(a) Reserve Bank of India Pension Regulations 1990

(a) Reserve Bank of India Pension Regulations 1990

(a) Reserve Bank of India Pension Regulations 1990

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

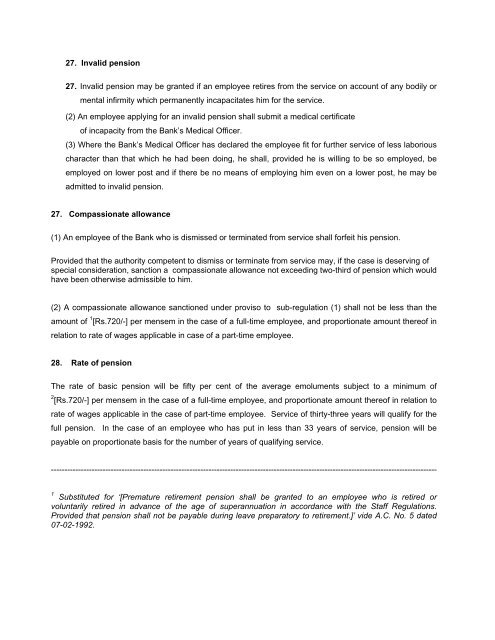

27. Invalid pension<br />

27. Invalid pension may be granted if an employee retires from the service on account <strong>of</strong> any bodily or<br />

mental infirmity which permanently incapacitates him for the service.<br />

(2) An employee applying for an invalid pension shall submit a medical certificate<br />

<strong>of</strong> incapacity from the <strong>Bank</strong>’s Medical Officer.<br />

(3) Where the <strong>Bank</strong>’s Medical Officer has declared the employee fit for further service <strong>of</strong> less laborious<br />

character than that which he had been doing, he shall, provided he is willing to be so employed, be<br />

employed on lower post and if there be no means <strong>of</strong> employing him even on a lower post, he may be<br />

admitted to invalid pension.<br />

27. Compassionate allowance<br />

(1) An employee <strong>of</strong> the <strong>Bank</strong> who is dismissed or terminated from service shall forfeit his pension.<br />

Provided that the authority competent to dismiss or terminate from service may, if the case is deserving <strong>of</strong><br />

special consideration, sanction a compassionate allowance not exceeding two-third <strong>of</strong> pension which would<br />

have been otherwise admissible to him.<br />

(2) A compassionate allowance sanctioned under proviso to sub-regulation (1) shall not be less than the<br />

amount <strong>of</strong> 1 [Rs.720/-] per mensem in the case <strong>of</strong> a full-time employee, and proportionate amount there<strong>of</strong> in<br />

relation to rate <strong>of</strong> wages applicable in case <strong>of</strong> a part-time employee.<br />

28. Rate <strong>of</strong> pension<br />

The rate <strong>of</strong> basic pension will be fifty per cent <strong>of</strong> the average emoluments subject to a minimum <strong>of</strong><br />

2 [Rs.720/-] per mensem in the case <strong>of</strong> a full-time employee, and proportionate amount there<strong>of</strong> in relation to<br />

rate <strong>of</strong> wages applicable in the case <strong>of</strong> part-time employee. Service <strong>of</strong> thirty-three years will qualify for the<br />

full pension. In the case <strong>of</strong> an employee who has put in less than 33 years <strong>of</strong> service, pension will be<br />

payable on proportionate basis for the number <strong>of</strong> years <strong>of</strong> qualifying service.<br />

-----------------------------------------------------------------------------------------------------------------------------------------------<br />

1 Substituted for ‘[Premature retirement pension shall be granted to an employee who is retired or<br />

voluntarily retired in advance <strong>of</strong> the age <strong>of</strong> superannuation in accordance with the Staff <strong>Regulations</strong>.<br />

Provided that pension shall not be payable during leave preparatory to retirement.]’ vide A.C. No. 5 dated<br />

07-02-1992.