Key drivers for EIA's short‐term US crude oil production outlook

Key drivers for EIA's short‐term US crude oil production outlook

Key drivers for EIA's short‐term US crude oil production outlook

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

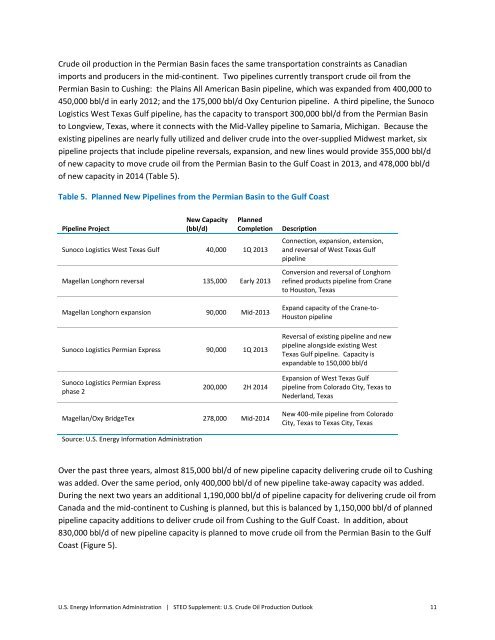

Crude <strong>oil</strong> <strong>production</strong> in the Permian Basin faces the same transportation constraints as Canadian<br />

imports and producers in the mid‐continent. Two pipelines currently transport <strong>crude</strong> <strong>oil</strong> from the<br />

Permian Basin to Cushing: the Plains All American Basin pipeline, which was expanded from 400,000 to<br />

450,000 bbl/d in early 2012; and the 175,000 bbl/d Oxy Centurion pipeline. A third pipeline, the Sunoco<br />

Logistics West Texas Gulf pipeline, has the capacity to transport 300,000 bbl/d from the Permian Basin<br />

to Longview, Texas, where it connects with the Mid‐Valley pipeline to Samaria, Michigan. Because the<br />

existing pipelines are nearly fully utilized and deliver <strong>crude</strong> into the over‐supplied Midwest market, six<br />

pipeline projects that include pipeline reversals, expansion, and new lines would provide 355,000 bbl/d<br />

of new capacity to move <strong>crude</strong> <strong>oil</strong> from the Permian Basin to the Gulf Coast in 2013, and 478,000 bbl/d<br />

of new capacity in 2014 (Table 5).<br />

Table 5. Planned New Pipelines from the Permian Basin to the Gulf Coast<br />

Pipeline Project<br />

New Capacity<br />

(bbl/d)<br />

Planned<br />

Completion<br />

Sunoco Logistics West Texas Gulf 40,000 1Q 2013<br />

Magellan Longhorn reversal 135,000 Early 2013<br />

Magellan Longhorn expansion 90,000 Mid‐2013<br />

Sunoco Logistics Permian Express 90,000 1Q 2013<br />

Description<br />

Connection, expansion, extension,<br />

and reversal of West Texas Gulf<br />

pipeline<br />

Conversion and reversal of Longhorn<br />

refined products pipeline from Crane<br />

to Houston, Texas<br />

Expand capacity of the Crane‐to‐<br />

Houston pipeline<br />

Reversal of existing pipeline and new<br />

pipeline alongside existing West<br />

Texas Gulf pipeline. Capacity is<br />

expandable to 150,000 bbl/d<br />

Sunoco Logistics Permian Express<br />

phase 2<br />

200,000 2H 2014<br />

Expansion of West Texas Gulf<br />

pipeline from Colorado City, Texas to<br />

Nederland, Texas<br />

Magellan/Oxy BridgeTex 278,000 Mid‐2014<br />

New 400‐mile pipeline from Colorado<br />

City, Texas to Texas City, Texas<br />

Source: U.S. Energy In<strong>for</strong>mation Administration<br />

Over the past three years, almost 815,000 bbl/d of new pipeline capacity delivering <strong>crude</strong> <strong>oil</strong> to Cushing<br />

was added. Over the same period, only 400,000 bbl/d of new pipeline take‐away capacity was added.<br />

During the next two years an additional 1,190,000 bbl/d of pipeline capacity <strong>for</strong> delivering <strong>crude</strong> <strong>oil</strong> from<br />

Canada and the mid‐continent to Cushing is planned, but this is balanced by 1,150,000 bbl/d of planned<br />

pipeline capacity additions to deliver <strong>crude</strong> <strong>oil</strong> from Cushing to the Gulf Coast. In addition, about<br />

830,000 bbl/d of new pipeline capacity is planned to move <strong>crude</strong> <strong>oil</strong> from the Permian Basin to the Gulf<br />

Coast (Figure 5).<br />

U.S. Energy In<strong>for</strong>mation Administration | STEO Supplement: U.S. Crude Oil Production Outlook 11