Download - Link Intime

Download - Link Intime

Download - Link Intime

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

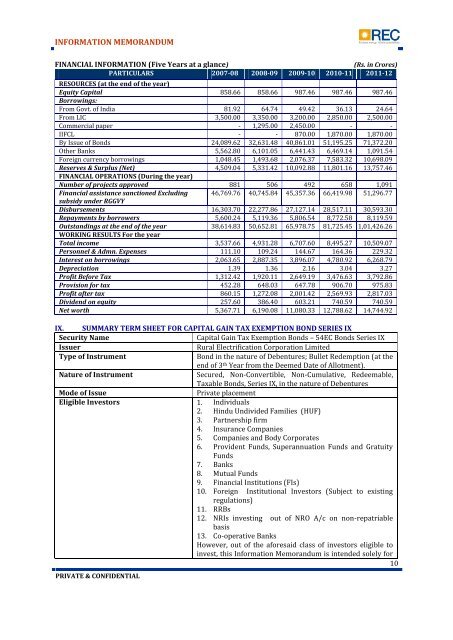

INFORMATION MEMORANDUM<br />

FINANCIAL INFORMATION (Five Years at a glance)<br />

(Rs. in Crores)<br />

PARTICULARS 2007-08 2008-09 2009-10 2010-11 2011-12<br />

RESOURCES (at the end of the year)<br />

Equity Capital 858.66 858.66 987.46 987.46 987.46<br />

Borrowings:<br />

From Govt. of India 81.92 64.74 49.42 36.13 24.64<br />

From LIC 3,500.00 3,350.00 3,200.00 2,850.00 2,500.00<br />

Commercial paper - 1,295.00 2,450.00 - -<br />

IIFCL - - 870.00 1,870.00 1,870.00<br />

By Issue of Bonds 24,089.62 32,631.48 40,861.01 51,195.25 71,372.20<br />

Other Banks 5,562.80 6,101.05 6,441.43 6,469.14 1,091.54<br />

Foreign currency borrowings 1,048.45 1,493.68 2,076.37 7,583.32 10,698.09<br />

Reserves & Surplus (Net) 4,509.04 5,331.42 10,092.88 11,801.16 13,757.46<br />

FINANCIAL OPERATIONS (During the year)<br />

Number of projects approved 881 506 492 658 1,091<br />

Financial assistance sanctioned Excluding 46,769.76 40,745.84 45,357.36 66,419.98 51,296.77<br />

subsidy under RGGVY<br />

Disbursements 16,303.70 22,277.86 27,127.14 28,517.11 30,593.30<br />

Repayments by borrowers 5,600.24 5,119.36 5,806.54 8,772.58 8,119.59<br />

Outstandings at the end of the year 38,614.83 50,652.81 65,978.75 81,725.45 1,01,426.26<br />

WORKING RESULTS For the year<br />

Total income 3,537.66 4,931.28 6,707.60 8,495.27 10,509.07<br />

Personnel & Admn. Expenses 111.10 109.24 144.67 164.36 229.32<br />

Interest on borrowings 2,063.65 2,887.35 3,896.07 4,780.92 6,268.79<br />

Depreciation 1.39 1.36 2.16 3.04 3.27<br />

Profit Before Tax 1,312.42 1,920.11 2,649.19 3,476.63 3,792.86<br />

Provision for tax 452.28 648.03 647.78 906.70 975.83<br />

Profit after tax 860.15 1,272.08 2,001.42 2,569.93 2,817.03<br />

Dividend on equity 257.60 386.40 603.21 740.59 740.59<br />

Net worth 5,367.71 6,190.08 11,080.33 12,788.62 14,744.92<br />

IX. SUMMARY TERM SHEET FOR CAPITAL GAIN TAX EXEMPTION BOND SERIES IX<br />

Security Name<br />

Capital Gain Tax Exemption Bonds – 54EC Bonds Series IX<br />

Issuer<br />

Rural Electrification Corporation Limited<br />

Type of Instrument<br />

Bond in the nature of Debentures; Bullet Redemption (at the<br />

end of 3 th Year from the Deemed Date of Allotment).<br />

Nature of Instrument<br />

Secured, Non-Convertible, Non-Cumulative, Redeemable,<br />

Taxable Bonds, Series IX, in the nature of Debentures<br />

Mode of Issue<br />

Private placement<br />

Eligible Investors 1. Individuals<br />

2. Hindu Undivided Families (HUF)<br />

3. Partnership firm<br />

4. Insurance Companies<br />

5. Companies and Body Corporates<br />

6. Provident Funds, Superannuation Funds and Gratuity<br />

Funds<br />

7. Banks<br />

8. Mutual Funds<br />

9. Financial Institutions (FIs)<br />

10. Foreign Institutional Investors (Subject to existing<br />

regulations)<br />

11. RRBs<br />

12. NRIs investing out of NRO A/c on non-repatriable<br />

basis<br />

13. Co-operative Banks<br />

However, out of the aforesaid class of investors eligible to<br />

invest, this Information Memorandum is intended solely for<br />

10<br />

PRIVATE & CONFIDENTIAL