Do Credit Rating Announcements Have Informational Value ...

Do Credit Rating Announcements Have Informational Value ...

Do Credit Rating Announcements Have Informational Value ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

33<br />

be seen that I have the same problem that previous researchers have faced, since the number of<br />

observations in a single stock exchange is frustratingly small.<br />

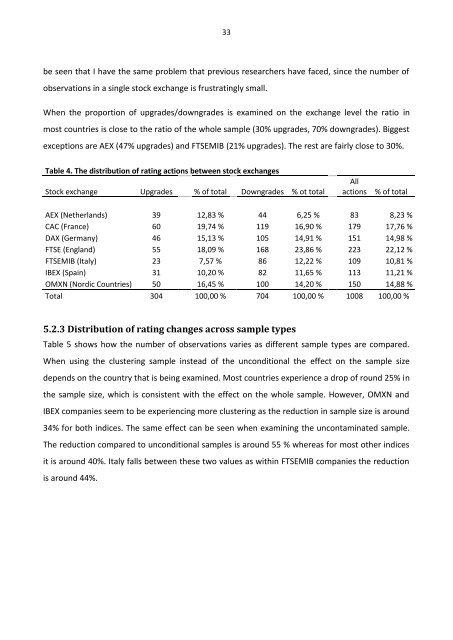

When the proportion of upgrades/downgrades is examined on the exchange level the ratio in<br />

most countries is close to the ratio of the whole sample (30% upgrades, 70% downgrades). Biggest<br />

exceptions are AEX (47% upgrades) and FTSEMIB (21% upgrades). The rest are fairly close to 30%.<br />

Table 4. The distribution of rating actions between stock exchanges<br />

Stock exchange Upgrades % of total <strong>Do</strong>wngrades % ot total<br />

All<br />

actions<br />

% of total<br />

AEX (Netherlands) 39 12,83 % 44 6,25 % 83 8,23 %<br />

CAC (France) 60 19,74 % 119 16,90 % 179 17,76 %<br />

DAX (Germany) 46 15,13 % 105 14,91 % 151 14,98 %<br />

FTSE (England) 55 18,09 % 168 23,86 % 223 22,12 %<br />

FTSEMIB (Italy) 23 7,57 % 86 12,22 % 109 10,81 %<br />

IBEX (Spain) 31 10,20 % 82 11,65 % 113 11,21 %<br />

OMXN (Nordic Countries) 50 16,45 % 100 14,20 % 150 14,88 %<br />

Total 304 100,00 % 704 100,00 % 1008 100,00 %<br />

5.2.3 Distribution of rating changes across sample types<br />

Table 5 shows how the number of observations varies as different sample types are compared.<br />

When using the clustering sample instead of the unconditional the effect on the sample size<br />

depends on the country that is being examined. Most countries experience a drop of round 25% in<br />

the sample size, which is consistent with the effect on the whole sample. However, OMXN and<br />

IBEX companies seem to be experiencing more clustering as the reduction in sample size is around<br />

34% for both indices. The same effect can be seen when examining the uncontaminated sample.<br />

The reduction compared to unconditional samples is around 55 % whereas for most other indices<br />

it is around 40%. Italy falls between these two values as within FTSEMIB companies the reduction<br />

is around 44%.