CROSSWALK GUIDE - HUD

CROSSWALK GUIDE - HUD

CROSSWALK GUIDE - HUD

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

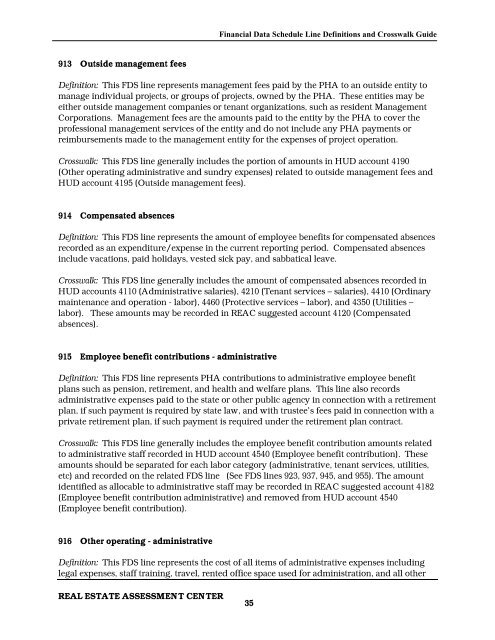

Financial Data Schedule Line Definitions and Crosswalk Guide<br />

913 Outside management fees<br />

Definition: This FDS line represents management fees paid by the PHA to an outside entity to<br />

manage individual projects, or groups of projects, owned by the PHA. These entities may be<br />

either outside management companies or tenant organizations, such as resident Management<br />

Corporations. Management fees are the amounts paid to the entity by the PHA to cover the<br />

professional management services of the entity and do not include any PHA payments or<br />

reimbursements made to the management entity for the expenses of project operation.<br />

Crosswalk: This FDS line generally includes the portion of amounts in <strong>HUD</strong> account 4190<br />

(Other operating administrative and sundry expenses) related to outside management fees and<br />

<strong>HUD</strong> account 4195 (Outside management fees).<br />

914 Compensated absences<br />

Definition: This FDS line represents the amount of employee benefits for compensated absences<br />

recorded as an expenditure/expense in the current reporting period. Compensated absences<br />

include vacations, paid holidays, vested sick pay, and sabbatical leave.<br />

Crosswalk: This FDS line generally includes the amount of compensated absences recorded in<br />

<strong>HUD</strong> accounts 4110 (Administrative salaries), 4210 (Tenant services – salaries), 4410 (Ordinary<br />

maintenance and operation - labor), 4460 (Protective services – labor), and 4350 (Utilities –<br />

labor). These amounts may be recorded in REAC suggested account 4120 (Compensated<br />

absences).<br />

915 Employee benefit contributions - administrative<br />

Definition: This FDS line represents PHA contributions to administrative employee benefit<br />

plans such as pension, retirement, and health and welfare plans. This line also records<br />

administrative expenses paid to the state or other public agency in connection with a retirement<br />

plan, if such payment is required by state law, and with trustee’s fees paid in connection with a<br />

private retirement plan, if such payment is required under the retirement plan contract.<br />

Crosswalk: This FDS line generally includes the employee benefit contribution amounts related<br />

to administrative staff recorded in <strong>HUD</strong> account 4540 (Employee benefit contribution). These<br />

amounts should be separated for each labor category (administrative, tenant services, utilities,<br />

etc) and recorded on the related FDS line (See FDS lines 923, 937, 945, and 955). The amount<br />

identified as allocable to administrative staff may be recorded in REAC suggested account 4182<br />

(Employee benefit contribution administrative) and removed from <strong>HUD</strong> account 4540<br />

(Employee benefit contribution).<br />

916 Other operating - administrative<br />

Definition: This FDS line represents the cost of all items of administrative expenses including<br />

legal expenses, staff training, travel, rented office space used for administration, and all other<br />

REAL ESTATE ASSESSMENT CENTER<br />

35