May 2010 Sales Taxes in Illinois - Illinois General Assembly

May 2010 Sales Taxes in Illinois - Illinois General Assembly

May 2010 Sales Taxes in Illinois - Illinois General Assembly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

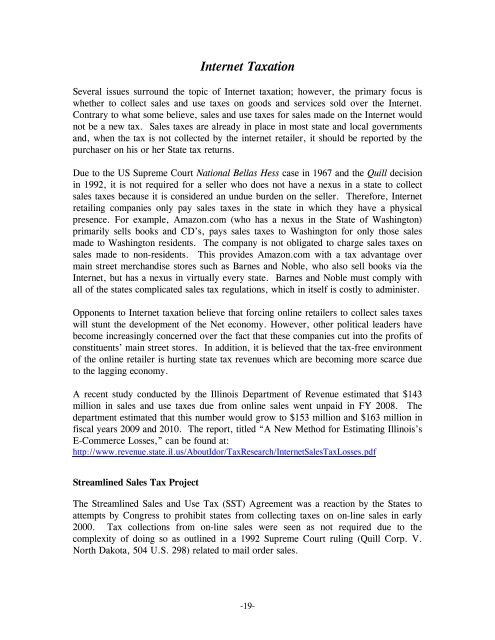

Internet Taxation<br />

Several issues surround the topic of Internet taxation; however, the primary focus is<br />

whether to collect sales and use taxes on goods and services sold over the Internet.<br />

Contrary to what some believe, sales and use taxes for sales made on the Internet would<br />

not be a new tax. <strong>Sales</strong> taxes are already <strong>in</strong> place <strong>in</strong> most state and local governments<br />

and, when the tax is not collected by the <strong>in</strong>ternet retailer, it should be reported by the<br />

purchaser on his or her State tax returns.<br />

Due to the US Supreme Court National Bellas Hess case <strong>in</strong> 1967 and the Quill decision<br />

<strong>in</strong> 1992, it is not required for a seller who does not have a nexus <strong>in</strong> a state to collect<br />

sales taxes because it is considered an undue burden on the seller. Therefore, Internet<br />

retail<strong>in</strong>g companies only pay sales taxes <strong>in</strong> the state <strong>in</strong> which they have a physical<br />

presence. For example, Amazon.com (who has a nexus <strong>in</strong> the State of Wash<strong>in</strong>gton)<br />

primarily sells books and CD’s, pays sales taxes to Wash<strong>in</strong>gton for only those sales<br />

made to Wash<strong>in</strong>gton residents. The company is not obligated to charge sales taxes on<br />

sales made to non-residents. This provides Amazon.com with a tax advantage over<br />

ma<strong>in</strong> street merchandise stores such as Barnes and Noble, who also sell books via the<br />

Internet, but has a nexus <strong>in</strong> virtually every state. Barnes and Noble must comply with<br />

all of the states complicated sales tax regulations, which <strong>in</strong> itself is costly to adm<strong>in</strong>ister.<br />

Opponents to Internet taxation believe that forc<strong>in</strong>g onl<strong>in</strong>e retailers to collect sales taxes<br />

will stunt the development of the Net economy. However, other political leaders have<br />

become <strong>in</strong>creas<strong>in</strong>gly concerned over the fact that these companies cut <strong>in</strong>to the profits of<br />

constituents’ ma<strong>in</strong> street stores. In addition, it is believed that the tax-free environment<br />

of the onl<strong>in</strong>e retailer is hurt<strong>in</strong>g state tax revenues which are becom<strong>in</strong>g more scarce due<br />

to the lagg<strong>in</strong>g economy.<br />

A recent study conducted by the Ill<strong>in</strong>ois Department of Revenue estimated that $143<br />

million <strong>in</strong> sales and use taxes due from onl<strong>in</strong>e sales went unpaid <strong>in</strong> FY 2008. The<br />

department estimated that this number would grow to $153 million and $163 million <strong>in</strong><br />

fiscal years 2009 and <strong>2010</strong>. The report, titled “A New Method for Estimat<strong>in</strong>g Ill<strong>in</strong>ois’s<br />

E-Commerce Losses,” can be found at:<br />

http://www.revenue.state.il.us/AboutIdor/TaxResearch/Internet<strong>Sales</strong>TaxLosses.pdf<br />

Streaml<strong>in</strong>ed <strong>Sales</strong> Tax Project<br />

The Streaml<strong>in</strong>ed <strong>Sales</strong> and Use Tax (SST) Agreement was a reaction by the States to<br />

attempts by Congress to prohibit states from collect<strong>in</strong>g taxes on on-l<strong>in</strong>e sales <strong>in</strong> early<br />

2000. Tax collections from on-l<strong>in</strong>e sales were seen as not required due to the<br />

complexity of do<strong>in</strong>g so as outl<strong>in</strong>ed <strong>in</strong> a 1992 Supreme Court rul<strong>in</strong>g (Quill Corp. V.<br />

North Dakota, 504 U.S. 298) related to mail order sales.<br />

-19-