brochure and order form - Business Insights

brochure and order form - Business Insights

brochure and order form - Business Insights

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

BUSINESS INSIGHTS<br />

Innovation in Healthy Snacks<br />

Growth opportunities in guilt-free, functional <strong>and</strong> hi-energy products<br />

New Food <strong>and</strong> Drinks Report - Published January 2008<br />

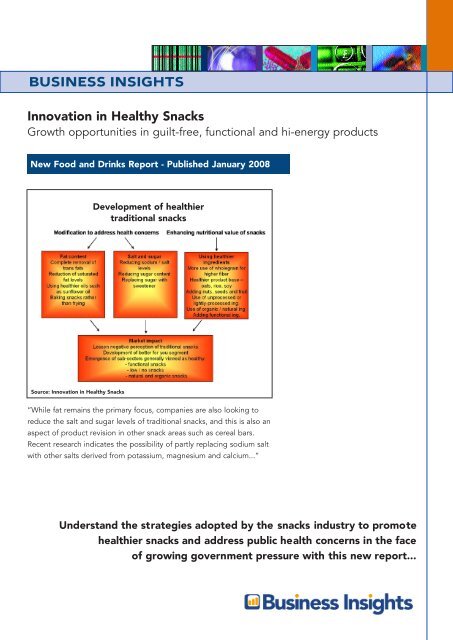

Development of healthier<br />

traditional snacks<br />

Source: Innovation in Healthy Snacks<br />

“While fat remains the primary focus, companies are also looking to<br />

reduce the salt <strong>and</strong> sugar levels of traditional snacks, <strong>and</strong> this is also an<br />

aspect of product revision in other snack areas such as cereal bars.<br />

Recent research indicates the possibility of partly replacing sodium salt<br />

with other salts derived from potassium, magnesium <strong>and</strong> calcium...”<br />

Underst<strong>and</strong> the strategies adopted by the snacks industry to promote<br />

healthier snacks <strong>and</strong> address public health concerns in the face<br />

of growing government pressure with this new report...

<strong>Business</strong> Intelligence for the Consumer Goods Industry<br />

<strong>Business</strong> <strong>Insights</strong>' portfolio of consumer goods management reports are designed to help you make well in<strong>form</strong>ed<br />

<strong>and</strong> timely business decisions. We underst<strong>and</strong> the problems facing today's consumer goods executives when trying<br />

to drive your business forward, <strong>and</strong> appreciate the importance of accurate, up-to-date, incisive product, market <strong>and</strong><br />

company analysis. We help you to crystallize your business decisions.<br />

The strength of our consumer goods research <strong>and</strong> analysis is derived from access to unparalleled databases <strong>and</strong><br />

libraries of in<strong>form</strong>ation <strong>and</strong> the use of proprietary analytic techniques. <strong>Business</strong> <strong>Insights</strong> reports are authored by<br />

independent experts <strong>and</strong> contain findings garnered from dedicated primary research. Our authors' leading<br />

positions secure them access to interview key executives <strong>and</strong> to establish which issues will be of greatest strategic<br />

significance for the industry.<br />

Our consumer goods portfolio of reports can be used across a wide range of business functions to assess market<br />

conditions <strong>and</strong> devise future strategies <strong>and</strong> cover the food, drink, health, cosmetics, toiletries, dairy categories<br />

<strong>and</strong> key consumer issues including eRetail <strong>and</strong> marketing.<br />

Key issues examined by this report...<br />

Developing next generation<br />

healthy snacks<br />

• Public health concerns such as obesity <strong>and</strong> related illnesses are<br />

exercising a high degree of influence over the wider snacks industry.<br />

In the US, companies are co-operating with government <strong>and</strong><br />

interest groups with a view to developing snacks t hat con<strong>form</strong> to<br />

specific nutritional criteria. This trend is expected to spread<br />

internationally.<br />

Source: Innovation in Healthy Snacks<br />

“Growing consumer dem<strong>and</strong> for healthier snacks is<br />

driving innovation. New snacks are targeting greater<br />

awareness of healthy eating <strong>and</strong> consumers’ willingness<br />

to eat healthier snacks, often with enhanced health<br />

benefits. Revising snacks to make them less unhealthy<br />

also reflects changing dem<strong>and</strong> patterns, as<br />

well as pressure from government <strong>and</strong><br />

health groups to make snacks healthier...“<br />

• Re<strong>form</strong>ulation of snack ranges with lower fat <strong>and</strong> salt levels is<br />

blurring the distinction between better-for-you snacks <strong>and</strong> st<strong>and</strong>ard<br />

products. Using less unhealthy fats in snacks manufacture is<br />

becoming widespread, along with modifying the manufacturing<br />

process using ‘baked’ <strong>and</strong> ‘unprocessed’ methods instead.<br />

• Positive nutrition is playing a major role in the market, with the<br />

new generation of healthy snacks based o n healthier ingredients<br />

including organics <strong>and</strong> those with functional properties.<br />

• Functional snacks are also evolving along the lines of healthy<br />

indulgence products, with consumers enjoying guilt-free indulgence<br />

through eating snacks that also provide health benefits.

Innovation in Healthy Snacks<br />

Growth opportunities in guilt-free, functional <strong>and</strong> hi-energy products<br />

New organic <strong>and</strong> functional snack bars<br />

Consumers are increasingly looking to eat healthily, <strong>and</strong> this is reflected in<br />

growing dem<strong>and</strong> for snack products perceived as nutritious. A new<br />

generation of snack products are emerging that contain new functional<br />

ingredients, use fat <strong>and</strong> sugar replacers <strong>and</strong> are developed with new<br />

cooking processes to make them healthier. Recent innovations include<br />

drinks to replace snacking occasions, satiety promoting products <strong>and</strong><br />

vitality boosting snacks. It is these latest developments that will lead the<br />

way in the future.<br />

Source: Innovation in Healthy Snacks<br />

“Nutty Pomegranate & Cranberry with Chocolate is one<br />

of the varieties of Aristo Body + Mind Wellness<br />

Nutrition Bars introduced in the US by Aristo Health.<br />

This range features other superfruit varieties açaí <strong>and</strong><br />

goji, increasingly fashionable in North America <strong>and</strong><br />

Europe. These are ultra-healthy products that combine<br />

the antioxidant content of superfruits with<br />

added functional ingredients such as<br />

omega-3 <strong>and</strong> plant sterols...”<br />

This new report will enable you to...<br />

Innovation in Healthy Snacks is a new management report published by<br />

<strong>Business</strong> <strong>Insights</strong> that tracks the development of healthier snacking<br />

options within the wider market. It looks at how different companies are<br />

gaining competitive advantage through healthier snack <strong>form</strong>ulation <strong>and</strong><br />

positioning. The current status <strong>and</strong> potential of key areas such as low/no,<br />

functional, natural/organic <strong>and</strong> sports/fitness snacks is assessed, together<br />

with emergent areas <strong>and</strong> marketing trends.<br />

Develop more effective strategies for healthy snacks using this<br />

report’s analysis of the development of the healthy snacks market by<br />

country <strong>and</strong> product category.<br />

Brown rice <strong>and</strong> soy snack chips<br />

• Identify key players in the healthy snacks market including<br />

PepsiCo, General Mills <strong>and</strong> Kraft. These companies have adapted<br />

core ranges <strong>and</strong> launched new products in <strong>order</strong> to benefit from<br />

the trend in healthy snacking.<br />

• Predict future market growth levels with this report's up-to-date<br />

healthy snacking occasions data, <strong>and</strong> underst<strong>and</strong> the major issues<br />

that are impacting on snacking now <strong>and</strong> in the future using<br />

functional snacks <strong>and</strong> sports bars market value data.<br />

Source: Innovation in Healthy Snacks<br />

“A number of new soy snacks in classic chip <strong>form</strong>at<br />

have been introduced in the US since 2004, typically<br />

marketed as being rich in soy protein <strong>and</strong> naturally free<br />

from cholesterol. Niche healthy snack company World<br />

Gourmet Marketing LLC recently launched Soy Crisps,<br />

an All Natural Baked Snack available as part of its<br />

Sensible Portions range. The ultra-healthy<br />

positioning is underpinned by the manufacturer’s<br />

claims for the product... “<br />

• Anticipate the impact of key trends in the healthy snacks<br />

market <strong>and</strong> quantify the new <strong>and</strong> emerging opportunities from<br />

growth areas including functional, organic, low/no, sports <strong>and</strong><br />

fitness <strong>and</strong> healthy indulgence snacks.<br />

• Improve targeting <strong>and</strong> the effectiveness of your NPD strategies<br />

with this report’s analysis of Productscan data of over 2,700<br />

healthy snack products launched between 2004 <strong>and</strong> 2007,<br />

detailing regional contribution, category coverage, product claims<br />

<strong>and</strong> fast-growth flavors.

Your questions answered...<br />

South Beach Diet <strong>and</strong> Curves<br />

100 calorie snack bars<br />

• How has health come to represent one of the key drivers of the<br />

snacks industry?<br />

• How are companies developing innovative healthy snack products<br />

<strong>and</strong> exploiting new opportunities?<br />

• Where are healthy products making the most headway <strong>and</strong> which<br />

markets offer greatest potential for new snacks?<br />

• What are the key trends in healthy snacks?<br />

Source: Innovation in Healthy Snacks<br />

“PepsiCo has its own calorie control snack bars, Quaker<br />

Chewy 90 Calorie Bars, <strong>and</strong> sells 100 calorie snack pack<br />

<strong>form</strong>ats for classic Frito-Lay br<strong>and</strong>s such as Cheetos.<br />

2006 saw the introduction of 100 calorie packs for its<br />

successful SunChips healthy snacks. While the trend for<br />

portion control is established in North America, a<br />

number of calorie-controlled <strong>form</strong>ats now feature in<br />

other markets, especially the UK <strong>and</strong> Australasia....”<br />

• Which product categories are viewed as healthy by consumers <strong>and</strong><br />

what motivates them to buy healthy snack foods?<br />

• Who is leading the way in healthy snack innovation?<br />

• Why is indulgence important in he althy snacks?<br />

Some key findings from this report...<br />

Selected healthier children’s fruit snacks<br />

• Organic snacks now account for 2% of the savory snack market<br />

in Europe <strong>and</strong> the US with sales of $820 million in 2007. The US<br />

market is growing at more than 20% per annum <strong>and</strong> higher growth<br />

is anticipated in Europe.<br />

• Natural is the most common claim on healthy snacks, used by<br />

7.5% of products launched in 2007. The claim has increased in<br />

share since 2005. Organic is also a fast-growth claim.<br />

Source: Innovation in Healthy Snacks<br />

“A novel children’s fruit snack launched in the UK is<br />

also organic <strong>and</strong> provides one of the five daily<br />

recommended servings of fruit. Use of this kind of c laim<br />

is expected to continue to become more widespread in<br />

children’s food marketing, reflecting the growing<br />

awareness of the importance of fruit <strong>and</strong><br />

vegetables in a healthy diet...”<br />

• The $1.2 billion functional snack sector is growing fast in<br />

Europe, now accounting for 13% of savory snack sales in Italy.<br />

Penetration is expected to develop significantly in countries such as<br />

the US <strong>and</strong> UK where functional snack share is still low.<br />

• Healthy snacking occasions now outweigh unhealthy snacking<br />

across Europe <strong>and</strong> the US. A third of consumers see healthy<br />

snacking as a way to get important nutrients into their diet.<br />

.

Pages: 133 Figures: 43 Tables: 14<br />

Sample from ‘Innovation in Healthy Snacks’<br />

Chapter 2:The Healthy Snacking Market<br />

Functional snacks<br />

The functional sector covers a wide range of classic<br />

traditional snacks – nuts <strong>and</strong> seeds, popcorn, potato chips,<br />

extruded snacks, corn chips, tortilla chips, pretzels etc <strong>and</strong><br />

represents a comparatively small segment of the overall<br />

market. Sales of $508m in the US in 2006 is equivalent to<br />

2.6% of the total US savory snack market, <strong>and</strong> the $665m<br />

European market for functional savory snacks represents<br />

3.9% of savory snack sales in this region. As such, functional<br />

snack penetration in the US is lower than in Europe, in<br />

contrast to the organic snack sector where the US market is<br />

significantly more developed.<br />

Table 2.10: Functional snacks market value by country, $m,<br />

2001-2006<br />

However, sales in Europe are growing at a faster rate, with<br />

Italy <strong>and</strong> Sweden at the forefront. Average compound<br />

Source: Innovation in Healthy Snacks<br />

annual growth in Europe of nearly 9% between 2001 <strong>and</strong><br />

2006 was much higher than in the US. Products classified as<br />

functional have grown at a lower rate in the US than the savory snack market as a whole, with healthy traditional snack<br />

growth attributable to natural <strong>and</strong> organic snacks <strong>and</strong> better-for-you products. Nevertheless, the past few years have seen<br />

growth in the number of new functional snacks launched in<br />

US, with the sector likely to outper<strong>form</strong> the savory snacks<br />

business in the future.<br />

The sector of functional snacks has grown at a faster rate<br />

than the savory snack market in all European territories<br />

between 2001 <strong>and</strong> 2006, <strong>and</strong> further above-trend growth is<br />

anticipated. As shown in Figure 2.6, functional snacks now<br />

account for nearly 13% of the total Italian savory snacks<br />

market. Share is also high in Germany <strong>and</strong> Sweden, above<br />

average in France <strong>and</strong> Spain, <strong>and</strong> lags behind the European<br />

average in the UK <strong>and</strong> the Netherl<strong>and</strong>s. Prospects are<br />

particularly good for functional snacks in the rest of Europe<br />

where penetration is very low, <strong>and</strong> rapid growth is<br />

anticipated in these territories.<br />

Figure 2.6: Functional snacks share of total savory snack<br />

value sales by country, Europe <strong>and</strong> the US, 2006<br />

Source: Innovation in Healthy Snacks<br />

The level of NPD activity in functional snacks is covered in<br />

Chapter 3, while Chapter 4 assesses the trends within functional snacks <strong>and</strong> likely areas of future growth. More<br />

sophisticated products with added benefit-specific functional ingredients are likely to drive the sector forward.<br />

- 47-<br />

Order this report today to find out more...

Table of Contents<br />

CHAPTER 1: FACTORS SHAPING THE CHANGING<br />

MARKET FOR SNACKS<br />

• Summary<br />

• Introduction<br />

• The next generation of healthy snacks<br />

• The trend towards healthier snacking<br />

• Public health issues<br />

- Health conditions<br />

- Obesity<br />

- Diabetes<br />

- Cardiovascular disease<br />

- Government policy on health<br />

- Companies <strong>and</strong> government cooperate on health<br />

- Promoting fitness <strong>and</strong> individual responsibility<br />

CHAPTER 2: THE HEALTHY SNACKING MARKET<br />

• Summary<br />

• Introduction<br />

• Dem<strong>and</strong> for traditional snacks stagnates<br />

• Development of healthy traditional snacks<br />

• Healthy snack market development<br />

- Natural <strong>and</strong> organic snacks<br />

- US<br />

- UK <strong>and</strong> Europe<br />

- Functional snacks<br />

- Low/no <strong>and</strong> other better-for-you snacks<br />

- US<br />

- Europe<br />

• Healthy snack category growth<br />

- Added value fruit, nut <strong>and</strong> seed snacks<br />

- Sports bars<br />

- Other healthy snack categories<br />

- Established products<br />

- Emergent products<br />

CHAPTER 3: INNOVATION AND NPD IN HEALTHY<br />

SNACKS<br />

• Summary<br />

• Introduction<br />

• Growth in NPD of healthy snacks<br />

• NPD share of healthy snack categories<br />

• Category analysis<br />

- Traditional snacks<br />

- Snack bars<br />

• Regional analysis<br />

• Innovation analysis<br />

- Innovation in <strong>form</strong>ulation<br />

- Innovative fortified <strong>and</strong> functional snacks<br />

- Innovative base ingredients<br />

- Innovative positioning<br />

- Innovation by product category<br />

• Product tags on healthy snacks<br />

• Flavor trends<br />

• Health trends within snacks NPD<br />

CHAPTER 4: TRENDS IN HEALTHY SNACKS<br />

• Summary<br />

• Introduction<br />

• Low/no <strong>and</strong> be tter-for-you snacks<br />

- Reducing fat, salt <strong>and</strong> sugar – food minus<br />

- Increasing nutritional value – food plus<br />

- Wholegrains<br />

- Soy<br />

- Weight management snacks<br />

- Calorie control snacks<br />

- Move to satiety positioning<br />

• Functional snack trends<br />

- Antioxidants<br />

- Cholesterol reduction<br />

- Omega-3 for mental function<br />

• Sports <strong>and</strong> energy snacks<br />

• Natural <strong>and</strong> organic snacks<br />

- Supply-side development of organic snacks<br />

- Raw food<br />

CHAPTER 5: INDULGENT AND CONVENIENT<br />

HEALTHY SNACKS<br />

• Summary<br />

• Introduction<br />

• Development of healthy indulgence<br />

- Low calorie <strong>and</strong> low fat indulgence<br />

- Indulgent snacks with healthy ingredients<br />

- Functional chocolate snacks<br />

• Out-of-home healthy snacking<br />

- Workplace <strong>and</strong> on-the-go healthy snacking<br />

- Healthy snack drinks<br />

- Healthy lunchbox snacks for children

Table of Contents (contd.)<br />

CHAPTER 6: CONCLUSIONS<br />

• Summary<br />

• Introduction<br />

• Market development<br />

• Industry development<br />

• Index<br />

FIGURES<br />

• Developing next generation healthy snacks<br />

• Perceptions regarding the healthiness of key snack<br />

food categories<br />

• PepsiCo’s Smart Spot, Kraft’s Sensible Solution <strong>and</strong><br />

General Mills’ Goodness Corner<br />

• Development of healthier traditional snacks<br />

• Key markets for organic snacks, Europe <strong>and</strong> the US,<br />

2007<br />

• Functional snacks share of total savory snack value<br />

sales by country, Europe <strong>and</strong> the US, 2006<br />

• Nuts, seeds <strong>and</strong> dry fruit snacks SWOT analysis<br />

• Percentage share of (2004-2007)<br />

- Growth of healthy products in snack categories<br />

- Products launched in each healthy snack category<br />

• Nature Valley Fruit Crisps <strong>and</strong> Frito-Lay Flat Earth<br />

• Brown rice <strong>and</strong> soy snack chips<br />

• Wholegrain <strong>and</strong> high fiber snacks<br />

• New baked not fried snacks<br />

• New organic <strong>and</strong> functional snack bars<br />

• % share of healthy snack products launched, by<br />

region, 2004-7<br />

• Tumaro’s Soy-full Heart, Attune Probiotic Bars <strong>and</strong><br />

Kellogg’s Smart Start<br />

• High protein snacks with innovative <strong>form</strong>ulation<br />

• Hain Celestial Bingooz rice <strong>and</strong> soy snack<br />

• Innovative healthy snacks<br />

- For children <strong>and</strong> mothers<br />

- In the meat products <strong>and</strong> ready meals categories<br />

• Inspirations Pretzel Minis <strong>and</strong> Deserv Energy Pretzels<br />

• % share of (2002-2007)<br />

- Innovative products launched in each healthy<br />

snack category<br />

- Snacks launched in each health trend<br />

- Healthy snacks launched in each health trend<br />

• Major low/no br<strong>and</strong>s in traditional snacks<br />

• Kashi GoLean <strong>and</strong> Asahi Balance Up bars<br />

• New antioxidant-rich snacks<br />

• Clif Kids Organic Z Bar <strong>and</strong> Reichel Foods Dippin’ Stix<br />

• SunChips Multigrain, Chex grain snacks <strong>and</strong> Nutradia<br />

Pretzels<br />

• Quaker, Clearspring, Newman’s Own Organic <strong>and</strong><br />

Garden of Eatin soy snacks<br />

• South Beach Diet <strong>and</strong> Curves 100 calorie snack bars<br />

• SunChips, Arnotts <strong>and</strong> Sensible Portions calorie<br />

control packs<br />

• Selected<br />

- Cholesterol-reducing snacks<br />

- Functional snacks with omega 3<br />

- New sports <strong>and</strong> energy snacks<br />

- Healthier children’s fruit snacks<br />

• Lidl Bioness, Marks & Spencer, <strong>and</strong> Whole Foods<br />

Market organic snacks<br />

• Natural <strong>and</strong> organic snacks with raw <strong>form</strong>ulation<br />

• Arnott’s Snack Right Cookies <strong>and</strong> Exquisa Fitline snack<br />

• Hershey Snacksters, Tohato All Apple, L<strong>and</strong>garten Soy<br />

& Chocolate Snack Mix<br />

• CocoaVia Snack Bars <strong>and</strong> Clif Nectar Cacao<br />

• Peterson Farms snacks, Go Natural 100% Fruit Bars,<br />

Taillefine Equilibre Les Matins<br />

• Promotion for Knorr Vie shots<br />

TABLES<br />

• Total snacking occasions by country, bn, Europe <strong>and</strong><br />

the US, 2006-11<br />

• Healthy <strong>and</strong> unhealthy snacking occasions by country,<br />

Europe <strong>and</strong> the US, bn, 2006-11<br />

• Ranking of per capita healthy snacking occasions by<br />

country, 2006<br />

• Reasons for engaging in healthy snacking<br />

• Prevalence of<br />

- Obesity in the six major markets by age, 2005<br />

- Type 1 & 2 diabetes in 7 major markets, 2004-5<br />

- Cardiovascular disease in 7 major markets, 2005<br />

• Savory snacks market value by country, $m, 2002-7<br />

• Market value <strong>and</strong> growth of the savory snacks market,<br />

by category, $m, Europe <strong>and</strong> the US, 2002-7<br />

• Functional snacks market value by country, $m, 2001-6<br />

• Consumer spending on sports bars, Europe & US, $m,<br />

by country, 2001-11<br />

• % share of innovative healthy snack products, by<br />

innovation type, 2004-7<br />

• Top 15 package tags on healthy snacks launched,<br />

2005-7<br />

• Top 15 flavors on healthy snacks launched, 2005-7

FAX BACK TO: +44 (0) 207 900 6688<br />

or scan <strong>and</strong> e-mail to<br />

marketing@globalbusinessinsights.com<br />

I would like to <strong>order</strong> the following report... 1<br />

(Please use BLOCK CAPITALS)<br />

______________________________________________________<br />

______________________________________________________<br />

Company details 3<br />

Company name: ________________________________________________________<br />

EU companies (except UK) must supply VAT / BTW / MOMS / MWST / IVA / FPA number:<br />

_____________________________________________________________________________________________<br />

Hard Copy (extra £50/€75/$95)<br />

Please allow 28 days for delivery<br />

Interactivity (extra £50/€75/$95)<br />

Search, customize & translate content<br />

Purchase Order Number (if required)_____________________________________<br />

Please select a license type: 2<br />

GB£ EUR US$<br />

Single User<br />

(eCopy)<br />

1495 2160 2875<br />

Access permitted for one individual only<br />

Payment method<br />

Please indicate your preferred currency: GB£ EUR US$<br />

Total <strong>order</strong> value is ____________________________<br />

I will forward a check payable to <strong>Business</strong> <strong>Insights</strong> Limited.<br />

4<br />

Site<br />

2995 4330 5750<br />

License<br />

Access permitted for every individual based at one location<br />

Company<br />

License<br />

5600 8100 10795<br />

Global access for every individual member of staff at the company<br />

To ask a question about license types, email: marketing@globalbusinessinsights.com<br />

Please invoice my company (please complete invoice address below)<br />

I would like to pay by bank transfer (email address required)<br />

Debit my credit/charge card: Amex Visa Mastercard<br />

Card No________________________________________________________________________<br />

Expiry Date _________ / _________ Signature ______________________________<br />

Communications Feedback<br />

Please let us know if any of the following factors influenced your purchase...<br />

Email/Fax/Postal promotion Trade Press<br />

Brochure<br />

My Account Manager<br />

Table of Contents<br />

Conference materials<br />

Colleague Recommendation Website/web search<br />

Recipient details (If different from Payor)<br />

Title: Mr/Mrs/Ms<br />

(Please use BLOCK CAPITALS)<br />

First Name:<br />

Last Name:<br />

Payor details 5<br />

Title: Mr/Mrs/Ms<br />

(Please use BLOCK CAPITALS)<br />

First Name:<br />

Last Name:<br />

Email<br />

Job Title<br />

Department<br />

Address<br />

Email<br />

Job Title<br />

Department<br />

Address<br />

City<br />

Country<br />

Tel<br />

State/Province<br />

Post Code/ZIP<br />

Fax<br />

City<br />

State/Province<br />

Country<br />

Post Code/ZIP<br />

Tel<br />

Fax<br />

Sign here to confirm your <strong>order</strong>:<br />

ORDERS WITHOUT A SIGNATURE CANNOT BE PROCESSED<br />

<br />

⌨