"FORM NO. 15G - RBS.in

"FORM NO. 15G - RBS.in

"FORM NO. 15G - RBS.in

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

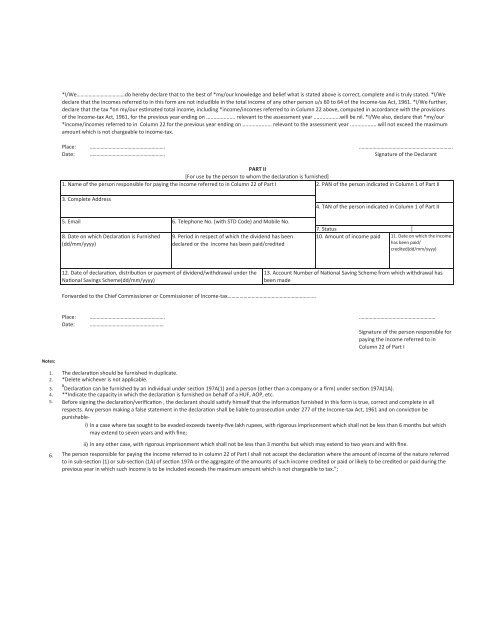

*I/We………………………………do hereby declare that to the best of *my/our knowledge and belief what is stated above is correct, complete and is truly stated. *I/We<br />

declare that the <strong>in</strong>comes referred to <strong>in</strong> this form are not <strong>in</strong>cludible <strong>in</strong> the total <strong>in</strong>come of any other person u/s 60 to 64 of the Income-tax Act, 1961. *I/We further,<br />

declare that the tax *on my/our estimated total <strong>in</strong>come, <strong>in</strong>clud<strong>in</strong>g *<strong>in</strong>come/<strong>in</strong>comes referred to <strong>in</strong> Column 22 above, computed <strong>in</strong> accordance with the provisions<br />

of the Income-tax Act, 1961, for the previous year end<strong>in</strong>g on .................... relevant to the assessment year ..................will be nil. *I/We also, declare that *my/our<br />

*<strong>in</strong>come/<strong>in</strong>comes referred to <strong>in</strong> Column 22 for the previous year end<strong>in</strong>g on .................... relevant to the assessment year .................. will not exceed the maximum<br />

amount which is not chargeable to <strong>in</strong>come-tax.<br />

Place:<br />

Date:<br />

………………………………………………..<br />

………………………………………………..<br />

…………………………………………………………….<br />

Signature of the Declarant<br />

PART II<br />

[For use by the person to whom the declaration is furnished]<br />

1. Name of the person responsible for pay<strong>in</strong>g the <strong>in</strong>come referred to <strong>in</strong> Column 22 of Part I<br />

2. PAN of the person <strong>in</strong>dicated <strong>in</strong> Column 1 of Part II<br />

3. Complete Address<br />

5. Email<br />

8. Date on which Declaration is Furnished<br />

(dd/mm/yyyy)<br />

6. Telephone No. (with STD Code) and Mobile No.<br />

9. Period <strong>in</strong> respect of which the dividend has been<br />

declared or the <strong>in</strong>come has been paid/credited<br />

4. TAN of the person <strong>in</strong>dicated <strong>in</strong> Column 1 of Part II<br />

7. Status<br />

10. Amount of <strong>in</strong>come paid 11. Date on which the <strong>in</strong>come<br />

has been paid/<br />

credited(dd/mm/yyyy)<br />

12. Date of declaration, distribution or payment of dividend/withdrawal under the<br />

National Sav<strong>in</strong>gs Scheme(dd/mm/yyyy)<br />

13. Account Number of National Sav<strong>in</strong>g Scheme from which withdrawal has<br />

been made<br />

Forwarded to the Chief Commissioner or Commissioner of Income-tax…………………………………………………………<br />

Place:<br />

Date:<br />

………………………………………………..<br />

……………………………………………….<br />

…………………………………………………<br />

Signature of the person responsible for<br />

pay<strong>in</strong>g the <strong>in</strong>come referred to <strong>in</strong><br />

Column 22 of Part I<br />

Notes:<br />

1.<br />

2.<br />

3.<br />

4.<br />

5.<br />

6.<br />

The declaration should be furnished <strong>in</strong> duplicate.<br />

*Delete whichever is not applicable.<br />

# Declaration can be furnished by an <strong>in</strong>dividual under section 197A(1) and a person (other than a company or a firm) under section 197A(1A).<br />

**Indicate the capacity <strong>in</strong> which the declaration is furnished on behalf of a HUF, AOP, etc.<br />

Before sign<strong>in</strong>g the declaration/verification , the declarant should satisfy himself that the <strong>in</strong>formation furnished <strong>in</strong> this form is true, correct and complete <strong>in</strong> all<br />

respects. Any person mak<strong>in</strong>g a false statement <strong>in</strong> the declaration shall be liable to prosecution under 277 of the Income-tax Act, 1961 and on conviction be<br />

punishablei)<br />

In a case where tax sought to be evaded exceeds twenty-five lakh rupees, with rigorous imprisonment which shall not be less than 6 months but which<br />

may extend to seven years and with f<strong>in</strong>e;<br />

ii) In any other case, with rigorous imprisonment which shall not be less than 3 months but which may extend to two years and with f<strong>in</strong>e.<br />

The person responsible for pay<strong>in</strong>g the <strong>in</strong>come referred to <strong>in</strong> column 22 of Part I shall not accept the declaration where the amount of <strong>in</strong>come of the nature referred<br />

to <strong>in</strong> sub-section (1) or sub-section (1A) of section 197A or the aggregate of the amounts of such <strong>in</strong>come credited or paid or likely to be credited or paid dur<strong>in</strong>g the<br />

previous year <strong>in</strong> which such <strong>in</strong>come is to be <strong>in</strong>cluded exceeds the maximum amount which is not chargeable to tax.";