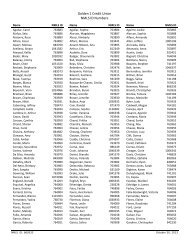

Disclosure of Account Information - The Golden 1 Credit Union

Disclosure of Account Information - The Golden 1 Credit Union

Disclosure of Account Information - The Golden 1 Credit Union

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

However, rather than automatically denying an everyday<br />

debit card transaction that may cause an overdraft on<br />

your account, you may be eligible for our Overdraft<br />

Protection for Everyday Debit Card Transactions, an<br />

additional feature <strong>of</strong> our Courtesy Pay program. Courtesy<br />

Pay program terms and conditions are incorporated into<br />

this disclosure by reference herein. Overdraft Protection<br />

for Everyday Debit Card Transactions provides a limited<br />

amount <strong>of</strong> overdraft protection in accordance with these<br />

terms and conditions. You will be eligible for Overdraft<br />

Protection for Everyday Debit Card Transactions if<br />

you have an eligible account type (as described below),<br />

if you maintain your account in good standing, if you<br />

are enrolled in our Courtesy Pay program, and if you ask<br />

us to authorize and pay (“opt-in”) your everyday debit<br />

card transactions. You may choose at any time to optout<br />

and not participate in the Courtesy Pay program. If<br />

you choose to no longer participate in the Courtesy Pay<br />

program and you have opted in to Overdraft Protection<br />

for Everyday Debit Card Transactions, you will also be<br />

automatically removed from debit card protection. If you<br />

do not “opt-in” and ask us to pay your overdrafts caused<br />

by everyday debit card transactions, your transactions will<br />

be declined. Maintaining your account in good standing<br />

includes, among other requirements, the following:<br />

1. You are not in default on any loan obligation to us;<br />

2. You bring your account to a positive balance (not<br />

overdrawn) immediately or as soon as possible<br />

after it has been overdrawn, and in no event less<br />

than once every thirty (30) days; and<br />

3. Your account is not the subject <strong>of</strong> any legal or<br />

administrative order or levy, such as bankruptcy or<br />

a tax lien.<br />

If you meet these requirements, and any additional<br />

requirements we may institute, we will consider, without<br />

obligation on our part, approving your reasonable<br />

overdrafts caused by everyday debit card transactions<br />

up to your assigned Courtesy Pay program limit.<br />

Generally you will be provided with up to $500.00 in<br />

overdraft negative balance protection for Free Checking,<br />

MarketRate Checking SM , and Premium Checking SM<br />

<strong>Account</strong>s. This disclosure is an addendum to the<br />

<strong>Disclosure</strong> <strong>of</strong> <strong>Account</strong> <strong>Information</strong> governing these<br />

accounts.<br />

Our normal fees and charges, including, without<br />

limitation, our Courtesy Pay Fee (which is currently<br />

$27.50 per overdraft item as set forth in our Fee<br />

Schedule and is subject to change with notice as<br />

required by law) will be charged. This means that<br />

for each everyday debit card transaction initiated for<br />

49