Fall 2005 - Halliburton

Fall 2005 - Halliburton

Fall 2005 - Halliburton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Newsstand<br />

Retiree Corner<br />

What the Portfolios Mean to You<br />

Participants in the Fixed Income Fund, General<br />

Investment Fund or the Equity Investment Fund, will<br />

only see a change to the fund names (see What’s in a<br />

Name?). They will maintain their same investment<br />

managers, strategies and objectives<br />

under the new names. The other<br />

funds maintain their original names,<br />

but will now be branded as Single<br />

Focus Funds. You don’t need to do<br />

anything if you are still satisfied with<br />

your investment decisions.<br />

However, you do have a new<br />

portfolio option to consider. The<br />

Conservative Premixed Portfolio is<br />

designed for individuals<br />

approaching or in retirement. The<br />

portfolio offers the opportunity for growth still needed<br />

during the early years of retirement, while providing<br />

balance against market volatility with investments in<br />

stable value classes.<br />

For those individuals who don’t want to spend the<br />

time selecting individual funds or who want to select<br />

a targeted risk level for investing, the Premixed<br />

Portfolios may be a good choice. The portfolios are<br />

highly diversified, self-balancing investment<br />

vehicles. Investors in the portfolios are encouraged<br />

to select the one that best fits<br />

their investment goals and risk<br />

level. Investing in more than one<br />

portfolio or investing in one of the<br />

portfolios as well as Single Focus<br />

Funds may produce exposure to<br />

risk and returns that are<br />

unexpected. Many financial<br />

advisors suggest using the<br />

premixed portfolios as a sole<br />

investment vehicle.<br />

Whether you have invested in<br />

one of the Premixed Portfolios or in the Single Focus<br />

Funds, you should periodically review your<br />

investments to make sure that they continue to fit<br />

your circumstances and your needs.<br />

Fast Facts<br />

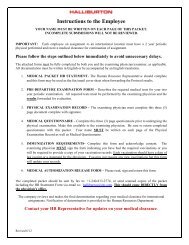

2006 IRS Contribution Limits<br />

The IRS sets maximum amounts for<br />

contributions to your retirement and<br />

savings accounts. Contributions to<br />

<strong>Halliburton</strong>'s investment funds fall under<br />

the limits set for regular 401(k)<br />

contributions. Participants over 50 years<br />

old, may be able to make an additional<br />

catch-up contribution. If you made a<br />

catch-up election in <strong>2005</strong>, it will carry over<br />

to 2006 unless you make a new election.<br />

Here are the 2006 IRS maximum<br />

contribution amounts for all types of<br />

retirement investments.<br />

Account<br />

Traditional and<br />

Roth IRA<br />

SIMPLE IRA and<br />

SIMPLE 401(k)<br />

Regular 401(k),<br />

403(b) and<br />

SARSEPs<br />

Annual<br />

Contribution<br />

Limit<br />

Annual<br />

Catch-up<br />

Limit<br />

$4,000 $1,000<br />

$10,000 $2,500<br />

$15,000 $5,000<br />

12