Noble VCT plc - Foresight Group

Noble VCT plc - Foresight Group

Noble VCT plc - Foresight Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

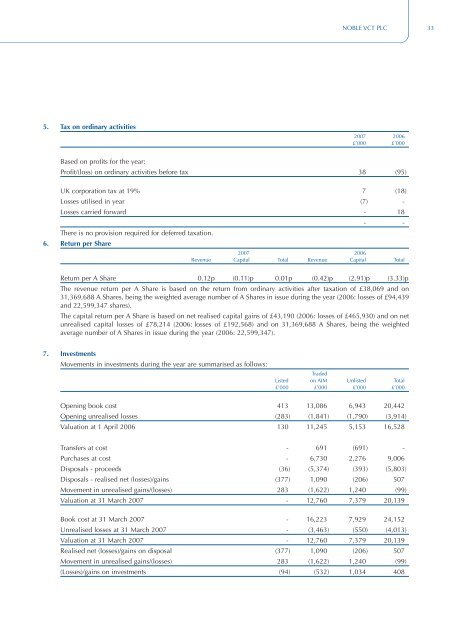

5. Tax on ordinary activities<br />

Based on profits for the year:<br />

NOBLE <strong>VCT</strong> PLC 33<br />

2007 2006<br />

£’000 £’000<br />

Profit/(loss) on ordinary activities before tax 38 (95)<br />

UK corporation tax at 19% 7 (18)<br />

Losses utilised in year (7) -<br />

Losses carried forward - 18<br />

There is no provision required for deferred taxation.<br />

- -<br />

6. Return per Share<br />

2007 2006<br />

Revenue Capital Total Revenue Capital Total<br />

Return per A Share 0.12p (0.11)p 0.01p (0.42)p (2.91)p (3.33)p<br />

The revenue return per A Share is based on the return from ordinary activities after taxation of £38,069 and on<br />

31,369,688 A Shares, being the weighted average number of A Shares in issue during the year (2006: losses of £94,439<br />

and 22,599,347 shares).<br />

The capital return per A Share is based on net realised capital gains of £43,190 (2006: losses of £465,930) and on net<br />

unrealised capital losses of £78,214 (2006: losses of £192,568) and on 31,369,688 A Shares, being the weighted<br />

average number of A Shares in issue during the year (2006: 22,599,347).<br />

7. Investments<br />

Movements in investments during the year are summarised as follows:<br />

Traded<br />

Listed on AIM Unlisted Total<br />

£’000 £’000 £’000 £’000<br />

Opening book cost 413 13,086 6,943 20,442<br />

Opening unrealised losses (283) (1,841) (1,790) (3,914)<br />

Valuation at 1 April 2006 130 11,245 5,153 16,528<br />

Transfers at cost - 691 (691) -<br />

Purchases at cost - 6,730 2,276 9,006<br />

Disposals - proceeds (36) (5,374) (393) (5,803)<br />

Disposals - realised net (losses)/gains (377) 1,090 (206) 507<br />

Movement in unrealised gains/(losses) 283 (1,622) 1,240 (99)<br />

Valuation at 31 March 2007 - 12,760 7,379 20,139<br />

Book cost at 31 March 2007 - 16,223 7,929 24,152<br />

Unrealised losses at 31 March 2007 - (3,463) (550) (4,013)<br />

Valuation at 31 March 2007 - 12,760 7,379 20,139<br />

Realised net (losses)/gains on disposal (377) 1,090 (206) 507<br />

Movement in unrealised gains/(losses) 283 (1,622) 1,240 (99)<br />

(Losses)/gains on investments (94) (532) 1,034 408