World Hospitals and Health Services - International Hospital ...

World Hospitals and Health Services - International Hospital ...

World Hospitals and Health Services - International Hospital ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

POLICY: CHINESE HEALTHCARE TRENDS<br />

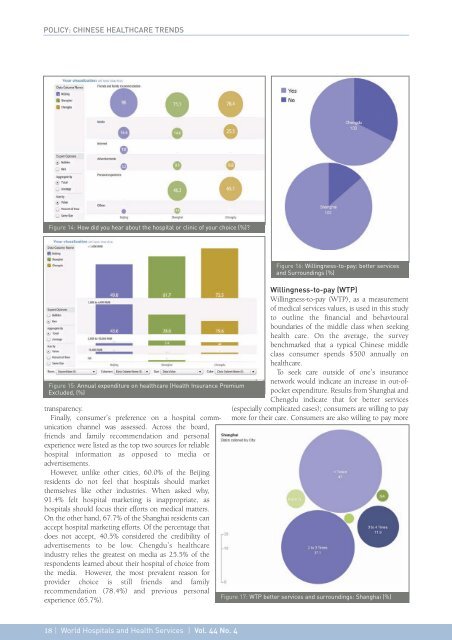

Figure 14: How did you hear about the hospital or clinic of your choice (%)?<br />

Figure 15: Annual expenditure on healthcare (<strong>Health</strong> Insurance Premium<br />

Excluded, (%)<br />

transparency.<br />

Finally, consumer’s preference on a hospital communication<br />

channel was assessed. Across the board,<br />

friends <strong>and</strong> family recommendation <strong>and</strong> personal<br />

experience were listed as the top two sources for reliable<br />

hospital information as opposed to media or<br />

advertisements.<br />

However, unlike other cities, 60.0% of the Beijing<br />

residents do not feel that hospitals should market<br />

themselves like other industries. When asked why,<br />

91.4% felt hospital marketing is inappropriate, as<br />

hospitals should focus their efforts on medical matters.<br />

On the other h<strong>and</strong>, 67.7% of the Shanghai residents can<br />

accept hospital marketing efforts. Of the percentage that<br />

does not accept, 40.5% considered the credibility of<br />

advertisements to be low. Chengdu’s healthcare<br />

industry relies the greatest on media as 25.5% of the<br />

respondents learned about their hospital of choice from<br />

the media. However, the most prevalent reason for<br />

provider choice is still friends <strong>and</strong> family<br />

recommendation (78.4%) <strong>and</strong> previous personal<br />

experience (65.7%).<br />

Figure 16: Willingness-to-pay: better services<br />

<strong>and</strong> Surroundings (%)<br />

Willingness-to-pay (WTP)<br />

Willingness-to-pay (WTP), as a measurement<br />

of medical services values, is used in this study<br />

to outline the financial <strong>and</strong> behavioural<br />

boundaries of the middle class when seeking<br />

health care. On the average, the survey<br />

benchmarked that a typical Chinese middle<br />

class consumer spends $500 annually on<br />

healthcare.<br />

To seek care outside of one’s insurance<br />

network would indicate an increase in out-ofpocket<br />

expenditure. Results from Shanghai <strong>and</strong><br />

Chengdu indicate that for better services<br />

(especially complicated cases); consumers are willing to pay<br />

more for their care. Consumers are also willing to pay more<br />

Figure 17: WTP better services <strong>and</strong> surroundings: Shanghai (%)<br />

18 | <strong>World</strong> <strong><strong>Hospital</strong>s</strong> <strong>and</strong> <strong>Health</strong> <strong>Services</strong> | Vol. 44 No. 4