Noble VCT plc - Foresight Group

Noble VCT plc - Foresight Group

Noble VCT plc - Foresight Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOBLE <strong>VCT</strong> PLC 31<br />

g) Deferred Tax<br />

Deferred tax is recognised in respect of all timing differences that have originated but not reversed at the balance<br />

sheet date where transactions or events that result in an obligation to pay more, or right to pay less, tax in the<br />

future have occurred at the balance sheet date. This is subject to deferred tax assets only being recognised if it is<br />

considered more likely than not that there will be suitable profits from which the future reversal of the underlying<br />

timing differences can be deducted. Timing differences are differences arising between the Company’s taxable<br />

profits and its results as stated in the financial statements which are capable of reversal in one or more subsequent<br />

periods. Due to the Company’s status as a Venture Capital Trust, and the intention to continue meeting the<br />

conditions required to obtain approval in the foreseeable future, the Company has not provided deferred tax on<br />

any capital gains and losses arising in the revaluation or disposal of investments.<br />

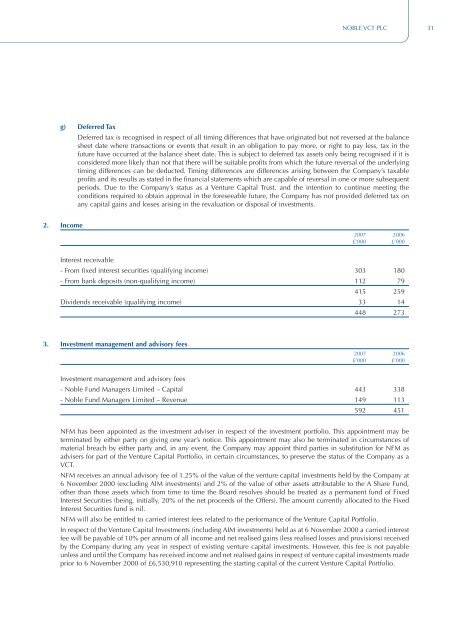

2. Income<br />

2007 2006<br />

£’000 £’000<br />

Interest receivable<br />

- From fixed interest securities (qualifying income) 303 180<br />

- From bank deposits (non-qualifying income) 112 79<br />

415 259<br />

Dividends receivable (qualifying income) 33 14<br />

448 273<br />

3. Investment management and advisory fees<br />

2007 2006<br />

£’000 £’000<br />

Investment management and advisory fees<br />

- <strong>Noble</strong> Fund Managers Limited – Capital 443 338<br />

- <strong>Noble</strong> Fund Managers Limited – Revenue 149 113<br />

592 451<br />

NFM has been appointed as the investment adviser in respect of the investment portfolio. This appointment may be<br />

terminated by either party on giving one year’s notice. This appointment may also be terminated in circumstances of<br />

material breach by either party and, in any event, the Company may appoint third parties in substitution for NFM as<br />

advisers for part of the Venture Capital Portfolio, in certain circumstances, to preserve the status of the Company as a<br />

<strong>VCT</strong>.<br />

NFM receives an annual advisory fee of 1.25% of the value of the venture capital investments held by the Company at<br />

6 November 2000 (excluding AIM investments) and 2% of the value of other assets attributable to the A Share Fund,<br />

other than those assets which from time to time the Board resolves should be treated as a permanent fund of Fixed<br />

Interest Securities (being, initially, 20% of the net proceeds of the Offers). The amount currently allocated to the Fixed<br />

Interest Securities fund is nil.<br />

NFM will also be entitled to carried interest fees related to the performance of the Venture Capital Portfolio.<br />

In respect of the Venture Capital Investments (including AIM investments) held as at 6 November 2000 a carried interest<br />

fee will be payable of 10% per annum of all income and net realised gains (less realised losses and provisions) received<br />

by the Company during any year in respect of existing venture capital investments. However, this fee is not payable<br />

unless and until the Company has received income and net realised gains in respect of venture capital investments made<br />

prior to 6 November 2000 of £6,530,910 representing the starting capital of the current Venture Capital Portfolio.