Hong Kong Institute of Accredited Accounting Technicians Limited ...

Hong Kong Institute of Accredited Accounting Technicians Limited ...

Hong Kong Institute of Accredited Accounting Technicians Limited ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes <br />

For the year ended 30 June 2006<br />

<br />

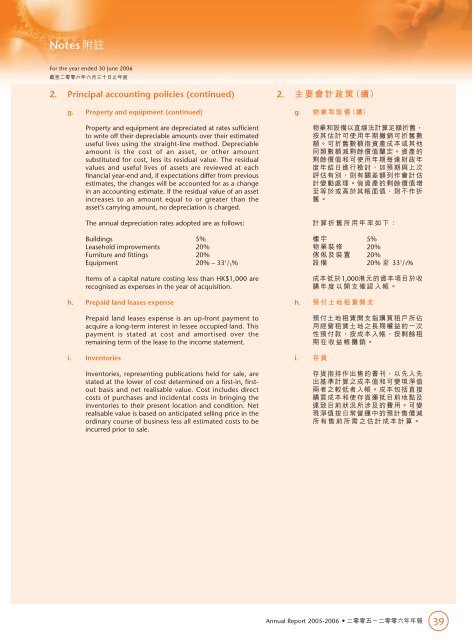

2. Principal accounting policies (continued)<br />

g. Property and equipment (continued)<br />

Property and equipment are depreciated at rates sufficient<br />

to write <strong>of</strong>f their depreciable amounts over their estimated<br />

useful lives using the straight-line method. Depreciable<br />

amount is the cost <strong>of</strong> an asset, or other amount<br />

substituted for cost, less its residual value. The residual<br />

values and useful lives <strong>of</strong> assets are reviewed at each<br />

financial year-end and, if expectations differ from previous<br />

estimates, the changes will be accounted for as a change<br />

in an accounting estimate. If the residual value <strong>of</strong> an asset<br />

increases to an amount equal to or greater than the<br />

asset’s carrying amount, no depreciation is charged.<br />

The annual depreciation rates adopted are as follows:<br />

Buildings 5%<br />

Leasehold improvements 20%<br />

Furniture and fittings 20%<br />

Equipment 20% – 33 1 / 3 %<br />

Items <strong>of</strong> a capital nature costing less than HK$1,000 are<br />

recognised as expenses in the year <strong>of</strong> acquisition.<br />

h. Prepaid land leases expense<br />

Prepaid land leases expense is an up-front payment to<br />

acquire a long-term interest in lessee occupied land. This<br />

payment is stated at cost and amortised over the<br />

remaining term <strong>of</strong> the lease to the income statement.<br />

i. Inventories<br />

Inventories, representing publications held for sale, are<br />

stated at the lower <strong>of</strong> cost determined on a first-in, firstout<br />

basis and net realisable value. Cost includes direct<br />

costs <strong>of</strong> purchases and incidental costs in bringing the<br />

inventories to their present location and condition. Net<br />

realisable value is based on anticipated selling price in the<br />

ordinary course <strong>of</strong> business less all estimated costs to be<br />

incurred prior to sale.<br />

2. <br />

g. <br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

5%<br />

20%<br />

20%<br />

20% 33 1 /3%<br />

1,000<br />

<br />

h. <br />

i. <br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Annual Report 2005-2006 <br />

39