IIFL Investor - India Infoline Finance Limited

IIFL Investor - India Infoline Finance Limited

IIFL Investor - India Infoline Finance Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

INVESTOR<br />

Volume 1, Issue 1, Mumbai, June 2012 Publication Price `3 Pages - 4<br />

Have you started investing?<br />

The importance of starting early<br />

Mutual Fund Fundas<br />

A Starter’s Guide<br />

Buying a Home?<br />

Five things to keep in mind<br />

Insurance & Fixed Deposit<br />

Schemes<br />

Page 2 Page 3 Page 4<br />

Page 2<br />

<strong>IIFL</strong> MF launches<br />

<strong>IIFL</strong> Dividend Opportunities Index Fund<br />

<strong>IIFL</strong> Dividend Opportunities Index Fund ('Scheme')<br />

is an open ended index fund which will invest in<br />

stocks which are constituents of CNX Dividend<br />

Opportunities Index ('Dividend Index') in the same<br />

proportion (weightage) as in the Dividend Index,<br />

subject to tracking error.<br />

Key Highlights<br />

• Maiden mutual fund scheme which will replicate<br />

a thematic index (Dividend Index) of high<br />

yielding companies listed on NSE<br />

• Diversified across sectors and market<br />

capitalization (25 sectors and consists of large cap<br />

and mid cap stocks)<br />

• Being an Index Fund - generally lower expenses<br />

are charged as compared to actively managed<br />

equity mutual fund schemes<br />

Dividend Index has generally<br />

outperformed* other key representative<br />

Indices (e.g S&P CNX Nifty,<br />

CNX 100, CNX Midcap)<br />

* Index base date October 2007<br />

About CNX Dividend Opportunities Index<br />

• Dividend Index is a thematic index owned and<br />

managed by <strong>India</strong> Index Service and Products Ltd<br />

(IISL) -(A Joint Venture between NSE and CRISIL)<br />

• Top 50 companies falling within IISL’s selection<br />

criteria and ranked by annual dividend yield<br />

across 25 sectors form part of Dividend Index<br />

• Companies are selected out of the top 300 by<br />

average free-float market capitalization and<br />

aggregate turnover for the last six months<br />

• Companies should have net profit and positive<br />

net worth as per latest annual audited results<br />

• The weightage of the Dividend Index constituents<br />

is capped at 8% and may increase up to a maximum<br />

of 10% between the rebalancing periods<br />

th<br />

(Source: IISL fact Sheet March 30 2012.<br />

For further details please read Scheme Information document)<br />

<strong>IIFL</strong> <strong>Investor</strong> -<br />

Your First Issue<br />

Dear investor,<br />

Insurance - let's get the amount "First-time-Right"<br />

The need for insurance is appreciated by<br />

all. It is important to first understand the<br />

various factors and variables to ensure an<br />

adequate insurance cover. After all, what<br />

you leave behind for your dependents is a<br />

sense of security and financial freedom in<br />

your absence.<br />

Your policy cover should be enough to<br />

cover the monthly expenses of your<br />

family. It should account for unforeseen<br />

emergencies, take care of your children's<br />

higher education and their wedding<br />

expenses.<br />

Before arriving at a number, take a closer<br />

look at the questions you need to ask<br />

yourself before selecting an optimum<br />

insurance plan.<br />

How much money does your family need<br />

in a month to live comfortably or<br />

maintain their present lifestyle?<br />

This is largely based on the number of<br />

dependents at home. More the number of<br />

dependants, higher is the cover required.<br />

How long will it take before your eldest<br />

child starts earning?<br />

The younger your kids are, higher will be<br />

the required policy cover.<br />

How risk prone is your lifestyle?<br />

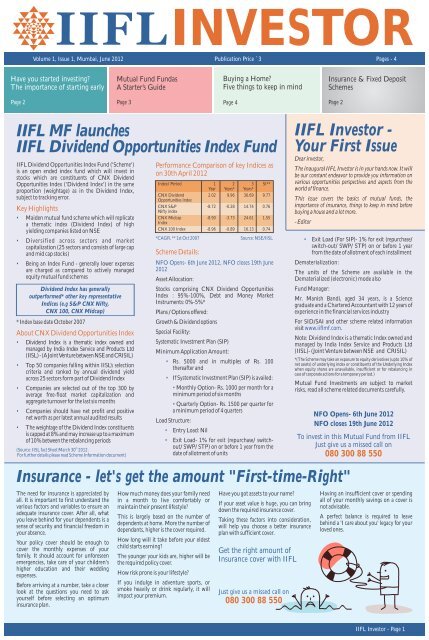

Performance Comparison of key Indices as<br />

on 30th April 2012<br />

Index/ Period 1 2 3 SI**<br />

Year Years* Years*<br />

CNX Dividend<br />

Opportunities Index<br />

CNX S&P<br />

2.02<br />

-8.72<br />

9.96<br />

-0.28<br />

30.69<br />

14.74<br />

9.77<br />

0.76<br />

Nifty index<br />

CNX Midcap -8.90 -3.73 24.61 1.55<br />

Index<br />

CNX 100 Index -8.96 -0.89 16.13 0.74<br />

*CAGR, ** 1st Oct 2007<br />

Scheme Details:<br />

If you indulge in adventure sports, or<br />

smoke heavily or drink regularly, it will<br />

impact your premium.<br />

Source: NSE/IISL<br />

NFO Opens- 6th June 2012, NFO closes 19th June<br />

2012<br />

Asset Allocation:<br />

Stocks comprising CNX Dividend Opportunities<br />

Index : 95%-100%, Debt and Money Market<br />

Instruments: 0%-5%*<br />

Plans / Options offered:<br />

Growth & Dividend options<br />

Special Facility:<br />

Systematic Investment Plan (SIP)<br />

Minimum Application Amount:<br />

• Rs. 5000 and in multiples of Rs. 100<br />

thereafter and<br />

• If Systematic Investment Plan (SIP) is availed:<br />

• Monthly Option- Rs. 1000 per month for a<br />

minimum period of six months<br />

• Quarterly Option- Rs. 1500 per quarter for<br />

a minimum period of 4 quarters<br />

Load Structure:<br />

• Entry Load: Nil<br />

• Exit Load- 1% for exit (repurchase/ switchout/<br />

SWP/ STP) on or before 1 year from the<br />

date of allotment of units<br />

Have you got assets to your name?<br />

Get the right amount of<br />

Insurance cover with <strong>IIFL</strong><br />

Just give us a missed call on<br />

080 300 88 550<br />

The inaugural <strong>IIFL</strong> <strong>Investor</strong> is in your hands now. It will<br />

be our constant endeavor to provide you information on<br />

various opportunities perspectives and aspects from the<br />

world of finance.<br />

This issue covers the basics of mutual funds, the<br />

importance of insurance, things to keep in mind before<br />

buying a house and a lot more.<br />

- Editor<br />

If your asset value is huge, you can bring<br />

down the required insurance cover.<br />

Taking these factors into consideration,<br />

will help you choose a better insurance<br />

plan with sufficient cover.<br />

• Exit Load (For SIP)- 1% for exit (repurchase/<br />

switch-out/ SWP/ STP) on or before 1 year<br />

from the date of allotment of each installment<br />

Dematerialization:<br />

The units of the Scheme are available in the<br />

Dematerialized (electronic) mode also<br />

Fund Manager:<br />

Mr. Manish Bandi, aged 34 years, is a Science<br />

graduate and a Chartered Accountant with 12 years of<br />

experience in the financial services industry<br />

For SID/SAI and other scheme related information<br />

visit www.iiflmf.com.<br />

Note: Dividend Index is a thematic Index owned and<br />

managed by <strong>India</strong> Index Service and Products Ltd<br />

(IISL)- (Joint Venture between NSE and CRISIL)<br />

*(The Scheme may take an exposure to equity derivatives (upto 10% of<br />

net assets) of underlying index or constituents of the Underlying Index<br />

when equity shares are unavailable, insufficient or for rebalancing in<br />

case of corporate actions for a temporary period.)<br />

Mutual Fund Investments are subject to market<br />

risks, read all scheme related documents carefully.<br />

NFO Opens- 6th June 2012<br />

NFO closes 19th June 2012<br />

To invest in this Mutual Fund from <strong>IIFL</strong><br />

Just give us a missed call on<br />

080 300 88 550<br />

Having an insufficient cover or spending<br />

all of your monthly savings on a cover is<br />

not advisable.<br />

A perfect balance is required to leave<br />

behind a 'I care about you' legacy for your<br />

loved ones.<br />

<strong>IIFL</strong> <strong>Investor</strong> - Page 1

INVESTOR<br />

June 2012<br />

Insurance Recommendations<br />

Sampoorn Samridhi (HDFC Life)<br />

Choices of Life: Two unique options for getting policy benefits<br />

a. Endowment + whole life: Here customers get Sum assured and all<br />

bonuses at the end of the term and life cover till 99 years.<br />

b. Enhanced cash option: Customer gets additional bonus or Enhanced<br />

Terminal Bonus with sum assured and other bonuses.<br />

• Inbuilt double sum assured on accidental death.<br />

Additional Bonus Benefits:<br />

• 4 different types of bonuses:<br />

a. Revisionary Bonus b. Terminal Bonus<br />

c. Interim Bonus d. Enhanced Terminal Bonus.<br />

Ease of Payment:<br />

Select term of policy from 5- 40 years as per your financial requirement.<br />

Tax benefits:<br />

Avail tax benefits on premiums paid and benefits received under the policy, as<br />

per the prevailing Income Tax laws.<br />

Guaranteed Savings Insurance Plan<br />

(ICICI Prudential)<br />

Ease of Payment:<br />

<strong>Limited</strong> premium payment term, longer term of life cover.<br />

Guaranteed Benefits:<br />

• Guaranteed life cover of 10 times of premium<br />

• Guaranteed sum assured of 7 times of premium at the maturity<br />

• Guaranteed regular additions (RA) is based on the G-sec rates. RA would<br />

be 50% of the G-sec rate<br />

Additional Benefits:<br />

• Maturity addition paid at the end of the term as a loyalty addition<br />

• All addition is paid as percentage of sum assured and not premium paid<br />

Tax Benefits:<br />

Avail tax benefits on premiums paid and benefits received under the policy, as<br />

per the prevailing Income Tax laws.<br />

FD Recommendations<br />

Mahindra <strong>Finance</strong> <strong>Limited</strong> - CRISIL AA+/FAAA/STABLE<br />

Minimum Amount: `10000 and in multiple of `1000 thereafter (Cumulative).<br />

Remarks: 0.25% extra for Sr. Citizen above 60 years/Employee. Renewal only<br />

principal amount. Interest Compounded Annually.<br />

Interest Rates (%):<br />

Highlights:<br />

• The Crisil rating FAAA indicates a high level of safety<br />

• Cumulative as well as non cumulative options are available<br />

Unitech <strong>Limited</strong><br />

Minimum Amount `25000 & in multiple of `1000 thereafter.<br />

Remarks: In Cumulative option, interest compounded monthly on deposits<br />

of one year or more and payable on maturity.<br />

Highlights:<br />

• Fastest Growing in its segment with over 100,000 investors<br />

• Current Mobilization of approx. `600 Cr<br />

• Tie-up with most Credible National Distributors' - PAN <strong>India</strong><br />

DHFL - Ashray Deposit (400 Days) - CARE (AA+) & BWR (FAAA)<br />

Minimum Amount `10000 & in multiple of `1000 thereafter.<br />

Remarks: 0.50% extra for Privilege Depositors (Sr. Citizens above 60 yrs,<br />

DHFL Shareholders, DHFL H.L Customers, Armed forces Personnel &<br />

Widows), 0.25% extra on single application deposit 25 Lacs and above.<br />

Interest Compounded Half Yearly.<br />

Highlights:<br />

• Safe, Secure Earnings for Short term investment<br />

• Liquid investment<br />

• Prompt / Timely ECS payment facility for Interest payments<br />

Interest Rates (%)<br />

6 M 1 YR 2YR 3 YR 4 YR 5YR<br />

Mahindra <strong>Finance</strong> Ltd. 10.00 9.5 10.25 10.5 10 10<br />

Unitech <strong>Limited</strong> 11.5 11.5 12 12.5 - -<br />

Ashray Deposit (400 Days) 400 Days Cumulative 10.75<br />

Have you started investing?<br />

The Importance of starting Early<br />

If you start investing early in life, you are<br />

bound to reap rich rewards in the long run.<br />

Take the case of two youngsters who start<br />

working at the age of 20.<br />

Case 1 (Vijay)<br />

Vijay understands the importance of<br />

investing early. He spends less money on<br />

entertainment and makes sure that he is<br />

investing `50,000 every year.<br />

Assume that Vijay gets 10% return on his<br />

investment every year. At the end of 10<br />

years, he gets `7.96 lakh. However, due to<br />

some financial responsibilities in his family,<br />

Vijay is unable to save money now and<br />

whatever he earns is used for household<br />

expenses. But, he keeps his accumulated of<br />

`7.96 lakh as a fixed deposit in a bank at<br />

10% interest rate till he is 65 years old. Vijay<br />

does not make any fresh investment. But<br />

interest keeps on accumulating on `7.96<br />

Start investing Now!<br />

Just give us a missed call on<br />

080 300 88 550<br />

lakh till 35 years. Thus, when he is 65, he<br />

gets `2.23 crore.<br />

Case 2 (Ajay)<br />

Ajay spends a lot of money and doesn't<br />

believe in investing early. He starts investing<br />

after 15 years when he is 35 years old and<br />

invests for next 30 years. He regularly<br />

invests `50,000 each year till he is 65.<br />

Assume that Ajay also gets a return of 10%<br />

per year. So at the age of 65, he gets a<br />

maturity amount of `82.24 lakh. Vijay<br />

makes regular investment for only 10 years<br />

but Ajay invests regularly for 30 years—20<br />

years more than Vijay. But, Ajay gets `1.41<br />

crore less than Vijay. This is almost 63%<br />

less.<br />

Thus, one needs to start investing as soon as<br />

he/she starts earning. The power of<br />

c o m p o u n d i n g i n c reases returns<br />

exponentially as time passes. What most<br />

people argue is that, they will earn lots of<br />

money later on in their lives but this is not<br />

true. The truth is that, even if you invest<br />

very small amount of money early in your<br />

life in an asset which gives you returns<br />

higher than the inflation, than over the time<br />

your this small amount will multiply into a<br />

big number.<br />

<strong>IIFL</strong> <strong>Investor</strong> - Page 2

INVESTOR<br />

June 2012<br />

Mutual Funds<br />

Top Five Recommendations<br />

Understanding the importance of early investing<br />

Franklin <strong>India</strong> Bluechip (NAV 196.91)<br />

The fund has consistently outperformed its benchmark (BSE<br />

Sensex) and the peer group average in the last 5 years. It has more<br />

than 85% of its holding in large caps and has one of the lowest<br />

expense ratios (1.81) in its category.<br />

This fund is particularly suitable to investors who wish to take<br />

limited risk and generate modest returns.<br />

ICICI Pru Dynamic (NAV 99.97)<br />

This fund aims at providing capital appreciation through<br />

investment in equity and related instruments and for defensive<br />

consideration in debt/money market instruments and<br />

derivatives.<br />

It has consistently outperformed its benchmark (S&P CNX<br />

Nifty) and its peer group average since inception. The fund has<br />

given the highest returns of ~27% CAGR in its category since<br />

inception.<br />

UTI Opportunities (NAV 26.76)<br />

In the last 3 years, this fund has emerged as one of the top 5<br />

funds in its category. About 96.23% of its investments are in<br />

large caps making it one of the safer bets.<br />

Besides, the fund has consistently outperformed its benchmark<br />

and peer group average since inception. In the last three years, it<br />

has given annualized returns of 13.7% as compared to its<br />

category returns of 8% for the same time period.<br />

HDFC Mid-cap Opportunities (NAV 15.48)<br />

The scheme has been ranked 1 in the Small & Mid-cap category<br />

by CRISIL. With CNX Midcap as its benchmark, the fund has<br />

been an outperformer since inception.<br />

For the last 3 years, it has given annualised returns of ~22% vs.<br />

its category returns of ~13% for the same time period.<br />

IDFC Premier Equity (NAV 32.19)<br />

With one of the highest fund sizes of Rs.2560 crores (as on<br />

March'12) in its category; the fund has given its investors<br />

annualized returns of ~20% since its launch in 2005.<br />

Even in the 3 year time frame, the fund has significantly<br />

outperformed its benchmark with returns of ~20% CAGR as<br />

compared to its category returns of ~13% CAGR over the<br />

same time period.<br />

Source: ACE MF<br />

NAVs & Returns are as on May 27, 2012<br />

Mutual Fund Investments are subject to market risks, read all<br />

scheme related documents carefully.<br />

Mutual Fund Fundas<br />

A Starter’s Guide<br />

A mutual fund is a company that pools money<br />

from many investors and invests the money in<br />

stocks, bonds, short-term money-market<br />

instruments, other securities or assets, or some<br />

combination of these investments.<br />

Returns from a Mutual Fund encompass the<br />

following:<br />

• Dividend/ Interest income: The fund may<br />

choose to distribute its surplus income in the<br />

form of dividend (for Equity funds) or<br />

interest (for debt funds)<br />

• Capital Gain: If the value of the Mutual Fund<br />

units increase, the investor witnesses an increase<br />

in his capital invested which is termed as<br />

“capital gain”<br />

Mutual Fund Terminologies<br />

• NFO (New Fund Offer) - Mutual Fund<br />

companies launch new funds in the market<br />

for the first time and offer the general public<br />

to subscribe to the same<br />

• NAV (Net Asset Value) - This denotes the<br />

fund's price per share value and is calculated<br />

by dividing the total value of all assets in the<br />

portfolio less liabilities, by the number of<br />

units (fund shares) outstanding<br />

• Exit Load - This is the charge levied by the<br />

Mutual Fund if the investor chooses to exit<br />

the scheme before a stipulated time period,<br />

<strong>Investor</strong> Calendar<br />

in most cases 6 months to 1 year. The exit load is<br />

mostly around 1% of the NAV<br />

• Expense Ratio - The ongoing expenses of a fund<br />

are represented by the expense ratio. It is the fee<br />

that Mutual Fund companies subtract from<br />

your investments each year for their service. The<br />

higher the expense ratio, higher the impact on<br />

your returns from investment<br />

Did you Know?<br />

The mutual fund industry in <strong>India</strong> started in<br />

1963 with the formation of Unit Trust of <strong>India</strong><br />

(UTI) and Reserve Bank of <strong>India</strong> (RBI). In 1978,<br />

UTI was de-linked from the RBI and the<br />

Industrial Development Bank of <strong>India</strong> (IDBI)<br />

took over the regulatory and administrative<br />

control in place of RBI. The first scheme<br />

launched by UTI was Unit Scheme 1964.<br />

To invest in Mutual Funds<br />

Just give us a missed call on<br />

080 300 88 550<br />

Scheme Name Category Type Open Close<br />

Canara Robeco Gold Savings Gold: Funds Open-end 04-Jun 18-Jun<br />

<strong>IIFL</strong> Dividend Opportunities Index Fund Equity Fund Open-end 06-Jun 19-Jun<br />

DWS Hybrid FTF Series 7 Hybrid: Debt-oriented Conservative Closed-end 13-Jun 27-Jun<br />

Union KBC Asset Allocation Moderate Hybrid: Others Open-end 04-Jun 18-Jun<br />

IDFC FMP 366 Days Series 80 Debt Closed-end 08-Jun 11-Jun<br />

IDFC FMP 90 Days Series 78 Debt Closed-end 08-Jun 12-Jun<br />

IDFC FMP 90 Days Series 79 Debt Closed-end 19-Jun 21-Jun<br />

HDFC FMP 90D June 2012 (2) Debt Closed-end 08-Jun 13-Jun<br />

HDFC FMP 372D June 2012 (3) Debt Closed-end 13-Jun 18-Jun<br />

HDFC FMP 92D June 2012 (1) Debt Closed-end 15-Jun 20-Jun<br />

Start investing now and secure a bright future for your family.<br />

Choose <strong>IIFL</strong> as your partner for investing in Mutual Funds,<br />

Fixed Deposits and Life Insurance<br />

Just give us a missed call on 080 300 88 550<br />

<strong>IIFL</strong> <strong>Investor</strong> - Page 3

INVESTOR<br />

Buying a Home? Perhaps<br />

your life's biggest Investment<br />

5 things to keep in mind<br />

Purchasing an apartment is a lifetime<br />

investment. Besides the space, style and<br />

location a host of issues have to be<br />

considered. The utmost question initially<br />

may be ‘Will this place ever feel like<br />

home?’ Listed below are a few aspects you<br />

need to take a closer look at before making<br />

your most expensive purchase:<br />

1. Planning <strong>Finance</strong>: The first factor is<br />

the cost. Here, we are talking of a<br />

lifelong investment (a good number of<br />

your working years) and so the thought<br />

process becomes even more vital.<br />

Before you start scouting for your<br />

home or the place you wish to settle,<br />

you must spend time first on planning<br />

your finance.<br />

3. Clearing doubts: Questions may keep<br />

popping up when you plan to buy a<br />

home. All doubts regarding amenities,<br />

facilities and loans need to be cleared<br />

before making any payment.<br />

4. Managing papers: When it is written it<br />

speaks. You must have valid papers<br />

thoroughly signed by the concerned<br />

person before you make the full<br />

payment for your home. When you<br />

have all the legal documents in your<br />

hand your property is safe and secured.<br />

5. Taking help from a trusted service<br />

provider: It is a tedious job to find out<br />

every little thing related to real estate<br />

but you can't even let it go as a huge<br />

amount will be involved.<br />

<strong>IIFL</strong> also offers<br />

Loans Against Property<br />

June 2012<br />

Home Loans<br />

Healthcare Equipment <strong>Finance</strong><br />

2. Understanding market condition: At<br />

times, the market offers relatively<br />

lower prices and you never know when<br />

it turns around and shoots up. So<br />

conduct proper research, analyze the<br />

information you get and take a call on<br />

whether it is indeed the right time for<br />

investing in real estate. If you need a<br />

house for staying, it will be a different<br />

ball game.<br />

What you can do is take guidance from<br />

an expert. Some companies provide<br />

valuable guidance from the site visit to<br />

the deal confirmation.<br />

www.iiflpropertysolutions.com is one<br />

such company. Its well trained and well<br />

informed professionals make it a point<br />

to provide multiple offers that suit<br />

your requirements and budget.<br />

Loans Against Gold Jewellery<br />

To know more, Just give us a missed call on<br />

080 300 88 550<br />

Our Touch-points<br />

Central Zone<br />

Chattisgarh<br />

Bhilai 0788-4010704<br />

Durg 0788-4033005<br />

Gujarat<br />

Ahmedabad 079-40271866/67<br />

Anand 02692-267840/41<br />

Ankleshwar 9228004017<br />

Baroda 0265-6619526<br />

Bharuch 9228014684/85<br />

Bhavnagar 0278-2783003156<br />

Bhuj 02832-220041/42<br />

Bilimora 9228014687<br />

Gandhidham 02836-229015/16<br />

Godhara 9228014688<br />

Himmatnagar 9228011059/60<br />

Jamnagar 0288-3921273/74<br />

Junagadh 0285-3021535/36<br />

Mehsana 02762-233052<br />

Nadiad 0268-2550508<br />

Navsari 9228014532/33<br />

Palanpur 9228004070/78<br />

Porbandar 9228004091/93<br />

Rajkot 281-6198364<br />

Rajpipla 9228088206<br />

Surat 9228013242/43<br />

Surendranagar 9228011042/43<br />

Unjha 0267-255550<br />

Valsad 9228032904/05<br />

Vapi 9228011040<br />

Madhya Pradesh<br />

Bhopal 0755-4041707<br />

Bilaspur 07751-400996<br />

Gwalior 0751-4007540<br />

Indore 0731-4282128<br />

Jabalpur 0761-4040812<br />

Raipur 0771-4262431<br />

Dewas 07272-252566<br />

Ratlam 07412-400330<br />

Sagar 07582-400782<br />

Ujjain 0734-4218182<br />

East Zone<br />

Assam<br />

Guwahati 0361-2466627<br />

Bihar<br />

Patna 9234462094<br />

Jharkhand<br />

Jamshedpur 0657-2290076<br />

Ranchi 0651-2530306<br />

Orissa<br />

Balasore 06782-264815<br />

Berhampur 0680-2223327<br />

Bhadrak 06784-241039<br />

Bhubaneswar 0674-2531993<br />

Cuttack 0671-2312333<br />

Jagatsinghpur 6724220381<br />

Jajpur 06726-222489<br />

Kendrapada 06727-221667<br />

Khurda 0674-2490570<br />

Nayagarh 06753-252530<br />

Puri 06752- 220755<br />

Raghunathpur 6724267038<br />

Tripura<br />

Agartala 0361-2737923<br />

West Bengal<br />

Durgapur 033-44053515<br />

Kolkata 033-44059007<br />

North Zone<br />

Delhi<br />

Delhi Dwarika 011-43573171<br />

Delhi Karol Bagh 011-25754693/90<br />

Delhi Mayur Vihar 011-22756173<br />

Delhi Munirka 011-26177833<br />

Delhi Preet Vihar 011-43602385<br />

Delhi Rohini 011-27044003/15<br />

Haryana<br />

Hisar 01662-234067/70<br />

Karnal 0184-4021330/31<br />

Panipat 0180-2644008<br />

Rohtak 01262-245004/05<br />

Sonipat 0130-2215101/02<br />

Punjab<br />

Ambala 0171-2551477<br />

Amritsar 0183-2211255<br />

Chandigarh 0172-4655024/25<br />

Jalandhar 0181-4601542<br />

Ludhiana 0161-4567831<br />

Patiala 0175-2307770<br />

Rajasthan<br />

Ajmer 0145-2633756<br />

Alwar 01462-250260<br />

Bikaner 0151-2200682<br />

Jaipur 0141-2786738<br />

Jodhpur 0291-2761067<br />

Kota 0744-2390642<br />

Sriganganagar 0154-2477625<br />

Udaipur 0294-2415446<br />

Uttar Pradesh<br />

Agra 0562-4021514/15<br />

Barelly 0581-2511759/60<br />

Kanpur 0512-6060041<br />

Lucknow 0522-6060016<br />

Meerut 0121-4009124/25<br />

Moradabad 0591-2415300/30<br />

Uttarakhand<br />

Dehradun 0135-2623990/91<br />

Haldwani 05946-220316/17<br />

Haridwar 01334-250096/97<br />

South Zone<br />

Andhra Pradesh<br />

Ananthapur 08554-220169<br />

Hyderabad 040-44889680<br />

Kurnool 08518-225103<br />

Prakasam 08598-221141/42<br />

Rajamandary 0883-2473725<br />

Tirupathi 0877-2228061/62<br />

Vijaywada 0866-2453788<br />

Vizag 0891-2515755<br />

Karnataka<br />

Bangalore 080-42618100<br />

Mysore 0821-4190426<br />

Shimoga 08182-220482<br />

Tumkur 0816-4014906<br />

Kerala<br />

Calicut 093496 45282<br />

Cochin 0484-2236546<br />

Kayamkulam 0479-2444505<br />

Kottayam 0481-2572686<br />

Palakkad 0491-3247888<br />

Tamil Nadu<br />

Chennai 044-43982570<br />

Coimbatore 0422-4366579<br />

Madurai 0452-4385861<br />

Nagercoil 0465-2228144<br />

Salem 0427-4043117/18<br />

Tirunelveli 0462-2578009<br />

Trichy 0431-4023071<br />

West Zone<br />

Mumbai<br />

Central 0251-2400610<br />

Navi Mumbai 022-39169453<br />

Western 022-26772212<br />

Rest of Maharashtra<br />

Aurangabad 0240-2355125<br />

Kolhapur 0231-2526591/ 92<br />

Nagpur 0712-2533033<br />

Nasik 0253-3021096<br />

Panaji 0832-2223579/80<br />

Pune 020-25538006/07<br />

Contact Us<br />

Email: iiflinvestor@indiainfoline.com<br />

Just give us a missed call at 080 300 88 550<br />

Printed & Published by: Anil N. Mascarenhas on<br />

behalf of <strong>India</strong> <strong>Infoline</strong> <strong>Limited</strong> and printed at<br />

Creative Printers, 91, Modi Street, Mapla House, 1st<br />

Floor, Fort, Mumbai - 400 001.<br />

Published from <strong>IIFL</strong> Center, Kamala City, Senapati<br />

Bapat Marg, Lower Parel, Mumbai - 400 013.<br />

Editor: Anil N. Mascarenhas<br />

To,<br />

Disclaimer - Investment in financial instruments carry market risk. We do not assure or guarantee, in any manner whatsoever, timely payment/ repayment of<br />

your investment and income thereon. While we have taken care to obtain information from authentic sources, we are not responsible for any errors/ omissions<br />

in the newsletter. You are requested to kindly obtain all necessary information before choosing your investment. Our offer of incentives is in accordance<br />

with the normal practice in this industry and shall not be construed as inducement to invest in any particular company or scheme.<br />

From: <strong>IIFL</strong> <strong>Investor</strong>, <strong>IIFL</strong> Center, Kamala City, Senapati Bapat Marg,<br />

Lower Parel, Mumbai - 400 013.<br />

<strong>IIFL</strong> <strong>Investor</strong> - Page 4