighted Number of Shares Outstanding<br />

Particulars As at As at<br />

31 st March, 31 st December,<br />

<strong>2006</strong> 2004<br />

Net Profit After Tax for the period (Rs.in Lacs) 14,458.71 2,663.82<br />

Weighted Number of Shares during the period-Basic 7,76,37,190 6,44,38,290<br />

Weighted Number of Shares during the period-Diluted 7,83,62,990 6,51,64,090<br />

Earning Per Share – Basic (Rs.) 18.62 4.13<br />

Earning Per Share – Diluted (Rs.) 18.45 4.09<br />

91