impact of government policies and investment agreements on fdi ...

impact of government policies and investment agreements on fdi ...

impact of government policies and investment agreements on fdi ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

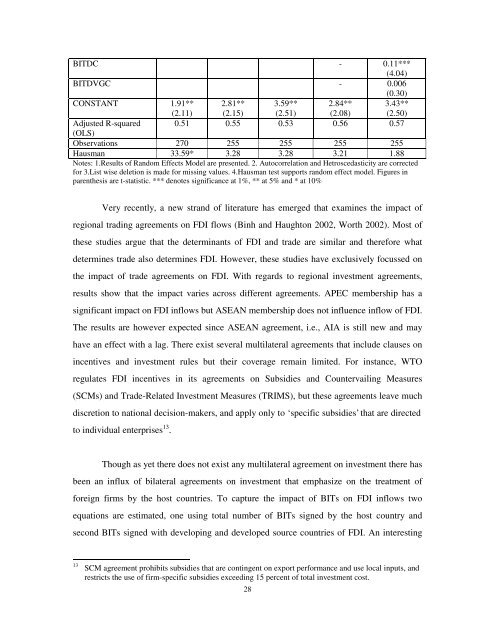

BITDC - 0.11***<br />

(4.04)<br />

BITDVGC - 0.006<br />

(0.30)<br />

CONSTANT 1.91**<br />

(2.11)<br />

2.81**<br />

(2.15)<br />

3.59**<br />

(2.51)<br />

2.84**<br />

(2.08)<br />

3.43**<br />

(2.50)<br />

Adjusted R-squared 0.51 0.55 0.53 0.56 0.57<br />

(OLS)<br />

Observati<strong>on</strong>s 270 255 255 255 255<br />

Hausman 33.59* 3.28 3.28 3.21 1.88<br />

Notes: 1.Results <str<strong>on</strong>g>of</str<strong>on</strong>g> R<str<strong>on</strong>g>and</str<strong>on</strong>g>om Effects Model are presented. 2. Autocorrelati<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> Hetroscedasticity are corrected<br />

for 3.List wise deleti<strong>on</strong> is made for missing values. 4.Hausman test supports r<str<strong>on</strong>g>and</str<strong>on</strong>g>om effect model. Figures in<br />

parenthesis are t-statistic. *** denotes significance at 1%, ** at 5% <str<strong>on</strong>g>and</str<strong>on</strong>g> * at 10%<br />

Very recently, a new str<str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> literature has emerged that examines the <str<strong>on</strong>g>impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

regi<strong>on</strong>al trading <str<strong>on</strong>g>agreements</str<strong>on</strong>g> <strong>on</strong> FDI flows (Binh <str<strong>on</strong>g>and</str<strong>on</strong>g> Haught<strong>on</strong> 2002, Worth 2002). Most <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

these studies argue that the determinants <str<strong>on</strong>g>of</str<strong>on</strong>g> FDI <str<strong>on</strong>g>and</str<strong>on</strong>g> trade are similar <str<strong>on</strong>g>and</str<strong>on</strong>g> therefore what<br />

determines trade also determines FDI. However, these studies have exclusively focussed <strong>on</strong><br />

the <str<strong>on</strong>g>impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> trade <str<strong>on</strong>g>agreements</str<strong>on</strong>g> <strong>on</strong> FDI. With regards to regi<strong>on</strong>al <str<strong>on</strong>g>investment</str<strong>on</strong>g> <str<strong>on</strong>g>agreements</str<strong>on</strong>g>,<br />

results show that the <str<strong>on</strong>g>impact</str<strong>on</strong>g> varies across different <str<strong>on</strong>g>agreements</str<strong>on</strong>g>. APEC membership has a<br />

significant <str<strong>on</strong>g>impact</str<strong>on</strong>g> <strong>on</strong> FDI inflows but ASEAN membership does not influence inflow <str<strong>on</strong>g>of</str<strong>on</strong>g> FDI.<br />

The results are however expected since ASEAN agreement, i.e., AIA is still new <str<strong>on</strong>g>and</str<strong>on</strong>g> may<br />

have an effect with a lag. There exist several multilateral <str<strong>on</strong>g>agreements</str<strong>on</strong>g> that include clauses <strong>on</strong><br />

incentives <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>investment</str<strong>on</strong>g> rules but their coverage remain limited. For instance, WTO<br />

regulates FDI incentives in its <str<strong>on</strong>g>agreements</str<strong>on</strong>g> <strong>on</strong> Subsidies <str<strong>on</strong>g>and</str<strong>on</strong>g> Countervailing Measures<br />

(SCMs) <str<strong>on</strong>g>and</str<strong>on</strong>g> Trade-Related Investment Measures (TRIMS), but these <str<strong>on</strong>g>agreements</str<strong>on</strong>g> leave much<br />

discreti<strong>on</strong> to nati<strong>on</strong>al decisi<strong>on</strong>-makers, <str<strong>on</strong>g>and</str<strong>on</strong>g> apply <strong>on</strong>ly to ‘specific subsidies’ that are directed<br />

to individual enterprises 13 .<br />

Though as yet there does not exist any multilateral agreement <strong>on</strong> <str<strong>on</strong>g>investment</str<strong>on</strong>g> there has<br />

been an influx <str<strong>on</strong>g>of</str<strong>on</strong>g> bilateral <str<strong>on</strong>g>agreements</str<strong>on</strong>g> <strong>on</strong> <str<strong>on</strong>g>investment</str<strong>on</strong>g> that emphasize <strong>on</strong> the treatment <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

foreign firms by the host countries. To capture the <str<strong>on</strong>g>impact</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> BITs <strong>on</strong> FDI inflows two<br />

equati<strong>on</strong>s are estimated, <strong>on</strong>e using total number <str<strong>on</strong>g>of</str<strong>on</strong>g> BITs signed by the host country <str<strong>on</strong>g>and</str<strong>on</strong>g><br />

sec<strong>on</strong>d BITs signed with developing <str<strong>on</strong>g>and</str<strong>on</strong>g> developed source countries <str<strong>on</strong>g>of</str<strong>on</strong>g> FDI. An interesting<br />

13<br />

SCM agreement prohibits subsidies that are c<strong>on</strong>tingent <strong>on</strong> export performance <str<strong>on</strong>g>and</str<strong>on</strong>g> use local inputs, <str<strong>on</strong>g>and</str<strong>on</strong>g><br />

restricts the use <str<strong>on</strong>g>of</str<strong>on</strong>g> firm-specific subsidies exceeding 15 percent <str<strong>on</strong>g>of</str<strong>on</strong>g> total <str<strong>on</strong>g>investment</str<strong>on</strong>g> cost.<br />

28