Framework-based IFRS teaching workshop at the BAFA Conference

Framework-based IFRS teaching workshop at the BAFA Conference

Framework-based IFRS teaching workshop at the BAFA Conference

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

© 2010 <strong>IFRS</strong> Found<strong>at</strong>ion. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org<br />

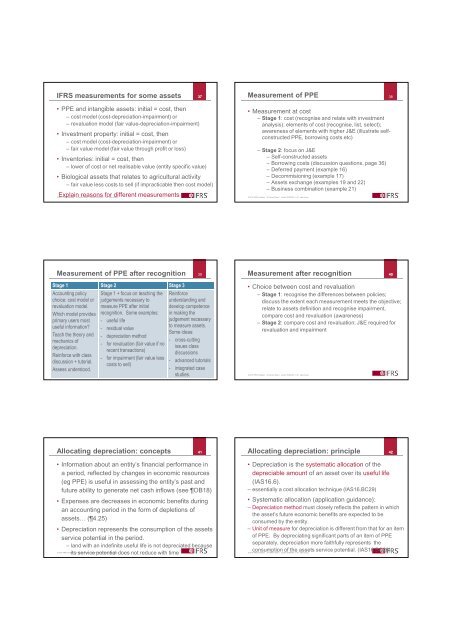

<strong>IFRS</strong> measurements for some assets 37<br />

Measurement of PPE<br />

38<br />

• PPE and intangible assets: initial = cost, <strong>the</strong>n<br />

– cost model (cost-depreci<strong>at</strong>ion-impairment) or<br />

– revalu<strong>at</strong>ion model (fair value-depreci<strong>at</strong>ion-impairment)<br />

• Investment property: initial = cost, <strong>the</strong>n<br />

– cost model (cost-depreci<strong>at</strong>ion-impairment) or<br />

– fair value model (fair value through profit or loss)<br />

• Inventories: initial = cost, <strong>the</strong>n<br />

– lower of cost or net realisable value (entity specific value)<br />

• Biological assets th<strong>at</strong> rel<strong>at</strong>es to agricultural activity<br />

– fair value less costs to sell (if impracticable <strong>the</strong>n cost model)<br />

Explain reasons for different measurements<br />

• Measurement <strong>at</strong> cost<br />

– Stage 1: cost (recognise and rel<strong>at</strong>e with investment<br />

analysis); elements of cost (recognise, list, select);<br />

awareness of elements with higher J&E (illustr<strong>at</strong>e selfconstructed<br />

PPE, borrowing costs etc)<br />

– Stage 2: focus on J&E<br />

– Self-constructed assets<br />

– Borrowing costs (discussion questions, page 36)<br />

– Deferred payment (example 16)<br />

– Decommisioning (example 17)<br />

– Assets exchange (examples 19 and 22)<br />

– Business combin<strong>at</strong>ion (example 21)<br />

© 2010 <strong>IFRS</strong> Found<strong>at</strong>ion. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org<br />

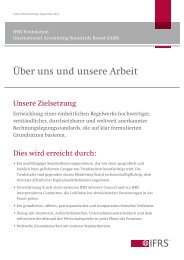

Measurement of PPE after recognition<br />

Stage 1 Stage 2 Stage 3<br />

Accounting policy<br />

choice: cost model or<br />

revalu<strong>at</strong>ion model.<br />

Which model provides<br />

primary users most<br />

useful inform<strong>at</strong>ion?<br />

Teach <strong>the</strong> <strong>the</strong>ory and<br />

mechanics of<br />

depreci<strong>at</strong>ion.<br />

Reinforce with class<br />

discussion + tutorial.<br />

Assess understood.<br />

© 2010 <strong>IFRS</strong> Found<strong>at</strong>ion. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org<br />

Stage 1 + focus on <strong>teaching</strong> <strong>the</strong><br />

judgements necessary to<br />

measure PPE after initial<br />

recognition. Some examples:<br />

- useful life<br />

- residual value<br />

- depreci<strong>at</strong>ion method<br />

- for revalu<strong>at</strong>ion (fair value if no<br />

recent transactions)<br />

- for impairment (fair value less<br />

costs to sell)<br />

39<br />

Reinforce<br />

understanding and<br />

develop competence<br />

in making <strong>the</strong><br />

judgement necessary<br />

to measure assets.<br />

Some ideas:<br />

- cross-cutting<br />

issues class<br />

discussions<br />

- advanced tutorials<br />

- integr<strong>at</strong>ed case<br />

studies.<br />

Measurement after recognition 40<br />

• Choice between cost and revalu<strong>at</strong>ion<br />

– Stage 1: recognise <strong>the</strong> differences between policies;<br />

discuss <strong>the</strong> extent each measurement meets <strong>the</strong> objective;<br />

rel<strong>at</strong>e to assets definition and recognise impairment,<br />

compare cost and revalu<strong>at</strong>ion (awareness)<br />

– Stage 2: compare cost and revalu<strong>at</strong>ion; J&E required for<br />

revalu<strong>at</strong>ion and impairment<br />

© 2010 <strong>IFRS</strong> Found<strong>at</strong>ion. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org<br />

Alloc<strong>at</strong>ing depreci<strong>at</strong>ion: concepts 41<br />

• Inform<strong>at</strong>ion about an entity’s financial performance in<br />

a period, reflected by changes in economic resources<br />

(eg PPE) is useful in assessing <strong>the</strong> entity’s past and<br />

future ability to gener<strong>at</strong>e net cash inflows (see OB18)<br />

• Expenses are decreases in economic benefits during<br />

an accounting period in <strong>the</strong> form of depletions of<br />

assets… (4.25)<br />

• Depreci<strong>at</strong>ion represents <strong>the</strong> consumption of <strong>the</strong> assets<br />

service potential in <strong>the</strong> period.<br />

– land with an indefinite useful life is not depreci<strong>at</strong>ed because<br />

© 2010 <strong>IFRS</strong> Found<strong>at</strong>ion. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org<br />

its service potential does not reduce with time<br />

Alloc<strong>at</strong>ing depreci<strong>at</strong>ion: principle 42<br />

• Depreci<strong>at</strong>ion is <strong>the</strong> system<strong>at</strong>ic alloc<strong>at</strong>ion of <strong>the</strong><br />

depreciable amount of an asset over its useful life<br />

(IAS16.6).<br />

– essentially a cost alloc<strong>at</strong>ion technique (IAS16.BC29)<br />

• System<strong>at</strong>ic alloc<strong>at</strong>ion (applic<strong>at</strong>ion guidance):<br />

– Depreci<strong>at</strong>ion method must closely reflects <strong>the</strong> p<strong>at</strong>tern in which<br />

<strong>the</strong> asset’s future economic benefits are expected to be<br />

consumed by <strong>the</strong> entity.<br />

– Unit of measure for depreci<strong>at</strong>ion is different from th<strong>at</strong> for an item<br />

of PPE. By depreci<strong>at</strong>ing significant parts of an item of PPE<br />

separ<strong>at</strong>ely, depreci<strong>at</strong>ion more faithfully represents <strong>the</strong><br />

consumption of <strong>the</strong> assets service potential. (IAS16.BC26)<br />

© 2010 <strong>IFRS</strong> Found<strong>at</strong>ion. 30 Cannon Street | London EC4M 6XH | UK. www.ifrs.org