May 2010 Sales Taxes in Illinois - Illinois General Assembly

May 2010 Sales Taxes in Illinois - Illinois General Assembly

May 2010 Sales Taxes in Illinois - Illinois General Assembly

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

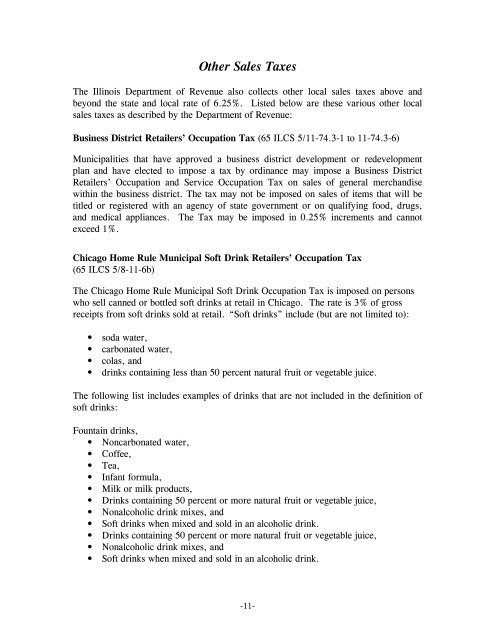

Other <strong>Sales</strong> <strong>Taxes</strong><br />

The Ill<strong>in</strong>ois Department of Revenue also collects other local sales taxes above and<br />

beyond the state and local rate of 6.25%. Listed below are these various other local<br />

sales taxes as described by the Department of Revenue:<br />

Bus<strong>in</strong>ess District Retailers’ Occupation Tax (65 ILCS 5/11-74.3-1 to 11-74.3-6)<br />

Municipalities that have approved a bus<strong>in</strong>ess district development or redevelopment<br />

plan and have elected to impose a tax by ord<strong>in</strong>ance may impose a Bus<strong>in</strong>ess District<br />

Retailers’ Occupation and Service Occupation Tax on sales of general merchandise<br />

with<strong>in</strong> the bus<strong>in</strong>ess district. The tax may not be imposed on sales of items that will be<br />

titled or registered with an agency of state government or on qualify<strong>in</strong>g food, drugs,<br />

and medical appliances. The Tax may be imposed <strong>in</strong> 0.25% <strong>in</strong>crements and cannot<br />

exceed 1%.<br />

Chicago Home Rule Municipal Soft Dr<strong>in</strong>k Retailers’ Occupation Tax<br />

(65 ILCS 5/8-11-6b)<br />

The Chicago Home Rule Municipal Soft Dr<strong>in</strong>k Occupation Tax is imposed on persons<br />

who sell canned or bottled soft dr<strong>in</strong>ks at retail <strong>in</strong> Chicago. The rate is 3% of gross<br />

receipts from soft dr<strong>in</strong>ks sold at retail. “Soft dr<strong>in</strong>ks” <strong>in</strong>clude (but are not limited to):<br />

• soda water,<br />

• carbonated water,<br />

• colas, and<br />

• dr<strong>in</strong>ks conta<strong>in</strong><strong>in</strong>g less than 50 percent natural fruit or vegetable juice.<br />

The follow<strong>in</strong>g list <strong>in</strong>cludes examples of dr<strong>in</strong>ks that are not <strong>in</strong>cluded <strong>in</strong> the def<strong>in</strong>ition of<br />

soft dr<strong>in</strong>ks:<br />

Founta<strong>in</strong> dr<strong>in</strong>ks,<br />

• Noncarbonated water,<br />

• Coffee,<br />

• Tea,<br />

• Infant formula,<br />

• Milk or milk products,<br />

• Dr<strong>in</strong>ks conta<strong>in</strong><strong>in</strong>g 50 percent or more natural fruit or vegetable juice,<br />

• Nonalcoholic dr<strong>in</strong>k mixes, and<br />

• Soft dr<strong>in</strong>ks when mixed and sold <strong>in</strong> an alcoholic dr<strong>in</strong>k.<br />

• Dr<strong>in</strong>ks conta<strong>in</strong><strong>in</strong>g 50 percent or more natural fruit or vegetable juice,<br />

• Nonalcoholic dr<strong>in</strong>k mixes, and<br />

• Soft dr<strong>in</strong>ks when mixed and sold <strong>in</strong> an alcoholic dr<strong>in</strong>k.<br />

-11-