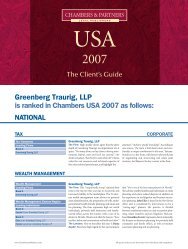

Greenberg Traurig, LLP_41P_US_2010

Greenberg Traurig, LLP_41P_US_2010

Greenberg Traurig, LLP_41P_US_2010

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PA082174<br />

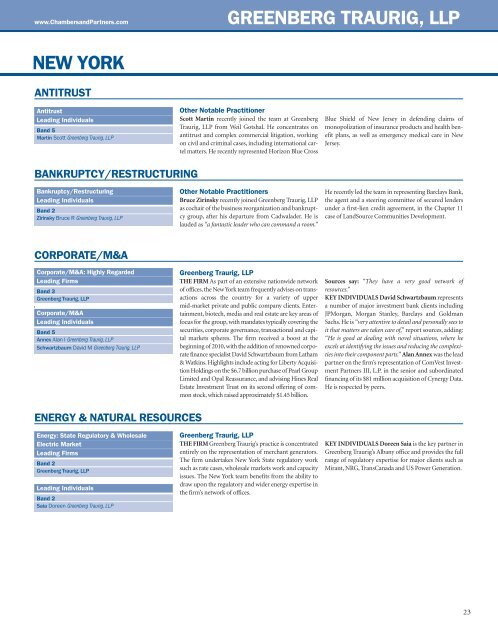

www.ChambersandPartners.com<br />

GREENBERG TRAURIG, <strong>LLP</strong><br />

NEW YORK<br />

ANTITR<strong>US</strong>T<br />

Antitrust<br />

Leading Individuals<br />

Band 5<br />

Martin Scott <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Other Notable Practitioner<br />

Scott Martin recently joined the team at <strong>Greenberg</strong><br />

<strong>Traurig</strong>, <strong>LLP</strong> from Weil Gotshal. He concentrates on<br />

antitrust and complex commercial litigation, working<br />

on civil and criminal cases, including international cartel<br />

matters. He recently represented Horizon Blue Cross<br />

Blue Shield of New Jersey in defending claims of<br />

monopolization of insurance products and health benefit<br />

plans, as well as emergency medical care in New<br />

Jersey.<br />

BANKRUPTCY/RESTRUCTURING<br />

Bankruptcy/Restructuring<br />

Leading Individuals<br />

Band 2<br />

Zirinsky Bruce R <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Other Notable Practitioners<br />

Bruce Zirinsky recently joined <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

as cochair of the business reorganization and bankruptcy<br />

group, after his departure from Cadwalader. He is<br />

lauded as “a fantastic leader who can command a room.”<br />

He recently led the team in representing Barclays Bank,<br />

the agent and a steering committee of secured lenders<br />

under a first-lien credit agreement, in the Chapter 11<br />

case of LandSource Communities Development.<br />

CORPORATE/M&A<br />

Corporate/M&A: Highly Regarded<br />

Leading Firms<br />

Band 3<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Corporate/M&A<br />

Leading Individuals<br />

Band 5<br />

Annex Alan I <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Schwartzbaum David M <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

THE FIRM As part of an extensive nationwide network<br />

of offices, the New York team frequently advises on transactions<br />

across the country for a variety of upper<br />

mid-market private and public company clients. Entertainment,<br />

biotech, media and real estate are key areas of<br />

focus for the group, with mandates typically covering the<br />

securities, corporate governance, transactional and capital<br />

markets spheres. The firm received a boost at the<br />

beginning of <strong>2010</strong>, with the addition of renowned corporate<br />

finance specialist David Schwartzbaum from Latham<br />

& Watkins. Highlights include acting for Liberty Acquisition<br />

Holdings on the $6.7 billion purchase of Pearl Group<br />

Limited and Opal Reassurance, and advising Hines Real<br />

Estate Investment Trust on its second offering of common<br />

stock, which raised approximately $1.45 billion.<br />

Sources say: “They have a very good network of<br />

resources.”<br />

KEY INDIVIDUALS David Schwartzbaum represents<br />

a number of major investment bank clients including<br />

JPMorgan, Morgan Stanley, Barclays and Goldman<br />

Sachs. He is “very attentive to detail and personally sees to<br />

it that matters are taken care of,” report sources, adding:<br />

“He is good at dealing with novel situations, where he<br />

excels at identifying the issues and reducing the complexities<br />

into their component parts.” Alan Annex was the lead<br />

partner on the firm’s representation of ComVest Investment<br />

Partners III, L.P. in the senior and subordinated<br />

financing of its $81 million acquisition of Cynergy Data.<br />

He is respected by peers.<br />

ENERGY & NATURAL RESOURCES<br />

Energy: State Regulatory & Wholesale<br />

Electric Market<br />

Leading Firms<br />

Band 2<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Leading Individuals<br />

Band 2<br />

Saia Doreen <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

THE FIRM <strong>Greenberg</strong> <strong>Traurig</strong>’s practice is concentrated<br />

entirely on the representation of merchant generators.<br />

The firm undertakes New York State regulatory work<br />

such as rate cases, wholesale markets work and capacity<br />

issues. The New York team benefits from the ability to<br />

draw upon the regulatory and wider energy expertise in<br />

the firm’s network of offices.<br />

KEY INDIVIDUALS Doreen Saia is the key partner in<br />

<strong>Greenberg</strong> <strong>Traurig</strong>’s Albany office and provides the full<br />

range of regulatory expertise for major clients such as<br />

Mirant, NRG, TransCanada and <strong>US</strong> Power Generation.<br />

23