FRANkLiN U.S. VALUE FUNDS - Franklin Templeton

FRANkLiN U.S. VALUE FUNDS - Franklin Templeton

FRANkLiN U.S. VALUE FUNDS - Franklin Templeton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

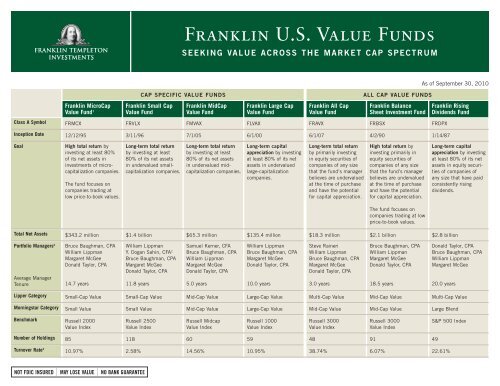

<strong>Franklin</strong> MicroCap<br />

Value Fund 1<br />

NOT FDIC INSURED | MAY LOSE <strong>VALUE</strong> | NO BANK GUARANTEE<br />

<strong>Franklin</strong> U.S. Value Funds<br />

SEEKING <strong>VALUE</strong> ACROSS THE MARKET CAP SPECTRUM<br />

CAP SPECIFIC <strong>VALUE</strong> <strong>FUNDS</strong> ALL CAP <strong>VALUE</strong> <strong>FUNDS</strong><br />

<strong>Franklin</strong> Small Cap<br />

Value Fund<br />

<strong>Franklin</strong> MidCap<br />

Value Fund<br />

<strong>Franklin</strong> Large Cap<br />

Value Fund<br />

<strong>Franklin</strong> All Cap<br />

Value Fund<br />

<strong>Franklin</strong> Balance<br />

Sheet Investment Fund<br />

Class A Symbol FRMCX FRVLX FMVAX FLVAX FRAVX FRBSX FRDPX<br />

Inception Date 12/12/95 3/11/96 7/1/05 6/1/00 6/1/07 4/2/90 1/14/87<br />

Goal High total return by<br />

investing at least 80%<br />

of its net assets in<br />

investments of microcapitalization<br />

companies.<br />

The fund focuses on<br />

companies trading at<br />

low price-to-book values.<br />

Long-term total return<br />

by investing at least<br />

80% of its net assets<br />

in undervalued smallcapitalization<br />

companies.<br />

Long-term total return<br />

by investing at least<br />

80% of its net assets<br />

in undervalued midcapitalization<br />

companies.<br />

Long-term capital<br />

appreciation by investing<br />

at least 80% of its net<br />

assets in undervalued<br />

large-capitalization<br />

companies.<br />

Long-term total return<br />

by primarily investing<br />

in equity securities of<br />

companies of any size<br />

that the fund’s manager<br />

believes are undervalued<br />

at the time of purchase<br />

and have the potential<br />

for capital appreciation.<br />

High total return by<br />

investing primarily in<br />

equity securities of<br />

companies of any size<br />

that the fund’s manager<br />

believes are undervalued<br />

at the time of purchase<br />

and have the potential<br />

for capital appreciation.<br />

The fund focuses on<br />

companies trading at low<br />

price-to-book values.<br />

As of September 30, 2010<br />

<strong>Franklin</strong> Rising<br />

Dividends Fund<br />

Total Net Assets $343.2 million $1.4 billion $65.3 million $135.4 million $18.3 million $2.1 billion $2.8 billion<br />

Portfolio Managers 2<br />

Average Manager<br />

Tenure<br />

Bruce Baughman, CPA<br />

William Lippman<br />

Margaret McGee<br />

Donald Taylor, CPA<br />

14.7 years<br />

William Lippman<br />

Y. Dogan Sahin, CFA 2<br />

Bruce Baughman, CPA<br />

Margaret McGee<br />

Donald Taylor, CPA<br />

11.8 years<br />

Samuel Kerner, CFA<br />

Bruce Baughman, CPA<br />

William Lippman<br />

Margaret McGee<br />

Donald Taylor, CPA<br />

5.0 years<br />

William Lippman<br />

Bruce Baughman, CPA<br />

Margaret McGee<br />

Donald Taylor, CPA<br />

10.0 years<br />

Steve Raineri<br />

William Lippman<br />

Bruce Baughman, CPA<br />

Margaret McGee<br />

Donald Taylor, CPA<br />

3.0 years<br />

Bruce Baughman, CPA<br />

William Lippman<br />

Margaret McGee<br />

Donald Taylor, CPA<br />

18.5 years<br />

Long-term capital<br />

appreciation by investing<br />

at least 80% of its net<br />

assets in equity securities<br />

of companies of<br />

any size that have paid<br />

consistently rising<br />

dividends.<br />

Donald Taylor, CPA<br />

Bruce Baughman, CPA<br />

William Lippman<br />

Margaret McGee<br />

20.0 years<br />

Lipper Category Small-Cap Value Small-Cap Value Mid-Cap Value Large-Cap Value Multi-Cap Value Mid-Cap Value Multi-Cap Value<br />

Morningstar Category Small Value Small Value Mid-Cap Value Large-Cap Value Mid-Cap Value Mid-Cap Value Large Blend<br />

Benchmark Russell 2000<br />

Value Index<br />

Russell 2500<br />

Value Index<br />

Russell Midcap<br />

Value Index<br />

Russell 1000<br />

Value Index<br />

Russell 3000<br />

Value Index<br />

Russell 3000<br />

Value Index<br />

Number of Holdings 85 118 60 59 48 91 49<br />

Turnover Rate 3<br />

S&P 500 Index<br />

10.97% 2.58% 14.56% 10.95% 38.74% 6.07% 22.61%

<strong>Franklin</strong> U.S. Value Funds: A Track Record of Strong Long-Term Performance<br />

AVERAGE ANNUAL TOTAL RETURNS–CLASS A SHARES (Period Ended September 30, 2010)<br />

With Maximum 5.75% Sales Charge<br />

1-Year 3-Year 5-Year 10-Year Since Inception (Date) Expense Ratio<br />

<strong>Franklin</strong> MicroCap Value Fund1 0.22% -6.81% 1.11% 10.14% 10.56% (12/12/95) 1.27%<br />

<strong>Franklin</strong> Small Cap Value Fund 3.62% -5.41% 0.77% 7.62% 7.76% (3/11/96) 1.44%<br />

<strong>Franklin</strong> MidCap Value Fund 10.06% -6.70% -0.22% — 0.04% (7/01/05) 1.90% without waiver<br />

1.37% with waiver 4<br />

<strong>Franklin</strong> Large Cap Value Fund 0.35% -10.38% -2.04% 2.79% 3.21% (6/1/00) 1.50%<br />

<strong>Franklin</strong> All Cap Value Fund 8.62% -5.80% — — -7.02% (6/1/07) 2.09% without waiver<br />

1.23% with waiver 4<br />

<strong>Franklin</strong> Balance Sheet Investment Fund 4.35% -9.90% -1.91% 6.50% 10.02% (4/2/90) 1.08%<br />

<strong>Franklin</strong> Rising Dividends Fund 9.55% -6.17% 1.37% 6.01% 8.26% (1/14/87) 1.17%<br />

Performance data represents past performance, which does not guarantee future results. Current performance may differ from figures<br />

shown. The funds’ investment returns and principal values will change with market conditions, an investor may have a gain or a loss<br />

when they sell their shares. Please call <strong>Franklin</strong> <strong>Templeton</strong> Investments at (800) 342-5236 or visit franklintempleton.com for the funds’<br />

most recent month-end performance.<br />

What Are the Risks?<br />

Value securities may not increase in price as anticipated or may decline further in value. Special risks are associated with foreign investing, including currency fluctuations, economic instability and<br />

political developments. While investments in smaller and mid-size company stocks may offer substantial opportunities for capital growth, they also involve heightened risks and should be considered<br />

speculative. Historically, smaller and mid-size company securities have been more volatile in price than larger company securities, especially over the short term. Investments in foreign securities involve<br />

special risks, including currency fluctuations and economic and political uncertainty. These and other risk considerations are discussed in a <strong>Franklin</strong> Value Investors Trust or <strong>Franklin</strong> Rising Dividends<br />

Fund prospectus.<br />

Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. To obtain a summary prospectus and/or a prospectus, which contains this and other<br />

information, please talk to your financial advisor, call us at (800) DIAL BEN/(800) 342-5236 or visit franklintempleton.com. Please carefully read a prospectus before you invest or send money.<br />

< GAIN FROM OUR PERSPECTIVE ® ><br />

V A L U E B L E N D G R O W T H S E C T O R G L O B A L I N T E R N A T I O N A L H Y B R I D A S S E T A L L O C A T I O N F I X E D I N C O M E T A X - F R E E I N C O M E<br />

<strong>Franklin</strong> <strong>Templeton</strong> Distributors, Inc.<br />

One <strong>Franklin</strong> Parkway, San Mateo, CA 94403-1906<br />

(800) DIAL BEN ® (800) 342-5236<br />

TDD/Hearing Impaired (800) 851-0637<br />

franklintempleton.com<br />

1. Effective January 14, 2004, the fund is closed to all new<br />

investors. Existing shareholders may continue adding additional<br />

money to their accounts.<br />

2. CFA ® and Chartered Financial Analyst ® are trademarks owned<br />

by CFA Institute.<br />

3. Turnover Rate data is as of 10/31/09 and is updated annually.<br />

For <strong>Franklin</strong> Rising Dividends Fund, turnover rate is as of 9/30/09<br />

and is updated annually.<br />

4. Fund investment results reflect the expense reduction, without<br />

which the results would have been lower. The fund’s expense<br />

ratio, without waiver, does not include an expense reduction<br />

contractually guaranteed through at least February 28, 2011.<br />

Please see the fund’s prospectus for additional information.<br />

<strong>Franklin</strong> <strong>Templeton</strong> Investments<br />

Your Source For:<br />

• Mutual Funds • 529 College Savings Plans<br />

• Retirement Plans • Separate Accounts<br />

© 2010 <strong>Franklin</strong> <strong>Templeton</strong> Investments. All rights reserved. VL FL 10/10