Chapter 8—Capital Budgeting Process and Techniques - Userpage

Chapter 8—Capital Budgeting Process and Techniques - Userpage

Chapter 8—Capital Budgeting Process and Techniques - Userpage

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

c. $6,000 million<br />

d. None of the above<br />

ANS: A<br />

The stock price increased by $2 per share.<br />

NPV = $2/share * 200m shares = $400m<br />

DIF: M<br />

REF: 8.5 Internal Rate of Return<br />

19. Kelley Industries has 100 million shares of common stock outst<strong>and</strong>ing with a current market price of<br />

$50. The firm is contemplating to take an investment project which requires an initial cash outflow of<br />

$100 million. The IRR of the project is equal to the firm’s cost of capital. What will be the firm’s stock<br />

price if capital markets fully reflect the value of undertaking the project?<br />

a. $50<br />

b. $49<br />

c. $51<br />

d. Cannot tell from the given information<br />

ANS: A<br />

The NPV of the project is zero since the project’s IRR equals the cost of capital. So there is no change<br />

in stock price.<br />

DIF: M<br />

REF: 8.5 Internal Rate of Return<br />

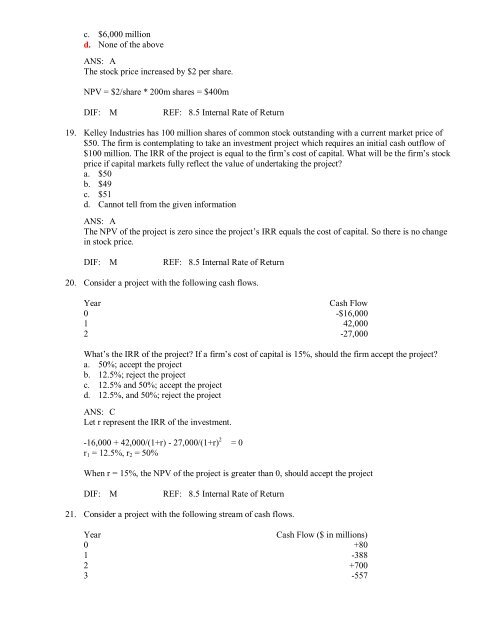

20. Consider a project with the following cash flows.<br />

Year<br />

Cash Flow<br />

0 -$16,000<br />

1 42,000<br />

2 -27,000<br />

What’s the IRR of the project? If a firm’s cost of capital is 15%, should the firm accept the project?<br />

a. 50%; accept the project<br />

b. 12.5%; reject the project<br />

c. 12.5% <strong>and</strong> 50%; accept the project<br />

d. 12.5%, <strong>and</strong> 50%; reject the project<br />

ANS: C<br />

Let r represent the IRR of the investment.<br />

-16,000 + 42,000/(1+r) - 27,000/(1+r) 2 = 0<br />

r 1 = 12.5%, r 2 = 50%<br />

When r = 15%, the NPV of the project is greater than 0, should accept the project<br />

DIF: M<br />

REF: 8.5 Internal Rate of Return<br />

21. Consider a project with the following stream of cash flows.<br />

Year<br />

Cash Flow ($ in millions)<br />

0 +80<br />

1 -388<br />

2 +700<br />

3 -557

![[UNBEGRENZTE MÖGLICHKEITEN?] - Userpage](https://img.yumpu.com/22343335/1/184x260/unbegrenzte-moglichkeiten-userpage.jpg?quality=85)