Noble VCT plc - Foresight Group

Noble VCT plc - Foresight Group

Noble VCT plc - Foresight Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Results, Dividends and Performance<br />

NOBLE <strong>VCT</strong> PLC 19<br />

Year ended Year ended<br />

31 March 2007 31 March 2006<br />

£’000 £’000<br />

Capital return, before taxation (35) (658)<br />

Revenue return, before taxation 38 (95)<br />

Taxation - -<br />

Total return, after taxation 3 (753)<br />

Dividend paid/or proposed (1,027) (412)<br />

Transfer from reserves (1,024) (1,165)<br />

Key Performance Indicators<br />

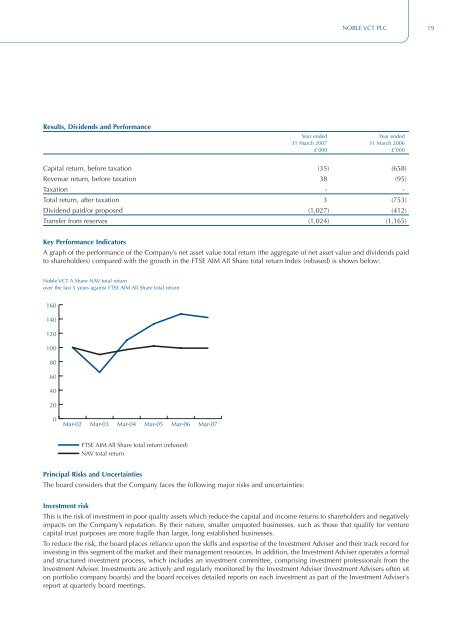

A graph of the performance of the Company’s net asset value total return (the aggregate of net asset value and dividends paid<br />

to shareholders) compared with the growth in the FTSE AIM All Share total return Index (rebased) is shown below:<br />

<strong>Noble</strong> <strong>VCT</strong> A Share NAV total return<br />

over the last 5 years against FTSE AIM All Share total return<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Mar-02<br />

Mar-03<br />

Mar-04<br />

Mar-05<br />

Mar-06<br />

FTSE AIM All Share total return (rebased)<br />

NAV total return<br />

Mar-07<br />

Principal Risks and Uncertainties<br />

The board considers that the Company faces the following major risks and uncertainties:<br />

Investment risk<br />

This is the risk of investment in poor quality assets which reduce the capital and income returns to shareholders and negatively<br />

impacts on the Company’s reputation. By their nature, smaller unquoted businesses, such as those that qualify for venture<br />

capital trust purposes are more fragile than larger, long established businesses.<br />

To reduce the risk, the board places reliance upon the skills and expertise of the Investment Adviser and their track record for<br />

investing in this segment of the market and their management resources. In addition, the Investment Adviser operates a formal<br />

and structured investment process, which includes an investment committee, comprising investment professionals from the<br />

Investment Adviser. Investments are actively and regularly monitored by the Investment Adviser (Investment Advisers often sit<br />

on portfolio company boards) and the board receives detailed reports on each investment as part of the Investment Adviser’s<br />

report at quarterly board meetings.