Martlet Homes Limited - Hyde Housing Association

Martlet Homes Limited - Hyde Housing Association

Martlet Homes Limited - Hyde Housing Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

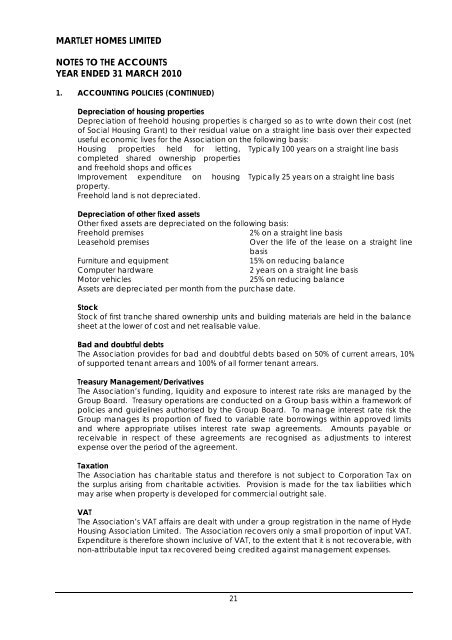

MARTLET HOMES LIMITED<br />

NOTES TO THE ACCOUNTS<br />

YEAR ENDED 31 MARCH 2010<br />

1. ACCOUNTING POLICIES (CONTINUED)<br />

Depreciation of housing properties<br />

Depreciation of freehold housing properties is charged so as to write down their cost (net<br />

of Social <strong>Housing</strong> Grant) to their residual value on a straight line basis over their expected<br />

useful economic lives for the <strong>Association</strong> on the following basis:<br />

<strong>Housing</strong> properties held for letting, Typically 100 years on a straight line basis<br />

completed shared ownership properties<br />

and freehold shops and offices<br />

Improvement expenditure on housing Typically 25 years on a straight line basis<br />

property.<br />

Freehold land is not depreciated.<br />

Depreciation of other fixed assets<br />

Other fixed assets are depreciated on the following basis:<br />

Freehold premises<br />

2% on a straight line basis<br />

Leasehold premises<br />

Over the life of the lease on a straight line<br />

basis<br />

Furniture and equipment<br />

15% on reducing balance<br />

Computer hardware<br />

2 years on a straight line basis<br />

Motor vehicles<br />

25% on reducing balance<br />

Assets are depreciated per month from the purchase date.<br />

Stock<br />

Stock of first tranche shared ownership units and building materials are held in the balance<br />

sheet at the lower of cost and net realisable value.<br />

Bad and doubtful debts<br />

The <strong>Association</strong> provides for bad and doubtful debts based on 50% of current arrears, 10%<br />

of supported tenant arrears and 100% of all former tenant arrears.<br />

Treasury Management/Derivatives<br />

The <strong>Association</strong>’s funding, liquidity and exposure to interest rate risks are managed by the<br />

Group Board. Treasury operations are conducted on a Group basis within a framework of<br />

policies and guidelines authorised by the Group Board. To manage interest rate risk the<br />

Group manages its proportion of fixed to variable rate borrowings within approved limits<br />

and where appropriate utilises interest rate swap agreements. Amounts payable or<br />

receivable in respect of these agreements are recognised as adjustments to interest<br />

expense over the period of the agreement.<br />

Taxation<br />

The <strong>Association</strong> has charitable status and therefore is not subject to Corporation Tax on<br />

the surplus arising from charitable activities. Provision is made for the tax liabilities which<br />

may arise when property is developed for commercial outright sale.<br />

VAT<br />

The <strong>Association</strong>’s VAT affairs are dealt with under a group registration in the name of <strong>Hyde</strong><br />

<strong>Housing</strong> <strong>Association</strong> <strong>Limited</strong>. The <strong>Association</strong> recovers only a small proportion of input VAT.<br />

Expenditure is therefore shown inclusive of VAT, to the extent that it is not recoverable, with<br />

non-attributable input tax recovered being credited against management expenses.<br />

21