Greenberg Traurig, LLP_4PP_Tax

Greenberg Traurig, LLP_4PP_Tax

Greenberg Traurig, LLP_4PP_Tax

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

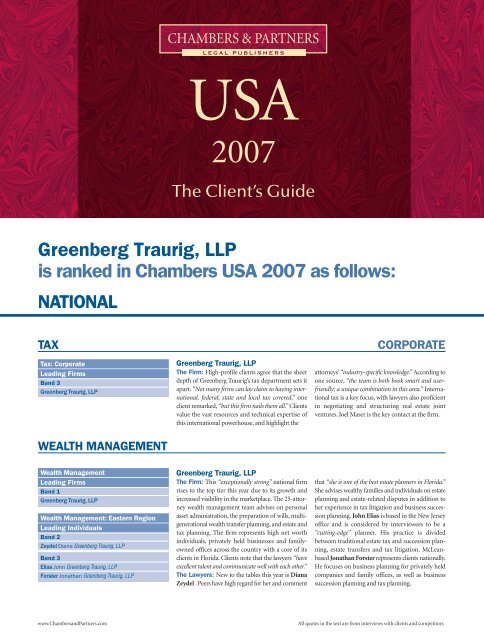

CHAMBERS & PARTNERS<br />

LEGAL PUBLISHERS<br />

USA<br />

2007<br />

The Client’s Guide<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

is ranked in Chambers USA 2007 as follows:<br />

NATIONAL<br />

TAX<br />

<strong>Tax</strong>: Corporate<br />

Leading Firms<br />

Band 3<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

The Firm: High-profile clients agree that the sheer<br />

depth of <strong>Greenberg</strong> <strong>Traurig</strong>’s tax department sets it<br />

apart. “Not many firms can lay claim to having international,<br />

federal, state and local tax covered,” one<br />

client remarked, “but this firm nails them all.” Clients<br />

value the vast resources and technical expertise of<br />

this international powerhouse, and highlight the<br />

CORPORATE<br />

attorneys’ “industry-specific knowledge.” According to<br />

one source, “the team is both book smart and userfriendly;<br />

a unique combination in this area.” International<br />

tax is a key focus, with lawyers also proficient<br />

in negotiating and structuring real estate joint<br />

ventures. Joel Maser is the key contact at the firm.<br />

WEALTH MANAGEMENT<br />

Wealth Management<br />

Leading Firms<br />

Band 1<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Wealth Management: Eastern Region<br />

Leading Individuals<br />

Band 2<br />

Zeydel Diana <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Band 3<br />

Elias John <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Forster Jonathan <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

The Firm: This “exceptionally strong” national firm<br />

rises to the top tier this year due to its growth and<br />

increased visibility in the marketplace. The 25-attorney<br />

wealth management team advises on personal<br />

asset administration, the preparation of wills, multigenerational<br />

wealth transfer planning, and estate and<br />

tax planning. The firm represents high net worth<br />

individuals, privately held businesses and familyowned<br />

offices across the country with a core of its<br />

clients in Florida. Clients note that the lawyers “have<br />

excellent talent and communicate well with each other.”<br />

The Lawyers: New to the tables this year is Diana<br />

Zeydel . Peers have high regard for her and comment<br />

that “she is one of the best estate planners in Florida.”<br />

She advises wealthy families and individuals on estate<br />

planning and estate-related disputes in addition to<br />

her experience in tax litigation and business succession<br />

planning. John Elias is based in the New Jersey<br />

office and is considered by interviewees to be a<br />

“cutting-edge” planner. His practice is divided<br />

between traditional estate tax and succession planning,<br />

estate transfers and tax litigation. McLeanbased<br />

Jonathan Forster represents clients nationally.<br />

He focuses on business planning for privately held<br />

companies and family offices, as well as business<br />

succession planning and tax planning.<br />

www.ChambersandPartners.com<br />

All quotes in the text are from interviews with clients and competitors

GREENBERG TRAURIG, <strong>LLP</strong><br />

www.ChambersandPartners.com<br />

REITS<br />

REITs<br />

Leading Firms<br />

Band 3<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Leading Individuals<br />

Band 3<br />

Fryer Judith <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Band 4<br />

Burton Richard <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

FLORIDA<br />

TAX<br />

<strong>Tax</strong><br />

Leading Firms<br />

Band 1<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> Miami<br />

Leading Individuals<br />

Band 1<br />

Maser Joel <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Band 4<br />

Hintze Russell <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Schindler Ozzie <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Stiver Charles <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

Up-and-coming individuals<br />

Entin Seth <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

<strong>Tax</strong>: Employee Benefits<br />

Leading Individuals<br />

Band 1<br />

Lapidus Steve <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

<strong>Tax</strong>: Estate Planning<br />

Leading Individuals<br />

Band 3<br />

Zeydel Diana <strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

The Firm: Onlookers agree: “This firm’s REIT<br />

department has grown by leaps and bounds over the<br />

last few years and has expanded in a number of areas.”<br />

Clients endorse the resources, international reach<br />

and depth of corporate and real estate talent on offer<br />

at this firm and point to its ability to handle formation,<br />

investment and operational issues. The firm has<br />

experience advising public and private REITs,<br />

including advice on IPOs and M&A, although its<br />

niche in representing publicly traded nonlisted<br />

REITs is what sets it apart. A firm of this size also<br />

offers REIT clients the benefits of its experience in<br />

related areas such as securities and insurance, with<br />

clients wholeheartedly endorsing its full-service<br />

capabilities. Headline deals this year include acting<br />

for CNL Retirement Properties in its sale for $5.2<br />

billion, and advising CNL Hotels & Resorts in its $2<br />

billion acquisition of KSL Recreation, one of the<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong><br />

The Firm: The tax group of this colossal law firm is<br />

“continuously at the forefront of taxation developments<br />

in Florida,” and has well-documented international,<br />

federal, state and local credentials. Over<br />

100 attorneys are on offer throughout its numerous<br />

offices in Florida, but it is not just the size and<br />

resources of the group that clients admire. Many<br />

place a huge value on the attorneys’ “creative, userfriendly<br />

and responsive advice” and “the business<br />

acumen that seems to run through the firm.” International<br />

taxation is one of the group’s recognized areas<br />

of excellence, with its advice on the acquisition of<br />

foreign entities and the structuring of foreign enterprises<br />

and international joint ventures coming in for<br />

specific client praise. Other highly recommended<br />

areas include executive compensation, employee<br />

benefits and estate planning. The cross-fertilization<br />

of practice groups and general “pulling together of<br />

resources” are additional reasons why clients enjoy<br />

the success they do with this firm.<br />

The Lawyers: Steve Lapidus is the chair of the Miami<br />

tax and executive compensation and employee benefits<br />

groups. He is “a reserved and highly effective tax<br />

attorney, especially with respect to executive compensation<br />

strategies and Section 409A compliance.” Joel Maser<br />

is a totemic figure in the tax group and a “highly<br />

respected and personable” transactional tax lawyer. His<br />

practice encompasses federal, state and local taxation<br />

and domestic and foreign tax planning, and he is<br />

largest resort owner-operators in the country. As well<br />

as the deal values, both of these transactions involved<br />

novel concepts and complex issues and illustrate<br />

what clients have called “a unique understanding of<br />

the industry and the ability to handle document-intensive<br />

projects.”<br />

The Lawyers: Judith Fryer is cochair of the REIT<br />

practice with Jennifer Weiss. “Extremely active and<br />

visible in the industry,” she is commended for her<br />

involvement in some significant REIT mergers and<br />

her knowledge of the “inner workings” of publicly<br />

traded nonlisted REITs. As ex-general tax counsel at<br />

Host Marriott, Richard Burton brings to the table<br />

“a valuable insight into the objectives of his clients.”<br />

Clients/Work Highlights: CNL Retirement Properties;<br />

CNL Hotels & Resorts; SL Green Realty;<br />

Kimco Realty; Archstone-Smith and Vornado Realty<br />

Trust.<br />

recognized for his work negotiating and structuring<br />

real estate joint ventures and for his niche experience<br />

representing automotive dealerships. An example of<br />

the younger talent in the group, respected transactional<br />

tax lawyer Russell Hintze is fully conversant in general<br />

business tax planning, including corporate tax and tax<br />

planning for mergers, acquisitions and joint ventures.<br />

Ozzie Schindler is a key contact for international tax<br />

in the Miami office and is considered by clients to be a<br />

corporate and private tax planning expert, especially<br />

noted for his experience in terms of M&A and the<br />

structuring of US investments. Charles Stiver is a longstanding<br />

member of this tax group and a regular<br />

feature on heavy-duty M&A transactions and general<br />

corporate income tax. Both foreign and domestic<br />

clients view Seth Entin as a talented younger attorney<br />

in the tax group and point to his proficiency in federal<br />

income tax and international experience as his practice<br />

strengths. As well as private practice, he is also an<br />

adjunct professor of tax at the University of Miami and<br />

“one of those attorneys who will be the future of tax in the<br />

south of Florida.” Diana Zeydel is a younger attorney<br />

with a national estate planning profile and is thoroughly<br />

endorsed by high net worth clients for the<br />

“individual attention she gives to each situation.”<br />

Clients/Work Highlights: Related Group of<br />

Florida; Swire Properties; INVESCO and CNL<br />

Retirement Properties.<br />

www.ChambersandPartners.com<br />

All quotes in the text are from interviews with clients and competitors

www.ChambersandPartners.com<br />

GREENBERG TRAURIG, <strong>LLP</strong><br />

Leaders<br />

BURTON, Richard A<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong>, McLean<br />

703 749 1324<br />

burtonr@gtlaw.com<br />

Recommended in REITs<br />

Practice Areas: Real estate investment<br />

trusts (REITs), tax.<br />

Prof. Memberships: Former Co-Chair,<br />

NAREIT Government Relations and <strong>Tax</strong><br />

Committee; Member, Real Estate Roundtable<br />

<strong>Tax</strong> Policy Committee.<br />

Publications: Author, The Constitutionality<br />

of an Apportioned Value Added <strong>Tax</strong>,<br />

<strong>Tax</strong> Notes, <strong>Tax</strong> Analyst, Vol. 49, No. 1,<br />

October 1990; Author, Retroactivity and<br />

Internal Inconsistency - How Far<br />

Extended, <strong>Tax</strong> Notes, <strong>Tax</strong> Analyst, Vol. 49,<br />

No. 8, P. 901, November 1990.<br />

Personal: LLM, Boston University School<br />

of Law; JD, University of Utah College of<br />

Law; BA, University of Utah.<br />

ELIAS, John M<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong>, Florham Park<br />

973 360 2354<br />

eliasj@gtlaw.com<br />

Recommended in Wealth Management<br />

Practice Areas: Wealth management,<br />

trusts and estates; tax.<br />

Prof. Memberships: Madison, New Jersey<br />

Borough Council, 2004-present; Madison,<br />

New Jersey Area YMCA Board of Directors,<br />

1997-2003; Museum of Early Trades<br />

and Crafts, Madison, New Jersey, Board of<br />

Directors, 1994-present; Clergy Partnership<br />

on Domestic Violence, Madison, NJ, Board<br />

of Directors, 1996-2002; Chair, 2000-02.<br />

Career: Listed, New Jersey Super Lawyer,<br />

2005 and 2006.<br />

Publications: Author,‘Protecting Assets of<br />

Elder Clients with Living Trusts’, New<br />

Jersey Business, 11/04.<br />

Personal: LLM, <strong>Tax</strong>ation, New York<br />

University School of Law, 1989; JD, The<br />

Catholic University of America Columbus<br />

School of Law, 1980; AB, cum laude,<br />

Boston College, 1977.<br />

ENTIN, Seth J<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> , Miami<br />

305 579 0500<br />

entins@gtlaw.com<br />

Recommended in <strong>Tax</strong><br />

Practice Areas: <strong>Tax</strong>.<br />

Prof. Memberships: Adjunct Professor of<br />

<strong>Tax</strong>ation, University of Miami School of<br />

Law, 2005-07; Chair, Outbound <strong>Tax</strong><br />

Committee, Florida Bar <strong>Tax</strong> Section,<br />

2005-07; Board of Directors, Commerce<br />

& Professions Division, Greater Miami<br />

Jewish Federation; Member, Professional<br />

Advisory Committee, Foundation of<br />

Jewish Philanthropies.<br />

Career: Listed,‘The Best Lawyers in<br />

America, 2007’.<br />

Publications: Author,‘IRS to Expand <strong>Tax</strong><br />

Exemption for Interest Income Earned by<br />

Foreign Investors,’Derivatives,August 2006.<br />

Personal: JD, summa cum laude, University<br />

of Miami School of Law; MPA, Barry<br />

University; MBA, Barry University; BTL,<br />

Talmudic University; Passed CPA Exam.<br />

FORSTER, Jonathan M<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong>, McLean<br />

703 903 7504<br />

forsterj@gtlaw.com<br />

Recommended in Wealth Management<br />

Practice Areas: Wealth management, tax,<br />

corporate and securities.<br />

Prof. Memberships: Special Task Force<br />

ABA, Committee for Developing Ethics<br />

Rules; Chairman, National Capital Business<br />

Ethics Award; Board Member, Northern<br />

Virginia Life Underwriters<br />

Associations; Board Member, Suburban<br />

Maryland Life Underwriters<br />

Association;Board Member, District of<br />

Columbia Life Underwriters Association.<br />

Career: Featured, Worth Magazine’s ‘The<br />

Top 100 Attorneys’, December 2006;<br />

Winner, Washington Business Journal’s<br />

Top Washington Lawyers in the field of<br />

tax, trusts & estates, September 2006;<br />

Recipient, Montgomery County, Maryland<br />

Leadership Award for Establishing<br />

Public/Private Business Partnerships.<br />

Personal: JD, George Mason University<br />

School of Law, 1989; BS, Finance, University<br />

of Maryland, 1986.<br />

FRYER, Judith D<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong>, New York<br />

212 801 9330<br />

fryerj@gtlaw.com<br />

Recommended in REITs<br />

Practice Areas: REITs, corporate and<br />

securities.<br />

Prof. Memberships: Chair, 1,700 member<br />

Women Rainmakers Group of the American<br />

Bar Association, (1996-99); Co-Chair,<br />

Women’s Executive Circle; Board Member,<br />

Women’s Forum Board Member, UJA<br />

Federation of New York; former Chair,<br />

Subcommittee on Partnership and REIT<br />

Products of the State Regulation of Securities<br />

Committee of the ABA.<br />

Career: Listed, Who’s Who in America;<br />

Fellow, American Bar Foundation (1/3 of<br />

1% of lawyers in each state), named ‘New<br />

York Super Lawyer’, 2006; featured,<br />

Alumni Profile of the Month, Hofstra<br />

University School of Law, April 2006.<br />

Personal: JD, Hofstra University School<br />

of Law, 1975; Recent Developments<br />

Editor, Law Review; BS, Washington<br />

University in St. Louis, 1972.<br />

HINTZE, Russell P<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> , Orlando<br />

407 420 1000<br />

hintzer@gtlaw.com<br />

Recommended in <strong>Tax</strong><br />

Practice Areas: <strong>Tax</strong>; corporate and securities;<br />

real estate.<br />

Prof. Memberships: Member, Orange<br />

County Bar Association; Former Treasurer<br />

and Board Member, Lake Brantley<br />

Youth Football Association, Inc.<br />

Career: Listed,‘Super Lawyer,’ Florida<br />

Super Lawyers magazine, 2006; Listed,<br />

‘Chambers & Partners USA Guide’, 2006;<br />

Listed, 2004 ‘Legal Elite’, Florida Trend<br />

Magazine; Board Certified <strong>Tax</strong> Lawyer,<br />

Florida Bar Board of Legal Specialization<br />

and Education.<br />

Publications: Frequent lecturer to CPA’s<br />

and attorneys on federal income tax issues.<br />

Personal: LLM, University of Florida<br />

Levin College of Law, 1988; JD, cum<br />

laude, Stetson University College of Law,<br />

1987; BS, with honors, Chemistry,<br />

University of Florida, 1984.<br />

LAPIDUS, Steve<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> , Miami<br />

305 579 0509<br />

lapiduss@gtlaw.com<br />

Recommended in <strong>Tax</strong><br />

Practice Areas: <strong>Tax</strong>, trusts and estates;<br />

executive compensation and employee<br />

benefits ERISA.<br />

Career: Listed,‘Top Lawyer,’ South<br />

Florida Legal Guide, 2005; Listed, The<br />

Best Lawyers in America; Listed, Chambers<br />

& Partners USA Guide, 2004-07.<br />

Personal: LLM, New York University<br />

School of Law, 1977; JD, cum laude, New<br />

York University School of Law, 1973; BS,<br />

Wharton School of the University of<br />

Pennsylvania, 1969.<br />

MASER, Joel<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> , Orlando<br />

407 418 2389<br />

maserj@gtlaw.com<br />

Recommended in <strong>Tax</strong><br />

Practice Areas: <strong>Tax</strong>; automotive dealerships;<br />

Mergers & Acquisitions.<br />

Prof. Memberships: Active Member,<br />

Executive Council, The Florida Bar <strong>Tax</strong><br />

Section and has served as Chairperson of<br />

several committees within the <strong>Tax</strong><br />

Section; Member, <strong>Tax</strong> Section’s Long<br />

Range Planning Committee and is serving<br />

as the <strong>Tax</strong> Section’s workshop director.<br />

Career: Recognized as one of the ‘Legal<br />

Elite’ in Florida by Florida Trend magazine,<br />

2006; Listed, Best Lawyers in America,<br />

2005-07; Listed, Chambers & Partners<br />

USA Guide, 2003-07.<br />

Personal: JD, magna cum laude, University<br />

of Miami School of Law, 1984; BS,<br />

with honors, University of Florida, 1981.<br />

SCHINDLER, Ozzie<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> , Miami<br />

305 579 0762<br />

schindlero@gtlaw.com<br />

Recommended in <strong>Tax</strong><br />

Practice Areas: International tax.<br />

Prof. Memberships: Assistant Director,<br />

Florida Bar <strong>Tax</strong> Section, International;<br />

Chair of International Fiscal Association,<br />

<strong>Tax</strong>ation of Multinationals Group, Palm<br />

Beach Chapter; Co-Chair, Florida Bar /<br />

FICPA International <strong>Tax</strong> Conference.<br />

Career: Listed,‘Super Lawyer,’ Florida<br />

Super Lawyers Magazine; Listed, Best<br />

Lawyers in America, 2006-07; Listed,<br />

Chambers & Partners USA Guide, 2004-<br />

07; Recipient, American Jurisprudence<br />

Awards for International Business Transactions<br />

and Family Law.<br />

Publications: Co-author,‘US Corporations<br />

Doing Business Abroad’, editions 2003-05;<br />

Co-author, BNA Portfolio: Passive Foreign<br />

Investment Companies, 2005.<br />

Personal: LLM, New York University<br />

School of Law; JD, University of Florida;<br />

BS, University of Florida.<br />

STIVER, Charles<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> , Miami<br />

305 579 0760<br />

stiverc@gtlaw.com<br />

Recommended in <strong>Tax</strong><br />

Practice Areas: <strong>Tax</strong>; structured finance<br />

and derivatives; real estate investment<br />

trusts.<br />

Career: Ranked No. 3 tax lawyer in the<br />

US in ‘The Nation’s Top Lawyers,’ United<br />

States Lawyer Rankings, 2006; Listed,<br />

‘Super Lawyer,’ Florida Super Lawyers<br />

Magazine, 2006; Listed, Best Lawyers in<br />

America, 2005-07; Listed, Chambers &<br />

Partners USA Guide, 2005-07.<br />

Personal: LLM, New York University<br />

School of Law, 1975; JD, Stanford Law<br />

School, 1974; BA, Stanford University,<br />

1971.<br />

ZEYDEL, Diana S C<br />

<strong>Greenberg</strong> <strong>Traurig</strong>, <strong>LLP</strong> , Miami<br />

305 579 0500<br />

zeydeld@gtlaw.com<br />

Recommended in <strong>Tax</strong>, Wealth<br />

Management<br />

Practice Areas: <strong>Tax</strong>; Trusts & Estates;<br />

Wealth Management.<br />

Prof. Memberships: Member, American<br />

College of Trusts and Estates Counsel;<br />

Member, American Bar Association;<br />

Member, The Florida Bar’s Executive<br />

Counsel; Member, Miami City Ballet’s<br />

Community Development Board.<br />

Career: Listed,‘Super Lawyer,’ Florida<br />

Super Lawyers Magazine, 2006.<br />

Publications: Author,‘Deemed Allocations<br />

of GST Exemption to Lifetime<br />

Transfers,’ 34 Estate Planning 3, (March<br />

2007); Panelist,‘Advanced Estate Planning<br />

Update,’ ALI-ABA, (Winter 2007).<br />

Personal: LLM, New York University<br />

School of Law, 1993; JD, Yale Law School,<br />

1986; BA, summa cum laude, Yale<br />

University, 1982.<br />

www.ChambersandPartners.com<br />

All quotes in the text are from interviews with clients and competitors