IFAC 2008 annual report - IBR

IFAC 2008 annual report - IBR

IFAC 2008 annual report - IBR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The <strong>IFAC</strong> Board expects that the activities of the IPSASB in relation to the standards program will continue and that<br />

the funds provided for this purpose by the external funding agencies will be used on those activities.<br />

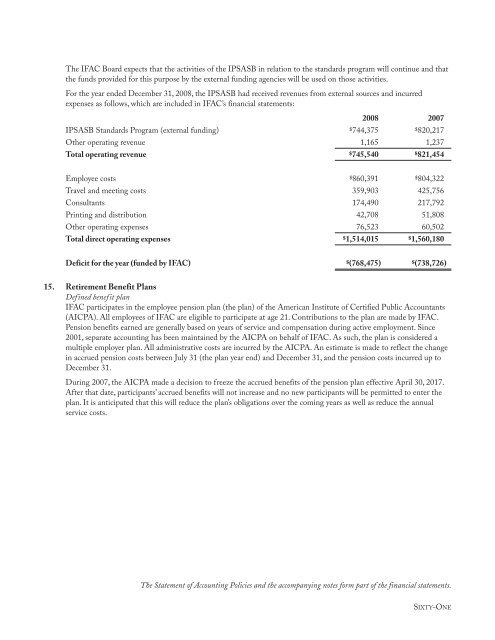

For the year ended December 31, <strong>2008</strong>, the IPSASB had received revenues from external sources and incurred<br />

expenses as follows, which are included in <strong>IFAC</strong>’s financial statements:<br />

<strong>2008</strong> 2007<br />

IPSASB Standards Program (external funding) $744,375 $820,217<br />

Other operating revenue 1,165 1,237<br />

Total operating revenue $745,540 $821,454<br />

Employee costs $860,391 $804,322<br />

Travel and meeting costs 359,903 425,756<br />

Consultants 174,490 217,792<br />

Printing and distribution 42,708 51,808<br />

Other operating expenses 76,523 60,502<br />

Total direct operating expenses $1,514,015 $1,560,180<br />

Deficit for the year (funded by <strong>IFAC</strong>) $(768,475) $(738,726)<br />

15. Retirement Benefit Plans<br />

Defined benefit plan<br />

<strong>IFAC</strong> participates in the employee pension plan (the plan) of the American Institute of Certified Public Accountants<br />

(AICPA). All employees of <strong>IFAC</strong> are eligible to participate at age 21. Contributions to the plan are made by <strong>IFAC</strong>.<br />

Pension benefits earned are generally based on years of service and compensation during active employment. Since<br />

2001, separate accounting has been maintained by the AICPA on behalf of <strong>IFAC</strong>. As such, the plan is considered a<br />

multiple employer plan. All administrative costs are incurred by the AICPA. An estimate is made to reflect the change<br />

in accrued pension costs between July 31 (the plan year end) and December 31, and the pension costs incurred up to<br />

December 31.<br />

During 2007, the AICPA made a decision to freeze the accrued benefits of the pension plan effective April 30, 2017.<br />

After that date, participants’ accrued benefits will not increase and no new participants will be permitted to enter the<br />

plan. It is anticipated that this will reduce the plan’s obligations over the coming years as well as reduce the <strong>annual</strong><br />

service costs.<br />

The Statement of Accounting Policies and the accompanying notes form part of the financial statements.<br />

SIXTY-ONE