Punjab National Bank Dramatically Improves ... - HCL Infosystems

Punjab National Bank Dramatically Improves ... - HCL Infosystems

Punjab National Bank Dramatically Improves ... - HCL Infosystems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Microsoft Windows Server System<br />

Customer Solution Case Study<br />

<strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> <strong>Dramatically</strong> <strong>Improves</strong><br />

Rural <strong>Bank</strong>ing in India<br />

Overview<br />

Country or Region: India<br />

Industry: <strong>Bank</strong>ing<br />

Customer Profile<br />

<strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> (PNB) is one of the<br />

leading public sector banks in India. It has<br />

a large retail-banking network of over<br />

4,400 branches and service counters that<br />

spreads out into far-flung and remote<br />

areas.<br />

Business Situation<br />

PNB was faced with the prospect of<br />

increased competition from new private<br />

and international banks. It also faced the<br />

challenge of linking all of its branch<br />

operations into a cohesive entity to serve<br />

its customers. The bank's operations serve<br />

a widespread population that speaks many<br />

different languages.<br />

Solution<br />

PNB chose BancMate from Natural<br />

Technologies to run its branch banking<br />

operations on Microsoft® Windows<br />

Server 2003 and Microsoft SQL Server<br />

2000.<br />

Benefits<br />

Bilingual software improves customer<br />

relationships.<br />

Easy to implement and troubleshoot.<br />

User friendly, cuts training time.<br />

Scalable from very small to large.<br />

“The Windows Server 2003–based solution was easy<br />

to implement as well as maintain remotely across our<br />

network of far-flung rural branches.”<br />

K. S. Bajwa, General Manager–IT, <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong><br />

<strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> (PNB) is one of the 500 largest banks in the<br />

world, and enjoys a rich history and heritage. PNB was the first<br />

Indian bank to be started solely with Indian capital. Established in<br />

1895 at Lahore, and nationalized in 1969, it has worked<br />

assiduously to build the banking sector in rural and urban India. It<br />

has presence in remote areas of the country, cutting across cultural<br />

and linguistic boundaries. Computerization of the branches for data<br />

accuracy, operational ease, facilitation of customer interaction with<br />

banking products, and centralization of data was of concern for<br />

remote branches. One of the important reasons for choosing<br />

BancMate—a multilingual Total Branch Automation (TBA) package<br />

for rural and semi-urban branches—was that it is based on<br />

Microsoft® Windows Server System, which provides ease of<br />

learning and intuitiveness, as well as the ability to easily implement<br />

and support solutions based on it.

“We chose BancMate as<br />

our rural banking<br />

solution because it is a<br />

robust solution.<br />

Together with the Windows<br />

operating Server 2003 system and SQL<br />

and<br />

database, Server 2000, it has it has<br />

never<br />

given never us given any us trouble. any<br />

In<br />

trouble. addition, In new addition, IT staff new<br />

members IT staff members also find also<br />

it<br />

easy find it to easy adapt to adapt to the to<br />

the solution.” solution.”<br />

K. S. Bajwa, General Manager - IT, <strong>Punjab</strong><br />

<strong>National</strong> <strong>Bank</strong><br />

“We have been able to<br />

deploy the BancMate<br />

solution at over 2,300<br />

branches in India over<br />

the last two years, which<br />

is a unique<br />

achievement.”<br />

K. S. Bajwa, General Manager–IT, <strong>Punjab</strong><br />

<strong>National</strong> <strong>Bank</strong><br />

Situation<br />

The <strong>Punjab</strong> <strong>National</strong> <strong>Bank</strong> (PNB) enjoys a<br />

long and rich history; established in 1895, in<br />

Lahore, in the then undivided India, it was the<br />

first bank to be started solely with Indian<br />

capital. Subsequent to the partition of the<br />

country, PNB was popularly known as an<br />

Indian <strong>Bank</strong>. As part of the nationalization of<br />

banks that happened in 1969, PNB was also<br />

nationalized.<br />

Today, PNB operates 4,070 branches and<br />

443 service counters across the country,<br />

consolidating its position as one of the top<br />

nationalized banks of India. PNB has been<br />

ranked at 395 th position amongst the top<br />

1000 global banks by the prestigious<br />

international publication The <strong>Bank</strong>er.<br />

Like other scheduled banks in India, the PNB<br />

also comes under the guidance of the<br />

Reserve <strong>Bank</strong> of India (RBI) and as a<br />

government establishment, it has to follow<br />

directions of the government. Two directives,<br />

one from the Reserve <strong>Bank</strong> of India and the<br />

other from India's Department of Official<br />

languages are key in this context. In 1985,<br />

the Department of Official Languages<br />

mandated that all electronic equipment used<br />

in ministries and departments of the<br />

government and their attached and<br />

subordinate offices would need to be<br />

bilingual. That is, they should be able to<br />

handle both Hindi and English. By the year<br />

2000, the Reserve <strong>Bank</strong> of India had<br />

mandated that banks should have a clear IT<br />

plan that should be implemented: that at<br />

least 70 percent of all branches should be<br />

computerized.<br />

At this time, PNB was perhaps the least<br />

computerized bank in the country. Not only<br />

that, almost the entire IT team was new.<br />

From that time onwards, PNB has come a<br />

long way, winning laurels for its innovative<br />

approach to IT implementation. It started out<br />

by first purchasing over 4,000 standalone<br />

PCs. As the next step, PNB needed to find a<br />

solution that would automate its business<br />

processes and link the existing PC "islands"<br />

into a more meaningful and manageable<br />

network.<br />

Business Situation<br />

Meanwhile, the banking environment in the<br />

country had undergone a sea change, with<br />

private banks and international operators<br />

entering the fray, and both retail and<br />

corporate banking operations becoming<br />

increasingly competitive and under cost<br />

pressure. Effectiveness of customer<br />

interactions was also coming under pressure<br />

with rising business volumes.<br />

IT Infrastructure at PNB<br />

With technology emerging as a key driver of<br />

business growth, the bank has taken a<br />

number of IT initiatives to provide its large<br />

clientele spread all across the country with<br />

the best of technology while retaining the allessential<br />

human warmth. Its core banking<br />

system (CBS) already acts as a single data<br />

bank, a backbone to 2,108 service outlets<br />

with internet banking services spread over 28<br />

states in the country. This deployment has<br />

lent PNB the status of being the largest core<br />

banking system in Asia.<br />

The bank has 676 ATMs and also coordinates<br />

with the MITR group of six banks with 2,200<br />

ATMs. PNB is a member of Institute<br />

Development and Research in <strong>Bank</strong>ing<br />

Technology (IDRBT)-sponsored <strong>National</strong><br />

Financial Switch (NFS) for mutual ATM<br />

transactions. NFS at present has 18 banks<br />

and a pool of 6,197 ATMs. PNB has also<br />

pioneered the cheque truncation system in<br />

India. Other software fuelling the systems are<br />

instant fund transfer mechanism, data<br />

warehouse for decision control and MIS and<br />

risk management software based on Basel II<br />

guidelines set by the <strong>Bank</strong> for International<br />

Settlements.

PNB has so far marketed BancMate (on<br />

a Corporate License basis, i.e.,<br />

complete banking on BancMate) to:<br />

1. United <strong>Bank</strong> of India<br />

2. Himachal Pradesh State Coop. <strong>Bank</strong><br />

3. Joginedra Central Coop. <strong>Bank</strong><br />

4. Haryana Ks. Grameen <strong>Bank</strong><br />

5. Hissar-Sirsa Ks. Grameen <strong>Bank</strong><br />

6. Himachal Grameen <strong>Bank</strong><br />

7. Shivalik Ks. Grameen <strong>Bank</strong><br />

8. Kapurthala-Ferozpur Ks. Grameen <strong>Bank</strong><br />

9. Gurdaspur Amritsar K G V <strong>Bank</strong><br />

10. Shekhawati Gramin <strong>Bank</strong><br />

11. Alwar Bharatpur Anch. Grameen <strong>Bank</strong><br />

12. Bhojpur Rohtas Grameen <strong>Bank</strong><br />

13. Magadh Gramin <strong>Bank</strong><br />

14. Nalanda Gramin <strong>Bank</strong><br />

15. Patliputra Grameen <strong>Bank</strong><br />

16. Kisan Gramin <strong>Bank</strong><br />

17. Devi Patan Ks. Grameen <strong>Bank</strong><br />

18. Rani Laks.Mi Bai Ks. Grameen <strong>Bank</strong><br />

19. Vidur Gramin <strong>Bank</strong><br />

20. Muzaffarnagar Ks. Grameen <strong>Bank</strong><br />

21. Hindon Gramin <strong>Bank</strong><br />

22. Ambala Kurushetra Gramin <strong>Bank</strong><br />

About 77 percent of its business is connected<br />

through leased lines, ISDN and VPN. Other<br />

services such as mobile banking, utility bill<br />

payments, funds transfer, e-commerce and<br />

CRM through mobile shall be introduced for<br />

the PNB branches including setting up a<br />

network operating centre (NOC) to monitor<br />

the CBS network.<br />

Since all the major branches are fully<br />

computerized and networked, PNB offers<br />

value-added services like 'anywhere anytime<br />

banking' through ATMs, and Corporate and<br />

Retail Internet <strong>Bank</strong>ing Services. New online<br />

services have also been developed—bill<br />

payment, railway ticketing, and payment of<br />

fees. For these initiatives PNB bagged the<br />

Nasscom Best IT user award in 2004 in the<br />

BFSI sector. Other acknowledgements: ITIL's<br />

certification for best practices in data<br />

centres; BIS certification for 116 offices; ISO<br />

2000 certification for services.<br />

Solution<br />

It was in this context that the IT team set<br />

about evaluating various solutions for retail<br />

automation and settled on BancMate, the<br />

multilingual solution from Natural<br />

Technologies Private Limited for retail and<br />

rural banking operations.<br />

BancMate is unique in the fact that it is a<br />

multilingual retail-banking package. A user<br />

can simultaneously use two languages within<br />

the system. Microsoft® Windows Server<br />

2003 operating system (part of Windows<br />

Server System integrated server software)<br />

was chosen as the implementation platform<br />

because of wide familiarity with the platform,<br />

as well as ease of operation and support,<br />

given the far-flung and remote branch<br />

network that the bank operates.<br />

The roll-out began in 2001 (on Windows®<br />

2000 Server operating system), and today,<br />

more than 2,300 branches are using<br />

BancMate for total branch automation and a<br />

total of around 2,400 locations will be<br />

automated by 2006. “We have been able to<br />

deploy the BancMate solution at over 2,300<br />

branches in India over the last two years,<br />

which is a unique achievement,” comments<br />

K. S. Bajwa, General Manager–IT, <strong>Punjab</strong><br />

<strong>National</strong> <strong>Bank</strong>.<br />

BancMate runs on Microsoft Windows 2000<br />

Server and Windows Server 2003, with<br />

Microsoft SQL Server 2000 as the<br />

database. The client runs on Windows 95 and<br />

later. In smaller branches, a peer-to-peer<br />

network on two machines running Windows<br />

98 provides the infrastructure for running<br />

BancMate.<br />

It took nine months to customize the 24<br />

modules of BancMate to meet PNB’s needs.<br />

The Windows Server System–based solution<br />

provides an easy-to-understand interface,<br />

reducing not only installation and support<br />

costs, but also training costs.<br />

PNB’s Confidence<br />

Viewing the robustness of the package on the<br />

Windows platform in all aspects, PNB decided<br />

to enter into a marketing agreement with<br />

Natural Technologies to sell out the product<br />

to other banks at a reasonable price.<br />

PNB and Natural Technologies have<br />

marketed BancMate so far to seven public<br />

sector banks, 30 regional rural banks, one<br />

private sector bank, one state cooperative<br />

bank, and two cooperative banks across 28<br />

states of the country.<br />

Awards for PNB and BancMate<br />

PNB itself has gone on to win many awards<br />

for its innovative approach to IT<br />

implementation. These awards include the<br />

‘Best <strong>Bank</strong> Award for Excellence in <strong>Bank</strong>ing<br />

Technology’ by the Institute for Development<br />

and Research in <strong>Bank</strong>ing Technologies,

“We liked BancMate so<br />

much that we entered<br />

into an agreement with<br />

Natural Technologies to<br />

market it to other banks<br />

in India.”<br />

K. S. Bajwa, General Manager- IT, <strong>Punjab</strong><br />

<strong>National</strong> <strong>Bank</strong><br />

Hyderabad, and the “Wharton Infosys<br />

Business Transformation Award–Enterprise<br />

Transformation Award’ for technology. PNB<br />

also received the ‘Innovator of the Year,’<br />

award from PC Quest, a leading Indian IT<br />

magazine, for bringing in the regional<br />

language support for rural banking that is<br />

provided in BancMate.<br />

Benefits<br />

Commenting on the benefits of BancMate<br />

and Windows Server System, Bajwa says “We<br />

chose BancMate as our rural banking<br />

solution because it is a robust solution.<br />

Together with Windows Server 2003 and SQL<br />

Server 2000, it has never given us any<br />

trouble. In addition, new IT staff members<br />

also find it easy to adapt to the solution.”<br />

Easy to Implement<br />

The implementation process is simple, fast<br />

and user friendly. In the last two years, PNB<br />

has been able to implement almost 2,300<br />

branches to BancMate and plans to complete<br />

implementation to an approximate total of<br />

2,400 locations by 2006. Adds Bajwa, “The<br />

Windows Server 2003–based solution was<br />

easy to implement as well as maintain<br />

remotely across our network of far-flung rural<br />

branches.”<br />

User Friendly Software Cuts Training<br />

Time<br />

The entire retail banking process is covered<br />

in just two screens in BancMate. This makes<br />

it very easy for bank employees to adopt the<br />

new technology. The advantage of the easyto-use<br />

features can be seen from the fact<br />

that PNB branches at rural locations have<br />

been running this solution successfully and<br />

have not faced any resistance in adoption.<br />

system and database has never given us any<br />

trouble. In addition untrained manpower also<br />

finds it easy to adapt to the solution,”<br />

explains Bajwa.<br />

Easy to Troubleshoot<br />

Further, the ease at which networking and<br />

configuration could be done—and<br />

troubleshooting—on the Windows platform<br />

meant that PNB was able to get the<br />

infrastructure up and running very fast, even<br />

in the remotest of branches.<br />

Bilingual Application Software <strong>Improves</strong><br />

Customer Relationship<br />

BancMate enables the bank to meet the<br />

directives of the Official Language Act of the<br />

country. BancMate gives the bank the ability<br />

to maintain the database in Hindi and<br />

English, as required.<br />

The multilingual solution has helped the bank<br />

maintain a better relationship with its retail<br />

and rural customers. By providing bank<br />

statements in the local language, PNB is able<br />

to bridge the divide in rural locations as well<br />

as with semi-literate customers. PNB has<br />

been able to effectively improve collections<br />

as well as to reduce bad debts and non<br />

performing assets in this market segment<br />

effectively. This is primarily due to local<br />

language support in Windows and BancMate.<br />

Scalable from Very Small to Medium<br />

Operations<br />

The scalability of the solution—from a twocomputer<br />

network to a larger one—meant<br />

that the bank could save on implementation<br />

costs by right-sizing the infrastructure to the<br />

needs of the particular branch.<br />

“The simplicity of the Windows interface has<br />

helped reduce training costs by bringing<br />

training time down to ten days. We chose<br />

BancMate as our rural banking solution<br />

because it is a robust solution. The operating<br />

Future Plans<br />

PNB has decided to have only two banking<br />

software solutions in the bank, in other<br />

words, either a core banking solution or

“The simplicity of the<br />

Windows interface has<br />

helped reduce training<br />

costs by bringing<br />

training time down to<br />

ten days..."<br />

K. S. Bajwa, General Manager- IT, <strong>Punjab</strong><br />

<strong>National</strong> <strong>Bank</strong><br />

BancMate. All the branches running on<br />

different legacy software will be migrated to<br />

either of the two solutions by June 2006.<br />

PNB has chosen Natural Technologies to<br />

develop additional modules on BancMate to<br />

enhance its features and meet the growing<br />

needs of PNB. These modules are being<br />

integrated through a distributed architecture<br />

with BancMate and a centralized architecture<br />

comprised of the bank’s core banking<br />

solution. These modules are:<br />

Proposal tracking solution to manage<br />

business proposals.<br />

Collection of excise and sales tax as per<br />

government of India regulations.<br />

Pension solution for government and<br />

personnel pensions.<br />

Retail lending module for consumer loans,<br />

vehicle loans, and so forth.<br />

Structured financial messaging system for<br />

online remittance transactions between<br />

PNB branches.<br />

Real Time Gross Settlement system for<br />

inter-bank remittance operations.<br />

PNB and Natural Technologies are now<br />

working towards consolidating the entire<br />

distributed BancMate data at the head office<br />

for the purpose of generating an enterprisewide<br />

reporting system.<br />

PNB and Natural Technologies are also<br />

developing a new bilingual BancMate<br />

centralized core banking solution based on<br />

Windows Server 2003 and SQL Server 2005.

For More Information<br />

For more information about Microsoft<br />

products and services, call the Microsoft<br />

Sales Information Center at 1600 111100.<br />

To access information using the World<br />

Wide Web, go to:<br />

www.microsoft.com/india/<br />

For more information about Natural<br />

Technologies (P) Ltd. products and<br />

services, call +91-141-2549089 or visit<br />

www.BancMate.com/<br />

For more information on <strong>Punjab</strong> <strong>National</strong><br />

<strong>Bank</strong> and its products and services, visit<br />

www.pnbindia.com<br />

About Natural Technologies Private<br />

Limited (NTPL)<br />

Natural Technologies Private Limited has<br />

created bilingual and multilingual solutions<br />

primarily for the banking industry. Natural<br />

Technologies is in the business of application<br />

development, consulting, distribution of<br />

software products, systems integration, and<br />

data processing.<br />

Microsoft Windows Server System<br />

Microsoft Windows Server System integrated<br />

server infrastructure software is designed to<br />

support end-to-end solutions built on<br />

Microsoft Windows Server 2003. It creates an<br />

infrastructure based on integrated<br />

innovation, Microsoft’s holistic approach to<br />

building products and solutions that are<br />

intrinsically designed to work together and<br />

interact seamlessly with other data and<br />

applications across your IT environment. This<br />

allows you to reduce the costs of ongoing<br />

operations; deliver a more secure and<br />

reliable IT infrastructure; and drive valuable<br />

new capabilities for the future growth of your<br />

business.<br />

For more information about Windows Server<br />

System, please go to:<br />

www.microsoft.com/windowsserversystem<br />

© 2006 Microsoft Corporation. All rights reserved.<br />

This case study is for informational purposes only. MICROSOFT<br />

MAKES NO WARRANTIES, EXPRESS OR IMPLIED, IN THIS SUMMARY.<br />

Microsoft, Windows, the Windows logo, Windows Server, and<br />

Windows Server System are either registered trademarks or<br />

trademarks of Microsoft Corporation in the United States and/or<br />

other countries. All other trademarks are property of their respective<br />

owners.<br />

Published in April 2006<br />

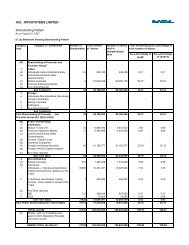

Software and Services<br />

Products<br />

− Microsoft SQL Server 2000<br />

− Microsoft Windows 2000 Server<br />

Standard Edition<br />

− Microsoft Windows Server 2003<br />

Standard Edition<br />

Partner<br />

Natural Technologies Private Limited