Martlet Homes Limited - Hyde Housing Association

Martlet Homes Limited - Hyde Housing Association

Martlet Homes Limited - Hyde Housing Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

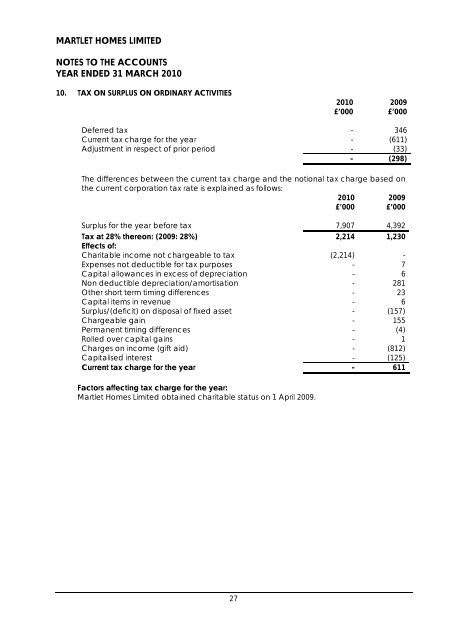

MARTLET HOMES LIMITED<br />

NOTES TO THE ACCOUNTS<br />

YEAR ENDED 31 MARCH 2010<br />

10. TAX ON SURPLUS ON ORDINARY ACTIVITIES<br />

2010 2009<br />

£’000 £’000<br />

Deferred tax - 346<br />

Current tax charge for the year - (611)<br />

Adjustment in respect of prior period - (33)<br />

- (298)<br />

The differences between the current tax charge and the notional tax charge based on<br />

the current corporation tax rate is explained as follows:<br />

2010 2009<br />

£’000 £’000<br />

Surplus for the year before tax 7,907 4,392<br />

Tax at 28% thereon: (2009: 28%) 2,214 1,230<br />

Effects of:<br />

Charitable income not chargeable to tax (2,214) -<br />

Expenses not deductible for tax purposes - 7<br />

Capital allowances in excess of depreciation - 6<br />

Non deductible depreciation/amortisation - 281<br />

Other short term timing differences - 23<br />

Capital items in revenue - 6<br />

Surplus/(deficit) on disposal of fixed asset - (157)<br />

Chargeable gain - 155<br />

Permanent timing differences - (4)<br />

Rolled over capital gains - 1<br />

Charges on income (gift aid) - (812)<br />

Capitalised interest - (125)<br />

Current tax charge for the year - 611<br />

Factors affecting tax charge for the year:<br />

<strong>Martlet</strong> <strong>Homes</strong> <strong>Limited</strong> obtained charitable status on 1 April 2009.<br />

27