The Hyde Group Annual Review 2009/10 - Hyde Housing Association

The Hyde Group Annual Review 2009/10 - Hyde Housing Association

The Hyde Group Annual Review 2009/10 - Hyde Housing Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

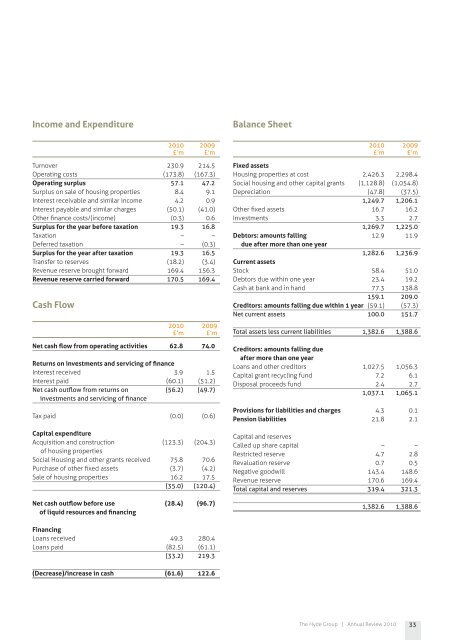

Income and Expenditure<br />

Balance Sheet<br />

Cash Flow<br />

20<strong>10</strong> <strong>2009</strong><br />

£’m £’m<br />

Turnover 230.9 214.5<br />

Operating costs (173.8) (167.3)<br />

Operating surplus 57.1 47.2<br />

Surplus on sale of housing properties 8.4 9.1<br />

Interest receivable and similar income 4.2 0.9<br />

Interest payable and similar charges (50.1) (41.0)<br />

Other finance costs/(income) (0.3) 0.6<br />

Surplus for the year before taxation 19.3 16.8<br />

Taxation – –<br />

Deferred taxation – (0.3)<br />

Surplus for the year after taxation 19.3 16.5<br />

Transfer to reserves (18.2) (3.4)<br />

Revenue reserve brought forward 169.4 156.3<br />

Revenue reserve carried forward 170.5 169.4<br />

20<strong>10</strong> <strong>2009</strong><br />

£’m £’m<br />

Net cash flow from operating activities 62.8 74.0<br />

Returns on investments and servicing of finance<br />

Interest received 3.9 1.5<br />

Interest paid (60.1) (51.2)<br />

Net cash outflow from returns on (56.2) (49.7)<br />

investments and servicing of finance<br />

Tax paid (0.0) (0.6)<br />

Capital expenditure<br />

Acquisition and construction (123.3) (204.3)<br />

of housing properties<br />

Social <strong>Housing</strong> and other grants received 75.8 70.6<br />

Purchase of other fixed assets (3.7) (4.2)<br />

Sale of housing properties 16.2 17.5<br />

(35.0) (120.4)<br />

Net cash outflow before use (28.4) (96.7)<br />

of liquid resources and financing<br />

20<strong>10</strong> <strong>2009</strong><br />

£’m £’m<br />

Fixed assets<br />

<strong>Housing</strong> properties at cost 2,426.3 2,298.4<br />

Social housing and other capital grants (1,128.8) (1,054.8)<br />

Depreciation (47.8) (37.5)<br />

1,249.7 1,206.1<br />

Other fixed assets 16.7 16.2<br />

Investments 3.3 2.7<br />

1,269.7 1,225.0<br />

Debtors: amounts falling 12.9 11.9<br />

due after more than one year<br />

1,282.6 1,236.9<br />

Current assets<br />

Stock 58.4 51.0<br />

Debtors due within one year 23.4 19.2<br />

Cash at bank and in hand 77.3 138.8<br />

159.1 209.0<br />

Creditors: amounts falling due within 1 year (59.1) (57.3)<br />

Net current assets <strong>10</strong>0.0 151.7<br />

Total assets less current liabilities 1,382.6 1,388.6<br />

Creditors: amounts falling due<br />

after more than one year<br />

Loans and other creditors 1,027.5 1,056.3<br />

Capital grant recycling fund 7.2 6.1<br />

Disposal proceeds fund 2.4 2.7<br />

1,037.1 1,065.1<br />

Provisions for liabilities and charges 4.3 0.1<br />

Pension liabilities 21.8 2.1<br />

Capital and reserves<br />

Called up share capital – –<br />

Restricted reserve 4.7 2.8<br />

Revaluation reserve 0.7 0.5<br />

Negative goodwill 143.4 148.6<br />

Revenue reserve 170.6 169.4<br />

Total capital and reserves 319.4 321.3<br />

1,382.6 1,388.6<br />

Financing<br />

Loans received 49.3 280.4<br />

Loans paid (82.5) (61.1)<br />

(33.2) 219.3<br />

(Decrease)/increase in cash (61.6) 122.6<br />

<strong>The</strong> <strong>Hyde</strong> <strong>Group</strong> | <strong>Annual</strong> <strong>Review</strong> 20<strong>10</strong><br />

33