IIFL Investor - India Infoline Finance Limited

IIFL Investor - India Infoline Finance Limited

IIFL Investor - India Infoline Finance Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INVESTOR<br />

June 2012<br />

Insurance Recommendations<br />

Sampoorn Samridhi (HDFC Life)<br />

Choices of Life: Two unique options for getting policy benefits<br />

a. Endowment + whole life: Here customers get Sum assured and all<br />

bonuses at the end of the term and life cover till 99 years.<br />

b. Enhanced cash option: Customer gets additional bonus or Enhanced<br />

Terminal Bonus with sum assured and other bonuses.<br />

• Inbuilt double sum assured on accidental death.<br />

Additional Bonus Benefits:<br />

• 4 different types of bonuses:<br />

a. Revisionary Bonus b. Terminal Bonus<br />

c. Interim Bonus d. Enhanced Terminal Bonus.<br />

Ease of Payment:<br />

Select term of policy from 5- 40 years as per your financial requirement.<br />

Tax benefits:<br />

Avail tax benefits on premiums paid and benefits received under the policy, as<br />

per the prevailing Income Tax laws.<br />

Guaranteed Savings Insurance Plan<br />

(ICICI Prudential)<br />

Ease of Payment:<br />

<strong>Limited</strong> premium payment term, longer term of life cover.<br />

Guaranteed Benefits:<br />

• Guaranteed life cover of 10 times of premium<br />

• Guaranteed sum assured of 7 times of premium at the maturity<br />

• Guaranteed regular additions (RA) is based on the G-sec rates. RA would<br />

be 50% of the G-sec rate<br />

Additional Benefits:<br />

• Maturity addition paid at the end of the term as a loyalty addition<br />

• All addition is paid as percentage of sum assured and not premium paid<br />

Tax Benefits:<br />

Avail tax benefits on premiums paid and benefits received under the policy, as<br />

per the prevailing Income Tax laws.<br />

FD Recommendations<br />

Mahindra <strong>Finance</strong> <strong>Limited</strong> - CRISIL AA+/FAAA/STABLE<br />

Minimum Amount: `10000 and in multiple of `1000 thereafter (Cumulative).<br />

Remarks: 0.25% extra for Sr. Citizen above 60 years/Employee. Renewal only<br />

principal amount. Interest Compounded Annually.<br />

Interest Rates (%):<br />

Highlights:<br />

• The Crisil rating FAAA indicates a high level of safety<br />

• Cumulative as well as non cumulative options are available<br />

Unitech <strong>Limited</strong><br />

Minimum Amount `25000 & in multiple of `1000 thereafter.<br />

Remarks: In Cumulative option, interest compounded monthly on deposits<br />

of one year or more and payable on maturity.<br />

Highlights:<br />

• Fastest Growing in its segment with over 100,000 investors<br />

• Current Mobilization of approx. `600 Cr<br />

• Tie-up with most Credible National Distributors' - PAN <strong>India</strong><br />

DHFL - Ashray Deposit (400 Days) - CARE (AA+) & BWR (FAAA)<br />

Minimum Amount `10000 & in multiple of `1000 thereafter.<br />

Remarks: 0.50% extra for Privilege Depositors (Sr. Citizens above 60 yrs,<br />

DHFL Shareholders, DHFL H.L Customers, Armed forces Personnel &<br />

Widows), 0.25% extra on single application deposit 25 Lacs and above.<br />

Interest Compounded Half Yearly.<br />

Highlights:<br />

• Safe, Secure Earnings for Short term investment<br />

• Liquid investment<br />

• Prompt / Timely ECS payment facility for Interest payments<br />

Interest Rates (%)<br />

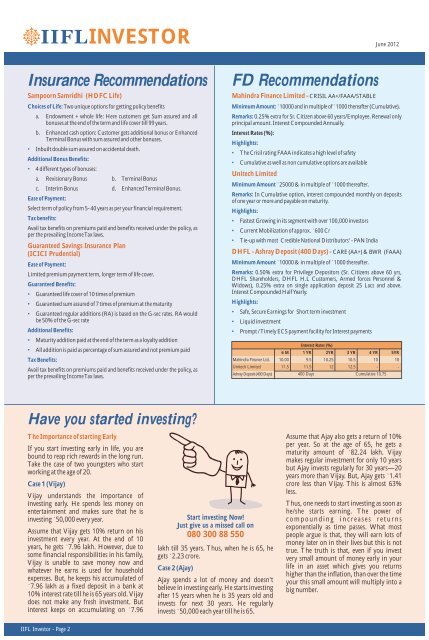

6 M 1 YR 2YR 3 YR 4 YR 5YR<br />

Mahindra <strong>Finance</strong> Ltd. 10.00 9.5 10.25 10.5 10 10<br />

Unitech <strong>Limited</strong> 11.5 11.5 12 12.5 - -<br />

Ashray Deposit (400 Days) 400 Days Cumulative 10.75<br />

Have you started investing?<br />

The Importance of starting Early<br />

If you start investing early in life, you are<br />

bound to reap rich rewards in the long run.<br />

Take the case of two youngsters who start<br />

working at the age of 20.<br />

Case 1 (Vijay)<br />

Vijay understands the importance of<br />

investing early. He spends less money on<br />

entertainment and makes sure that he is<br />

investing `50,000 every year.<br />

Assume that Vijay gets 10% return on his<br />

investment every year. At the end of 10<br />

years, he gets `7.96 lakh. However, due to<br />

some financial responsibilities in his family,<br />

Vijay is unable to save money now and<br />

whatever he earns is used for household<br />

expenses. But, he keeps his accumulated of<br />

`7.96 lakh as a fixed deposit in a bank at<br />

10% interest rate till he is 65 years old. Vijay<br />

does not make any fresh investment. But<br />

interest keeps on accumulating on `7.96<br />

Start investing Now!<br />

Just give us a missed call on<br />

080 300 88 550<br />

lakh till 35 years. Thus, when he is 65, he<br />

gets `2.23 crore.<br />

Case 2 (Ajay)<br />

Ajay spends a lot of money and doesn't<br />

believe in investing early. He starts investing<br />

after 15 years when he is 35 years old and<br />

invests for next 30 years. He regularly<br />

invests `50,000 each year till he is 65.<br />

Assume that Ajay also gets a return of 10%<br />

per year. So at the age of 65, he gets a<br />

maturity amount of `82.24 lakh. Vijay<br />

makes regular investment for only 10 years<br />

but Ajay invests regularly for 30 years—20<br />

years more than Vijay. But, Ajay gets `1.41<br />

crore less than Vijay. This is almost 63%<br />

less.<br />

Thus, one needs to start investing as soon as<br />

he/she starts earning. The power of<br />

c o m p o u n d i n g i n c reases returns<br />

exponentially as time passes. What most<br />

people argue is that, they will earn lots of<br />

money later on in their lives but this is not<br />

true. The truth is that, even if you invest<br />

very small amount of money early in your<br />

life in an asset which gives you returns<br />

higher than the inflation, than over the time<br />

your this small amount will multiply into a<br />

big number.<br />

<strong>IIFL</strong> <strong>Investor</strong> - Page 2