The following portfolio data for the Franklin Templeton funds is made ...

The following portfolio data for the Franklin Templeton funds is made ...

The following portfolio data for the Franklin Templeton funds is made ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

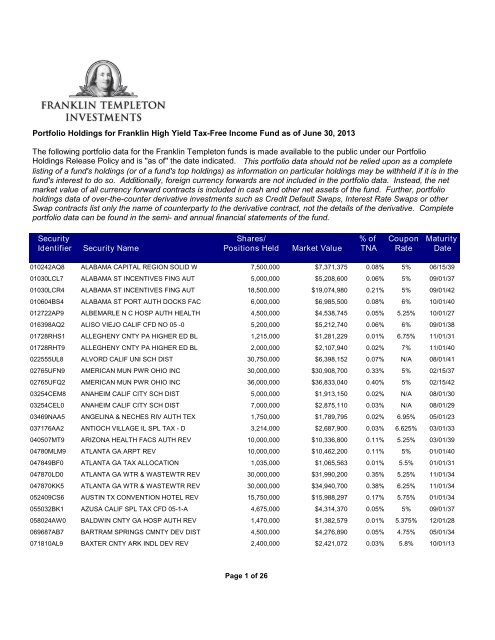

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

<strong>The</strong> <strong>following</strong> <strong>portfolio</strong> <strong>data</strong> <strong>for</strong> <strong>the</strong> <strong>Franklin</strong> <strong>Templeton</strong> <strong>funds</strong> <strong>is</strong> <strong>made</strong> available to <strong>the</strong> public under our Portfolio<br />

Holdings Release Policy and <strong>is</strong> "as of" <strong>the</strong> date indicated. Th<strong>is</strong> <strong>portfolio</strong> <strong>data</strong> should not be relied upon as a complete<br />

l<strong>is</strong>ting of a fund's holdings (or of a fund's top holdings) as in<strong>for</strong>mation on particular holdings may be withheld if it <strong>is</strong> in <strong>the</strong><br />

fund's interest to do so. Additionally, <strong>for</strong>eign currency <strong>for</strong>wards are not included in <strong>the</strong> <strong>portfolio</strong> <strong>data</strong>. Instead, <strong>the</strong> net<br />

market value of all currency <strong>for</strong>ward contracts <strong>is</strong> included in cash and o<strong>the</strong>r net assets of <strong>the</strong> fund. Fur<strong>the</strong>r, <strong>portfolio</strong><br />

holdings <strong>data</strong> of over-<strong>the</strong>-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or o<strong>the</strong>r<br />

Swap contracts l<strong>is</strong>t only <strong>the</strong> name of counterparty to <strong>the</strong> derivative contract, not <strong>the</strong> details of <strong>the</strong> derivative. Complete<br />

<strong>portfolio</strong> <strong>data</strong> can be found in <strong>the</strong> semi- and annual financial statements of <strong>the</strong> fund.<br />

Security<br />

Identifier<br />

010242AQ8<br />

01030LCL7<br />

01030LCR4<br />

010604BS4<br />

012722AP9<br />

016398AQ2<br />

01728RHS1<br />

01728RHT9<br />

022555UL8<br />

02765UFN9<br />

02765UFQ2<br />

03254CEM8<br />

03254CEL0<br />

03469NAA5<br />

037176AA2<br />

040507MT9<br />

04780MLM9<br />

047849BF0<br />

047870LD0<br />

047870KK5<br />

052409CS6<br />

055032BK1<br />

058024AW0<br />

069687AB7<br />

071810AL9<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

ALABAMA CAPITAL REGION SOLID W 7,500,000 $7,371,375 0.08% 5% 06/15/39<br />

ALABAMA ST INCENTIVES FING AUT 5,000,000 $5,208,600 0.06% 5% 09/01/37<br />

ALABAMA ST INCENTIVES FING AUT 18,500,000 $19,074,980 0.21% 5% 09/01/42<br />

ALABAMA ST PORT AUTH DOCKS FAC 6,000,000 $6,985,500 0.08% 6% 10/01/40<br />

ALBEMARLE N C HOSP AUTH HEALTH 4,500,000 $4,538,745 0.05% 5.25% 10/01/27<br />

ALISO VIEJO CALIF CFD NO 05 -0 5,200,000 $5,212,740 0.06% 6% 09/01/38<br />

ALLEGHENY CNTY PA HIGHER ED BL 1,215,000 $1,281,229 0.01% 6.75% 11/01/31<br />

ALLEGHENY CNTY PA HIGHER ED BL 2,000,000 $2,107,940 0.02% 7% 11/01/40<br />

ALVORD CALIF UNI SCH DIST 30,750,000 $6,398,152 0.07% N/A 08/01/41<br />

AMERICAN MUN PWR OHIO INC 30,000,000 $30,908,700 0.33% 5% 02/15/37<br />

AMERICAN MUN PWR OHIO INC 36,000,000 $36,833,040 0.40% 5% 02/15/42<br />

ANAHEIM CALIF CITY SCH DIST 5,000,000 $1,913,150 0.02% N/A 08/01/30<br />

ANAHEIM CALIF CITY SCH DIST 7,000,000 $2,875,110 0.03% N/A 08/01/29<br />

ANGELINA & NECHES RIV AUTH TEX 1,750,000 $1,789,795 0.02% 6.95% 05/01/23<br />

ANTIOCH VILLAGE IL SPL TAX - D 3,214,000 $2,687,900 0.03% 6.625% 03/01/33<br />

ARIZONA HEALTH FACS AUTH REV 10,000,000 $10,336,800 0.11% 5.25% 03/01/39<br />

ATLANTA GA ARPT REV 10,000,000 $10,462,200 0.11% 5% 01/01/40<br />

ATLANTA GA TAX ALLOCATION 1,035,000 $1,065,563 0.01% 5.5% 01/01/31<br />

ATLANTA GA WTR & WASTEWTR REV 30,000,000 $31,990,200 0.35% 5.25% 11/01/34<br />

ATLANTA GA WTR & WASTEWTR REV 30,000,000 $34,940,700 0.38% 6.25% 11/01/34<br />

AUSTIN TX CONVENTION HOTEL REV 15,750,000 $15,988,297 0.17% 5.75% 01/01/34<br />

AZUSA CALIF SPL TAX CFD 05-1-A 4,675,000 $4,314,370 0.05% 5% 09/01/37<br />

BALDWIN CNTY GA HOSP AUTH REV 1,470,000 $1,382,579 0.01% 5.375% 12/01/28<br />

BARTRAM SPRINGS CMNTY DEV DIST 4,500,000 $4,276,890 0.05% 4.75% 05/01/34<br />

BAXTER CNTY ARK INDL DEV REV 2,400,000 $2,421,072 0.03% 5.8% 10/01/13<br />

Page 1 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

072024JL7<br />

074406GX1<br />

074427AF2<br />

074614AC2<br />

095175QZ1<br />

097206AC0<br />

097552RB1<br />

102022BT6<br />

102869AE4<br />

105911BV2<br />

10741LBX3<br />

114420AC6<br />

117657AK2<br />

118217AR9<br />

118217AV0<br />

118217AQ1<br />

121342MW6<br />

121342MT3<br />

121342ML0<br />

123550GA7<br />

13016NBX1<br />

13033FRJ1<br />

13033FRH5<br />

13033FRK8<br />

13033LBM8<br />

13033LBP1<br />

13033K8C6<br />

13033WMN0<br />

13033WMM2<br />

13048TEK5<br />

13055JAA3<br />

13063BPX4<br />

13063BWB4<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

BAY AREA TOLL AUTH CALIF TOLL 29,685,000 $31,497,862 0.34% 5.5% 04/01/43<br />

BEAUMONT CA CFD 93-1 IMPROVE A 3,680,000 $3,542,662 0.04% 5.35% 09/01/36<br />

BEAUMONT CALIF PUB FING AUTH R 3,535,000 $4,056,766 0.04% 6.9% 09/01/23<br />

BEAUREGARD PARISH LA 13,990,000 $14,046,379 0.15% 6.8% 02/01/27<br />

BLOUNT CNTY TENN PUB BLDG AUTH 17,865,000 $17,865,000 0.19% 0.05% 06/01/31<br />

BOGGY CREEK FLA IMPT DIST 5,000,000 $4,560,950 0.05% 5.125% 05/01/43<br />

BOLINGBROOK ILL GO 16,800,000 $4,998,504 0.05% N/A 01/01/35<br />

BOURBONNAIS ILL INDL PROJ REV 3,570,000 $3,447,441 0.04% 5.5% 11/01/40<br />

BOWLING GREEN OHIO STUDENT HSG 12,500,000 $12,941,750 0.14% 6% 06/01/45<br />

BRAZOS CNTY TEX HEALTH FAC DEV 5,250,000 $5,339,250 0.06% 5.5% 01/01/38<br />

BREVARD CNTY FLA HEALTH FACS A 6,500,000 $7,370,155 0.08% 7% 04/01/39<br />

BROOKS OF BONITA SPRINGS CMNTY 1,185,000 $1,185,841 0.01% 6.85% 05/01/31<br />

BRYANT ILL POLLUTN CTL REV 11,000,000 $11,034,870 0.12% 5.9% 08/01/23<br />

BUCKEYE OHIO TOB SETTLEMENT FI 5,000,000 $4,083,150 0.04% 5.75% 06/01/34<br />

BUCKEYE OHIO TOB SETTLEMENT FI 15,000,000 $12,928,650 0.14% 6.25% 06/01/37<br />

BUCKEYE OHIO TOB SETTLEMENT FI 22,500,000 $19,084,050 0.21% 5.875% 06/01/30<br />

BURKE CNTY GA DEV AUTH 15,400,000 $15,400,000 0.17% 0.06% 07/01/49<br />

BURKE CNTY GA DEV AUTH POLLUTN 25,000,000 $29,255,500 0.32% 7% 01/01/23<br />

BURKE CNTY GA DEV AUTH POLLUTN 55,000,000 $59,209,700 0.64% 5.7% 01/01/43<br />

BUTLER CNTY OHIO HOSP FACS REV 10,000,000 $10,198,400 0.11% 5.5% 11/01/40<br />

CALIFORNIA CNTY TOB STL - ALAM 3,700,000 $3,700,148 0.04% 5.875% 06/01/35<br />

CALIFORNIA HEALTH FACS FING AU 2,220,000 $2,258,672 0.02% 5% 11/01/29<br />

CALIFORNIA HEALTH FACS FING AU 2,295,000 $2,349,391 0.03% 5% 11/01/24<br />

CALIFORNIA HEALTH FACS FING AU 3,130,000 $3,177,200 0.03% 5% 11/01/33<br />

CALIFORNIA HEALTH FACS FING AU 5,000,000 $5,844,500 0.06% 6.5% 11/01/24<br />

CALIFORNIA HEALTH FACS FING AU 8,000,000 $9,228,560 0.10% 6.5% 11/01/38<br />

CALIFORNIA HSG FIN AGY REV 20,000,000 $19,198,600 0.21% 4.7% 08/01/31<br />

CALIFORNIA INFRASTRUCTURE & EC 5,000,000 $5,108,500 0.06% 5% 12/01/35<br />

CALIFORNIA INFRASTRUCTURE & EC 10,300,000 $10,658,852 0.12% 5% 12/01/30<br />

CALIFORNIA MUN FIN AUTH REV 5,000,000 $5,903,100 0.06% 8.5% 11/01/39<br />

CALIFORNIA POLLUTION CTL FING 6,000,000 $5,897,580 0.06% 5.25% 08/01/40<br />

CALIFORNIA ST GO 10,000,000 $10,354,500 0.11% 5% 10/01/41<br />

CALIFORNIA ST GO 20,000,000 $20,729,600 0.22% 5% 04/01/42<br />

Page 2 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

13063A4Y7<br />

13063BQ88<br />

13063BKC5<br />

13063BES7<br />

13063BEQ1<br />

130685ZC7<br />

1306852W9<br />

1306852F6<br />

130685ZD5<br />

130795T23<br />

130795T31<br />

130795QY6<br />

13077EDD9<br />

130795RL3<br />

130795YB7<br />

130911HQ6<br />

1307955E3<br />

130911U24<br />

132661AB5<br />

132661AA7<br />

133303ZH3<br />

134340AA6<br />

139372PZ3<br />

13972MAX6<br />

14329NDK7<br />

14329NDH4<br />

145339KH9<br />

147073AZ3<br />

152339LX3<br />

155498BH0<br />

155498BG2<br />

155498BF4<br />

155498BD9<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

CALIFORNIA ST GO 28,725,000 $32,670,953 0.35% 6% 04/01/38<br />

CALIFORNIA ST GO 35,000,000 $36,348,200 0.39% 5% 02/01/43<br />

CALIFORNIA ST GO 47,000,000 $49,566,670 0.54% 5.25% 11/01/40<br />

CALIFORNIA ST GO 60,000,000 $64,922,400 0.70% 5.5% 03/01/40<br />

CALIFORNIA ST GO 70,000,000 $75,068,700 0.81% 5.25% 03/01/30<br />

CALIFORNIA ST PUB WKS BRD LEAS 7,365,000 $8,555,773 0.09% 6% 11/01/29<br />

CALIFORNIA ST PUB WKS BRD LEAS 12,500,000 $12,892,125 0.14% 5% 04/01/33<br />

CALIFORNIA ST PUB WKS BRD LEAS 17,785,000 $18,551,533 0.20% 5% 04/01/30<br />

CALIFORNIA ST PUB WKS BRD LEAS 17,560,000 $20,042,106 0.22% 6% 11/01/34<br />

CALIFORNIA STATEWIDE CMNTYS DE 3,125,000 $3,356,375 0.04% 6% 10/01/29<br />

CALIFORNIA STATEWIDE CMNTYS DE 5,000,000 $5,395,150 0.06% 6.25% 10/01/39<br />

CALIFORNIA STATEWIDE CMNTYS DE 5,000,000 $5,425,550 0.06% 5.75% 07/01/47<br />

CALIFORNIA STATEWIDE CMNTYS DE 10,000,000 $9,677,300 0.10% 6% 09/01/37<br />

CALIFORNIA STATEWIDE CMNTYS DE 10,000,000 $10,368,300 0.11% 5.25% 07/01/47<br />

CALIFORNIA STATEWIDE CMNTYS DE 11,730,000 $11,612,934 0.13% 7.25% 10/01/38<br />

CALIFORNIA STATEWIDE CMNTYS DE 13,240,000 $14,787,226 0.16% 5.5% 07/01/31<br />

CALIFORNIA STATEWIDE CMNTYS DE 20,000,000 $20,367,200 0.22% 5% 04/01/42<br />

CALIFORNIA STATEWIDE CMNTYS DE 25,000,000 $25,683,250 0.28% 5% 11/15/43<br />

CAMDEN ALA INDL DEV BRD EXEMPT 1,750,000 $1,792,385 0.02% 6.375% 12/01/24<br />

CAMDEN ALA INDL DEV BRD EXEMPT 3,000,000 $3,072,750 0.03% 6.125% 12/01/24<br />

CAMERON CNTY TEX 7,500,000 $7,814,025 0.08% 5% 02/15/38<br />

CAMPBELL CNTY WY SOLID WASTE F 5,500,000 $5,944,015 0.06% 5.75% 07/15/39<br />

CAPE CORAL FLA WTR & SWR REV 10,000,000 $10,502,200 0.11% 5% 10/01/42<br />

CAPITAL AREA CULTURAL ED FACS 10,000,000 $10,660,000 0.12% 6.125% 04/01/45<br />

CARMEL IN REDEV AUTH LEASE REN 7,220,000 $6,830,192 0.07% 4% 02/01/38<br />

CARMEL IN REDEV AUTH LEASE REN 8,500,000 $8,327,195 0.09% 4% 08/01/33<br />

CARROLLTON GA PAYROLL DEV AUTH 10,000,000 $10,515,300 0.11% 5% 06/15/40<br />

CASA GRANDE ARIZ INDL DEV AUTH 14,500,000 $14,928,765 0.16% 7.25% 12/01/32<br />

CENTINELA VALLEY CA USD GO 8,400,000 $2,100,756 0.02% N/A 08/01/37<br />

CENTRAL TEX REGL MOBILITY AUTH 2,545,000 $519,612 0.01% N/A 01/01/39<br />

CENTRAL TEX REGL MOBILITY AUTH 2,405,000 $523,857 0.01% N/A 01/01/38<br />

CENTRAL TEX REGL MOBILITY AUTH 2,500,000 $582,150 0.01% N/A 01/01/37<br />

CENTRAL TEX REGL MOBILITY AUTH 3,000,000 $799,140 0.01% N/A 01/01/35<br />

Page 3 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

155498BQ0<br />

155498BU1<br />

155498BV9<br />

15722TDV0<br />

15722TEG2<br />

15722TDU2<br />

158708AA5<br />

167505PC4<br />

167505NY8<br />

167505PL4<br />

167486NF2<br />

167486HH5<br />

167593EF5<br />

167592N83<br />

1675923L6<br />

167593EG3<br />

16768TJJ4<br />

16772PBC9<br />

167727TU0<br />

167727UK0<br />

16876QBG3<br />

16876QBF5<br />

169511HJ4<br />

171312EH0<br />

171312HV6<br />

176553GR0<br />

176553EF8<br />

177457DC9<br />

181003HZ0<br />

181003HY3<br />

181004CM2<br />

181003FR0<br />

181003FS8<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

CENTRAL TEX REGL MOBILITY AUTH 2,350,000 $2,620,109 0.03% 5.75% 01/01/25<br />

CENTRAL TEX REGL MOBILITY AUTH 7,925,000 $8,632,068 0.09% 6% 01/01/41<br />

CENTRAL TEX REGL MOBILITY AUTH 24,340,000 $26,845,316 0.29% 6.25% 01/01/46<br />

CHABOT-LAS POSITAS CALIF CMNTY 10,000,000 $3,002,700 0.03% N/A 08/01/34<br />

CHABOT-LAS POSITAS CALIF CMNTY 34,035,000 $5,287,337 0.06% N/A 08/01/45<br />

CHABOT-LAS POSITAS CALIF CMNTY 21,015,000 $7,125,556 0.08% N/A 08/01/33<br />

CHAMPIONSGATE CMNTY DEV DIST F 1,550,000 $1,447,731 0.02% 6.25% 05/01/20<br />

CHICAGO ILL BRD ED 6,500,000 $6,941,350 0.07% 5.5% 12/01/39<br />

CHICAGO ILL BRD ED 12,500,000 $12,850,000 0.14% 5% 12/01/31<br />

CHICAGO ILL BRD ED 40,200,000 $40,317,786 0.44% 5% 12/01/42<br />

CHICAGO ILL GO 7,000,000 $7,281,190 0.08% 5.25% 01/01/35<br />

CHICAGO ILL GO 34,105,000 $35,859,361 0.39% 5% 01/01/27<br />

CHICAGO ILL O HARE INTL ARPT R 12,555,000 $13,135,292 0.14% 5% 01/01/35<br />

CHICAGO ILL O HARE INTL ARPT R 15,000,000 $15,217,500 0.16% 5% 01/01/33<br />

CHICAGO ILL O HARE INTL ARPT R 16,500,000 $16,651,800 0.18% 5% 01/01/38<br />

CHICAGO ILL O HARE INTL ARPT R 20,430,000 $21,256,393 0.23% 5% 01/01/40<br />

CHICAGO ILL SALES TAX REV 10,000,000 $10,421,400 0.11% 5% 01/01/41<br />

CHICAGO ILL TRAN AUTH SALES TA 11,000,000 $11,603,460 0.13% 5.25% 12/01/36<br />

CHICAGO ILL WASTEWATER TRANSMI 5,000,000 $4,405,150 0.05% 4% 01/01/42<br />

CHICAGO ILL WASTEWATER TRANSMI 14,805,000 $15,439,542 0.17% 5% 01/01/42<br />

CHILDRENS TR FD PR TOB SETTLEM 4,000,000 $3,992,280 0.04% 5.625% 05/15/43<br />

CHILDRENS TR FD PR TOB SETTLEM 11,500,000 $11,546,575 0.12% 5.5% 05/15/39<br />

CHINO CA CFD #2003-3 IMPROVE A 2,215,000 $1,987,984 0.02% 5% 09/01/36<br />

CHULA VISTA CA CFD 07-1 - OTAY 2,855,000 $2,864,735 0.03% 5.875% 09/01/34<br />

CHULA VISTA CA CFD 13-1-OTAY R 1,800,000 $1,592,928 0.02% 5.35% 09/01/36<br />

CITIZENS PPTY INS CORP FLA 10,760,000 $11,890,660 0.13% 5% 06/01/22<br />

CITIZENS PPTY INS CORP FLA 25,000,000 $28,541,000 0.31% 6% 06/01/17<br />

CITRUS CNTY FLA HOSP BRD REV 10,550,000 $10,160,494 0.11% 6.375% 08/15/32<br />

CLARK CNTY NEV IMPT DIST #128 1,035,000 $785,368 0.01% 5.05% 02/01/31<br />

CLARK CNTY NEV IMPT DIST #128 1,320,000 $1,068,117 0.01% 5% 02/01/26<br />

CLARK CNTY NEV INDL DEV REV 7,260,000 $7,266,679 0.08% 5.55% 12/01/38<br />

CLARK CNTY NEV SID # 151(SUMME 740,000 $627,431 0.01% 5% 08/01/20<br />

CLARK CNTY NEV SID # 151(SUMME 2,365,000 $1,811,187 0.02% 5% 08/01/25<br />

Page 4 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

181003LG7<br />

18610RBA1<br />

18610RBB9<br />

19648AGG4<br />

199040AE6<br />

199048AA7<br />

199820K75<br />

20774HXP4<br />

20775BUC8<br />

207758NZ2<br />

213185DY4<br />

213185EE7<br />

220245SL9<br />

220245TK0<br />

222721AD4<br />

230186AM0<br />

235036H86<br />

235036QS2<br />

235036XL9<br />

235036QR4<br />

245834CA2<br />

246018DQ5<br />

246018DR3<br />

249189CF6<br />

249189CE9<br />

249181JH2<br />

249182GJ9<br />

249182GK6<br />

249182GR1<br />

249182GG5<br />

249271GU5<br />

24918EBN9<br />

251129ZY1<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

CLARK CNTY NV IMPT DIST 142 - 1,640,000 $1,701,713 0.02% 5% 08/01/21<br />

CLEVELAND-CUYAHOGA CNTY OHIO P 5,000,000 $5,320,500 0.06% 5% 07/01/33<br />

CLEVELAND-CUYAHOGA CNTY OHIO P 6,000,000 $6,301,740 0.07% 5% 07/01/37<br />

COLORADO HEALTH FACS AUTH REV 20,000,000 $20,796,600 0.22% 5.25% 03/01/40<br />

COLUMBUS CTY NC INDL FAC&POLL 1,300,000 $1,414,270 0.02% 6.25% 11/01/33<br />

COLUMBUS CTY NC INDL FAC&POLL 4,000,000 $4,351,600 0.05% 6.25% 11/01/33<br />

COMAL TEX INDPT SCH DIST 10,500,000 $10,609,305 0.11% 4% 02/01/31<br />

CONNECTICUT ST HEALTH & EDL FA 5,650,000 $5,650,282 0.06% 5.5% 07/01/20<br />

CONNECTICUT ST HSG FIN AUTH 1,300,000 $1,300,000 0.01% 0.05% 11/15/36<br />

CONNECTICUT ST SPL TAX TRANSN 21,635,000 $23,796,769 0.26% 5% 01/01/29<br />

COOK CNTY ILL 8,720,000 $9,243,461 0.10% 5.25% 11/15/33<br />

COOK CNTY ILL 50,000,000 $53,226,500 0.58% 5% 11/15/28<br />

CORPUS CHRISTI TEX UTIL SYS RE 5,000,000 $5,267,300 0.06% 5% 07/15/37<br />

CORPUS CHRISTI TEX UTIL SYS RE 14,860,000 $15,395,108 0.17% 5% 07/15/42<br />

COURTLAND ALA INDL DEV BRD ENV 2,500,000 $2,504,575 0.03% 6.25% 08/01/25<br />

CULLMAN CNTY ALA HEALTH CARE A 7,500,000 $7,879,575 0.09% 7% 02/01/36<br />

DALLAS-FORT WORTH TEX INTL ARP 11,385,000 $11,648,448 0.13% 5% 11/01/44<br />

DALLAS-FORT WORTH TEX INTL ARP 12,000,000 $12,242,640 0.13% 5% 11/01/42<br />

DALLAS-FORT WORTH TEX INTL ARP 14,000,000 $14,285,740 0.15% 5% 11/01/45<br />

DALLAS-FORT WORTH TEX INTL ARP 50,000,000 $50,917,500 0.55% 5% 11/01/45<br />

DELAWARE CNTY IND HOSP AUTH HO 5,000,000 $5,125,250 0.06% 5.25% 08/01/36<br />

DELAWARE CNTY PA INDL DEV AUTH 7,875,000 $7,875,000 0.09% 6.1% 07/01/13<br />

DELAWARE CNTY PA INDL DEV AUTH 17,525,000 $17,531,834 0.19% 6.2% 07/01/19<br />

DENVER CO CONVENTION CENTER HO 15,000,000 $15,223,800 0.16% 5% 12/01/35<br />

DENVER CO CONVENTION CENTER HO 15,000,000 $15,471,600 0.17% 5% 12/01/30<br />

DENVER COLO CITY & CNTY ARPT R 95,000 $97,569 0.00% 7.75% 11/15/13<br />

DENVER COLO CITY & CNTY ARPT R 10,250,000 $8,891,157 0.10% 4% 11/15/43<br />

DENVER COLO CITY & CNTY ARPT R 15,775,000 $16,177,420 0.17% 5% 11/15/43<br />

DENVER COLO CITY & CNTY ARPT R 16,435,000 $17,145,978 0.19% 5% 11/15/33<br />

DENVER COLO CITY & CNTY ARPT R 18,000,000 $18,820,800 0.20% 5% 11/15/32<br />

DENVER COLO CITY & CNTY SPL FA 9,000,000 $8,549,730 0.09% 5.25% 10/01/32<br />

DENVER COLO HEALTH & HOSP AUTH 4,000,000 $4,331,880 0.05% 6.25% 12/01/33<br />

DETROIT MICH CITY SCH DIST 15,900,000 $16,820,610 0.18% 6% 05/01/29<br />

Page 5 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

251093S35<br />

2512373P6<br />

251237WV1<br />

2512373R2<br />

251250AR7<br />

251237F99<br />

251255Y82<br />

2512553B9<br />

25476WBE0<br />

25483VAW4<br />

254764HA4<br />

25477GMW2<br />

25477GLD5<br />

25483VJS4<br />

25483VJR6<br />

2548396F5<br />

25483VAT1<br />

254839UA9<br />

2548396G3<br />

25483VEG5<br />

25483VEH3<br />

25483VFD1<br />

254839P31<br />

254842BC0<br />

254842BB2<br />

254842AJ6<br />

254845HP8<br />

258174AQ4<br />

259561MJ4<br />

26116PBD1<br />

26822LKF0<br />

26822LEV2<br />

26822LGT5<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

DETROIT MICH GO 23,000,000 $23,025,990 0.25% 5.25% 11/01/35<br />

DETROIT MICH SEW DISP SYS REV 3,000,000 $2,843,040 0.03% 5% 07/01/36<br />

DETROIT MICH SEW DISP SYS REV 5,000,000 $4,906,200 0.05% 5.5% 07/01/29<br />

DETROIT MICH SEW DISP SYS REV 10,000,000 $9,694,400 0.10% 5% 07/01/36<br />

DETROIT MICH SEW DISP SYS REV 12,000,000 $11,507,640 0.12% 5.25% 07/01/39<br />

DETROIT MICH SEW DISP SYS REV 25,750,000 $25,715,752 0.28% 5% 07/01/35<br />

DETROIT MICH WTR SUPPLY SYS RE 11,000,000 $10,504,780 0.11% 5% 07/01/33<br />

DETROIT MICH WTR SUPPLY SYS RE 20,430,000 $19,876,142 0.21% 5% 07/01/33<br />

DISTRICT COLUMBIA BALLPARK REV 18,000,000 $17,905,140 0.19% 5% 02/01/35<br />

DISTRICT COLUMBIA DEED TAX REV 13,000,000 $13,235,040 0.14% 5% 06/01/40<br />

DISTRICT COLUMBIA HOSP REV 11,000,000 $11,218,790 0.12% 5.25% 07/15/38<br />

DISTRICT COLUMBIA INCOME TAX R 3,740,000 $3,615,271 0.04% 4% 12/01/37<br />

DISTRICT COLUMBIA INCOME TAX R 8,905,000 $8,608,018 0.09% 4% 12/01/37<br />

DISTRICT COLUMBIA REV 1,500,000 $1,539,345 0.02% 5% 07/01/36<br />

DISTRICT COLUMBIA REV 2,000,000 $2,040,660 0.02% 5% 07/01/42<br />

DISTRICT COLUMBIA REV 2,525,000 $2,556,688 0.03% 7.375% 01/01/30<br />

DISTRICT COLUMBIA REV 3,750,000 $3,870,037 0.04% 5% 10/01/34<br />

DISTRICT COLUMBIA REV 4,750,000 $4,546,985 0.05% 6% 01/01/29<br />

DISTRICT COLUMBIA REV 4,580,000 $4,635,784 0.05% 7.5% 01/01/39<br />

DISTRICT COLUMBIA REV 5,200,000 $5,346,744 0.06% 6.375% 03/01/31<br />

DISTRICT COLUMBIA REV 5,500,000 $5,636,895 0.06% 6.625% 03/01/41<br />

DISTRICT COLUMBIA REV 12,425,000 $13,025,127 0.14% 5.25% 10/01/36<br />

DISTRICT COLUMBIA REV 27,105,000 $20,957,314 0.23% N/A 04/01/36<br />

DISTRICT COLUMBIA TOBACCO SETT 66,000,000 $2,055,900 0.02% N/A 06/15/46<br />

DISTRICT COLUMBIA TOBACCO SETT 175,000,000 $13,366,500 0.14% N/A 06/15/46<br />

DISTRICT COLUMBIA TOBACCO SETT 22,000,000 $24,132,900 0.26% 6.5% 05/15/33<br />

DISTRICT COLUMBIA WTR & SWR AU 8,000,000 $8,256,480 0.09% 5% 10/01/37<br />

DORCHESTER CNTY SC SCH DIST #2 16,500,000 $17,637,015 0.19% 5.25% 12/01/29<br />

DOUGLAS CNTY WASH PUB UTIL DIS 7,685,000 $7,930,689 0.09% 5% 09/01/35<br />

DOWNTOWN PHOENIX HOTEL CORP AR 12,000,000 $12,193,800 0.13% 5% 07/01/36<br />

E-470 PUB HIGHWAY AUTH COLO 3,000,000 $3,184,170 0.03% 5.5% 09/01/24<br />

E-470 PUB HIGHWAY AUTH COLO 10,000,000 $3,633,500 0.04% N/A 09/01/31<br />

E-470 PUB HIGHWAY AUTH COLO 15,720,000 $3,894,001 0.04% N/A 09/01/37<br />

Page 6 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

26822LET7<br />

26822LLM4<br />

26822LKS2<br />

26822LEU4<br />

26822LEN0<br />

26822LJH8<br />

269480AA7<br />

273106AA2<br />

279155BX2<br />

28310NAP0<br />

29610QAE3<br />

30382LCF3<br />

304286BD8<br />

311450EZ9<br />

311450FA3<br />

311450FB1<br />

341422XX6<br />

34281PQH9<br />

34281PPB3<br />

343564AA8<br />

345105EZ9<br />

345105EX4<br />

345105EU0<br />

345105DS6<br />

345105FM7<br />

34660EAB5<br />

34660EAC3<br />

346832AM0<br />

346832AP3<br />

360058EV9<br />

302716AT2<br />

302716AU9<br />

362896AN2<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

E-470 PUB HIGHWAY AUTH COLO 10,000,000 $4,111,500 0.04% N/A 09/01/29<br />

E-470 PUB HIGHWAY AUTH COLO 5,000,000 $5,268,100 0.06% 5.375% 09/01/26<br />

E-470 PUB HIGHWAY AUTH COLO 6,000,000 $6,368,340 0.07% 5.5% 09/01/24<br />

E-470 PUB HIGHWAY AUTH COLO 17,300,000 $6,685,066 0.07% N/A 09/01/30<br />

E-470 PUB HIGHWAY AUTH COLO 15,000,000 $6,736,800 0.07% N/A 09/01/28<br />

E-470 PUB HIGHWAY AUTH COLO 10,000,000 $10,613,900 0.11% 5.5% 09/01/24<br />

EAGLE CNTY COLO SPORTS FAC REV 41,200,000 $41,581,512 0.45% 6.95% 08/01/19<br />

EAST HOMESTEAD FL CDD 1,400,000 $1,335,236 0.01% 5.45% 05/01/36<br />

ECORSE CITY MICH 5,215,000 $5,335,414 0.06% 6.5% 11/01/35<br />

EL DORADO CNTY CALIF CFD#1 PRO 3,500,000 $3,503,990 0.04% 6.3% 09/01/31<br />

ESCAMBIA CNTY FLA ENVIRONMENTA 7,975,000 $9,888,840 0.11% 9.5% 03/01/33<br />

FAIRFAX CNTY VA ECONOMIC DEV A 16,980,000 $17,176,628 0.19% 4.5% 03/01/42<br />

FAIRFIELD CNTY OHIO HOSP REV 10,000,000 $9,381,000 0.10% 5% 06/15/43<br />

FARMINGTON N M POLLUTN CTL REV 18,435,000 $19,648,391 0.21% 5.9% 06/01/40<br />

FARMINGTON N M POLLUTN CTL REV 53,520,000 $57,042,686 0.62% 5.9% 06/01/40<br />

FARMINGTON N M POLLUTN CTL REV 58,000,000 $61,817,560 0.67% 5.9% 06/01/40<br />

FLORIDA ST BOARD OF EDUCATION 5,000,000 $6,336,600 0.07% 6% 06/01/23<br />

FLORIDA ST GOVERNMENTAL UTIL A 2,500,000 $2,466,850 0.03% 5% 10/01/40<br />

FLORIDA ST GOVERNMENTAL UTIL A 5,260,000 $5,114,718 0.06% 5% 10/01/40<br />

FLOYD CNTY GA DEV AUTH ENVIRON 1,575,000 $1,583,442 0.02% 5.7% 12/01/15<br />

FOOTHILL/EASTERN CORRIDOR AGY 4,000,000 $1,035,720 0.01% N/A 01/15/36<br />

FOOTHILL/EASTERN CORRIDOR AGY 4,500,000 $1,214,100 0.01% N/A 01/15/34<br />

FOOTHILL/EASTERN CORRIDOR AGY 4,000,000 $1,405,360 0.02% N/A 01/15/31<br />

FOOTHILL/EASTERN CORRIDOR AGY 49,115,000 $29,750,428 0.32% N/A 01/15/22<br />

FOOTHILL/EASTERN CORRIDOR AGY 35,000,000 $35,615,300 0.38% 5.85% 01/15/23<br />

FORSYTH CNTY GA HOSP AUTH REV 4,565,000 $5,132,201 0.06% 6.25% 10/01/18<br />

FORSYTH CNTY GA HOSP AUTH REV 8,000,000 $9,945,440 0.11% 6.375% 10/01/28<br />

FORT BEND TEX GRAND PKWY TOLL 5,000,000 $5,370,300 0.06% 5% 03/01/37<br />

FORT BEND TEX GRAND PKWY TOLL 8,000,000 $7,070,080 0.08% 4% 03/01/46<br />

FULTON CNTY GA RESIDNTIAL CARE 5,000,000 $4,711,600 0.05% 5% 07/01/27<br />

FYI PROPERTIES WASH LEASE REV 11,935,000 $12,700,749 0.14% 5.5% 06/01/34<br />

FYI PROPERTIES WASH LEASE REV 16,250,000 $17,240,275 0.19% 5.5% 06/01/39<br />

GAINESVILLE GA REDEV AUTH EDL 6,500,000 $5,461,495 0.06% 5.125% 03/01/37<br />

Page 7 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

365128AM9<br />

365128AH0<br />

378294FC1<br />

38122NNZ1<br />

38122NJA1<br />

38122NGG1<br />

383276BQ4<br />

383276BR2<br />

392397CC7<br />

39483RAA2<br />

40065BCB7<br />

40065BCM3<br />

40065BCN1<br />

40065BCP6<br />

40065BCC5<br />

40065AAD7<br />

40065AAC9<br />

40065FAT1<br />

40065FAH7<br />

40065FAJ3<br />

405815GF2<br />

40727RAS7<br />

40727RAR9<br />

412516AA4<br />

414152SR0<br />

41524CAU8<br />

419800HZ3<br />

419791R26<br />

419791Q76<br />

4252004N9<br />

4252004M1<br />

4252004K5<br />

4252004L3<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

GARDEN CITY MICH HOSP FIN AUTH 430,000 $430,395 0.00% 5.75% 09/01/17<br />

GARDEN CITY MICH HOSP FIN AUTH 5,250,000 $4,458,667 0.05% 5% 08/15/38<br />

GLENDALE ARIZ MUN PPTY CORP EX 15,500,000 $15,972,595 0.17% 5% 07/01/38<br />

GOLDEN STATE TOBACCO SECURITIZ 9,960,000 $8,402,156 0.09% 5% 06/01/33<br />

GOLDEN STATE TOBACCO SECURITIZ 13,250,000 $13,608,942 0.15% 5% 06/01/45<br />

GOLDEN STATE TOBACCO SECURITIZ 15,750,000 $16,366,140 0.18% 5% 06/01/45<br />

GOSHEN IND REV 3,000,000 $2,999,910 0.03% 5.75% 08/15/19<br />

GOSHEN IND REV 5,000,000 $4,692,300 0.05% 5.75% 08/15/28<br />

GREATER WENATCHEE REGL EVENTS 3,150,000 $3,060,666 0.03% 5.5% 09/01/42<br />

GREENEWAY FLA IMPT DIST 35,750,000 $32,624,735 0.35% 5.125% 05/01/43<br />

GUAM GOVT 7,270,000 $6,795,487 0.07% 5.125% 11/15/27<br />

GUAM GOVT 8,000,000 $8,373,360 0.09% 6% 11/15/19<br />

GUAM GOVT 10,000,000 $10,696,100 0.12% 6.75% 11/15/29<br />

GUAM GOVT 15,000,000 $16,218,600 0.18% 7% 11/15/39<br />

GUAM GOVT 37,000,000 $34,269,030 0.37% 5.25% 11/15/37<br />

GUAM GOVT DEPT ED COPS 4,000,000 $4,153,400 0.04% 6.875% 12/01/40<br />

GUAM GOVT DEPT ED COPS 5,065,000 $5,181,950 0.06% 6.625% 12/01/30<br />

GUAM GOVT WTRWKS AUTH WTR & WA 4,000,000 $4,054,160 0.04% 5.625% 07/01/40<br />

GUAM GOVT WTRWKS AUTH WTR & WA 4,000,000 $4,092,560 0.04% 6% 07/01/25<br />

GUAM GOVT WTRWKS AUTH WTR & WA 8,000,000 $8,123,680 0.09% 5.875% 07/01/35<br />

HALIFAX HOSP MED CTR FLA HOSP 18,000,000 $18,498,600 0.20% 5.375% 06/01/46<br />

HAMILTON CNTY OHIO HEALTH CARE 2,500,000 $2,704,300 0.03% 6.625% 01/01/46<br />

HAMILTON CNTY OHIO HEALTH CARE 4,970,000 $5,306,469 0.06% 6.5% 01/01/41<br />

HARFORD CNTY MD SPL OBLIG 7,000,000 $7,325,710 0.08% 7.5% 07/01/40<br />

HARRIS CNTY TEX HEALTH FACS DE 13,500,000 $17,470,890 0.19% 7.25% 12/01/35<br />

HARRISON CNTY W VA CNTY COMMN 14,745,000 $15,110,528 0.16% 5.5% 10/15/37<br />

HAWAII ST DEPT BUDGET & FIN SP 7,500,000 $8,418,450 0.09% 6.5% 07/01/39<br />

HAWAII ST GO 10,000,000 $9,897,000 0.11% 4% 11/01/31<br />

HAWAII ST GO 18,000,000 $20,254,140 0.22% 5% 11/01/28<br />

HENDERSON NEV 5,230,000 $4,786,182 0.05% 4% 06/01/34<br />

HENDERSON NEV 5,240,000 $4,825,778 0.05% 4% 06/01/33<br />

HENDERSON NEV 5,685,000 $5,319,738 0.06% 4% 06/01/31<br />

HENDERSON NEV 6,230,000 $5,771,783 0.06% 4% 06/01/32<br />

Page 8 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

425203BM7<br />

425208QA6<br />

425208PZ2<br />

425208PX7<br />

425208QD0<br />

425208QG3<br />

425208JX4<br />

425208HL2<br />

425208QS7<br />

425208QT5<br />

425208QY4<br />

426357FM6<br />

43233ABY1<br />

43233ACA2<br />

432320DX4<br />

43232VSF9<br />

438670F97<br />

438701TD6<br />

438701TC8<br />

442348P85<br />

442348P69<br />

443731BM5<br />

451295TW9<br />

45130CAB7<br />

45203EAC3<br />

45203EAD1<br />

45200LG34<br />

452152LR0<br />

452152LT6<br />

452152LS8<br />

452152SZ5<br />

452152SX0<br />

452152TC5<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

HENDERSON NEV HEALTH CARE FAC 7,000,000 $7,243,670 0.08% 5.625% 07/01/24<br />

HENDERSON NEV LOC IMPT DIST 955,000 $906,581 0.01% 5% 03/01/19<br />

HENDERSON NEV LOC IMPT DIST 955,000 $915,463 0.01% 5% 03/01/18<br />

HENDERSON NEV LOC IMPT DIST 1,350,000 $1,317,087 0.01% 4.9% 03/01/16<br />

HENDERSON NEV LOC IMPT DIST 1,440,000 $1,321,358 0.01% 5.1% 03/01/22<br />

HENDERSON NEV LOC IMPT DIST 1,525,000 $1,343,875 0.01% 5.125% 03/01/25<br />

HENDERSON NEV LOC IMPT DIST 3,005,000 $3,012,242 0.03% 5.9% 11/01/18<br />

HENDERSON NEV LOC IMPT DIST 22,435,000 $22,452,723 0.24% 7.375% 08/01/18<br />

HENDERSON NV LID #T-17 MADEIRA 685,000 $696,453 0.01% 5% 09/01/15<br />

HENDERSON NV LID #T-17 MADEIRA 710,000 $718,221 0.01% 5% 09/01/16<br />

HENDERSON NV LID #T-17 MADEIRA 1,315,000 $1,248,211 0.01% 5% 09/01/25<br />

HENRY CNTY GA HOSPITAL AUTH RE 15,000,000 $15,365,850 0.17% 5% 07/01/34<br />

HILLSBOROUGH CNTY FLA INDL DEV 1,500,000 $1,518,465 0.02% 5.25% 10/01/28<br />

HILLSBOROUGH CNTY FLA INDL DEV 7,250,000 $7,339,247 0.08% 5.25% 10/01/34<br />

HILLSBOROUGH CNTY FLA INDL DEV 6,525,000 $7,477,193 0.08% 5.65% 05/15/18<br />

HILLSBOROUGH CNTY FLA SCH BRD 15,715,000 $17,278,485 0.19% 5% 07/01/29<br />

HONOLULU HAWAII CITY & CNTY 15,650,000 $17,009,985 0.18% 5% 11/01/33<br />

HONOLULU HAWAII CITY & CNTY WA 3,500,000 $3,729,530 0.04% 5% 07/01/42<br />

HONOLULU HAWAII CITY & CNTY WA 8,025,000 $8,613,714 0.09% 5% 07/01/37<br />

HOUSTON TEX ARPT SYS REV 31,520,000 $31,517,793 0.34% 6.75% 07/01/29<br />

HOUSTON TEX ARPT SYS REV 35,095,000 $35,234,327 0.38% 6.75% 07/01/21<br />

HUDSON CNTY N J IMPT AUTH SOLI 5,000,000 $5,481,150 0.06% 5.75% 01/01/40<br />

IDAHO HEALTH FACS AUTH REV 12,500,000 $14,012,875 0.15% 6.75% 11/01/37<br />

IDAHO HSG & FIN ASSN ECONOMIC 13,305,000 $14,744,601 0.16% 7% 02/01/36<br />

ILLINOIS FIN AUTH WTR FAC REV 9,200,000 $9,108,644 0.10% 5.25% 10/01/39<br />

ILLINOIS FIN AUTH WTR FAC REV 10,415,000 $10,237,632 0.11% 5.25% 05/01/40<br />

ILLINOIS HEALTH FACS AUTH REV 8,595,000 $8,608,580 0.09% 5.375% 08/15/28<br />

ILLINOIS ST 1,000,000 $969,070 0.01% 5% 03/01/35<br />

ILLINOIS ST 2,000,000 $1,929,940 0.02% 5% 03/01/37<br />

ILLINOIS ST 2,000,000 $1,931,480 0.02% 5% 03/01/36<br />

ILLINOIS ST 5,000,000 $5,073,800 0.05% 5.25% 07/01/31<br />

ILLINOIS ST 5,000,000 $5,101,300 0.06% 5.25% 07/01/29<br />

ILLINOIS ST 5,000,000 $5,119,650 0.06% 5.5% 07/01/38<br />

Page 9 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

452152RV5<br />

452152RU7<br />

452152RW3<br />

45200FZA0<br />

45200FYX1<br />

45200F6F1<br />

45200FZN2<br />

45200BE87<br />

45202QBS1<br />

45200FTZ2<br />

45200FF38<br />

45200FJF7<br />

45202QCD3<br />

45200FBB4<br />

45450NAA7<br />

45470CAA7<br />

45479RCM7<br />

454795AY1<br />

4547977U9<br />

4547977V7<br />

454898QW0<br />

455057L23<br />

45506DDA0<br />

455057P52<br />

45506DGY5<br />

45505MCK0<br />

45505MCD6<br />

45567RAA8<br />

45567RAC4<br />

46246SAE5<br />

462460L87<br />

46458RAA8<br />

471373BX7<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

ILLINOIS ST 10,000,000 $9,656,600 0.10% 5% 04/01/36<br />

ILLINOIS ST 10,000,000 $9,689,900 0.10% 5% 04/01/35<br />

ILLINOIS ST 20,000,000 $19,203,200 0.21% 5% 04/01/38<br />

ILLINOIS ST FIN AUTH REV 1,000,000 $1,060,210 0.01% 6.5% 02/01/23<br />

ILLINOIS ST FIN AUTH REV 1,500,000 $1,590,540 0.02% 7.125% 02/01/34<br />

ILLINOIS ST FIN AUTH REV 4,500,000 $4,584,375 0.05% 6.5% 10/15/40<br />

ILLINOIS ST FIN AUTH REV 5,000,000 $5,447,650 0.06% 6.25% 11/15/35<br />

ILLINOIS ST FIN AUTH REV 7,500,000 $7,130,100 0.08% 5.25% 02/01/37<br />

ILLINOIS ST FIN AUTH REV 7,500,000 $8,190,975 0.09% 7% 04/01/43<br />

ILLINOIS ST FIN AUTH REV 10,000,000 $11,850,300 0.13% 7.25% 11/01/38<br />

ILLINOIS ST FIN AUTH REV 15,000,000 $16,026,900 0.17% 6.5% 04/01/39<br />

ILLINOIS ST FIN AUTH REV 15,500,000 $16,195,020 0.17% 5.25% 05/15/29<br />

ILLINOIS ST FIN AUTH REV 15,000,000 $16,644,450 0.18% 6.875% 10/01/43<br />

ILLINOIS ST FIN AUTH REV 17,240,000 $18,170,442 0.20% 5.5% 08/01/37<br />

INDIAN TRACE DEV DIST FLA SPL 2,560,000 $2,365,081 0.03% 5.5% 05/01/33<br />

INDIANA FIN AUTH MIDWESTERN DI 10,000,000 $9,831,500 0.11% 5% 06/01/32<br />

INDIANA HEALTH & EDL FAC FING 8,000,000 $8,421,200 0.09% 5.5% 03/01/37<br />

INDIANA HEALTH & EDL FAC FING 12,000,000 $12,089,400 0.13% 5.25% 11/15/35<br />

INDIANA HEALTH FAC FING AUTH H 5,900,000 $6,193,820 0.07% 6.25% 03/01/25<br />

INDIANA HEALTH FAC FING AUTH H 12,000,000 $12,577,800 0.14% 6% 03/01/34<br />

INDIANA MUN PWR AGY PWR SUPPLY 4,000,000 $4,485,280 0.05% 6% 01/01/39<br />

INDIANA ST FIN AUTH REV 5,000,000 $5,267,500 0.06% 5.75% 11/15/41<br />

INDIANA ST FIN AUTH REV 11,000,000 $11,006,930 0.12% 5% 03/01/41<br />

INDIANA ST FIN AUTH REV 12,500,000 $12,806,875 0.14% 6.375% 09/15/41<br />

INDIANA ST FIN AUTH REV 15,000,000 $14,652,450 0.16% 5% 07/01/40<br />

INDIANA ST FIN AUTH WASTEWATER 5,000,000 $5,217,800 0.06% 5% 10/01/37<br />

INDIANA ST FIN AUTH WASTEWATER 22,620,000 $20,118,228 0.22% 4% 10/01/42<br />

INDIGO CDD FL CAP IMPT REV SER 800,000 $731,000 0.01% 7% 05/01/31<br />

INDIGO CDD FL CAP IMPT REV SER 4,390,000 $2,195,000 0.02% 7% 05/01/30<br />

IOWA FIN AUTH REV 2,500,000 $2,022,825 0.02% 4.75% 08/01/42<br />

IOWA HIGHER ED LN AUTH REV 11,000,000 $11,393,360 0.12% 6% 09/01/39<br />

ISLANDS AT DORAL FL CDD 1,350,000 $1,368,873 0.01% 6.125% 05/01/24<br />

JASPER CNTY IND POLLUTN CTL RE 5,000,000 $5,595,300 0.06% 5.85% 04/01/19<br />

Page 10 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

471373BU3<br />

47770VAK6<br />

478271EE5<br />

478271ED7<br />

478271EC9<br />

478271EB1<br />

48542ABX8<br />

490728XB3<br />

49126VEJ2<br />

49127KBA7<br />

49126VDL8<br />

49126VDP9<br />

49126VEF0<br />

49126KGX3<br />

499523UR7<br />

499523UP1<br />

49952MBU9<br />

507507AA9<br />

511727AJ8<br />

511727AH2<br />

511727AK5<br />

514045ZA4<br />

514045ZB2<br />

514136AD2<br />

5178405S9<br />

523523JL3<br />

523836AT1<br />

531127AC2<br />

537292JY1<br />

538169BX0<br />

542690N40<br />

544435K41<br />

544435T67<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

JASPER CNTY IND POLLUTN CTL RE 10,000,000 $10,893,300 0.12% 5.6% 11/01/16<br />

JOBSOHIO BEVERAGE SYS REV OH 21,060,000 $21,816,896 0.24% 5% 01/01/38<br />

JOHNSON CITY TN HLTH & ED 19,370,000 $7,403,795 0.08% N/A 07/01/30<br />

JOHNSON CITY TN HLTH & ED 19,365,000 $8,005,103 0.09% N/A 07/01/29<br />

JOHNSON CITY TN HLTH & ED 19,400,000 $8,599,632 0.09% N/A 07/01/28<br />

JOHNSON CITY TN HLTH & ED 19,365,000 $9,224,711 0.10% N/A 07/01/27<br />

KANSAS ST DEV FIN AUTH HOSP RE 6,250,000 $6,855,375 0.07% 5.75% 11/15/38<br />

KENT ST UNIV OHIO UNIV REVS 11,000,000 $11,502,370 0.12% 5% 05/01/42<br />

KENTUCKY ECONOMIC DEV FIN AUTH 3,995,000 $4,054,365 0.04% 6.15% 10/01/27<br />

KENTUCKY ECONOMIC DEV FIN AUTH 5,000,000 $5,223,950 0.06% 6% 12/01/42<br />

KENTUCKY ECONOMIC DEV FIN AUTH 5,325,000 $5,452,800 0.06% 6.1% 10/01/22<br />

KENTUCKY ECONOMIC DEV FIN AUTH 6,005,000 $6,149,840 0.07% 6.15% 10/01/27<br />

KENTUCKY ECONOMIC DEV FIN AUTH 10,650,000 $10,819,122 0.12% 6.1% 10/01/22<br />

KENTUCKY ECONOMIC DEV FIN AUTH 18,330,000 $20,290,943 0.22% 6.5% 03/01/45<br />

KNOX CNTY TENN HEALTH EDL & HS 13,755,000 $3,348,104 0.04% N/A 01/01/39<br />

KNOX CNTY TENN HEALTH EDL & HS 12,760,000 $3,469,954 0.04% N/A 01/01/37<br />

KNOX CNTY TENN HEALTH EDL & HS 23,475,000 $23,992,623 0.26% 5.25% 04/01/36<br />

LAKE ASHTON FLA CMNTY DEV DIST 1,125,243 $1,075,057 0.01% 7.4% 05/01/32<br />

LAKELAND FLA RETIREMENT CMNTY 1,230,000 $1,317,686 0.01% 6.25% 01/01/28<br />

LAKELAND FLA RETIREMENT CMNTY 1,255,000 $1,370,685 0.01% 5.875% 01/01/19<br />

LAKELAND FLA RETIREMENT CMNTY 2,250,000 $2,379,352 0.03% 6.375% 01/01/43<br />

LANCASTER CNTY PA HOSP AUTH RE 1,000,000 $1,038,610 0.01% 6.375% 07/01/30<br />

LANCASTER CNTY PA HOSP AUTH RE 3,000,000 $3,106,260 0.03% 6.5% 07/01/40<br />

LANCASTER SC EDL ASSISTANCE PR 15,015,000 $16,007,941 0.17% 5% 12/01/26<br />

LAS VEGAS VALLEY NEV WTR DIST 8,000,000 $8,428,800 0.09% 5% 06/01/37<br />

LEE CNTY FLA TRANSN FACS REV 11,505,000 $11,957,146 0.13% 5% 10/01/30<br />

LEE LAKE WTR DIST CALIF CFD NO 5,000,000 $5,033,700 0.05% 5.95% 09/01/34<br />

LIBERTY N Y DEV CORP REV 65,000,000 $69,429,100 0.75% 5.25% 10/01/35<br />

LITTLE MIAMI OHIO LOC SCH DIST 5,860,000 $6,270,082 0.07% 6.875% 12/01/34<br />

LIVERMORE CA CFD # 06-1 SHEA P 6,595,000 $5,789,025 0.06% 5.4% 09/01/36<br />

LONG ISLAND NY POWER AUTH ELEC 12,500,000 $14,183,250 0.15% 6% 05/01/33<br />

LOS ANGELES CALIF DEPT ARPTS A 25,500,000 $25,957,980 0.28% 5% 05/15/40<br />

LOS ANGELES CALIF DEPT ARPTS A 52,685,000 $53,631,222 0.58% 5% 05/15/40<br />

Page 11 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

544582NN5<br />

544582NL9<br />

544582NP0<br />

544646A51<br />

53945CBW9<br />

53945CBS8<br />

546282HX5<br />

546282CJ1<br />

546279V64<br />

546398L89<br />

546398J82<br />

546398VP0<br />

546398VQ8<br />

546395H72<br />

546398L48<br />

546398J90<br />

546475LK8<br />

54675RBG5<br />

54675RBF7<br />

546593AE4<br />

54877EAA4<br />

549802BY1<br />

560224BD8<br />

56036YDJ1<br />

56036YDG7<br />

56036YDK8<br />

560427ML7<br />

560427MR4<br />

566816GY4<br />

566854DU6<br />

566854DY8<br />

566854DT9<br />

566854DL6<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

LOS ANGELES CALIF MULTIFAMILY 10,000 $10,020 0.00% 8.5% 01/01/24<br />

LOS ANGELES CALIF MULTIFAMILY 25,000 $24,899 0.00% 7.125% 01/01/24<br />

LOS ANGELES CALIF MULTIFAMILY 130,000 $128,407 0.00% 8.5% 01/01/24<br />

LOS ANGELES CALIF UNI SCH DIST 36,625,000 $39,836,646 0.43% 5.25% 07/01/34<br />

LOS ANGELES CALIF WASTEWTR SYS 1,305,000 $1,377,022 0.01% 5% 06/01/30<br />

LOS ANGELES CALIF WASTEWTR SYS 6,225,000 $6,748,398 0.07% 5% 06/01/30<br />

LOUISIANA LOC GOVT ENVIR FACS 8,000,000 $8,580,960 0.09% 6.5% 11/01/35<br />

LOUISIANA LOC GOVT ENVIR FACS 9,000,000 $9,773,640 0.11% 6.5% 08/01/29<br />

LOUISIANA LOC GOVT ENVIR FACS 41,250,000 $44,339,625 0.48% 6.75% 11/01/32<br />

LOUISIANA PUB FACS AUTH REV 5,000,000 $5,763,350 0.06% 6.5% 05/15/37<br />

LOUISIANA PUB FACS AUTH REV 8,500,000 $8,766,220 0.09% 5% 06/01/30<br />

LOUISIANA PUB FACS AUTH REV 10,000,000 $10,284,300 0.11% 5.25% 05/15/38<br />

LOUISIANA PUB FACS AUTH REV 10,000,000 $10,336,400 0.11% 5.5% 05/15/47<br />

LOUISIANA PUB FACS AUTH REV 10,000,000 $11,293,800 0.12% 6.75% 07/01/39<br />

LOUISIANA PUB FACS AUTH REV 15,500,000 $17,743,780 0.19% 6.75% 05/15/41<br />

LOUISIANA PUB FACS AUTH REV 25,000,000 $25,767,500 0.28% 5% 09/01/28<br />

LOUISIANA ST GAS & FUELS TAX R 26,340,000 $27,995,732 0.30% 5% 05/01/45<br />

LOUISVILLE & JEFFERSON CNTY KY 5,000,000 $5,238,000 0.06% 6.125% 05/01/39<br />

LOUISVILLE & JEFFERSON CNTY KY 5,555,000 $5,762,257 0.06% 5.625% 05/01/29<br />

LOUISVILLE & JEFFERSON CNTY KY 11,500,000 $13,929,605 0.15% 6.125% 02/01/37<br />

LOWNDES CNTY MISS SOLID WASTE 18,875,000 $21,438,602 0.23% 6.7% 04/01/22<br />

LUFKIN TEX HEALTH FACS DEV COR 5,000,000 $5,267,450 0.06% 6.25% 02/15/37<br />

MAHTOMEDI MINN SR HSG REV REF 5,000,000 $4,594,200 0.05% 5.75% 12/01/40<br />

MAIN STREET NATURAL GAS INC GA 4,000,000 $4,501,360 0.05% 5.5% 09/15/27<br />

MAIN STREET NATURAL GAS INC GA 5,000,000 $5,630,500 0.06% 5.5% 09/15/25<br />

MAIN STREET NATURAL GAS INC GA 10,000,000 $11,256,600 0.12% 5.5% 09/15/28<br />

MAINE HEALTH & HIGHER EDL FACS 4,250,000 $4,886,140 0.05% 6.75% 07/01/36<br />

MAINE HEALTH & HIGHER EDL FACS 10,000,000 $11,597,600 0.13% 7% 07/01/41<br />

MARICOPA CNTY ARIZ INDL DEV AU 7,500,000 $7,772,250 0.08% 5.5% 07/01/26<br />

MARICOPA CNTY ARIZ POLLUTION C 6,025,000 $6,238,164 0.07% 5% 06/01/35<br />

MARICOPA CNTY ARIZ POLLUTION C 13,200,000 $13,200,000 0.14% 0.04% 05/01/29<br />

MARICOPA CNTY ARIZ POLLUTION C 15,000,000 $16,381,650 0.18% 6.25% 01/01/38<br />

MARICOPA CNTY ARIZ POLLUTION C 20,000,000 $22,679,200 0.25% 7.25% 04/01/40<br />

Page 12 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

573903EF4<br />

57419JKR3<br />

574205FM7<br />

574205FN5<br />

574205FK1<br />

574205FL9<br />

57421HAA1<br />

57420NBE0<br />

574217XV2<br />

5742173U7<br />

574217T21<br />

575567UU4<br />

575567UT7<br />

575577MY4<br />

57563RKY4<br />

57583FEX5<br />

57583FFC0<br />

57583USD1<br />

57583FEY3<br />

57583USC3<br />

57583RGK5<br />

57583USE9<br />

57583FFD8<br />

57583HAN7<br />

57583TBY6<br />

57583UXQ6<br />

57583UXP8<br />

57583UXN3<br />

575898CU3<br />

576000NH2<br />

576002BP3<br />

576528DM2<br />

57652TBD8<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

MARTIN CNTY FL HLTH FACS AUTH 3,800,000 $3,907,426 0.04% 5.5% 11/15/42<br />

MARYLAND ST CDA SFMR DEPT HSNG 595,000 $595,464 0.01% 5.875% 07/01/16<br />

MARYLAND ST ECONOMIC DEV CORP 400,000 $339,544 0.00% 5% 12/01/16<br />

MARYLAND ST ECONOMIC DEV CORP 2,000,000 $1,281,460 0.01% 5.25% 12/01/31<br />

MARYLAND ST ECONOMIC DEV CORP 2,500,000 $2,122,150 0.02% 5% 12/01/16<br />

MARYLAND ST ECONOMIC DEV CORP 10,000,000 $6,394,800 0.07% 5% 12/01/31<br />

MARYLAND ST ECONOMIC DEV CORP 8,600,000 $9,186,692 0.10% 5.75% 09/01/25<br />

MARYLAND ST ECONOMIC DEV CORP 13,070,000 $14,184,871 0.15% 5.75% 06/01/35<br />

MARYLAND ST HEALTH & HIGHER ED 1,200,000 $1,202,616 0.01% 5.4% 01/01/37<br />

MARYLAND ST HEALTH & HIGHER ED 3,000,000 $3,539,100 0.04% 6.75% 07/01/39<br />

MARYLAND ST HEALTH & HIGHER ED 6,000,000 $6,280,560 0.07% 6% 01/01/43<br />

MASSACHUSETTS BAY TRANSN AUTH 775,000 $982,614 0.01% 7% 03/01/21<br />

MASSACHUSETTS BAY TRANSN AUTH 930,000 $1,052,183 0.01% 7% 03/01/21<br />

MASSACHUSETTS BAY TRANSN AUTH 15,000,000 $14,417,400 0.16% 4% 07/01/37<br />

MASSACHUSETTS EDL FING AUTH ED 10,000,000 $9,840,600 0.11% 5.25% 07/01/29<br />

MASSACHUSETTS ST DEV FIN AGY 780,000 $780,592 0.01% 5.6% 07/01/19<br />

MASSACHUSETTS ST DEV FIN AGY 880,000 $880,800 0.01% 5.625% 07/01/15<br />

MASSACHUSETTS ST DEV FIN AGY 1,450,000 $1,355,489 0.01% 5% 07/01/32<br />

MASSACHUSETTS ST DEV FIN AGY 1,620,000 $1,620,291 0.02% 5.625% 07/01/29<br />

MASSACHUSETTS ST DEV FIN AGY 1,720,000 $1,701,234 0.02% 5% 07/01/27<br />

MASSACHUSETTS ST DEV FIN AGY 2,000,000 $1,918,700 0.02% 5% 03/01/36<br />

MASSACHUSETTS ST DEV FIN AGY 2,400,000 $2,231,640 0.02% 5.25% 07/01/42<br />

MASSACHUSETTS ST DEV FIN AGY 3,500,000 $3,504,550 0.04% 5.75% 07/01/23<br />

MASSACHUSETTS ST DEV FIN AGY 3,700,000 $4,537,199 0.05% 5.75% 12/01/42<br />

MASSACHUSETTS ST DEV FIN AGY 16,000,000 $14,978,560 0.16% 5.25% 11/01/42<br />

MASSACHUSETTS ST DEV FIN AGY R 2,000,000 $1,954,820 0.02% 6.25% 11/15/33<br />

MASSACHUSETTS ST DEV FIN AGY R 2,250,000 $2,221,402 0.02% 6.25% 11/15/28<br />

MASSACHUSETTS ST DEV FIN AGY R 4,125,000 $4,028,516 0.04% 6.5% 11/15/43<br />

MASSACHUSETTS ST PORT AUTH REV 10,340,000 $10,890,501 0.12% 5.125% 07/01/41<br />

MASSACHUSETTS ST SCH BLDG AUTH 15,000,000 $16,460,250 0.18% 5% 08/15/30<br />

MASSACHUSETTS ST SPL OBLIG DED 40,000,000 $43,958,000 0.47% 5.5% 01/01/34<br />

MATAGORDA CNTY TEX NAV DIST NO 10,000,000 $11,190,700 0.12% 6.3% 11/01/29<br />

MATAGORDA CNTY TEX NAV DIST NO 12,000,000 $12,224,400 0.13% 5.6% 03/01/27<br />

Page 13 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

580387AA6<br />

586111KW5<br />

586111KV7<br />

592249AC0<br />

592248AW8<br />

59259RB45<br />

59259YEQ8<br />

59259YPH6<br />

59259YHN2<br />

592643BM1<br />

593328EV5<br />

59333PYK8<br />

59333NUP6<br />

59333NUR2<br />

59333NUM3<br />

59333NUF8<br />

59333NUG6<br />

59333NUH4<br />

59333AGQ8<br />

59334KHK7<br />

59334KHM3<br />

59334KHL5<br />

59334KFW3<br />

59333MH65<br />

59333MVF9<br />

59334PEL7<br />

5946142K4<br />

594614G45<br />

5946147X1<br />

594614ZN2<br />

594614VX4<br />

59447PGF2<br />

59465EYY3<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

MC DUFFIE CNTY GA DEV AUTH WAS 5,120,000 $5,254,297 0.06% 6.95% 12/01/23<br />

MEMPHIS-SHELBY CNTY TENN ARPT 3,500,000 $3,947,825 0.04% 5.75% 07/01/24<br />

MEMPHIS-SHELBY CNTY TENN ARPT 5,000,000 $5,682,650 0.06% 5.75% 07/01/23<br />

METROPOLITAN PIER & EXPOSITION 7,500,000 $10,082,625 0.11% 7% 07/01/26<br />

METROPOLITAN PIER & EXPOSITION 10,475,000 $11,106,747 0.12% 5.5% 06/15/2050<br />

METROPOLITAN TRANSN AUTH TRANS 7,000,000 $7,427,770 0.08% 5% 11/15/30<br />

METROPOLITAN TRANSN AUTH TRANS 10,000,000 $10,344,800 0.11% 5.25% 11/15/40<br />

METROPOLITAN TRANSN AUTH TRANS 14,000,000 $14,303,800 0.15% 5% 11/15/41<br />

METROPOLITAN TRANSN AUTH TRANS 15,500,000 $15,807,055 0.17% 5% 11/15/41<br />

METROPOLITAN WASHINGTON D C AR 60,145,000 $55,969,132 0.60% N/A 10/01/41<br />

MIAMI CNTY OHIO HOSP FACS REV 2,750,000 $2,827,082 0.03% 5.25% 05/15/26<br />

MIAMI-DADE CNTY FL AVIATION RE 20,850,000 $22,378,305 0.24% 5.5% 10/01/41<br />

MIAMI-DADE CNTY FL SPL OBLIG 3,250,000 $3,285,717 0.04% 5% 10/01/35<br />

MIAMI-DADE CNTY FL SPL OBLIG 4,500,000 $4,668,345 0.05% 5% 10/01/32<br />

MIAMI-DADE CNTY FL SPL OBLIG 5,000,000 $5,190,850 0.06% 5% 10/01/31<br />

MIAMI-DADE CNTY FL SPL OBLIG 8,365,000 $8,919,013 0.10% 5% 10/01/28<br />

MIAMI-DADE CNTY FL SPL OBLIG 10,000,000 $10,575,600 0.11% 5% 10/01/29<br />

MIAMI-DADE CNTY FL SPL OBLIG 11,925,000 $12,435,270 0.13% 5% 10/01/30<br />

MIAMI-DADE CNTY FLA ED FAC AUT 10,995,000 $11,950,465 0.13% 5.25% 04/01/27<br />

MIAMI-DADE CNTY FLA EXPWY AUTH 5,385,000 $5,738,148 0.06% 5% 07/01/29<br />

MIAMI-DADE CNTY FLA EXPWY AUTH 5,900,000 $6,200,900 0.07% 5% 07/01/31<br />

MIAMI-DADE CNTY FLA EXPWY AUTH 6,000,000 $6,333,480 0.07% 5% 07/01/30<br />

MIAMI-DADE CNTY FLA EXPWY AUTH 30,270,000 $31,060,047 0.34% 5% 07/01/40<br />

MIAMI-DADE CNTY FLA SCH BRD CO 10,000,000 $10,425,300 0.11% 5% 05/01/32<br />

MIAMI-DADE CNTY FLA SCH BRD CO 14,310,000 $14,887,265 0.16% 5% 05/01/33<br />

MIAMI-DADE CNTY FLA TRANSIT SY 31,855,000 $32,408,958 0.35% 5% 07/01/42<br />

MICHIGAN ST BLDG AUTH REV 6,000,000 $6,650,280 0.07% 6% 10/15/38<br />

MICHIGAN ST BLDG AUTH REV 9,500,000 $10,144,670 0.11% 5% 10/15/31<br />

MICHIGAN ST BLDG AUTH REV 10,000,000 $10,340,100 0.11% 5.375% 10/15/41<br />

MICHIGAN ST BLDG AUTH REV 13,495,000 $14,365,697 0.16% 5% 10/15/33<br />

MICHIGAN ST BLDG AUTH REV 16,585,000 $16,748,030 0.18% 5% 10/15/29<br />

MICHIGAN ST FIN AUTH REV 10,000,000 $11,386,100 0.12% 5.5% 06/01/21<br />

MICHIGAN ST HOSP FIN AUTH REV 635,000 $635,889 0.01% 5.75% 11/15/15<br />

Page 14 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

59465HGA8<br />

59465HLD6<br />

59465HBA3<br />

594698JB9<br />

594698JD5<br />

594751AF6<br />

594751AG4<br />

597495BC3<br />

59807PAC9<br />

59807PAB1<br />

603908MD3<br />

60374VCU5<br />

60374VCT8<br />

604920V88<br />

604146AR1<br />

604335AB5<br />

606092ED2<br />

55374SAJ9<br />

55374SAE0<br />

55374SAD2<br />

639096BA3<br />

644614T25<br />

644618Q60<br />

64468KBX3<br />

6459053B4<br />

645918YV9<br />

645916S65<br />

645916S73<br />

64577FBG9<br />

64578CAG6<br />

64578CAE1<br />

64578CAH4<br />

64579FJG9<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

MICHIGAN ST HOSP FIN AUTH REV 3,680,000 $3,689,236 0.04% 5% 07/15/37<br />

MICHIGAN ST HOSP FIN AUTH REV 4,065,000 $4,511,052 0.05% 6.125% 06/01/34<br />

MICHIGAN ST HOSP FIN AUTH REV 6,000,000 $6,495,120 0.07% 5% 05/15/34<br />

MICHIGAN ST STRATEGIC FD LTD O 2,800,000 $2,922,388 0.03% 6.75% 12/01/28<br />

MICHIGAN ST STRATEGIC FD LTD O 20,050,000 $20,880,270 0.23% 6.25% 06/01/14<br />

MICHIGAN TOB SETTLEMENT FIN AU 2,500,000 $2,207,475 0.02% 6% 06/01/34<br />

MICHIGAN TOB SETTLEMENT FIN AU 10,000,000 $8,342,500 0.09% 6% 06/01/48<br />

MIDLAND CNTY TEX FRESH WTR SPL 5,000,000 $5,321,950 0.06% 5% 09/15/40<br />

MIDTOWN MIAMI FL CDD SPECIAL A 3,785,000 $3,802,146 0.04% 6.5% 05/01/37<br />

MIDTOWN MIAMI FL CDD SPECIAL A 7,500,000 $7,620,825 0.08% 6.25% 05/01/37<br />

MINNEAPOLIS MINN HEALTH CARE F 5,075,000 $4,878,445 0.05% 5.875% 06/01/35<br />

MINNEAPOLIS MINN HEALTH CARE S 6,250,000 $7,098,187 0.08% 6.75% 11/15/32<br />

MINNEAPOLIS MINN HEALTH CARE S 11,000,000 $12,598,520 0.14% 6.625% 11/15/28<br />

MINNESOTA AGRIC & ECONOMIC DEV 175,000 $175,593 0.00% 6.375% 11/15/29<br />

MINNESOTA ST GEN FUND REV 8,000,000 $8,832,960 0.10% 5% 03/01/28<br />

MINOOKA IL SPL TAX - PRAIRIE R 2,854,000 $2,649,082 0.03% 6.875% 03/01/33<br />

MISSOURI JT MUN ELEC UTIL COMM 11,000,000 $11,707,300 0.13% 6% 01/01/39<br />

M-S-R ENERGY AUTH CALIF 20,000,000 $23,704,000 0.26% 6.5% 11/01/39<br />

M-S-R ENERGY AUTH CALIF 20,000,000 $24,903,600 0.27% 7% 11/01/34<br />

M-S-R ENERGY AUTH CALIF 30,505,000 $34,668,932 0.37% 6.125% 11/01/29<br />

NAVAJO CNTY ARIZ POLLUTN CTL C 10,750,000 $12,062,790 0.13% 5.75% 06/01/34<br />

NEW HAMPSHIRE HEALTH & ED FACS 7,500,000 $7,245,900 0.08% 5% 01/01/42<br />

NEW HAMPSHIRE HIGHER EDL & HEA 12,750,000 $12,753,442 0.14% 7.5% 07/01/24<br />

NEW HAMPSHIRE ST BUSINESS FIN 5,000,000 $5,381,300 0.06% 6.125% 10/01/39<br />

NEW JERSEY ECONOMIC DEV AUTH R 1,525,000 $1,431,243 0.02% 5.75% 01/01/24<br />

NEW JERSEY ECONOMIC DEV AUTH R 5,000,000 $5,279,650 0.06% 5.875% 06/01/42<br />

NEW JERSEY ECONOMIC DEV AUTH R 6,500,000 $6,827,405 0.07% 5.5% 06/15/31<br />

NEW JERSEY ECONOMIC DEV AUTH R 10,000,000 $10,527,500 0.11% 5.75% 06/15/34<br />

NEW JERSEY ECONOMIC DEV AUTH S 9,965,000 $10,010,241 0.11% 6% 06/01/32<br />

NEW JERSEY ECONOMIC DEV AUTH S 19,800,000 $19,194,516 0.21% 5.125% 09/15/23<br />

NEW JERSEY ECONOMIC DEV AUTH S 22,500,000 $21,975,300 0.24% 4.875% 09/15/19<br />

NEW JERSEY ECONOMIC DEV AUTH S 37,900,000 $35,574,456 0.38% 5.25% 09/15/29<br />

NEW JERSEY HEALTH CARE FACS FI 6,000,000 $6,034,740 0.07% 5% 07/01/46<br />

Page 15 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

64579FKT9<br />

64579FKS1<br />

64579FXC2<br />

646136E23<br />

646136ZA2<br />

646136J85<br />

646136J51<br />

646136ZB0<br />

646136J69<br />

647370DH5<br />

647370DF9<br />

64763FPF0<br />

64763FPR4<br />

64763FPE3<br />

64763FLJ6<br />

64763FMH9<br />

64971CG81<br />

64971SBF5<br />

64971SCE7<br />

64971SCC1<br />

64971QL27<br />

64971QRM7<br />

649519CL7<br />

649519CK9<br />

649519CH6<br />

649519CF0<br />

649519CG8<br />

649519AF2<br />

64966BZ48<br />

649664H77<br />

64966C5H0<br />

649665WX0<br />

64966J2F2<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

NEW JERSEY HEALTH CARE FACS FI 52,330,000 $15,563,988 0.17% N/A 07/01/34<br />

NEW JERSEY HEALTH CARE FACS FI 57,680,000 $18,317,437 0.20% N/A 07/01/33<br />

NEW JERSEY HEALTH CARE FACS FI 25,000,000 $26,947,500 0.29% 6.625% 07/01/38<br />

NEW JERSEY ST TRANSN TR FD AUT 10,000,000 $10,759,200 0.12% 5.25% 06/15/36<br />

NEW JERSEY ST TRANSN TR FD AUT 19,295,000 $23,810,994 0.26% 6% 12/15/38<br />

NEW JERSEY ST TRANSN TR FD AUT 24,910,000 $25,670,502 0.28% 5% 06/15/42<br />

NEW JERSEY ST TRANSN TR FD AUT 37,500,000 $38,980,125 0.42% 5% 06/15/38<br />

NEW JERSEY ST TRANSN TR FD AUT 35,705,000 $40,744,403 0.44% 6% 12/15/38<br />

NEW JERSEY ST TRANSN TR FD AUT 40,000,000 $41,698,800 0.45% 5% 06/15/33<br />

NEW MEXICO ST HOSP EQUIP LN CO 3,470,000 $3,761,410 0.04% 5% 07/01/35<br />

NEW MEXICO ST HOSP EQUIP LN CO 4,360,000 $4,747,691 0.05% 5.25% 07/01/30<br />

NEW ORLEANS LA GO 2,535,000 $2,730,042 0.03% 5% 12/01/25<br />

NEW ORLEANS LA GO 2,840,000 $3,114,514 0.03% 5% 12/01/23<br />

NEW ORLEANS LA GO 4,500,000 $4,890,330 0.05% 5% 12/01/24<br />

NEW ORLEANS LA GO 5,000,000 $5,202,000 0.06% 5% 03/01/21<br />

NEW ORLEANS LA GO 13,480,000 $13,874,424 0.15% 5.25% 12/01/36<br />

NEW YORK CITY IDA CIVIC FAC RE 5,000,000 $5,059,100 0.05% 6.8% 06/01/28<br />

NEW YORK CITY IDA SPL FAC REV 15,550,000 $15,805,797 0.17% 7.625% 12/01/32<br />

NEW YORK CITY IDA SPL FAC REV 15,000,000 $16,899,750 0.18% 7.75% 08/01/31<br />

NEW YORK CITY IDA SPL FAC REV 31,860,000 $35,777,187 0.39% 7.625% 08/01/25<br />

NEW YORK CITY TRANSITIONAL FIN 12,455,000 $14,035,913 0.15% 5% 11/01/27<br />

NEW YORK CITY TRANSITIONAL FIN 41,310,000 $43,758,856 0.47% 5% 11/01/38<br />

NEW YORK LIBERTY DEV CORP LIBE 5,000,000 $5,130,900 0.06% 5% 09/15/43<br />

NEW YORK LIBERTY DEV CORP LIBE 5,000,000 $5,348,850 0.06% 5% 09/15/40<br />

NEW YORK LIBERTY DEV CORP LIBE 11,000,000 $11,842,820 0.13% 5% 09/15/32<br />

NEW YORK LIBERTY DEV CORP LIBE 19,475,000 $21,146,344 0.23% 5% 09/15/30<br />

NEW YORK LIBERTY DEV CORP LIBE 20,000,000 $21,624,200 0.23% 5% 09/15/31<br />

NEW YORK LIBERTY DEV CORP SECO 18,500,000 $20,632,495 0.22% 6.375% 07/15/49<br />

NEW YORK N Y 5,000 $5,016 0.00% 6.125% 08/01/25<br />

NEW YORK N Y 10,000 $10,044 0.00% 7.5% 02/01/22<br />

NEW YORK N Y 20,000 $20,084 0.00% 6.25% 08/01/15<br />

NEW YORK N Y 85,000 $85,386 0.00% 7.5% 02/01/21<br />

NEW YORK N Y 4,250,000 $4,538,235 0.05% 5% 10/01/34<br />

Page 16 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

64966J3E4<br />

64966J2E5<br />

64966JSD9<br />

64971CTF1<br />

6499027D9<br />

64990EDH7<br />

649903ZZ7<br />

649903A27<br />

64990EFG7<br />

650035XD5<br />

650035XE3<br />

650035XF0<br />

653337AC9<br />

65820YEV4<br />

65820YEW2<br />

657902Z88<br />

657902Z70<br />

657902Z62<br />

6579022A9<br />

6591543A4<br />

66272RAL6<br />

66272RAM4<br />

66285WAU0<br />

66285WHD1<br />

66285WHF6<br />

66285WJX5<br />

66285WBQ8<br />

66285WFG6<br />

66285WET9<br />

66285WHG4<br />

66285WDX1<br />

66285WEF9<br />

66285WAW6<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

NEW YORK N Y 6,270,000 $6,802,824 0.07% 5% 08/01/30<br />

NEW YORK N Y 9,000,000 $9,631,800 0.10% 5% 10/01/33<br />

NEW YORK N Y 9,550,000 $10,138,662 0.11% 5% 10/01/34<br />

NEW YORK N Y CITY INDL DEV AGY 4,680,000 $4,531,222 0.05% 6.75% 06/01/20<br />

NEW YORK ST DORM AUTH REV 5,000,000 $5,272,500 0.06% 5% 08/15/38<br />

NEW YORK ST DORM AUTH REV 12,500,000 $13,536,750 0.15% 5% 06/15/31<br />

NEW YORK ST DORM AUTH REV 16,000,000 $17,116,800 0.18% 6.125% 12/01/29<br />

NEW YORK ST DORM AUTH REV 30,000,000 $31,830,000 0.34% 6.25% 12/01/37<br />

NEW YORK ST DORM AUTH REV 33,385,000 $35,815,761 0.39% 5% 03/15/32<br />

NEW YORK ST URBAN DEV CORP REV 11,920,000 $12,653,914 0.14% 5% 03/15/34<br />

NEW YORK ST URBAN DEV CORP REV 12,515,000 $13,251,507 0.14% 5% 03/15/35<br />

NEW YORK ST URBAN DEV CORP REV 13,140,000 $13,877,811 0.15% 5% 03/15/36<br />

NEZ PERCE CNTY IDAHO POLLUTION 22,500,000 $22,579,650 0.24% 6% 10/01/24<br />

NORTH CAROLINA MED CARE COMMN 920,000 $930,782 0.01% 5.25% 10/01/24<br />

NORTH CAROLINA MED CARE COMMN 1,600,000 $1,611,248 0.02% 5.5% 10/01/32<br />

NORTH CAROLINA MED CARE COMMN 2,000,000 $1,894,880 0.02% 5.65% 10/01/25<br />

NORTH CAROLINA MED CARE COMMN 2,500,000 $2,501,275 0.03% 6% 10/01/23<br />

NORTH CAROLINA MED CARE COMMN 3,625,000 $3,564,136 0.04% 5.75% 10/01/23<br />

NORTH CAROLINA MED CARE COMMN 21,750,000 $20,240,550 0.22% 6.125% 10/01/35<br />

NORTH EAST INDPT SCH DIST 7,635,000 $8,966,544 0.10% 5.25% 02/01/30<br />

NORTH SUMTER CNTY UTILITY REV 3,780,000 $4,083,269 0.04% 6% 10/01/30<br />

NORTH SUMTER CNTY UTILITY REV 6,865,000 $7,303,330 0.08% 6.25% 10/01/43<br />

NORTH TEX TWY AUTH REV 1,000,000 $1,088,530 0.01% 5.625% 01/01/33<br />

NORTH TEX TWY AUTH REV 7,500,000 $1,943,475 0.02% N/A 09/01/37<br />

NORTH TEX TWY AUTH REV 10,000,000 $6,627,500 0.07% N/A 09/01/43<br />

NORTH TEX TWY AUTH REV 10,000,000 $10,347,200 0.11% 5% 01/01/38<br />

NORTH TEX TWY AUTH REV 11,680,000 $12,743,814 0.14% 5.75% 01/01/40<br />

NORTH TEX TWY AUTH REV 12,500,000 $13,907,500 0.15% 6.25% 01/01/39<br />

NORTH TEX TWY AUTH REV 15,000,000 $16,489,950 0.18% 6% 01/01/38<br />

NORTH TEX TWY AUTH REV 25,000,000 $18,696,250 0.20% N/A 09/01/45<br />

NORTH TEX TWY AUTH REV 20,000,000 $21,426,800 0.23% 5.75% 01/01/38<br />

NORTH TEX TWY AUTH REV 25,000,000 $26,810,250 0.29% N/A 01/01/43<br />

NORTH TEX TWY AUTH REV 30,000,000 $32,293,500 0.35% 5.75% 01/01/48<br />

Page 17 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

66353RAJ3<br />

66537RAP8<br />

665588NG0<br />

66988TDB6<br />

62619RCS0<br />

62619RCR2<br />

67501KAK4<br />

677288AG7<br />

677525US4<br />

67884WAV1<br />

6817938E8<br />

685869CP2<br />

68608FFX2<br />

686543SG5<br />

689585AQ0<br />

690384BC5<br />

69069AAA8<br />

69069AAC4<br />

696638AA3<br />

69671TCY3<br />

69671TCX5<br />

69671TCV9<br />

69671TDA4<br />

70583PAT9<br />

70583PAU6<br />

707162AZ6<br />

708692BC1<br />

70869RAQ6<br />

708686CT5<br />

709223XA4<br />

7092234U2<br />

7092234Q1<br />

709223WZ0<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

NORTHAMPTON CNTY PA GEN PURP A 15,000,000 $15,381,600 0.17% 5.5% 08/15/40<br />

NORTHERN MARIANA ISLANDS COMWL 6,520,000 $6,226,600 0.07% 6.6% 03/15/28<br />

NORTHERN PALM BEACH CNTY IMPT 800,000 $788,528 0.01% 5.35% 08/01/41<br />

NOVATO CALIF REDEV AGY TAX ALL 3,750,000 $4,129,612 0.04% 6.75% 09/01/40<br />

NY MUNICIPAL ASSISTANCE CORP F 428,010 $339,895 0.00% N/A 07/15/21<br />

NY MUNICIPAL ASSISTANCE CORP F 649,658 $503,887 0.01% N/A 01/15/22<br />

OCEAN SHORES WASH LOC IMPT DIS 15,535,000 $18,242,750 0.20% 7.25% 02/01/31<br />

OHIO CNTY KY POLLUTION CTL REV 10,500,000 $10,111,710 0.11% 6% 07/15/31<br />

OHIO ST AIR QUALITY DEV AUTH R 15,000,000 $15,880,650 0.17% 6% 12/01/40<br />

OKLAHOMA DEV FIN AUTH REV 5,000,000 $4,777,000 0.05% 5.75% 01/01/37<br />

OMAHA PUB PWR DIST NEB ELEC RE 3,250,000 $3,474,185 0.04% 5% 02/01/37<br />

OREGON HEALTH SCIENCES UNIV RE 5,000,000 $5,535,200 0.06% 5.75% 07/01/39<br />

OREGON ST HEALTH HSG EDL & CUL 900,000 $900,000 0.01% 0.03% 12/01/15<br />

ORLANDO-ORANGE CNTY EXPWY AUTH 15,000,000 $15,628,500 0.17% 5% 07/01/40<br />

OTTER CREEK WTR RECLAMATION DS 4,500,000 $4,509,990 0.05% 5% 01/01/39<br />

OVERTON PWR DIST NO 5 NEV SPL 7,500,000 $8,403,900 0.09% 8% 12/01/38<br />

OWEN CNTY KY WTRWKS SYS REV 8,000,000 $8,372,640 0.09% 6.25% 06/01/39<br />

OWEN CNTY KY WTRWKS SYS REV 10,000,000 $10,002,300 0.11% 5.375% 06/01/40<br />

PALM GLADES FL CDD SER 06 A 1,100,000 $1,028,148 0.01% 5.3% 05/01/36<br />

PALMDALE CALIF ELEM SCH DIST S 1,250,000 $447,012 0.00% N/A 08/01/31<br />

PALMDALE CALIF ELEM SCH DIST S 1,250,000 $477,912 0.01% N/A 08/01/30<br />

PALMDALE CALIF ELEM SCH DIST S 1,500,000 $661,920 0.01% N/A 08/01/28<br />

PALMDALE CALIF ELEM SCH DIST S 2,500,000 $1,194,850 0.01% N/A 08/01/34<br />

PELICAN MARSH CMNTY DEV DIST F 1,380,000 $1,339,924 0.01% 4.875% 05/01/22<br />

PELICAN MARSH CMNTY DEV DIST F 1,500,000 $1,450,635 0.02% 5.375% 05/01/31<br />

PENINSULA PORTS AUTH VA COAL T 9,500,000 $9,568,400 0.10% 6% 04/01/33<br />

PENNSYLVANIA ECONOMIC DEV FING 3,000,000 $3,014,130 0.03% 1.75% 12/01/33<br />

PENNSYLVANIA ECONOMIC DEV FING 7,500,000 $7,800,900 0.08% 5% 12/01/43<br />

PENNSYLVANIA ECONOMIC DEV FING 60,000,000 $68,802,000 0.74% 7% 07/15/39<br />

PENNSYLVANIA ST TPK COMMN TPK 5,000,000 $4,969,600 0.05% N/A 06/01/33<br />

PENNSYLVANIA ST TPK COMMN TPK 5,000,000 $5,162,750 0.06% 5% 12/01/37<br />

PENNSYLVANIA ST TPK COMMN TPK 11,500,000 $11,785,890 0.13% 5% 12/01/42<br />

PENNSYLVANIA ST TPK COMMN TPK 20,000,000 $21,531,200 0.23% 5.75% 06/01/39<br />

Page 18 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

709427EH7<br />

71440PAU7<br />

71440PAW3<br />

71440PAX1<br />

717903J25<br />

717903D54<br />

71883MEB6<br />

71883MHE7<br />

722021BG6<br />

727140AA3<br />

72818QAX1<br />

728896CF6<br />

73358EAA2<br />

73358WFX7<br />

73358WGB4<br />

735389PB8<br />

735352JG2<br />

736892AA8<br />

738855QW8<br />

740032AD9<br />

744387AB7<br />

744387AC5<br />

744387AD3<br />

745160QA2<br />

745160QB0<br />

745160RS2<br />

74514LYW1<br />

74514LA98<br />

74514LB71<br />

74514LB30<br />

745190ZT8<br />

745181E45<br />

745220FR9<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

PENSACOLA FLA ARPT REV 7,000,000 $7,799,470 0.08% 6% 10/01/28<br />

PERRIS UNION HIGH SCHOOL DIST 1,690,000 $1,732,976 0.02% 5.75% 09/01/30<br />

PERRIS UNION HIGH SCHOOL DIST 2,570,000 $2,647,896 0.03% 6% 09/01/33<br />

PERRIS UNION HIGH SCHOOL DIST 5,500,000 $5,646,740 0.06% 6.125% 09/01/41<br />

PHILADELPHIA PA HOSPS & HIGHER 10,000,000 $9,660,600 0.10% 5.625% 07/01/42<br />

PHILADELPHIA PA HOSPS & HIGHER 10,000,000 $10,354,500 0.11% 5.5% 07/01/26<br />

PHOENIX ARIZ ARPT REV 15,000,000 $16,122,450 0.17% 5% 07/01/38<br />

PHOENIX ARIZ ARPT REV 24,000,000 $24,568,560 0.27% 5% 07/01/40<br />

PINAL CNTY AZ ELEC DIST #3 10,000,000 $10,322,600 0.11% 5.25% 07/01/41<br />

PLANO IL SSA #2 - LAKEWOOD SPR 7,575,000 $7,602,573 0.08% 6.375% 03/01/34<br />

PLAZA CO MET DIST #1 REVENUE 3,000,000 $2,866,350 0.03% 5% 12/01/40<br />

PLEASANTS CNTY W VA PCR 16,250,000 $16,808,350 0.18% 5.25% 10/15/37<br />

PORT AUTH N Y & N J SPL OBLIG 14,140,000 $14,215,931 0.15% 9.125% 12/01/15<br />

PORT AUTH NY & NJ CONS 15,000,000 $14,536,800 0.16% 4% 07/15/33<br />

PORT AUTH NY & NJ CONS 31,560,000 $30,286,869 0.33% 4% 07/15/37<br />

PORT SEATTLE WASH REV 17,000,000 $17,714,680 0.19% 5% 06/01/40<br />

PORT ST LUCIE FLA UTIL REV 11,025,000 $11,695,099 0.13% 5% 09/01/29<br />

PORTOFINO LANDINGS CDD 2,705,000 $946,750 0.01% 5.4% 05/01/38<br />

POWAY CALIF USD CFD NO. 14 - D 7,465,000 $7,193,274 0.08% 5.25% 09/01/36<br />

PRATTVILLE ALA INDL DEV BRD EN 5,500,000 $6,752,130 0.07% 9.25% 03/01/33<br />

PUBLIC AUTH FOR COLO ENERGY NA 2,465,000 $2,759,074 0.03% 6.125% 11/15/23<br />

PUBLIC AUTH FOR COLO ENERGY NA 12,500,000 $14,175,375 0.15% 6.25% 11/15/28<br />

PUBLIC AUTH FOR COLO ENERGY NA 90,100,000 $104,941,272 1.13% 6.5% 11/15/38<br />

PUERTO RICO COMWLTH AQUEDUCT & 9,755,000 $9,448,595 0.10% 6% 07/01/38<br />

PUERTO RICO COMWLTH AQUEDUCT & 12,420,000 $11,706,222 0.13% 6% 07/01/44<br />

PUERTO RICO COMWLTH AQUEDUCT & 18,765,000 $17,236,403 0.19% 5.75% 07/01/37<br />

PUERTO RICO COMWLTH GO 15,000,000 $13,995,450 0.15% 5.75% 07/01/41<br />

PUERTO RICO COMWLTH GO 24,450,000 $23,347,060 0.25% 5.5% 07/01/26<br />

PUERTO RICO COMWLTH GO 33,000,000 $30,360,660 0.33% 5.5% 07/01/39<br />

PUERTO RICO COMWLTH GO 32,125,000 $31,712,515 0.34% 5.75% 07/01/28<br />

PUERTO RICO COMWLTH HWY & TRAN 7,500,000 $6,700,875 0.07% 5.25% 07/01/39<br />

PUERTO RICO COMWLTH HWY & TRAN 10,000,000 $9,869,500 0.11% 5.5% 07/01/28<br />

PUERTO RICO COMWLTH INFRASTRUC 4,950,000 $4,806,945 0.05% 5.5% 07/01/26<br />

Page 19 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

74526QZZ8<br />

74526QVE9<br />

74526QPQ9<br />

74526QWE8<br />

74526QKW1<br />

74526QA28<br />

74526QVX7<br />

74527JAC1<br />

745235P70<br />

745235R37<br />

745291UY8<br />

74529JKR5<br />

74529JKS3<br />

74529JLP8<br />

74529JLR4<br />

74529JLQ6<br />

74529JNX9<br />

74529JKQ7<br />

74529JLX1<br />

74529JLL7<br />

74529JKV6<br />

74529JHU2<br />

74529JKM6<br />

75076PAR6<br />

75076PAT2<br />

75687RAF9<br />

75687RAG7<br />

75687RAD4<br />

75913TGE8<br />

762243TH6<br />

762243K28<br />

764588AG4<br />

76912DAR9<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

PUERTO RICO ELEC PWR AUTH PWR 4,250,000 $3,822,535 0.04% 5% 07/01/29<br />

PUERTO RICO ELEC PWR AUTH PWR 5,125,000 $4,858,756 0.05% 5.5% 07/01/38<br />

PUERTO RICO ELEC PWR AUTH PWR 8,500,000 $7,791,695 0.08% 5.25% 07/01/32<br />

PUERTO RICO ELEC PWR AUTH PWR 8,620,000 $8,522,507 0.09% 5.75% 07/01/36<br />

PUERTO RICO ELEC PWR AUTH PWR 18,220,000 $16,653,080 0.18% 5% 07/01/32<br />

PUERTO RICO ELEC PWR AUTH PWR 26,990,000 $23,401,139 0.25% 5% 07/01/42<br />

PUERTO RICO ELEC PWR AUTH PWR 48,125,000 $44,908,325 0.49% 5.25% 07/01/40<br />

PUERTO RICO INDL TOURIST EDL M 11,865,000 $11,421,723 0.12% 6.625% 06/01/26<br />

PUERTO RICO PUB BLDGS AUTH REV 15,000,000 $14,681,550 0.16% 6% 07/01/41<br />

PUERTO RICO PUB BLDGS AUTH REV 22,500,000 $19,569,600 0.21% 5.25% 07/01/42<br />

PUERTO RICO PUB FIN CORP 93,125,000 $86,889,350 0.94% 5.5% 08/01/31<br />

PUERTO RICO SALES TAX FING COR 4,000,000 $1,129,560 0.01% N/A 08/01/34<br />

PUERTO RICO SALES TAX FING COR 4,930,000 $1,297,132 0.01% N/A 08/01/35<br />

PUERTO RICO SALES TAX FING COR 15,000,000 $3,448,350 0.04% N/A 08/01/37<br />

PUERTO RICO SALES TAX FING COR 18,130,000 $3,642,498 0.04% N/A 08/01/39<br />

PUERTO RICO SALES TAX FING COR 30,000,000 $6,441,000 0.07% N/A 08/01/38<br />

PUERTO RICO SALES TAX FING COR 7,150,000 $7,295,860 0.08% 5.25% 08/01/40<br />

PUERTO RICO SALES TAX FING COR 29,950,000 $9,032,920 0.10% N/A 08/01/33<br />

PUERTO RICO SALES TAX FING COR 10,000,000 $9,507,700 0.10% 5% 08/01/43<br />

PUERTO RICO SALES TAX FING COR 25,000,000 $25,158,750 0.27% 5.5% 08/01/40<br />

PUERTO RICO SALES TAX FING COR 36,500,000 $27,819,935 0.30% N/A 08/01/33<br />

PUERTO RICO SALES TAX FING COR 53,000,000 $52,553,210 0.57% N/A 08/01/32<br />

PUERTO RICO SALES TAX FING COR 61,560,000 $61,826,554 0.67% 5.5% 08/01/42<br />

RAILSPLITTER TOBACCO SETTLEMEN 6,000,000 $6,578,160 0.07% 6.25% 06/01/24<br />

RAILSPLITTER TOBACCO SETTLEMEN 24,650,000 $27,468,974 0.30% 6% 06/01/28<br />

RED RIVER TX HLTH FACS DEV COR 1,500,000 $1,469,325 0.02% 5.5% 01/01/32<br />

RED RIVER TX HLTH FACS DEV COR 2,000,000 $1,820,660 0.02% 5.125% 01/01/41<br />

RED RIVER TX HLTH FACS DEV COR 11,000,000 $11,020,020 0.12% 7.25% 12/15/42<br />

REGIONAL TRANSN DIST COLO COPS 13,500,000 $14,578,245 0.16% 5% 06/01/25<br />

RHODE ISLAND ST HEALTH & EDUCA 405,000 $405,368 0.00% 5.75% 05/15/23<br />

RHODE ISLAND ST HEALTH & EDUCA 8,200,000 $9,116,678 0.10% 7% 05/15/39<br />

RICHMOND CNTY GA DEV AUTH ENVI 7,000,000 $7,615,300 0.08% 6.25% 11/01/33<br />

RIVERSIDE CNTY CA COMMN TOLL R 5,000,000 $713,300 0.01% N/A 06/01/41<br />

Page 20 of 26

Portfolio Holdings <strong>for</strong> <strong>Franklin</strong> High Yield Tax-Free Income Fund as of June 30, 2013<br />

Security<br />

Identifier<br />

76912DAS7<br />

76912DAN8<br />

76912DAP3<br />

773747CZ1<br />

776192FN1<br />

776192FM3<br />

776192GD2<br />

777870NS1<br />

780486FJ0<br />

780486FV3<br />

781432AF6<br />

794458DG1<br />

794458DJ5<br />

794458DH9<br />

794458DK2<br />

794458DL0<br />

79575EAL2<br />

79575EAQ1<br />

796334AR1<br />

796334AP5<br />

796334AS9<br />

797049AH6<br />

797049AJ2<br />

797355R48<br />

797355R30<br />

79765VBR0<br />

79765VBQ2<br />

79765DVX5<br />

798111DR8<br />

798111DQ0<br />

798111DJ6<br />

798111DH0<br />

798111BY5<br />

Security Name<br />

Shares/<br />

Positions Held Market Value<br />

% of<br />

TNA<br />

Coupon<br />

Rate<br />

Maturity<br />

Date<br />

RIVERSIDE CNTY CA COMMN TOLL R 7,000,000 $928,690 0.01% N/A 06/01/42<br />

RIVERSIDE CNTY CA COMMN TOLL R 4,000,000 $1,125,320 0.01% N/A 06/01/32<br />

RIVERSIDE CNTY CA COMMN TOLL R 5,500,000 $1,433,080 0.02% N/A 06/01/33<br />

ROCKLIN CA CFD # 10 WHITNEY RA 7,030,000 $6,497,758 0.07% 5% 09/01/35<br />

ROMOLAND SCH DIST CALIF CFD #1 6,175,000 $6,086,203 0.07% 5.4% 09/01/36<br />

ROMOLAND SCH DIST CALIF CFD #1 7,015,000 $7,034,291 0.08% 5.35% 09/01/28<br />

ROMOLAND SCH DIST CALIF CFD #1 7,900,000 $7,179,836 0.08% 5.35% 09/01/38<br />

ROSEVILLE CA CFD #1-WESTPARK 1,550,000 $1,525,277 0.02% 5.25% 09/01/25<br />

ROYAL OAK MICH HOSP FIN AUTH H 20,000,000 $24,523,000 0.26% 8.25% 09/01/39<br />

ROYAL OAK MICH HOSP FIN AUTH H 33,120,000 $35,444,030 0.38% 6% 08/01/39<br />

RUMFORD ME POLLUTN CTL REV 4,800,000 $4,819,344 0.05% 6.625% 07/01/20<br />