Real Options

Real Options

Real Options

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

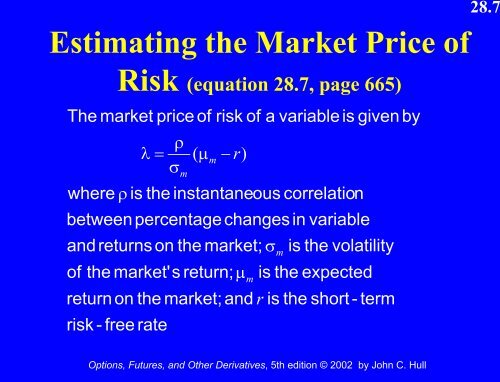

28.7<br />

Estimating the Market Price of<br />

of<br />

Risk (equation 28.7, page 665)<br />

The market price of risk of a variable is given by<br />

ρ<br />

λ = ( µ<br />

m<br />

− r)<br />

σ<br />

where ρ is the instantaneous correlation<br />

between percentage changes in variable<br />

and returns on the market; σ<br />

the market's return; µ<br />

m<br />

is the volatility<br />

is the expected<br />

return on the market; and r is the short - term<br />

risk - free rate<br />

m<br />

m<br />

<strong>Options</strong>, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull