Biannual Survey of Suppliers of Business ... - Industrie Canada

Biannual Survey of Suppliers of Business ... - Industrie Canada

Biannual Survey of Suppliers of Business ... - Industrie Canada

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong> Financing<br />

Data Analysis, Second Half 2012<br />

This document presents data on business lending activities gathered from the<br />

<strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong> Financing.<br />

www. ic.gc.ca/surveys<br />

May 2013<br />

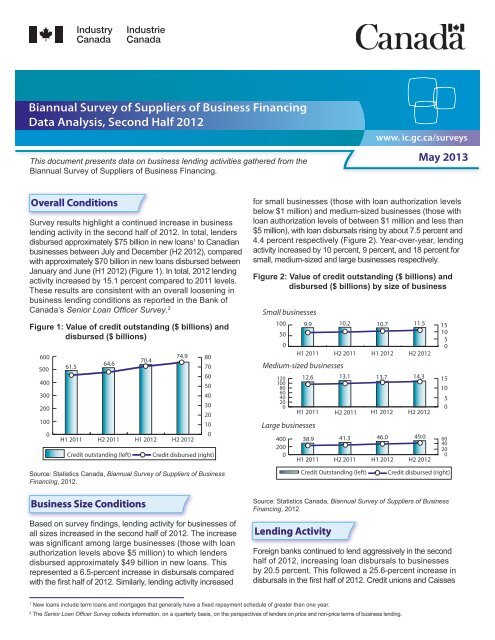

Overall Conditions<br />

<strong>Survey</strong> results highlight a continued increase in business<br />

lending activity in the second half <strong>of</strong> 2012. In total, lenders<br />

disbursed approximately $75 billion in new loans 1 to Canadian<br />

businesses between July and December (H2 2012), compared<br />

with approximately $70 billion in new loans disbursed between<br />

January and June (H1 2012) (Figure 1). In total, 2012 lending<br />

activity increased by 15.1 percent compared to 2011 levels.<br />

These results are consistent with an overall loosening in<br />

business lending conditions as reported in the Bank <strong>of</strong><br />

<strong>Canada</strong>’s Senior Loan Officer <strong>Survey</strong>. 2<br />

Figure 1: Value <strong>of</strong> credit outstanding ($ billions) and<br />

disbursed ($ billions)<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

61.5<br />

H1 2011<br />

64.6<br />

H2 2011<br />

Credit outstanding (left)<br />

70.4<br />

H1 2012<br />

74.9<br />

H2 2012<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Credit disbursed (right)<br />

for small businesses (those with loan authorization levels<br />

below $1 million) and medium-sized businesses (those with<br />

loan authorization levels <strong>of</strong> between $1 million and less than<br />

$5 million), with loan disbursals rising by about 7.5 percent and<br />

4.4 percent respectively (Figure 2). Year-over-year, lending<br />

activity increased by 10 percent, 9 percent, and 18 percent for<br />

small, medium-sized and large businesses respectively.<br />

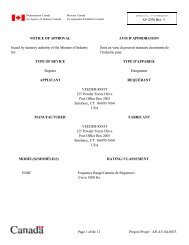

Figure 2: Value <strong>of</strong> credit outstanding ($ billions) and<br />

disbursed ($ billions) by size <strong>of</strong> business<br />

Small businesses<br />

100<br />

50<br />

0<br />

Medium-sized businesses<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Large businesses<br />

400<br />

200<br />

0<br />

9.9<br />

H1 2011<br />

12.6<br />

H1 2011<br />

38.9<br />

H1 2011<br />

10.2 10.7<br />

H2 2011<br />

H1 2012<br />

13.1 13.7<br />

H2 2011<br />

41.3 46.0<br />

H2 2011<br />

H1 2012<br />

H1 2012<br />

11.5<br />

H2 2012<br />

14.3<br />

H2 2012<br />

49.0<br />

H2 2012<br />

15<br />

10<br />

5<br />

0<br />

15<br />

10<br />

5<br />

0<br />

60<br />

40<br />

20<br />

0<br />

Source: Statistics <strong>Canada</strong>, <strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong><br />

Financing, 2012.<br />

Credit Outstanding (left)<br />

Credit disbursed (right)<br />

<strong>Business</strong> Size Conditions<br />

Based on survey findings, lending activity for businesses <strong>of</strong><br />

all sizes increased in the second half <strong>of</strong> 2012. The increase<br />

was significant among large businesses (those with loan<br />

authorization levels above $5 million) to which lenders<br />

disbursed approximately $49 billion in new loans. This<br />

represented a 6.5-percent increase in disbursals compared<br />

with the first half <strong>of</strong> 2012. Similarly, lending activity increased<br />

Source: Statistics <strong>Canada</strong>, <strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong><br />

Financing, 2012.<br />

Lending Activity<br />

Foreign banks continued to lend aggressively in the second<br />

half <strong>of</strong> 2012, increasing loan disbursals to businesses<br />

by 20.5 percent. This followed a 25.6-percent increase in<br />

disbursals in the first half <strong>of</strong> 2012. Credit unions and Caisses<br />

1<br />

New loans include term loans and mortgages that generally have a fixed repayment schedule <strong>of</strong> greater than one year.<br />

2<br />

The Senior Loan Officer <strong>Survey</strong> collects information, on a quarterly basis, on the perspectives <strong>of</strong> lenders on price and non-price terms <strong>of</strong> business lending.

populaires continued to increase loans as well, with disbursals<br />

rising 10.3 percent in the second half <strong>of</strong> 2012 compared with<br />

the first half <strong>of</strong> 2012. Loan disbursals by domestic banks, which<br />

make up 42.2 percent <strong>of</strong> the new loans market, also continued<br />

to grow steadily increasing disbursals by 3.4 percent in the<br />

second half <strong>of</strong> 2012 compared with the first half <strong>of</strong> 2012. Yearover-year,<br />

loans from domestic banks, other banks (including<br />

foreign), credit unions and Caisses populaires have increased<br />

by 10 percent, 27 percent, and 19 percent respectively.<br />

Table 1: Value <strong>of</strong> credit disbursed ($ millions) by<br />

supplier type<br />

2011 2012<br />

Supplier type H1 H2 H1 H2<br />

Domestic banks 26,726 29,994 30,563 31,609<br />

Other banks 15,609 13,191 16,567 19,962<br />

Credit unions, Caisses 6,744 7,419 8,029 8,856<br />

populaires<br />

Finance companies 6,876 8,081 9,370 9,242<br />

Insurance companies 5,578 5,964 5,850 5,193<br />

and portfolio managers<br />

All suppliers 61,533 64,648 70,379 74,862<br />

Source: Statistics <strong>Canada</strong>, <strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong><br />

Financing, 2012.<br />

Industry Conditions<br />

<strong>Survey</strong> findings point to an increase in lending activity across<br />

most sectors in the second half <strong>of</strong> 2012. Sectors experiencing<br />

the strongest increases were the accommodation and food<br />

services sector and the construction sector, which saw<br />

increases in loan disbursals <strong>of</strong> 22.2 percent and 9.9 percent<br />

respectively (Figure 3). Firms in the manufacturing sector<br />

also experienced a strong increase in lending activity, with<br />

loan disbursals rising by 8.9 percent. Conversely, a decline<br />

in lending activity was observed in the pr<strong>of</strong>essional services<br />

sector. Specifically, new loans disbursed to pr<strong>of</strong>essional<br />

service businesses fell by 8.8 percent from $3.2 billion in the<br />

first half <strong>of</strong> 2012 to $2.8 billion in the second half <strong>of</strong> 2012.<br />

However, on a year-over-year basis, lending activity was up<br />

across all sectors.<br />

About the <strong>Survey</strong><br />

The <strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong> Financing is<br />

the result <strong>of</strong> a commitment by the Government <strong>of</strong> <strong>Canada</strong><br />

to improve the availability <strong>of</strong> information about financing <strong>of</strong><br />

businesses in <strong>Canada</strong>. Data are collected from 120 major<br />

suppliers <strong>of</strong> financing, including domestic banks and credit<br />

unions and Caisses populaires, representing over 90 percent<br />

<strong>of</strong> all lending to businesses in <strong>Canada</strong>.<br />

This report was prepared by Daniel Seens, CFA, an<br />

economist in the Small <strong>Business</strong> Branch. Questions can<br />

be directed to him at daniel.seens@ic.gc.ca.<br />

Figure 3: Value <strong>of</strong> credit outstanding ($ billions) and<br />

disbursed ($ billions) by industry<br />

Primary and agriculture<br />

100<br />

10.3<br />

12.3 14.6<br />

50<br />

0<br />

Construction<br />

50<br />

25<br />

0<br />

H1 2011<br />

6.6<br />

H1 2011<br />

Transportation<br />

40<br />

20<br />

0<br />

2.7<br />

H1 2011<br />

Manufacturing<br />

60<br />

40<br />

20<br />

0<br />

5.5<br />

H1 2011<br />

H2 2011<br />

H2 2011<br />

H1 2012<br />

H1 2012<br />

3.1 3.1<br />

H2 2011<br />

H1 2012<br />

5.9 5.6<br />

H2 2011<br />

Wholesale and retail trade<br />

100<br />

50<br />

0<br />

5.2<br />

H1 2011<br />

H2 2011<br />

H1 2012<br />

H1 2012<br />

Finance, insurance, real estate and rental<br />

200<br />

100<br />

0<br />

15.7<br />

H1 2011<br />

Pr<strong>of</strong>essional services<br />

20<br />

10<br />

0<br />

1.9<br />

H1 2011<br />

15.9 16.0<br />

H2 2011<br />

H1 2012<br />

2.2 3.2<br />

H2 2011<br />

Accommodation and food services<br />

20<br />

10<br />

0<br />

2.5<br />

H1 2011<br />

6.3 7.1<br />

5.6<br />

H1 2012<br />

1.6 1.8<br />

H2 2011<br />

Credit outstanding (left)<br />

H2 2012<br />

H2 2012<br />

H2 2012<br />

H2 2012<br />

H2 2012<br />

H2 2012<br />

Source: Statistics <strong>Canada</strong>, <strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong><br />

Financing, 2012.<br />

Note: Numbers do not add up due to exclusion <strong>of</strong> the “other industries”<br />

category.<br />

7.1<br />

H1 2012<br />

14.7<br />

7.8<br />

2.9<br />

6.1<br />

7.6<br />

16.9<br />

2.8<br />

H2 2012<br />

2.2<br />

H2 2012<br />

20<br />

10<br />

0<br />

10<br />

4<br />

2<br />

0<br />

5<br />

0<br />

10<br />

5<br />

0<br />

10<br />

5<br />

0<br />

20<br />

10<br />

4<br />

2<br />

0<br />

4<br />

2<br />

0<br />

0<br />

Credit disbursed (right)<br />

<strong>Biannual</strong> <strong>Survey</strong> <strong>of</strong> <strong>Suppliers</strong> <strong>of</strong> <strong>Business</strong> Financing—Data Analysis, Second Half 2012 2