Creative Financing - Foley & Lardner LLP

Creative Financing - Foley & Lardner LLP

Creative Financing - Foley & Lardner LLP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FALAnews<br />

volume 13 issue 2<br />

promoting excellence in assisted living l fall 2009<br />

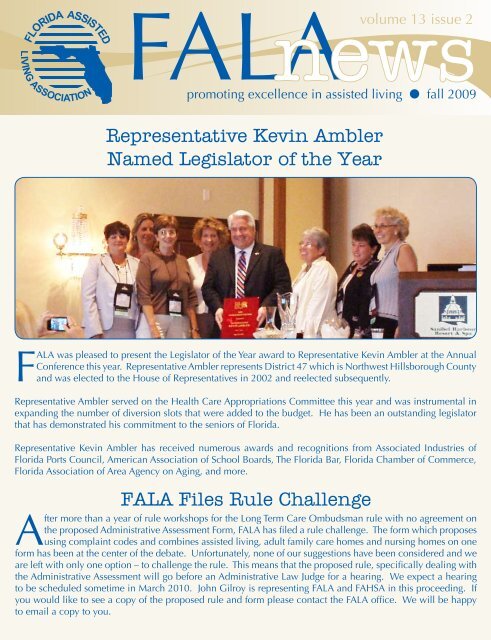

Representative Kevin Ambler<br />

Named Legislator of the Year<br />

FALA was pleased to present the Legislator of the Year award to Representative Kevin Ambler at the Annual<br />

Conference this year. Representative Ambler represents District 47 which is Northwest Hillsborough County<br />

and was elected to the House of Representatives in 2002 and reelected subsequently.<br />

Representative Ambler served on the Health Care Appropriations Committee this year and was instrumental in<br />

expanding the number of diversion slots that were added to the budget. He has been an outstanding legislator<br />

that has demonstrated his commitment to the seniors of Florida.<br />

Representative Kevin Ambler has received numerous awards and recognitions from Associated Industries of<br />

Florida Ports Council, American Association of School Boards, The Florida Bar, Florida Chamber of Commerce,<br />

Florida Association of Area Agency on Aging, and more.<br />

FALA Files Rule Challenge<br />

After more than a year of rule workshops for the Long Term Care Ombudsman rule with no agreement on<br />

the proposed Administrative Assessment Form, FALA has filed a rule challenge. The form which proposes<br />

using complaint codes and combines assisted living, adult family care homes and nursing homes on one<br />

form has been at the center of the debate. Unfortunately, none of our suggestions have been considered and we<br />

are left with only one option – to challenge the rule. This means that the proposed rule, specifically dealing with<br />

the Administrative Assessment will go before an Administrative Law Judge for a hearing. We expect a hearing<br />

to be scheduled sometime in March 2010. John Gilroy is representing FALA and FAHSA in this proceeding. If<br />

you would like to see a copy of the proposed rule and form please contact the FALA office. We will be happy<br />

to email a copy to you.

2010 Legislative Priorities<br />

Elimination of Specialty Licenses<br />

FALA supports the elimination of the Limited Nursing Services (LNS) license and<br />

the Extended Congregate Care (ECC) license. These licenses are outdated and in<br />

many instances vague and misleading with a lot of duplication. These licenses are<br />

confusing to providers as well as consumers and serve no purpose. The LNS and<br />

ECC licenses were implemented to allow certain nursing services in assisted living<br />

facilities for the purpose of aging in place. In many instances, facilities that have<br />

these licenses do not even have a nurse on staff. Many times, the facility simply<br />

has the license (LNS or ECC) to be able to participate in the Assisted Living for the<br />

Elderly Waiver. FALA supports allowing nurses in assisted living facilities to be<br />

able to provide services that are currently under the rule and law for LNS and ECC<br />

licenses.<br />

Maintain/Increase Funding for the following programs: Assistive Care Services Waiver, Assisted Living for the<br />

Elderly Waiver, and Nursing Home Diversion<br />

In accordance with FALA’s mission, ensuring that residents are placed in the most appropriate setting is vital to<br />

the well being of Florida’s elders. The State’s objective of providing appropriate care in the least restrictive and<br />

more cost effective setting for Medicaid recipients is furthered by increasing funding for these programs. All<br />

of these programs have saved the Medicaid program significant dollars. FALA supports increased funding for<br />

the Assistive Care Services Waiver, the Assisted Living for the Elderly Waiver, and the Nursing Home Diversion<br />

Program.<br />

Property Tax Exemption<br />

Property taxes have increased over 80% and many assisted living facilities are faced with the possibility of<br />

closing due to the inability to pay high property tax assessments. Particularly hard hit are the smaller facilities<br />

with limited budgets that care for individuals on limited incomes and that receive state/federal funding. These<br />

facilities play a vital role by providing appropriate care in the least restrictive and more affordable settings for<br />

many low income seniors. The loss of these facilities would force many individuals into a more costly nursing<br />

home setting. FALA supports initiatives for relief of increased property taxes for assisted living facilities.<br />

2<br />

Alberta Granger Joins FALA Team<br />

FALA was proud to have Alberta Granger join the FALA team this year after her<br />

retirement from the Agency for Health Care Administration (AHCA). Alberta<br />

had been with the State of Florida for 35 years and most recently managed the<br />

Assisted Living Unit at AHCA.<br />

During the FALA Annual Conference in Ft. Myers, FALA presented Alberta with an<br />

appreciation plaque for her many years of service and dedication to the assisted<br />

living profession in Florida.<br />

Since coming to FALA, Alberta has been busy providing technical assistance to members, training, developing<br />

curriculum and working with FALA’s Executive Director, Pat, on legislative issues.<br />

Alberta is available to FALA members for telephone assistance with survey questions, law and rule questions or<br />

general information. On site consulting is available by appointment for a fee.

FALA Office<br />

1922 Miccosukee Road<br />

Tallahassee, FL 32308<br />

Phone: 850.383.1159<br />

Fax: 850.224.0448<br />

Toll Free: 800.785.3252<br />

Email: info@falausa.com<br />

www.falausa.com<br />

FALA Staff<br />

Patricia Lange<br />

Executive Director<br />

Sally Hicks<br />

Director of Operations<br />

Courtney Ann Hicks<br />

Membership Manager<br />

Tom Campbell<br />

Director of Education<br />

Alberta Granger<br />

Assisted Living Specialist<br />

Sharon Collier<br />

Education Coordinator<br />

Karen Klena<br />

Marketing Manager<br />

FALA Officers<br />

Jamie Glavich<br />

President<br />

Krone Weidler<br />

Vice President<br />

Steven Schrunk<br />

Treasurer<br />

Brian Robare<br />

Immediate Past President<br />

Damon Thomas<br />

Secretary<br />

Larry Sherberg<br />

Past President’s Adivsory Council<br />

Brian Bursa<br />

Ex Officio<br />

FALA Directors<br />

Linda Amin<br />

Director, Southwest Region<br />

Rene Buck<br />

Director, Northwest Region<br />

Veronica Catoe<br />

Director, 17-49 Beds<br />

Luis Collazo<br />

Director, Southeast Region<br />

Nina Corsi<br />

Associate Member Representative<br />

Mark Crews<br />

Director, 50+ Beds<br />

Donna Damiani<br />

Director, West Central Region<br />

Charlie Goucher<br />

Director, ACS Facilities<br />

Albert Green<br />

Director, East Central Region<br />

Malcolm Harriman<br />

Director at Large<br />

Stacy Hartley<br />

Director, Northeast Region<br />

Michael Karban<br />

Director at Large<br />

Sandy Lynch<br />

Director, 50+ Beds<br />

John Lyncheski<br />

Chair, FALERF (Ex-Officio)<br />

Michael Okaty<br />

Associate Member Representative<br />

Mary Sue Patchett<br />

Director, Multi-Facilities<br />

FALA Installs New Board of<br />

Directors<br />

At the Annual Conference in August, FALA installed the newly elected Board of<br />

Directors for 2009-2010.<br />

Officers<br />

President: Jamie Glavich, Almost Home Senior Services, Inc.<br />

Vice President: Krone Weidler, The Fountains ALF<br />

Treasurer: Steven Schrunk, Countryside Lakes<br />

Secretary: Damon Thomas, Emeritus Assisted Living<br />

Immediate Past President: Brian Robare, The Villa at Carpenter<br />

Directors<br />

17-49 Beds: Veronica Cate, The Allegro at Harbour Island<br />

50+ Beds: Sandi Lynch, Ormond in the Pines<br />

ECC/LNS Facilities: Mark Crews, North Florida Retirement Village<br />

ACS Facilities: Charlie Goucher, Spring Hills Lake Mary<br />

At Large: Malcolm Harriman, Stone Ledge Manor<br />

At Large: Michael Karban, Bay Pointe Terrace<br />

Multi-Facilities: Mary Sue Patchett, Horizon Bay Retirement Living<br />

Association Member Representative: Nina Corsi, Evercare<br />

Association Member Representative: Michael Okaty, <strong>Foley</strong> & <strong>Lardner</strong><br />

Region Directors<br />

Southwest Region: Linda Amin, Highlands at the Glenridge on Palmer Ranch<br />

Northwest Region: Rene Buck, Heritage Oaks Senior Housing<br />

Southeast Region: Luis Collazo, Palm Breeze Assisted Living Facility<br />

West Central Region: Donna Damiani, Heather Haven<br />

East Central Region: Albert Green, Summit Care ALF<br />

Northeast Region: Stacy Hartley, Ashford Court at Marsh Landing<br />

President’s Advisory Council<br />

Larry Sherberg, Lincoln Manor<br />

Ex Officio<br />

Brian Bursa, Lewis, Brisbois, Bisgaard & Smith, <strong>LLP</strong><br />

Chair, FALA Foundation<br />

John Lyncheski, Cohen & Grigsby<br />

3

4<br />

<strong>Creative</strong> <strong>Financing</strong><br />

As you know, the downturn in the credit and housing markets and the ensuing economic recession have created<br />

difficult financial problems for the senior living industry. Occupancy rates at many facilities have declined or are<br />

declining, as more seniors are choosing to stay in their homes rather than move into senior living communities.<br />

This development, in turn, affects facility owners, who are finding it difficult to operate profitably, which in turn<br />

leads to distressed sales, bankruptcies, and, in some cases, facility closures. This article discusses the current<br />

financial environment of the senior living industry, exploring creative ways that operators are attracting residents<br />

in the hopes of avoiding unfortunate outcomes.<br />

<strong>Creative</strong> <strong>Financing</strong> to Attract Residents<br />

America’s seniors have not been immune to the recent housing crisis. For some, it is affecting long-term housing<br />

and care options. The downturn has reduced the value of seniors’ homes – in many cases the single, most<br />

valuable asset that many seniors own. Unfortunately, this crisis has struck when the cost of long-term care<br />

continues to increase.<br />

A recently released Case-Schiller Index report, which is considered a valuable source for housing market pricing<br />

information, showed that May prices this year were down 17.1 percent compared to 2008. In contrast, the increase<br />

in the average cost of long-term care from 2006 to 2008 ranged from 5 percent to 13 percent, depending on the<br />

type of service, with the cost of assisted living facilities increasing at the highest rate (according to a Prudential<br />

Insurance Company of America: Research Report 2008: Long-Term Care Cost Study). And the average monthly<br />

cost in an assisted living facility is roughly $3,000 per month.<br />

As a result, seniors, like all Americans, have become increasingly reluctant to list their homes for sale for fear<br />

that the price they would receive does not reflect the home’s true value. Long-term care facilities (independent<br />

living facilities, assisted living facilities, nursing homes, and CCRCs) are feeling the effects of this recalcitrance,<br />

with fewer seniors moving in. Those which appear to be most affected by this trend are facilities like CCRCs that<br />

employ an entrance fee model. Those following a rental model, while still feeling the effects of this trend, have<br />

faired somewhat better.<br />

As a result, financial institutions and the facilities themselves are employing a number of creative strategies to<br />

assist seniors in these difficult market conditions. For example, Elderlife Financial has developed a home equity<br />

line of credit program to be used for entrance fees, deposits and rents until seniors can sell their homes. The<br />

equity line would even be available if the home is listed for sale, a practice which is typically prohibited under

traditional home equity lines of credit. The program acts as a kind of bridge funding that would allow seniors<br />

to enter long-term housing, then pay off the line of credit once their home is sold (according to Irving Levin<br />

Associates, Inc., The Senior Care Investor, Vol. 21, Iss. 3, Mar. 2009).<br />

Long-term care facilities are also offering an array of new financing options, allowing seniors to finance entrance<br />

fees or monthly rental payments. For example, a recent Chicago Sun Times article mentioned some long-term<br />

care facilities waiving certain fees or offering introductory rates to entice seniors to move in. Still others are<br />

offering seniors assistance selling their homes, sometimes agreeing to purchase the home if it does not sell within<br />

a specified time period from the move-in date. Finally, certain developers are changing their business models,<br />

constructing facilities in phases and guarantying each resident will have appropriate housing no matter what<br />

level of services are needed, irrespective of the stage of the facility’s development.<br />

Distressed M&A Activity<br />

Just as senior living facility owners and operators are finding it increasingly difficult to maintain revenue streams,<br />

in part due to the decrease in occupancy rates, capital for merger and acquisition activity has similarly become<br />

scarce. In fact, a recent study found that merger and acquisitions (M&A) activity in the senior living industry is<br />

50% below what it was during the last six months of 2008, averaging 14 announced transactions per quarter. This<br />

development is not surprising, since M&A activity for many sectors of the economy has decreased dramatically,<br />

with 2009 being described as a “subdued year for M&A activity.” And the value of global announced mergers<br />

and acquisitions fell to $1,670 billion for 2009, compared to $2,520 billion in 2008 and $3,600 billion in 2007.<br />

A majority of the activity in the senior living industry has involved underperforming or lower-quality properties.<br />

Below are several examples of the significant measures that some companies have been forced to take in these<br />

uncertain economic times.<br />

Sunwest Management recently reached a tentative agreement to sell up to 148 senior living properties to Blackstone<br />

Real Estate Advisors, a private equity investment firm. (according to The Oregonian, Sept. 15, 2009). Although it<br />

has concerns about the “lowball price,” which is reported to be $270 million in cash plus the assumption of $1<br />

billion in bank debt, Sunwest has signed a preliminary term sheet. Blackstone’s offer is contingent on Sunwest’s<br />

restructuring following a Securities and Exchange Commission lawsuit in which it is alleged that Sunwest and its<br />

former CEO misled investors. If approved by the court, the plan would then be considered in conjunction with<br />

Sunwest’s reorganization under Chapter 11 later this year.<br />

Sunwest previously sold several facilities in the Carolinas as part of bankruptcy proceedings. Late last year, Five<br />

Star Quality Care purchased seven independent living, assisted living and Alzheimer’s care communities in<br />

North and South Carolina from affiliates of Sunwest Management.<br />

Sunrise Senior Living announced in March 2009 (Washington Post article) that it may seek bankruptcy protection<br />

if it cannot reach new agreements with its lenders. In its most recent reporting of financial and operating data,<br />

Sunrise admitted that even if its efforts to extend maturity dates and obtain covenant waivers with respect to<br />

some of its debt were successful, it would still have to refinance existing indebtedness that becomes due within<br />

the next 12 months. Sunrise also confirmed that it was engaged in discussions with venture partners and other<br />

third parties regarding the sale of certain assets. These discussions may lead to the sale by Goldman Sachs of<br />

21 properties owned by Sunrise, currently dubbed the “Blackjack” portfolio, for an estimated $185 million<br />

(according to Irving Levin Associates, Inc., The Senior Care Investor, Oct. 2009).<br />

Downey Regional Medical Center – Hospital recently filed for reorganization under Chapter 11. Healthcare<br />

Finance Group, a specialty lender dedicated exclusively to healthcare companies, announced on September 29,<br />

2009 that it had provided $10 million in debtor-in-possession financing to Downey Regional Medical Center –<br />

Hospital for the continued operation of its acute care hospital in Southeast Los Angeles.<br />

5

Some operators are simply shutting down facilities. Jackson Health System recently proposed closing two Miami<br />

area nursing homes, among other actions, to achieve a balanced budget (The Miami Herald, Sept. 17, 2009).<br />

The plan would close the Perdue Medical Center in South Dade and Jackson Memorial Long Term Care Center<br />

in Miami, which were described as “persistent money losers.” Jackson Health’s CEO said that the nursing home<br />

residents, many of whom are undocumented immigrants, would be placed in other facilities with Jackson<br />

continuing to be financially responsible for the residents.<br />

6<br />

Unfortunately, until the credit and housing markets return to normalcy (with the new<br />

“normal” being different than in the recent past), seniors will continue to delay selling<br />

their homes and moving to senior living residences. This means that operators will<br />

continue to utilize creative methods for attracting seniors to their facilities. It also means<br />

that distressed sales and bankruptcies in the senior living industry will likely continue.<br />

Michael A. Okaty is a partner with <strong>Foley</strong> & <strong>Lardner</strong> <strong>LLP</strong> in Orlando, and is founder and<br />

chair of the firm’s Senior Living Industry Team. He can be reached at 407.244.3229 or<br />

mokaty@foley.com.<br />

2009 Sid Rosenblatt<br />

Excellence in<br />

Leadership Award<br />

Kandy Hill, long time FALA<br />

lobbyist, was the recipient<br />

of the 2009 Sid Rosenblatt<br />

Excellence in Leadership Award<br />

at the FALA Annual Conference.<br />

Kandy has been instrumental in<br />

achieving increases in funding<br />

and during these tough budget<br />

ome diversion program,safeguarding<br />

assisted living funding programs and achieving increases<br />

in the FALA since 2005 and has been instrumental in getting<br />

increases in the Nursing Home Diversion Program over the years.<br />

Additionally, she led the charge in 2007 when FALA was successful<br />

in increasing the reimbursement rate for the Assisted Living for the<br />

Elderly Waiver.<br />

Recently Steven Schrunk of<br />

Countryside Lakes hosted a<br />

fundraiser for Representative<br />

Marco Rubio who is running for<br />

U.S. Senator in the 2010 Election.

2009 Conference Photos

2009 Conference Photos

Horizon Bay Retirement Living Announces<br />

New Hyde Park Community<br />

South Tampa project will serve as company’s flagship property<br />

Horizon Bay Retirement Living, a national seniors housing operator based in Tampa, Fla., announces<br />

plans to build a new luxury retirement community in the historic Hyde Park area of South Tampa.<br />

Scheduled to open in 2011, the new community, which will be named Horizon Bay at Hyde Park, will<br />

serve as Horizon Bay’s flagship property. The property is being developed by BI Hyde Park, LLC., and is designed<br />

to accommodate both independent and assisted living older adults. Horizon Bay at Hyde Park joins six other<br />

communities currently managed by Horizon Bay in the greater Tampa Bay area.<br />

“We are proud to build our flagship community right here in Tampa,” says Thilo Best, Chairman & CEO of<br />

Horizon Bay Retirement Living. “This community will be an excellent addition to our ever-growing roster of<br />

diverse retirement communities nationwide. This area has been good to us, and we really wanted to give back<br />

to the city of Tampa. This community will provide good jobs for many local residents, and we look forward to<br />

serving the families and older adults of the Tampa area for many years to come.”<br />

During construction, the six-story mid-rise building will provide 100 full-time construction jobs, as well as 50 to<br />

60 operational jobs when the project is complete. The last retirement community designed to offer independent<br />

and assisted living apartments was built in Tampa over 20 years ago. This property will feature 136 apartment<br />

homes, with a wide range of services and amenities.<br />

Located at 800 West Azeele Street, the community will be built in the heart of the historic Hyde Park area of<br />

South Tampa, and will feature its very own Internet café, library, fitness center, game room, pool and a bar and<br />

lounge area with views of Tampa Bay. With 9” ceilings, each apartment home will have full kitchens, granite<br />

countertops, walk-in closets, ceramic tile and carpet flooring.<br />

Currently managing over 16,000 units with 89 communities in 18 states, Horizon Bay Retirement Living is one<br />

of the top ten seniors housing operators in the United States. With this transaction, Horizon Bay will expand<br />

to 23 communities located in the state of Florida. Horizon Bay at Hyde Park joins six other communities in the<br />

greater Tampa Bay area, including Pinecrest Place in Largo, Horizon Bay in Lutz, Horizon Bay in Clearwater,<br />

and Regency Oaks, also in Clearwater. Sarasota communities include Horizon Bay in Sarasota and Waterside<br />

Retirement Estates.<br />

For more information on Horizon Bay, visit www.horizonbay.com.<br />

About Horizon Bay Retirement Living<br />

Based in Tampa, Fla., Horizon Bay Retirement Living is a privately owned seniors housing management company<br />

focused on managing large portfolios of retirement communities across the United States for institutional real estate<br />

investors. With 88 communities in 18 states, the company has grown beyond traditional property management<br />

into a fully integrated service platform. The Horizon Bay portfolio includes independent living, assisted living,<br />

memory care, skilled nursing care and continuing care retirement communities. For more information on Horizon<br />

Bay, visit HYPERLINK “http://www.horizonbay.com” www.horizonbay.com.<br />

7

8<br />

2010 FALA Legislative Days<br />

REGISTER TODAY!<br />

Make plans today to attend FALA Legislative<br />

Days 2010!<br />

Your legislators need to hear from you so they understand<br />

assisted living. We must demonstrate a united front to<br />

ensure our voice is heard. You can make the difference<br />

between achieving success and maintaining the status quo.<br />

Your voice counts and needs to be heard!<br />

MAKE APPOINTMENTS TO MEET WITH YOUR<br />

LEGISLATORS<br />

Call your local legislators offices to make appointments to<br />

meet with them during one of the time frames listed below<br />

(Tuesday and Wednesday). If you need assistance, contact<br />

the FALA office.<br />

Name:<br />

Facility/Business:<br />

Mailing Address:<br />

City FL Zip+Four<br />

Phone #:<br />

Fax #:<br />

Email:<br />

Payment Method: Check Visa MasterCard Amex<br />

Amount:<br />

REGISTRATION PACKET<br />

When you register you will receive a packet from FALA<br />

with details about the meeting including a complete<br />

schedule of events, the FALA Legislative Guidebook and<br />

contact information for your legislator.<br />

ACCOMODATIONS<br />

FALA has negotiated a very special room rate of $119.00<br />

at the Residence Inn by Marriott for the night of Tuesday,<br />

February 16, 2010. In order to receive the special group<br />

rate, you must indicate that you are with the FALA<br />

Legislative Days Event room block.<br />

Cut off date is January 29, 2010.<br />

Residence Inn by Marriott<br />

600 West Gaines Street<br />

Tallahassee, Fl 32304<br />

800-331-3131<br />

AGENDA<br />

Tuesday, February 16<br />

12:30pm Registration – Residence Inn by Marriott<br />

1:00 - 2:00pm Legislative Issue Briefing – Residence Inn by Marriott<br />

2:30pm-5:00pm Legislator Appointments<br />

6:30pm-8:30pm Reception – Residence Inn by Marriott<br />

Wednesday, February 17<br />

8:00am-12:00pm Legislator Appointments<br />

12:00pm-1:30pm Lunch – Residence Inn by Marriott<br />

1:30pm Travel home<br />

Credit Card #:<br />

Exp. Date:<br />

Name on Card:<br />

Signature:<br />

Checks should be made payable to FALA and mailed<br />

to the address below.<br />

Florida Assisted Living Association<br />

Legislative Days 2010<br />

1922 Miccosukee Road<br />

Tallahassee, FL 32308<br />

Phone: (850) 383-1159 – (850) 224-0448 fax

Assisted Living Administrator<br />

Core Training 2010 Schedule<br />

This program is designed for prospective assisted living facility administrators in preparation to take the state mandated exam<br />

Please allow sufficient travel time for weather, parking and traffic. We will begin on time each day!<br />

Seating is limited please register early.<br />

Classes are Monday – Friday 8:00 am – 4:30 pm<br />

Pre-registration and payment is required to attend. No cancellations one week prior to class<br />

Registration Fee: $375 for FALA members, $385.00 for non-members and includes all materials.<br />

Jan 11-15 Jacksonville, Instructor: Tom Campbell Class # 1101<br />

APEX HOME HEALTHCARE<br />

6789 Southpointe Pkwy., Jacksonville, 32216<br />

Jan 11-15 Lakeland, Instructor: Jack Morton Class # 3101<br />

Southland Suites<br />

4250 Lakeland Highland Rd., Lakeland, 33813<br />

Jan 11-14 Tallahassee, Instructor: Alberta Granger Class # 4101<br />

Heritage Oaks Senior Housing<br />

4501 Shannon Lakes Dr. W., Tallahassee, 32308<br />

Jan 18-22 Sarasota, Instructor: Tom Campbell Class # 1102<br />

The Pines of Sarasota<br />

1501 N. Orange Ave, Sarasota, 34236<br />

Feb 1-5 Orlando, Instructor: Tom Campbell Class # 1103<br />

Westchester ALF<br />

558 N. Semoran Blvd, Winter Park, 32792<br />

Feb 8-12 Boynton Beach, Instructor: Tom Campbell Class # 1104<br />

Homewood Residence of Boynton Bch<br />

2400 S Congress Ave, Boynton Bch, 33426<br />

Feb 8-12 Lutz, Instructor: Jack Morton Class # 3102<br />

Horizon Bay of Lutz<br />

414 Chapman Rd. East, Lutz, 33549<br />

Mar 8-12 Jacksonville, Instructor: Tom Campbell Class # 1105<br />

APEX HOME HEALTHCARE<br />

6789 Southpointe Pkwy., Jacksonville, 32216<br />

Mar 8-12 Pinellas Park, Instructor: Jack Morton Class # 3103<br />

Bayside Terrace<br />

9381 US Hwy 19 N, Pinellas Park, 33782<br />

Mar 8-11 Panama City, Instructor: Alberta Granger Class # 4102<br />

Gulf Coast Counseling, The Kidd Farm<br />

5409 Nehi Rd., Panama City, 32405<br />

Mar 15-19 Vero Beach Area, Instructor: Virginia Wood<br />

Location to be announced<br />

Mar 22-26 Sarasota, Instructor: Tom Campbell Class # 1106<br />

The Pines of Sarasota<br />

1501 N. Orange Ave, Sarasota, 34236<br />

9

Apr 12-16 Orlando, Instructor: Tom Campbell Class # 1107<br />

Westchester ALF<br />

558 N. Semoran Blvd, Winter Park, 32792<br />

Apr 12-16 Sun City Center, Instructor: Jack Morton Class # 3104<br />

The Inn at The Courtyards<br />

255 Courtyard Blvd., Sun City Center, 33573<br />

Apr 26-30 Lauderhill, Instructor: Tom Campbell Class # 1108<br />

The Lenox on the Lakes<br />

6700 W. Commercial Blvd., Lauderhill, 33319<br />

May 3-6 Pensacola, Instructor: Alberta Granger Class # 4103<br />

Homestead Village<br />

7830 Pine Forest Rd, Pensacola, 32526<br />

May 10-14 Jacksonville, Instructor: Tom Campbell Class # 1109<br />

APEX HOME HEALTHCARE<br />

6789 Southpointe Pkwy., Jacksonville, 32216<br />

May 10-14 Palm Harbor, Instructor: Jack Morton Class # 3105<br />

Coral Oaks<br />

900 West Lake Rd., Palm Harbor, 34684<br />

May 24-28 Sarasota, Instructor: Tom Campbell Class # 1110<br />

The Pines of Sarasota<br />

1501 N. Orange Ave, Sarasota, 34236<br />

Jun 7-11 Boynton Beach, Instructor: Tom Campbell Class # 1111<br />

Homewood Residence of Boynton Bch<br />

2400 S Congress Ave, Boynton Bch, 33426<br />

Jun 14-18 Lakeland, Instructor: Jack Morton Class # 3105<br />

Southland Suites<br />

4250 Lakeland Highland Rd. Lakeland, 33813<br />

Jun 21-25 Orlando, Instructor: Tom Campbell Class # 1112<br />

Westchester ALF<br />

558 N. Semoran Blvd, Winter Park, 32792<br />

Jul 6-9 Jacksonville, Instructor: Tom Campbell Class # 1113<br />

APEX HOME HEALTHCARE<br />

6789 Southpointe Pkwy., Jacksonville, 32216<br />

Jul 19-23 Sarasota, Instructor: Tom Campbell Class # 1114<br />

The Pines of Sarasota<br />

1501 N. Orange Ave, Sarasota, 34236<br />

Jul 19-22 Gainesville, Instructor: Alberta Granger Class # 4104<br />

North Florida Retirement Village<br />

10935 NW 32nd Ave, Gainesville, 32606<br />

Aug 2-6 Orlando, Instructor: Tom Campbell Class # 1115<br />

Westchester ALF<br />

558 N. Semoran Blvd, Winter Park, 32792<br />

Aug 23-27 Lauderhill, Instructor: Tom Campbell Class # 1116<br />

The Lenox on the Lakes<br />

6700 W. Commercial Blvd., Lauderhill, 33319<br />

10

Aug 23-27 Hernando, Instructor: Jack Morton Class # 3106<br />

Residence at Timber Pines<br />

3140 Forest Rd., Spring Hill, 34606<br />

Sept 7-10 Tallahassee, Instructor: Alberta Granger Class # 4105<br />

Heritage Oaks Senior Housing<br />

4501 Shannon Lakes Dr. W., Tallahassee, 32308<br />

Sept 13-17 Jacksonville, Instructor: Tom Campbell Class # 1117<br />

APEX HOME HEALTHCARE<br />

6789 Southpointe Pkwy., Jacksonville, 32216<br />

Sept 13-17 Vero Beach Area, Instructor: Virginia Wood<br />

Location to be announced<br />

Sept 20-24 Pinellas Park, Instructor: Jack Morton Class # 3108<br />

Bayside Terrace<br />

9381 US Hwy 19 N, Pinellas Park, 33782<br />

Sept 27-01 Sarasota, Instructor: Tom Campbell Class # 1118<br />

The Pines of Sarasota<br />

1501 N. Orange Ave, Sarasota, 34236<br />

Oct 11-15 Orlando, Instructor: Tom Campbell Class # 1119<br />

Westchester ALF<br />

558 N. Semoran Blvd, Winter Park, 32792<br />

Oct 11-15 Holiday, Instructor: Jack Morton Class # 3109<br />

Sunshine Christian Homes<br />

5250 Whippoorwill Dr., Holiday, 34690<br />

Oct 11-14 Pensacola, Instructor: Alberta Granger Class # 4106<br />

Homestead Village<br />

7830 Pine Forest Rd, Pensacola, 32526<br />

Oct 25-29 Boynton Beach, Instructor: Tom Campbell Class # 1120<br />

Homewood Residence of Boynton Bch<br />

2400 S Congress Ave, Boynton Bch, 33426<br />

Nov 8-12 Jacksonville, Instructor: Tom Campbell Class # 1117<br />

APEX HOME HEALTHCARE<br />

6789 Southpointe Pkwy., Jacksonville, 32216<br />

Nov 15-19 Lutz, Instructor: Jack Morton Class # 3110<br />

Horizon Bay of Lutz<br />

414 Chapman Rd. East, Lutz, 33549<br />

Nov 15-19 Sarasota, Instructor: Tom Campbell Class # 1122<br />

The Pines of Sarasota<br />

1501 N. Orange Ave, Sarasota, 34236<br />

Nov 15-16 Panama City, Instructor: Alberta Granger Class # 4109<br />

Gulf Coast Counseling, The Kidd Farm<br />

5409 Nehi Rd., Panama City, 32405<br />

Dec 6-10 Lauderhill, Instructor: Tom Campbell Class # 1123<br />

The Lenox on the Lakes<br />

6700 W. Commercial Blvd., Lauderhill, 33319<br />

Dec 13-16 Orlando, Instructor: Tom Campbell Class # 1124<br />

Westchester ALF<br />

558 N. Semoran Blvd, Winter Park, 32792<br />

To register for class go to www.falausa.com and go to the Education Tab. Select, “To register for class Click here” and<br />

follow the directions. If you need additional help or information call: (800) 785-3252 and ask for Sharon Collier<br />

11

1922 Miccosukee Road<br />

Tallahassee, Florida 32308<br />

850.383.1159<br />

ssociation