Do Credit Rating Announcements Have Informational Value ...

Do Credit Rating Announcements Have Informational Value ...

Do Credit Rating Announcements Have Informational Value ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

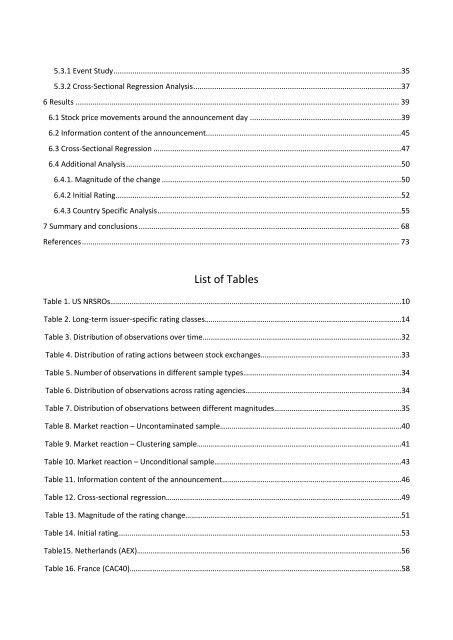

5.3.1 Event Study.........................................................................................................................................35<br />

5.3.2 Cross-Sectional Regression Analysis...................................................................................................37<br />

6 Results .......................................................................................................................................................... 39<br />

6.1 Stock price movements around the announcement day ........................................................................39<br />

6.2 Information content of the announcement.............................................................................................45<br />

6.3 Cross-Sectional Regression ......................................................................................................................47<br />

6.4 Additional Analysis...................................................................................................................................50<br />

6.4.1. Magnitude of the change ..................................................................................................................50<br />

6.4.2 Initial <strong>Rating</strong>........................................................................................................................................52<br />

6.4.3 Country Specific Analysis....................................................................................................................55<br />

7 Summary and conclusions ............................................................................................................................ 68<br />

References....................................................................................................................................................... 73<br />

List of Tables<br />

Table 1. US NRSROs…………………………………………………………………………………………………………………………………….10<br />

Table 2. Long-term issuer-specific rating classes…………………………………………………………………………………………14<br />

Table 3. Distribution of observations over time………………………………………………………………………………………….32<br />

Table 4. Distribution of rating actions between stock exchanges……………………………………………………………….33<br />

Table 5. Number of observations in different sample types……………………………………………………………………….34<br />

Table 6. Distribution of observations across rating agencies………………………………………………………………………34<br />

Table 7. Distribution of observations between different magnitudes…………………………………………………………35<br />

Table 8. Market reaction – Uncontaminated sample………………………………………………………………………………….40<br />

Table 9. Market reaction – Clustering sample…………………………………………………………………………………………….41<br />

Table 10. Market reaction – Unconditional sample…………………………………………………………………………………….43<br />

Table 11. Information content of the announcement…………………………………………………………………………………46<br />

Table 12. Cross-sectional regression…………………………………………………………………………………………………………..49<br />

Table 13. Magnitude of the rating change………………………………………………………………………………………………….51<br />

Table 14. Initial rating…………………………………………………………………………………………………………………………………53<br />

Table15. Netherlands (AEX)………………………………………………………………………………………………………………………..56<br />

Table 16. France (CAC40)……………………………………………………………………………………………………………………………58