Bayer Group - Investor-Relations

Bayer Group - Investor-Relations

Bayer Group - Investor-Relations

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

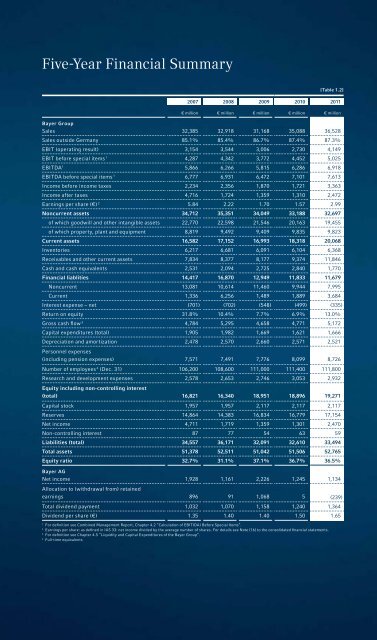

Five-Year Financial Summary<br />

[Table 1.2]<br />

2007 2008 2009 2010 2011<br />

€ million € million € million € million € million<br />

<strong>Bayer</strong> <strong>Group</strong><br />

Sales 32,385 32,918 31,168 35,088 36,528<br />

Sales outside Germany 85.1% 85.4% 86.7% 87.4% 87.3%<br />

EBIT (operating result) 3,154 3,544 3,006 2,730 4,149<br />

EBIT before special items 1 4,287 4,342 3,772 4,452 5,025<br />

EBITDA 1 5,866 6,266 5,815 6,286 6,918<br />

EBITDA before special items 1 6,777 6,931 6,472 7,101 7,613<br />

Income before income taxes 2,234 2,356 1,870 1,721 3,363<br />

Income after taxes 4,716 1,724 1,359 1,310 2,472<br />

Earnings per share (€) 2 5.84 2.22 1.70 1.57 2.99<br />

Noncurrent assets 34,712 35,351 34,049 33,188 32,697<br />

of which goodwill and other intangible assets 22,770 22,598 21,546 20,163 19,455<br />

of which property, plant and equipment 8,819 9,492 9,409 9,835 9,823<br />

Current assets 16,582 17,152 16,993 18,318 20,068<br />

Inventories 6,217 6,681 6,091 6,104 6,368<br />

Receivables and other current assets 7,834 8,377 8,177 9,374 11,846<br />

Cash and cash equivalents 2,531 2,094 2,725 2,840 1,770<br />

Financial liablities 14,417 16,870 12,949 11,833 11,679<br />

Noncurrent 13,081 10,614 11,460 9,944 7,995<br />

Current 1,336 6,256 1,489 1,889 3,684<br />

Interest expense – net (701) (702) (548) (499) (335)<br />

Return on equity 31.8% 10.4% 7.7% 6.9% 13.0%<br />

Gross cash fl ow 3 4,784 5,295 4,658 4,771 5,172<br />

Capital expenditures (total) 1,905 1,982 1,669 1,621 1,666<br />

Depreciation and amortization 2,478 2,570 2,660 2,571 2,521<br />

Personnel expenses<br />

(including pension expenses) 7,571 7,491 7,776 8,099 8,726<br />

Number of employees 4 (Dec. 31) 106,200 108,600 111,000 111,400 111,800<br />

Research and development expenses<br />

Equity including non-controlling interest<br />

2,578 2,653 2,746 3,053 2,932<br />

(total) 16,821 16,340 18,951 18,896 19,271<br />

Capital stock 1,957 1,957 2,117 2,117 2,117<br />

Reserves 14,864 14,383 16,834 16,779 17,154<br />

Net income 4,711 1,719 1,359 1,301 2,470<br />

Non-controlling interest 87 77 54 63 59<br />

Liabilities (total) 34,557 36,171 32,091 32,610 33,494<br />

Total assets 51,378 52,511 51,042 51,506 52,765<br />

Equity ratio 32.7% 31.1% 37.1% 36.7% 36.5%<br />

<strong>Bayer</strong> AG<br />

Net income<br />

Allocation to (withdrawal from) retained<br />

1,928 1,161 2,226 1,245 1,134<br />

earnings 896 91 1,068 5 (239)<br />

Total dividend payment 1,032 1,070 1,158 1,240 1,364<br />

Dividend per share (€) 1.35 1.40 1.40 1.50 1.65<br />

1 For defi nition see Combined Management Report, Chapter 4.2 “Calculation of EBIT(DA) Before Special Items”.<br />

2 Earnings per share: as defi ned in IAS 33: net income divided by the average number of shares. For details see Note [16] to the consolidated fi nancial statements.<br />

3 For defi nition see Chapter 4.5 “Liquidity and Capital Expenditures of the <strong>Bayer</strong> <strong>Group</strong>”.<br />

4 Full-time equivalents