Annual Report 2005-2006 - Gammon India

Annual Report 2005-2006 - Gammon India

Annual Report 2005-2006 - Gammon India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GAMMON INDIA LIMITED<br />

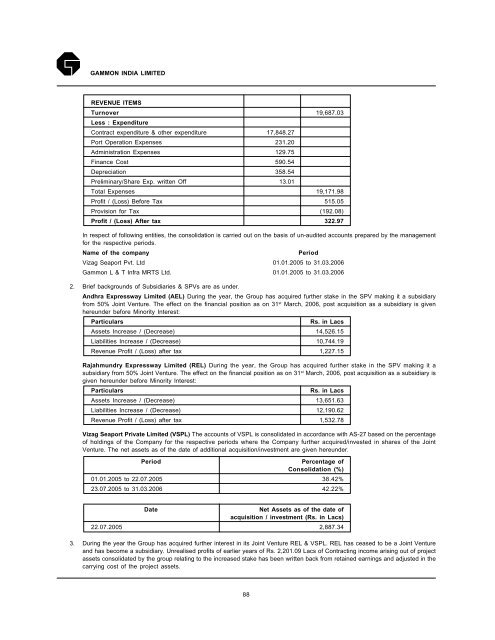

REVENUE ITEMS<br />

Turnover 19,687.03<br />

Less : Expenditure<br />

Contract expenditure & other expenditure 17,848.27<br />

Port Operation Expenses 231.20<br />

Administration Expenses 129.75<br />

Finance Cost 590.54<br />

Depreciation 358.54<br />

Preliminary/Share Exp. written Off 13.01<br />

Total Expenses 19,171.98<br />

Profit / (Loss) Before Tax 515.05<br />

Provision for Tax (192.08)<br />

Profit / (Loss) After tax 322.97<br />

In respect of following entities, the consolidation is carried out on the basis of un-audited accounts prepared by the management<br />

for the respective periods.<br />

Name of the company Period<br />

Vizag Seaport Pvt. Ltd 01.01.<strong>2005</strong> to 31.03.<strong>2006</strong><br />

<strong>Gammon</strong> L & T Infra MRTS Ltd. 01.01.<strong>2005</strong> to 31.03.<strong>2006</strong><br />

2. Brief backgrounds of Subsidiaries & SPVs are as under.<br />

Andhra Expressway Limited (AEL) During the year, the Group has acquired further stake in the SPV making it a subsidiary<br />

from 50% Joint Venture. The effect on the financial position as on 31st March, <strong>2006</strong>, post acquisition as a subsidiary is given<br />

hereunder before Minority Interest:<br />

Particulars Rs. in Lacs<br />

Assets Increase / (Decrease) 14,526.15<br />

Liabilities Increase / (Decrease) 10,744.19<br />

Revenue Profit / (Loss) after tax 1,227.15<br />

Rajahmundry Expressway Limited (REL) During the year, the Group has acquired further stake in the SPV making it a<br />

subsidiary from 50% Joint Venture. The effect on the financial position as on 31st March, <strong>2006</strong>, post acquisition as a subsidiary is<br />

given hereunder before Minority Interest:<br />

Particulars Rs. in Lacs<br />

Assets Increase / (Decrease) 13,651.63<br />

Liabilities Increase / (Decrease) 12,190.62<br />

Revenue Profit / (Loss) after tax 1,532.78<br />

Vizag Seaport Private Limited (VSPL) The accounts of VSPL is consolidated in accordance with AS-27 based on the percentage<br />

of holdings of the Company for the respective periods where the Company further acquired/invested in shares of the Joint<br />

Venture. The net assets as of the date of additional acquisition/investment are given hereunder.<br />

Period Percentage of<br />

Consolidation (%)<br />

01.01.<strong>2005</strong> to 22.07.<strong>2005</strong> 38.42%<br />

23.07.<strong>2005</strong> to 31.03.<strong>2006</strong> 42.22%<br />

Date Net Assets as of the date of<br />

acquisition / investment (Rs. in Lacs)<br />

22.07.<strong>2005</strong> 2,887.34<br />

3. During the year the Group has acquired further interest in its Joint Venture REL & VSPL. REL has ceased to be a Joint Venture<br />

and has become a subsidiary. Unrealised profits of earlier years of Rs. 2,201.09 Lacs of Contracting income arising out of project<br />

assets consolidated by the group relating to the increased stake has been written back from retained earnings and adjusted in the<br />

carrying cost of the project assets.<br />

88