May 2010 Sales Taxes in Illinois - Illinois General Assembly

May 2010 Sales Taxes in Illinois - Illinois General Assembly

May 2010 Sales Taxes in Illinois - Illinois General Assembly

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Commission on Government<br />

Forecast<strong>in</strong>g and Accountability<br />

COMMISSION CO-CHAIRMEN<br />

Senator Jeffrey M. Schoenberg<br />

Representative Richard P. Myers<br />

SENATE<br />

Senator Bill Brady<br />

Senator Michael Frerichs<br />

Senator Matt Murphy<br />

Senator Dave Syverson<br />

Senator Donne Trotter<br />

HOUSE<br />

Representative Patricia Bellock<br />

Representative Kev<strong>in</strong> McCarthy<br />

Representative Ela<strong>in</strong>e Nekritz<br />

Representative Raymond Poe<br />

Representative Al Riley<br />

EXECUTIVE DIRECTOR<br />

Dan R. Long<br />

DEPUTY DIRECTOR<br />

Trevor J. Clatfelter<br />

REVENUE MANAGER<br />

Jim Musch<strong>in</strong>ske<br />

AUTHOR OF REPORT<br />

Benjam<strong>in</strong> L. Varner<br />

EXECUTIVE SECRETARY<br />

Donna K. Belknap

TABLE OF CONTENTS<br />

<strong>Sales</strong> <strong>Taxes</strong> <strong>in</strong> Ill<strong>in</strong>ois – <strong>May</strong> <strong>2010</strong><br />

PAGE<br />

Executive Summary<br />

i<br />

I. Ill<strong>in</strong>ois <strong>Sales</strong> <strong>Taxes</strong> 1<br />

II. History of <strong>Sales</strong> <strong>Taxes</strong> 2<br />

III. Distribution of Funds 3<br />

IV. Revenues and Projections 5<br />

V. History of Exemptions 7<br />

VI. Comparison of States 9<br />

VII. Other <strong>Sales</strong> <strong>Taxes</strong> 11<br />

VIII. <strong>Sales</strong> Tax Base 15<br />

IX. Internet Taxation 19<br />

X. Flow Chart for <strong>Sales</strong> <strong>Taxes</strong> 23<br />

TABLES:<br />

1 Historical Ill<strong>in</strong>ois <strong>Sales</strong> Tax Rates 2<br />

2 <strong>General</strong> Revenue <strong>Sales</strong> Tax Receipts 5<br />

3 All Appropriated <strong>Sales</strong> Tax Receipts 6<br />

4 Surround<strong>in</strong>g States <strong>Sales</strong> Tax Rates 9<br />

5 2007 State <strong>General</strong> <strong>Sales</strong> Tax Revenue for Surround<strong>in</strong>g States 10<br />

6 County Public Safety <strong>Sales</strong> Tax Rates 14<br />

7 Top Ten Industries by SIC Code 16<br />

8 <strong>Sales</strong> Tax Receipts by Sector 17<br />

9 2009 State <strong>Sales</strong> Tax Receipts by County 18<br />

10 2009 State <strong>Sales</strong> Tax Revenue by Municipality 18<br />

11 Streaml<strong>in</strong>ed <strong>Sales</strong> Tax Project States 22<br />

CHARTS:<br />

1 <strong>Sales</strong> and Use Tax Exemptions 8<br />

2 Ill<strong>in</strong>ois <strong>Sales</strong> Tax Flowchart 24-25<br />

APPENDIX:<br />

1 Ill<strong>in</strong>ois <strong>Sales</strong> Tax Exemptions 26<br />

2 Ill<strong>in</strong>ois <strong>Sales</strong> Tax Exemption Statistics 27<br />

3 <strong>Sales</strong> Tax Rate by State 28<br />

4 State <strong>Sales</strong> Tax Revenue 29<br />

5 Ill<strong>in</strong>ois Home Rule Units 30-33<br />

6 2009 State <strong>Sales</strong> Tax Receipts by County 34-35

EXECUTIVE SUMMARY<br />

<strong>Sales</strong> taxes are a prom<strong>in</strong>ent factor <strong>in</strong> Ill<strong>in</strong>ois’ tax<strong>in</strong>g structure. They are the general<br />

revenue fund’s second largest revenue-generat<strong>in</strong>g source and make up approximately<br />

one quarter of total revenues. <strong>Sales</strong> tax laws with<strong>in</strong> Ill<strong>in</strong>ois as well as throughout the<br />

nation are diverse, and sometimes confus<strong>in</strong>g. The follow<strong>in</strong>g report attempts to provide<br />

basic facts and <strong>in</strong>formation that surround sales tax issues <strong>in</strong> Ill<strong>in</strong>ois. This report builds<br />

on the Commission’s 2001 report, “<strong>Sales</strong> Tax Issues <strong>in</strong> Ill<strong>in</strong>ois” by updat<strong>in</strong>g the<br />

statistics there<strong>in</strong> and expands the analysis to <strong>in</strong>clude an exam<strong>in</strong>ation of the sales tax<br />

base.<br />

• To beg<strong>in</strong>, the report gives def<strong>in</strong>itions for both the sales Use Tax and Occupation<br />

Tax. Also, a sales tax rate, revenue, and exemption history is provided. Ill<strong>in</strong>ois’<br />

sales tax rate has grown from 2% <strong>in</strong> 1933 to the current rate of 6.25% which was<br />

<strong>in</strong>stituted <strong>in</strong> 1990. <strong>Sales</strong> tax revenues are divided between State and local<br />

governments: 80% of the tax goes <strong>in</strong>to the State’s treasury and 20% is directed back<br />

to local municipalities <strong>in</strong> which the sale was made. Local governments also have<br />

the option of <strong>in</strong>stitut<strong>in</strong>g home-rule taxes, which br<strong>in</strong>g additional revenue to their<br />

cities.<br />

• Although general revenue sales taxes have historically grown, fiscal year 2009<br />

yielded a disappo<strong>in</strong>t<strong>in</strong>g figure of $6.77 billion, which was a 6.1% decrease from the<br />

previous year. This was the largest decl<strong>in</strong>e <strong>in</strong> sales tax revenue <strong>in</strong> over 60 years,<br />

though FY <strong>2010</strong> revenues are estimated to decl<strong>in</strong>e even more. These decl<strong>in</strong>es are<br />

associated with the extended recession that began <strong>in</strong> approximately December of<br />

2007. The Commission estimates that the State will see some small growth <strong>in</strong><br />

FY 2011 as the economy beg<strong>in</strong>s to climb out of the recession.<br />

• Total sales tax exemptions were approximately $3.4 billion <strong>in</strong> fiscal year 2008. The<br />

largest exemption be<strong>in</strong>g the Food, Drugs, and Medical Appliance rate reduction<br />

which accounted for $1.4 billion or just over 40% of total exemptions.<br />

• Ill<strong>in</strong>ois has one of the highest sales tax rates <strong>in</strong> the nation. Ill<strong>in</strong>ois was tied for 10 th<br />

highest as of April <strong>2010</strong>. Ill<strong>in</strong>ois also had the 2 nd highest rate when compared to<br />

surround<strong>in</strong>g states. Only Indiana at 7.00% had a higher rate.<br />

• There are numerous other local sales taxes <strong>in</strong> Ill<strong>in</strong>ois <strong>in</strong>clud<strong>in</strong>g Bus<strong>in</strong>ess District<br />

taxes, County Motor Fuel taxes, Home Rule and Non-home rule taxes, Mass<br />

Transit District taxes, County Public Safety taxes, among others.<br />

• The Ill<strong>in</strong>ois sales tax was designed to primarily tax real property. The largest<br />

amount of sales tax revenue comes from the Automotive and Fill<strong>in</strong>g Station sector<br />

of the economy which provides just below 21% of total sales tax revenue. This<br />

-i-

• The majority of the sales tax base is located with<strong>in</strong> Cook and the Collar Counties<br />

with pockets of sales tax revenue com<strong>in</strong>g from the larger downstate cities.<br />

• The Internet has greatly affected virtually all facets of economic activity, <strong>in</strong>clud<strong>in</strong>g<br />

states’ sales tax revenues. Currently, onl<strong>in</strong>e retailers are subject to Ill<strong>in</strong>ois sales<br />

taxes if they have a nexus with<strong>in</strong> the State. The Department of Revenue estimated<br />

that over $143 million of sales taxes related to onl<strong>in</strong>e commerce went unpaid <strong>in</strong><br />

FY 2008. The department estimated that this number would grow to $153 million<br />

and $163 million <strong>in</strong> fiscal years 2009 and <strong>2010</strong><br />

• Another important issue that will have an impact on sales taxation is the Streaml<strong>in</strong>ed<br />

<strong>Sales</strong> Tax Project (SSTP). The SSTP is an effort by states to simplify and<br />

modernize sales and use tax collection and adm<strong>in</strong>istration. The goal of the Project<br />

is to substantially reduce or elim<strong>in</strong>ate the costs and burdens of sales tax compliance<br />

for bus<strong>in</strong>esses via a comb<strong>in</strong>ation of simplified laws and adm<strong>in</strong>istrative policies.<br />

• F<strong>in</strong>ally, a sales tax flowchart has been developed <strong>in</strong> order to depict the <strong>in</strong>tricacies of<br />

Ill<strong>in</strong>ois sales taxation. Several decisions and many steps are <strong>in</strong>volved <strong>in</strong> order to<br />

determ<strong>in</strong>e what the end sales tax will be for a consumer.<br />

-ii-

Ill<strong>in</strong>ois <strong>Sales</strong> <strong>Taxes</strong><br />

A sales tax is a levy placed on a good or service when it is purchased from a company<br />

that has a physical presence (or “nexus”) <strong>in</strong> the same state as the consumer. When a<br />

consumer buys a good or service from a retailer that is outside of his or her state, they<br />

pay a use tax. Ill<strong>in</strong>ois is one of 45 states (plus the District of Columbia) <strong>in</strong> the nation<br />

that requires its residents to pay sales taxes when purchas<strong>in</strong>g retail merchandise. If the<br />

seller does not charge Ill<strong>in</strong>ois <strong>Sales</strong> Tax, the purchaser owes the tax directly to the<br />

Department.<br />

Ill<strong>in</strong>ois sales taxes are actually derived from four different tax acts; the Retailers’<br />

Occupation Tax (ROT) and its complement the Use Tax (UT), the Service Occupation<br />

Tax (SOT) and its complement the Service Use Tax (SUT).<br />

The Retailers’ Occupation Tax is generally referred to as the sales tax. The tax is<br />

imposed on Ill<strong>in</strong>ois retailers on the gross receipts from sales of tangible personal<br />

property. Ill<strong>in</strong>ois retailers forward the collected Retailers’ Occupation Tax to the<br />

Department of Revenue for deposit <strong>in</strong>to the State’s Treasury. The ROT’s partner, the<br />

Use Tax, applies to Ill<strong>in</strong>ois purchasers who buy property out of state at a lower tax rate<br />

or from a vendor who does not have a physical nexus with<strong>in</strong> the State. The difference<br />

between the lower tax rate and Ill<strong>in</strong>ois’ sales tax rate must be forwarded to the<br />

Department of Revenue as a Use Tax. The purpose of the Use Tax is to protect <strong>in</strong>-state<br />

retailers from competition from out-of-state retailers who may not be subject to the<br />

Retailers’ Occupation Tax.<br />

The Service Occupation Tax is imposed on service providers when tangible personal<br />

property is transferred with<strong>in</strong> the course of perform<strong>in</strong>g a service. The tax is measured<br />

by the sell<strong>in</strong>g price of the tangible personal property transferred as an <strong>in</strong>cident to the<br />

sale of the service. Likewise, the Service Use Tax is also imposed upon the purchaser<br />

for the privilege of us<strong>in</strong>g property that was acquired <strong>in</strong>cident to the purchase of a<br />

service. However, this tax would apply when a purchaser obta<strong>in</strong>s property from an<br />

out-of-state service provider who does not have a “nexus” with<strong>in</strong> the State and is not<br />

obligated to collect Ill<strong>in</strong>ois sales taxes.<br />

-1-

History of <strong>Sales</strong> <strong>Taxes</strong><br />

State sales taxes orig<strong>in</strong>ated dur<strong>in</strong>g the Great Depression, when the ma<strong>in</strong> source of<br />

revenue for state and local governments, property taxes, collapsed with property<br />

values. In 1930, twenty-three states began us<strong>in</strong>g the sales tax as an additional revenue<br />

source. Due to problems with our own State budget, Ill<strong>in</strong>ois adopted a “temporary” 2<br />

percent sales tax <strong>in</strong> 1933. In 1935, the tax was made permanent, and the rate was<br />

raised to 3 percent.<br />

While the State rate ranged between 2 and 3 percent, municipalities and counties were<br />

allowed to impose a local sales tax beg<strong>in</strong>n<strong>in</strong>g <strong>in</strong> 1955 and 1959, respectively. Also, <strong>in</strong><br />

1955 the Use Tax was added at the same rate as the Retailers’ Occupation Tax. Six<br />

years later, the Service Use Tax and Service Occupation <strong>Taxes</strong> were added to the<br />

Ill<strong>in</strong>ois sales tax structure. By 1984, the State rate <strong>in</strong>creased to 5 percent and the<br />

County Supplementary Tax Act authorized all counties except Cook County to impose a<br />

0.25 percent sales tax. In addition, the State tax on certa<strong>in</strong> food and medical supplies<br />

and mach<strong>in</strong>ery and parts used <strong>in</strong> manufactur<strong>in</strong>g was elim<strong>in</strong>ated (local taxes rema<strong>in</strong>ed on<br />

the exempt items).<br />

Effective January 1, 1990, as part of <strong>Sales</strong> Tax Reform, a uniform State sales and use<br />

tax rate on general merchandise of 6.25 percent was established. The local sales tax<br />

acts and the County Supplementary Tax Act were repealed and the Department of<br />

Revenue began adm<strong>in</strong>ister<strong>in</strong>g Non-Home rule sales taxes <strong>in</strong> September 1990. Many of<br />

these taxes were already <strong>in</strong> effect but were adm<strong>in</strong>istered by the locals themselves.<br />

While the number of local municipalities and counties <strong>in</strong>stitut<strong>in</strong>g home rule sales tax<br />

rates has grown, the State sales tax rate has rema<strong>in</strong>ed constant at 6.25% for the past<br />

twenty years. Table 1 outl<strong>in</strong>es the history of Ill<strong>in</strong>ois sales tax rates.<br />

Table 1. HISTORICAL ILLINOIS SALES TAX RATES<br />

Effective Date<br />

Rate<br />

July 1, 1933 2.00%<br />

July 1, 1935 3.00%<br />

July 1, 1941 2.00%<br />

July 1, 1955 2.50%<br />

July 1, 1959 3.00%<br />

July 1, 1961 3.50%<br />

July 1, 1967 4.25%<br />

October 1, 1969 4.00%<br />

January 1, 1984 5.00%<br />

January 1, 1990 - Current 6.25%<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

-2-

Distribution of Funds<br />

The current State sales tax rate is 6.25%, of which the State reta<strong>in</strong>s 80% of the tax and<br />

local governments receive the rema<strong>in</strong><strong>in</strong>g 20%. Therefore, a 5% sales tax is given to<br />

the State, and 1.25% is provided to local governments. Below is the distribution<br />

pattern of the Ill<strong>in</strong>ois sales and use taxes as described by the Ill<strong>in</strong>ois Legislative<br />

Research Unit <strong>in</strong> their March <strong>2010</strong> report, “Ill<strong>in</strong>ois Tax Handbook for Legislators” and<br />

the Ill<strong>in</strong>ois Department of Revenue website.<br />

Proceeds from the 5% portion of the State sales and use taxes (or 80% of total State<br />

sales taxes) contribute to the follow<strong>in</strong>g:<br />

• 1.75% to Build Ill<strong>in</strong>ois Fund;<br />

• 3.8% to Build Ill<strong>in</strong>ois Fund to retire bonds;<br />

• 0.27% to Ill<strong>in</strong>ois Tax Increment Fund;<br />

• 80% of net tax revenue on Ill<strong>in</strong>ois coal bought by a new electric generat<strong>in</strong>g<br />

facility that received state f<strong>in</strong>ancial aid, to the Energy Infrastructure Fund (for<br />

the first 25 years that the facility buys Ill<strong>in</strong>ois coal).<br />

• 25% reserved for transfer to Common Schools Special Account Fund;<br />

• Rema<strong>in</strong>der to the <strong>General</strong> Revenue Fund, with two transfers out:<br />

1) 3/32 of net revenue from counties and municipalities that have Downstate<br />

mass transit districts, to the Downstate Public Transportation Fund<br />

2) 3/32 of net revenue from Madison, Monroe, and St. Clair Counties to the<br />

Downstate Public Transportation Fund.<br />

Proceeds from the 1.25% portion of the State sales tax (or 20% of the total State sales<br />

tax) is returned to local governments <strong>in</strong> the follow<strong>in</strong>g manner:<br />

• 80% of net proceeds to the Local Government Tax Fund<br />

• 20% of net revenue to the County and Mass Transit Fund<br />

Proceeds from the 1.25% portion of the State use taxes (or 20% of the total State use<br />

tax) are put <strong>in</strong>to the State and Local <strong>Sales</strong> Tax Reform Fund and distributed <strong>in</strong> the<br />

follow<strong>in</strong>g manner:<br />

• 20% is distributed to Chicago<br />

• 10% is distributed to the Regional Transportation Authority (RTA)<br />

• 0.6% is distributed to the Metro-East Mass Transit District (MED)<br />

• $3.15 million is distributed to the Build Ill<strong>in</strong>ois Fund<br />

• The rema<strong>in</strong><strong>in</strong>g balance of the State and Local <strong>Sales</strong> Tax Reform Fund is<br />

distributed to municipal and county governments (except Chicago) based on<br />

each one’s population <strong>in</strong> proportion to the total state population.<br />

-3-

Recently, new legislation, related to the Ill<strong>in</strong>ois Jobs Now! construction program,<br />

<strong>in</strong>creased the rate of sales tax on certa<strong>in</strong> types of products. These items were primarily<br />

items that previously were taxed at the 1% rate under the Food or Drug exemptions.<br />

State sales tax revenue on these products would be used to partially fund the program.<br />

As part of Public Act 096-0034, beg<strong>in</strong>n<strong>in</strong>g September 1, 2009, each month the<br />

Department of Revenue is to pay <strong>in</strong>to the Capital Projects Fund the estimated amount of<br />

sales tax that represented 80% of the net revenue realized for the preced<strong>in</strong>g month from<br />

the sale of candy, groom<strong>in</strong>g and hygiene products, and soft dr<strong>in</strong>ks that were taxed at<br />

1% prior to August 1, 2009 but that are now taxed at 6.25%.<br />

-4-

Revenues and Projections<br />

<strong>Sales</strong> tax revenues are one of Ill<strong>in</strong>ois largest revenue sources, second only to the<br />

personal <strong>in</strong>come tax. In FY 2009, general revenue fund (GRF) sales taxes were $6.77<br />

billion, which was down 6.1% from the all-time high of $7.21 billion <strong>in</strong> FY 2008.<br />

This was the worst decl<strong>in</strong>e s<strong>in</strong>ce 1950, which is as far back as the Commission has<br />

data. It is expected that this will be surpassed <strong>in</strong> FY <strong>2010</strong>, when sales taxes are<br />

expected to be down 8.5%. To illustrate to the reader how severe the current<br />

recession has affected sales tax revenue, between FY 1950 and FY 2008 GRF sales<br />

tax had only decl<strong>in</strong>ed 5 times previously and never two years <strong>in</strong> a row. Prior to<br />

FY 2009, the largest decl<strong>in</strong>es were -2.9% <strong>in</strong> FY 1950 and -1.9% <strong>in</strong> FY 1981.<br />

Between fiscal years 2000 and 2009, sales taxes were quite volatile when compared to<br />

the previous decade. GRF sales taxes <strong>in</strong>creased 4.2% per year dur<strong>in</strong>g the boom<strong>in</strong>g<br />

1990’s, while they grew at a slower average rate of 2.0% dur<strong>in</strong>g the turbulent 2000’s.<br />

Besides grow<strong>in</strong>g at a slower rate, GRF sales taxes were much less dependable. From<br />

FY 1990 thru FY 1999, sales taxes grew at least 2% every year except FY 1991 when<br />

growth was only 1%. In contrast, dur<strong>in</strong>g the 2000’s only four of the ten years had<br />

sales tax growth of over 2% and actually had two years of decl<strong>in</strong>es (FY 2001 and<br />

FY 2009).<br />

It also should be noted that sales tax revenues as a percentage of total general revenues<br />

has decl<strong>in</strong>ed from almost 30% <strong>in</strong> fiscal year 1990, to less than 23% <strong>in</strong> fiscal year <strong>2010</strong>.<br />

It is anticipated that fiscal year 2011 will be a transitional year with slow growth<br />

(1.6%) as the economy comes out of the recessionary low to the recovery phase of the<br />

bus<strong>in</strong>ess cycle. Table 2 provides historical details and projections of the general<br />

revenue sales tax beg<strong>in</strong>n<strong>in</strong>g <strong>in</strong> fiscal year 2000.<br />

Table 2. GENERAL REVENUE SALES TAX RECEIPTS<br />

($ billions)<br />

Fiscal Year<br />

<strong>Sales</strong> Tax<br />

Revenue % Growth<br />

Total <strong>General</strong><br />

Revenue* % Growth<br />

2000 $6.03 7.5% $23.25 7.3% 25.9%<br />

2001 $5.96 -1.1% $24.11 3.7% 24.7%<br />

2002 $6.05 1.6% $23.38 -3.0% 25.9%<br />

2003 $6.06 0.1% $22.79 -2.5% 26.6%<br />

2004 $6.24 2.9% $25.43 11.6% 24.5%<br />

2005 $6.59 5.8% $26.16 2.9% 25.2%<br />

2006 $7.09 7.5% $27.36 4.6% 25.9%<br />

2007 $7.14 0.6% $28.64 4.7% 24.9%<br />

2008 $7.21 1.1% $29.66 3.6% 24.3%<br />

2009 $6.77 -6.1% $29.14 -1.7% 23.2%<br />

<strong>2010</strong>** $6.20 -8.5% $27.90 -4.3% 22.2%<br />

2011** $6.30 1.6% $26.56 -4.8% 23.7%<br />

<strong>Sales</strong> as a % of<br />

Total<br />

*Total <strong>General</strong> Revenue excludes cash management transactions <strong>in</strong>clud<strong>in</strong>g short term borrow<strong>in</strong>g and certa<strong>in</strong> transfers<br />

** CGFA estimates<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

-5-

All Appropriated (AAP) sales tax revenues encompass the entire amount of sales tax<br />

revenues that Ill<strong>in</strong>ois receives. GRF sales tax amounts were just those that went <strong>in</strong>to<br />

the <strong>General</strong> Revenue Funds which were the <strong>General</strong> Revenue Fund (0001) and the<br />

<strong>General</strong> Revenue - Common School Special Account Fund (0005). The AAP sales tax<br />

revenue amount <strong>in</strong>cludes those monies plus the amounts that went <strong>in</strong>to the Home Rule<br />

Municipal Retailers’ Occupation Tax Fund (0138), the State and Local <strong>Sales</strong> Tax<br />

Reform Fund (0186), the Ill<strong>in</strong>ois Tax Increment Fund (0281), the McCormick Place<br />

Expansion Project Fund (0377), the Tax Compliance and Adm<strong>in</strong>istration Fund (0384),<br />

the Capital Projects Fund (0694), and the Build Ill<strong>in</strong>ois Fund (0960)<br />

AAP sales tax revenues historical trends mirror the general revenue trends. All<br />

Appropriated revenues grew steadily between fiscal year 1990 and 2000 but grew<br />

slower <strong>in</strong> the 2000’s. Similar to GRF sales tax revenue, AAP revenue decl<strong>in</strong>ed <strong>in</strong><br />

FY 2009 and is expected to decl<strong>in</strong>e significantly aga<strong>in</strong> <strong>in</strong> FY <strong>2010</strong>. For FY 2009, AAP<br />

sales tax revenue was $8.22 billion. A decl<strong>in</strong>e to $7.58 billion is expected <strong>in</strong> FY <strong>2010</strong><br />

with small growth <strong>in</strong> FY 2011. Table 3 provides a historical review of AAP sales tax<br />

revenues<br />

Table 3. ALL APPROPRIATED SALES TAX RECEIPTS<br />

($ billions)<br />

Fiscal Year AAP <strong>Sales</strong> Tax Revenue % Growth<br />

2001 $6.96 -0.8%<br />

2002 $7.06 1.3%<br />

2003 $7.05 0.0%<br />

2004 $7.34 4.1%<br />

2005 $7.78 6.1%<br />

2006 $8.43 8.3%<br />

2007 $8.60 2.1%<br />

2008 $8.73 1.5%<br />

2009 $8.22 -5.9%<br />

<strong>2010</strong>* $7.58 -7.8%<br />

2011* $7.70 1.7%<br />

* CGFA estimates<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

-6-

History of Exemptions<br />

Upon the <strong>in</strong>ception of the State sales tax, almost all general merchandise was subject to<br />

taxation. However, as the years progressed, the amount of allowed exemptions<br />

escalated along with the sales tax rate, yield<strong>in</strong>g a smaller tax base but cont<strong>in</strong>ued<br />

revenue growth.<br />

Beg<strong>in</strong>n<strong>in</strong>g <strong>in</strong> 1933 (when the State sales tax was implemented), allowed exemptions<br />

<strong>in</strong>cluded feed and seed for farmers and occasional sales exemptions. Between 1955 and<br />

1979, the number of exemptions cont<strong>in</strong>ued to grow to <strong>in</strong>clude among other th<strong>in</strong>gs, sales<br />

to exempt organizations, newspr<strong>in</strong>t and <strong>in</strong>k, roll<strong>in</strong>g stock, and farm chemicals. But it<br />

wasn’t until after 1979 that the amount of exemptions allowed by the State began to<br />

proliferate (Appendix 1 at the end of this report provides a list of exemptions and the<br />

year they were enacted).<br />

In 1979, sales taxes were elim<strong>in</strong>ated on sales of mach<strong>in</strong>ery and equipment to<br />

manufacturers. Exemptions for mach<strong>in</strong>ery and equipment to pr<strong>in</strong>ters, coal m<strong>in</strong>es, oil<br />

field drillers, distillers of ethanol, and farmers quickly followed <strong>in</strong> 1980. Also <strong>in</strong> 1980,<br />

the State began to reduce the tax rate on sales of food (grocery), drugs, and medical<br />

appliances to <strong>in</strong>dividuals. Between 1985 and 2000 sales tax exemptions were added for<br />

property used <strong>in</strong> pollution control facilities, property used with an enterprise zone, legal<br />

tender, medallions, and bullion, photo process<strong>in</strong>g mach<strong>in</strong>ery, coal and oil mach<strong>in</strong>ery,<br />

leased property to hospitals or governmental bodies, and many more. In January 1995,<br />

manufacturers began earn<strong>in</strong>g additional sales tax credit (Manufacturer’s Purchase<br />

Credit or MPC) that could be applied toward the tax due on purchases of non-exempt<br />

items. MPC earned is a percentage of the tax the manufacturer would have paid on the<br />

purchase of mach<strong>in</strong>ery and equipment if the mach<strong>in</strong>ery and equipment had not been<br />

exempt from tax.<br />

Many organizations that do not have to pay sales taxes on their purchases also <strong>in</strong>creased<br />

<strong>in</strong> number. Certa<strong>in</strong> senior citizen organizations, county fair associations, not-for-profit<br />

music or dramatic arts organizations, and certa<strong>in</strong> licensed day care centers are all<br />

exempt from sales taxation. In addition, sales by elementary or secondary teachersponsored<br />

student organizations and certa<strong>in</strong> sales by not-for-profit service organizations<br />

operat<strong>in</strong>g for the benefit of persons 65 or older are also exempt from sales taxes.<br />

In 2003, two exemptions related to motor fuels were enacted. The first exemption was<br />

related to majority blended ethanol fuel. The second was a discount and exemption<br />

associated with biodiesel. Legislation exempt<strong>in</strong>g sales of jet fuel and petroleum<br />

products used or consumed by any aircraft support center directly <strong>in</strong> the process of<br />

ma<strong>in</strong>ta<strong>in</strong><strong>in</strong>g, rebuild<strong>in</strong>g, or repair<strong>in</strong>g aircraft from the sales tax was passed <strong>in</strong> 2007.<br />

Chart 1 provides estimates for sales tax exemptions for Ill<strong>in</strong>ois as estimated by the<br />

Ill<strong>in</strong>ois State Comptroller <strong>in</strong> their “Tax Expenditure Report”. In FY 2008, exemptions<br />

to the <strong>Sales</strong> and Use taxes were estimated at $3.4 billion. As depicted <strong>in</strong> the chart, the<br />

-7-

food, drug, and medical appliance sales tax reduction ($1.4 billion) accounted for the<br />

greatest amount of sales tax exemptions, followed by sales to exempt organizations<br />

($515 million) and the traded-<strong>in</strong> property exemption ($357).<br />

Appendix 2 provides historical figures for sales tax exemptions from fiscal years 1996<br />

through 2008. As the appendix <strong>in</strong>dicates, the dollar amount of all exemptions has<br />

<strong>in</strong>creased steadily over the past 12 years. Total sales and use tax exemptions have<br />

grown by approximately 50% dur<strong>in</strong>g that time period. Tax exemptions of the sales and<br />

use taxes actually peaked <strong>in</strong> FY 2007 at $3.9 billion but fell approximately $570 million<br />

<strong>in</strong> FY 2008. The food, drugs, and medical rate reduction has grown an average of<br />

4.8% per year, while total sales and use tax exemptions have averaged growth of 3.8%<br />

between FY 1996 and FY 2008.<br />

Chart 1. <strong>Sales</strong> and Use Tax Exemptions<br />

(FY 2008)<br />

$1,600<br />

$1,400<br />

$1,200<br />

Dollars (<strong>in</strong> Millions)<br />

$1,000<br />

$800<br />

$600<br />

$400<br />

$200<br />

$-<br />

Food, Drugs, <strong>Sales</strong> to Exempt<br />

and Medical Organizations<br />

Appliances Rate<br />

Reduction<br />

Traded-In<br />

Property<br />

Exemption<br />

Farm Chemicals<br />

(Includes Feed<br />

and Seed)<br />

Exemption<br />

Manufactur<strong>in</strong>g<br />

and Assembl<strong>in</strong>g<br />

Mach<strong>in</strong>ery<br />

Exemption<br />

Gasahol<br />

Discount<br />

Retailer's<br />

Discount<br />

Biodiesel<br />

Discount and<br />

Exemption<br />

All Other<br />

Source: Ill<strong>in</strong>ois State Comptroller<br />

-8-

Comparison of States<br />

<strong>Sales</strong> taxes are not unique to Ill<strong>in</strong>ois. Virtually every state <strong>in</strong> the nation has some sort of<br />

sales taxation. Table 4 provides sales tax rates for Ill<strong>in</strong>ois and its neighbor<strong>in</strong>g states.<br />

As <strong>in</strong>dicated, Ill<strong>in</strong>ois’ state sales tax rate at 6.25% is the second highest among all of its<br />

neighbor<strong>in</strong>g states beh<strong>in</strong>d Indiana at 7.00%. In fact, Ill<strong>in</strong>ois 6.25% sales tax ranks<br />

among the nation’s highest tax rates. Currently, Ill<strong>in</strong>ois is tied with Texas and<br />

Massachusetts for the 10th highest state sales tax rate. Rates range between 0% (for<br />

Alaska, Delaware, Montana, New Hampshire, and Oregon) and 7.25% (California).<br />

Appendix 3 provides details of each of the states sales tax rates.<br />

Not only do sales tax rates vary widely across the nation, but so do the items taxed and<br />

the def<strong>in</strong>ition of these items. For example, some states tax necessity items (such as<br />

food, cloth<strong>in</strong>g, medical appliances, and drugs), while some do not. Others have a<br />

reduced tax rate. Even more, the def<strong>in</strong>ition of the non-taxable goods may differ among<br />

states. Non-taxable food <strong>in</strong> one state might be def<strong>in</strong>ed as only food that is consumable<br />

off the sales premises, while another state may exempt all food from sales taxation,<br />

regardless of where it will be consumed.<br />

Thus, the diversity of sales tax rates, applied products, and accompany<strong>in</strong>g def<strong>in</strong>itions<br />

make it difficult, at best, to form any k<strong>in</strong>d of analytical state comparison of the various<br />

states sales tax revenues. Table 5 provides a numerical summation of State sales tax<br />

revenues for Ill<strong>in</strong>ois and its boundary states and Appendix 4 provides details for every<br />

state. Total revenues generated from sales taxation may have a direct relationship with<br />

state population, the sales tax rate, as well as the comprehensiveness of the items taxed.<br />

Although Ill<strong>in</strong>ois ranks first among its neighbor<strong>in</strong>g states for total sales tax revenues at<br />

$7.8 billion, when consider<strong>in</strong>g these revenues on a per-capita basis, Ill<strong>in</strong>ois is <strong>in</strong> the<br />

lower half. Residents <strong>in</strong> Ill<strong>in</strong>ois paid approximately $608 <strong>in</strong> sales tax <strong>in</strong> 2007 on<br />

average which was well below what residents of Indiana paid ($855). On a per capita<br />

basis, the State of Missouri had the lowest amount at $557.<br />

Table 4. SURROUNDING STATES SALES TAX RATES<br />

State State Rate Range of Local Rates<br />

Missouri 4.225% .5% - 6. 625%<br />

Wiscons<strong>in</strong> 5.00% 0% - 1.5%<br />

Iowa 6.00% 0% - 2%<br />

Kentucky 6.00% 0%<br />

ILLINOIS 6.25% 0% - 4.25%<br />

Indiana 7.00% 0%<br />

Source: <strong>Sales</strong> Tax Institute, as of 4/1/<strong>2010</strong><br />

-9-

Table 5. 2007 STATE GENERAL SALES TAX REVENUE FOR<br />

SURROUNDING STATES<br />

State<br />

Total <strong>General</strong> <strong>Sales</strong> Tax Receipts<br />

($ billion)<br />

State<br />

Total <strong>General</strong> <strong>Sales</strong> Tax Receipts<br />

per Capita<br />

ILLINOIS $7.80 Indiana $855<br />

Wiscons<strong>in</strong> $4.16 Wiscons<strong>in</strong> $742<br />

Missouri $3.27 Kentucky $664<br />

Kentucky $2.82 ILLINOIS $608<br />

Iowa $1.79 Iowa $598<br />

Indiana $5.42 Missouri $557<br />

Source: <strong>2010</strong> Statistical Abstract, U.S. Census Bureau<br />

-10-

Other <strong>Sales</strong> <strong>Taxes</strong><br />

The Ill<strong>in</strong>ois Department of Revenue also collects other local sales taxes above and<br />

beyond the state and local rate of 6.25%. Listed below are these various other local<br />

sales taxes as described by the Department of Revenue:<br />

Bus<strong>in</strong>ess District Retailers’ Occupation Tax (65 ILCS 5/11-74.3-1 to 11-74.3-6)<br />

Municipalities that have approved a bus<strong>in</strong>ess district development or redevelopment<br />

plan and have elected to impose a tax by ord<strong>in</strong>ance may impose a Bus<strong>in</strong>ess District<br />

Retailers’ Occupation and Service Occupation Tax on sales of general merchandise<br />

with<strong>in</strong> the bus<strong>in</strong>ess district. The tax may not be imposed on sales of items that will be<br />

titled or registered with an agency of state government or on qualify<strong>in</strong>g food, drugs,<br />

and medical appliances. The Tax may be imposed <strong>in</strong> 0.25% <strong>in</strong>crements and cannot<br />

exceed 1%.<br />

Chicago Home Rule Municipal Soft Dr<strong>in</strong>k Retailers’ Occupation Tax<br />

(65 ILCS 5/8-11-6b)<br />

The Chicago Home Rule Municipal Soft Dr<strong>in</strong>k Occupation Tax is imposed on persons<br />

who sell canned or bottled soft dr<strong>in</strong>ks at retail <strong>in</strong> Chicago. The rate is 3% of gross<br />

receipts from soft dr<strong>in</strong>ks sold at retail. “Soft dr<strong>in</strong>ks” <strong>in</strong>clude (but are not limited to):<br />

• soda water,<br />

• carbonated water,<br />

• colas, and<br />

• dr<strong>in</strong>ks conta<strong>in</strong><strong>in</strong>g less than 50 percent natural fruit or vegetable juice.<br />

The follow<strong>in</strong>g list <strong>in</strong>cludes examples of dr<strong>in</strong>ks that are not <strong>in</strong>cluded <strong>in</strong> the def<strong>in</strong>ition of<br />

soft dr<strong>in</strong>ks:<br />

Founta<strong>in</strong> dr<strong>in</strong>ks,<br />

• Noncarbonated water,<br />

• Coffee,<br />

• Tea,<br />

• Infant formula,<br />

• Milk or milk products,<br />

• Dr<strong>in</strong>ks conta<strong>in</strong><strong>in</strong>g 50 percent or more natural fruit or vegetable juice,<br />

• Nonalcoholic dr<strong>in</strong>k mixes, and<br />

• Soft dr<strong>in</strong>ks when mixed and sold <strong>in</strong> an alcoholic dr<strong>in</strong>k.<br />

• Dr<strong>in</strong>ks conta<strong>in</strong><strong>in</strong>g 50 percent or more natural fruit or vegetable juice,<br />

• Nonalcoholic dr<strong>in</strong>k mixes, and<br />

• Soft dr<strong>in</strong>ks when mixed and sold <strong>in</strong> an alcoholic dr<strong>in</strong>k.<br />

-11-

County Motor Fuel Tax (55 ILCS 5/5-1035.1)<br />

DuPage, Kane, and McHenry counties have imposed a tax on the retail sale of motor<br />

fuel at a rate not exceed<strong>in</strong>g 4 cents per gallon. DuPage, McHenry, and Kane counties<br />

levy the tax at the maximum rate of 4 cents per gallon.<br />

DuPage County Water Commission Tax (70 ILCS 3720/4)<br />

The DuPage Water Commission Tax of 0.25% is imposed on sales of general<br />

merchandise with<strong>in</strong> the boundaries serviced by the DuPage Water Commission. The<br />

tax rate is 0.25%. A “use” tax is also imposed at the same rate. The tax revenue is<br />

used to support the DuPage County Water Commission which pipes water from Lake<br />

Michigan throughout DuPage County.<br />

Home Rule and Non-home Rule <strong>Sales</strong> and Use <strong>Taxes</strong><br />

• Home Rule County Retailers’ Occupation Tax — 55 ILCS 5/5-1006<br />

• Home Rule County Service Occupation Tax — 55 ILCS 5/5-1007<br />

• Home Rule Municipal Retailers’ Occupation Tax — 65 ILCS 5/8-11-1<br />

• Home Rule Municipal Service Occupation Tax — 65 ILCS 5/8-11-5<br />

• Non-home Rule Municipal Retailers’ Occupation Tax — 65 ILCS 5/8-11-1.3<br />

• Non-home Rule Municipal Service Occupation Tax — 65 ILCS 5/8-11-1.4<br />

Home rule units of local government are authorized to impose a Home Rule sales tax<br />

and certa<strong>in</strong> non-home rule units of local government are authorized to impose a Nonhome<br />

Rule sales tax to be collected by the department. Both taxes are imposed on the<br />

same general merchandise base as the state sales tax, exclud<strong>in</strong>g titled or registered<br />

tangible personal property (such as vehicles, watercraft, aircraft, trailers, and mobile<br />

homes), and qualify<strong>in</strong>g food, drugs and medical appliances.<br />

The Home Rule sales tax is <strong>in</strong> 0.25% <strong>in</strong>crements with no maximum rate limit. The<br />

Non-home Rule sales tax is <strong>in</strong> 0.25% <strong>in</strong>crements with a 0.50% maximum rate limit.<br />

As of April <strong>2010</strong>, Ill<strong>in</strong>ois had 200 home rule units of government <strong>in</strong> Ill<strong>in</strong>ois. 125 of<br />

these were enacted by referendum, while 75 qualified as a home rule unit due to their<br />

population. Cook County is the only home rule county <strong>in</strong> Ill<strong>in</strong>ois. Appendix 5 conta<strong>in</strong>s<br />

a list of all the home rule units and their comb<strong>in</strong>ed sales tax rate which range from<br />

6.25% <strong>in</strong> areas where home rule has passed but have not raised sales taxes to 11.5% <strong>in</strong><br />

certa<strong>in</strong> bus<strong>in</strong>ess districts <strong>in</strong> Bellwood.<br />

The department also adm<strong>in</strong>isters the Chicago Home Rule Use Tax on automobiles and<br />

other titled or registered items sold by dealers located <strong>in</strong> the counties of Cook, Kane,<br />

Lake, McHenry, DuPage, and Will sell<strong>in</strong>g items that will be registered to an address<br />

with<strong>in</strong> the corporate limits of Chicago. The Chicago Home Rule Use Tax is 1.25%.<br />

-12-

Mass Transit District <strong>Taxes</strong><br />

• Metro-East Mass Transit District (MED) Retailers’ Occupation Tax<br />

• (70 ILCS 3610/5.01(b))<br />

• Metro-East Mass Transit District (MED) Service Occupation Tax<br />

• (70 ILCS 3610/5.01(c))<br />

• Metro-East Mass Transit District (MED) Use Tax<br />

• (70 ILCS 3610/5.01(d))<br />

• Regional Transportation Authority (RTA) Retailers’ Occupation Tax<br />

• (70 ILCS 3615/4.03)<br />

• Regional Transportation Authority (RTA) Service Occupation Tax<br />

• (70 ILCS 3615/4.03)<br />

• Regional Transportation Authority (RTA) Use Tax<br />

• (70 ILCS 3615/4.03)<br />

The Metro-East Mass Transit District (MED) imposes a sales tax <strong>in</strong> parts of Madison<br />

and St. Clair counties. The Regional Transportation Authority (RTA) is authorized to<br />

impose a sales tax <strong>in</strong> Cook, DuPage, Kane, Lake, McHenry, and Will counties. These<br />

tax revenues are used to support public mass transportation systems.<br />

The MED imposes taxes at the follow<strong>in</strong>g rates:<br />

• 0.25% sales tax on general merchandise and sales of qualify<strong>in</strong>g food, drugs,<br />

and medical appliances <strong>in</strong> Madison County<br />

• 0.75% sales tax on general merchandise (exclud<strong>in</strong>g items that are titled or<br />

registered) and sales of qualify<strong>in</strong>g food, drugs, and medical appliances <strong>in</strong> St.<br />

Clair County<br />

• 0.25 percent sales tax on sales of titled or registered general merchandise <strong>in</strong><br />

St. Clair County and Madison County<br />

The RTA imposes taxes at the follow<strong>in</strong>g rates:<br />

• 1.00% sales tax on general merchandise <strong>in</strong> Cook County<br />

• 1.25% sales tax on qualify<strong>in</strong>g food, drugs, and medical appliances <strong>in</strong> Cook<br />

County<br />

• 0.75% sales tax on general merchandise and qualify<strong>in</strong>g food, drugs, and<br />

medical appliances <strong>in</strong> DuPage, Kane, Lake, McHenry, and Will counties<br />

Metro-East Park and Recreation District Tax (70 ILCS 1605)<br />

The Metro-East Park and Recreation District tax of 0.10% is imposed on sales of<br />

general merchandise with<strong>in</strong> the district’s boundaries. The tax is imposed on the same<br />

general merchandise base as the state sales tax, exclud<strong>in</strong>g titled or registered tangible<br />

-13-

personal property (such as vehicles, watercraft, aircraft, trailers, and mobile homes),<br />

and qualify<strong>in</strong>g food, drugs and medical appliances.<br />

Metropolitan Pier and Exposition Authority (MPEA) Food and Beverage Tax<br />

(70 ILCS 210/13(b))<br />

A retailers’ occupation tax on the gross receipts from food prepared for immediate<br />

consumption, alcoholic beverages, and soft dr<strong>in</strong>ks is imposed on sales with<strong>in</strong> Chicago’s<br />

Metropolitan Pier and Exposition Authority (MPEA) boundaries. The tax rate is 1%.<br />

Revenues from this tax are deposited <strong>in</strong>to the MPEA Trust Fund to pay debt service on<br />

all MPEA bonds and refund<strong>in</strong>g bonds.<br />

Special County Retailers’ Occupation Tax for Public Safety (55 ILCS 5/5-1006.5)<br />

County governments are authorized to impose, with voter approval, a countywide tax<br />

(<strong>in</strong> 0.25% <strong>in</strong>crements) for public safety expenditures to be collected by the department.<br />

The tax is imposed on the same general merchandise base as the state sales tax,<br />

exclud<strong>in</strong>g titled or registered tangible personal property (such as vehicles, watercraft,<br />

aircraft, trailers, and mobile homes) and qualify<strong>in</strong>g food, drugs and medical appliances.<br />

Thirty five counties <strong>in</strong> Ill<strong>in</strong>ois have county public safety sales taxes. Table 6 shows<br />

these counties and their associated tax rates.<br />

Table 6. COUNTY PUBLIC SAFETY SALES TAX RATES<br />

County Tax Rate County Tax Rate<br />

Boone 0.50% Macon 0.25%<br />

Brown 0.25% Marion 0.25%<br />

Bureau 0.50% Mcdonough 0.50%<br />

Carroll 0.25% Menard 1.00%<br />

Cass 1.00% Moultrie 0.50%<br />

Champaign 0.25% Peoria 0.50%<br />

Clark 1.00% Perry 0.50%<br />

Clay 0.50% Pike 0.50%<br />

Eff<strong>in</strong>gham 0.25% Richland 0.50%<br />

Fulton 0.50% Sal<strong>in</strong>e 0.75%<br />

Henderson 1.00% Stephenson 0.50%<br />

Jefferson 0.25% Tazewell 0.50%<br />

Jersey 0.50% Union 0.25%<br />

Kendall 1.00% Vermilion 0.25%<br />

Knox 0.25% Wayne 0.75%<br />

LaSalle 0.25% W<strong>in</strong>nebago 1.00%<br />

Logan 0.50% Woodford 1.00%<br />

Marion 0.25%<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

-14-

<strong>Sales</strong> Tax Base<br />

The Ill<strong>in</strong>ois sales tax base is made up primarily of transfers of tangible personal<br />

property. Even though the service sector has become a greater part of the Ill<strong>in</strong>ois<br />

economy, Ill<strong>in</strong>ois is one of the states that taxes services the least. In the Federation of<br />

Tax Adm<strong>in</strong>istrators 2007 update of their Service Tax Survey, Ill<strong>in</strong>ois taxed the fifth<br />

fewest amount of services. Ill<strong>in</strong>ois taxed only 17 out of 168 identified services, the<br />

majority of those be<strong>in</strong>g related to public utilities. This is <strong>in</strong> spite of over 40% of<br />

Ill<strong>in</strong>ois’ economy be<strong>in</strong>g service related.<br />

Many states have not taxed services as broadly as tangible property due to when sales<br />

taxes were orig<strong>in</strong>ally enacted. Many states sales taxes were enacted <strong>in</strong> the 1930s.<br />

Dur<strong>in</strong>g this time, services accounted for a smaller portion of overall economic activity.<br />

Because of this, most states have tangible personal property as their primary base. This<br />

has limited the amount of sales tax revenue, as the country’s economy has become more<br />

service oriented. See the Commission’s report, “Service <strong>Taxes</strong>: 2009 Update” for<br />

more <strong>in</strong>formation on this topic.<br />

To exam<strong>in</strong>e the sales tax base, the Commission analyzed Standard Industrial<br />

Classification (SIC) code data from the Ill<strong>in</strong>ois Department of Revenue to discover<br />

from what sectors of the economy sales tax receipts come from and how these revenues<br />

have changed over the last decade. Growth rates for sales tax receipts from <strong>in</strong>dividual<br />

sectors of the economy were also calculated. F<strong>in</strong>ally, the changes <strong>in</strong> the make up of the<br />

sales tax base were calculated. The results of these calculations can be seen <strong>in</strong> Tables<br />

7 and 8.<br />

Look<strong>in</strong>g at <strong>in</strong>dividual SIC codes, restaurants, car dealerships, and department stores<br />

were the three largest <strong>in</strong>dustries that collected Ill<strong>in</strong>ois state sales taxes <strong>in</strong> 2009. The<br />

Eat<strong>in</strong>g Places (SIC Code 5812) was the largest <strong>in</strong>dustry at 12.3% of total state sales<br />

taxes collected. Two other <strong>in</strong>dustries, New and Used Car Dealers (SIC Code 5511)<br />

and Department Stores (SIC Code 5311) contributed just over 12% each also. The ten<br />

<strong>in</strong>dustries that collect the most state sales tax can be found <strong>in</strong> Table 7. These ten<br />

<strong>in</strong>dustries accounted for approximately 63% of all the state sales tax revenue received.<br />

For data from each of the <strong>in</strong>dividual SIC codes please see the Department of Revenue’s<br />

“The <strong>Sales</strong> Tax for 2009 Annual Report” which can be found at<br />

http://www.revenue.state.il.us/AboutIdor/TaxStats/SICAnnual09.pdf.<br />

-15-

Table 7. TOP TEN INDUSTRIES BY SIC CODE<br />

SIC CODE<br />

SIC Code<br />

Percent of Total <strong>Sales</strong><br />

Tax Receipts, 2009<br />

Rank<br />

Eat<strong>in</strong>g Places 5812 12.3% 1<br />

New and Used Car Dealers 5511 12.2% 2<br />

Department Stores 5311 12.1% 3<br />

Gasol<strong>in</strong>e Service Stations 5541 6.4% 4<br />

Lumber and Other Build<strong>in</strong>g Materials 5211 5.0% 5<br />

Grocery Stores 5411 4.7% 6<br />

Miscellaneous Retail Stores 5999 3.5% 7<br />

Family Cloth<strong>in</strong>g Stores 5651 2.3% 8<br />

Computer and Software Stores 5734 2.3% 9<br />

Auto and Home Supply Stores 5531 1.7% 10<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

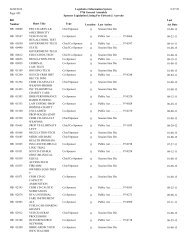

The Department of Revenue has categorized the SIC codes <strong>in</strong>to 10 categories. Table 8<br />

illustrates the results of this categorization. In 2009, the largest portion of sales tax<br />

receipts came from the Automotive and Fill<strong>in</strong>g Stations sector. This sector contributed<br />

$1.41 billion, or just fewer than 21%, of the $6.76 billion <strong>in</strong> sales tax revenue. This<br />

was followed by the Agriculture and All Others category at $1.15 billion. The<br />

Dr<strong>in</strong>k<strong>in</strong>g and Eat<strong>in</strong>g Places ($855 million), Drugs and Misc. Retail ($845 million), and<br />

<strong>General</strong> Merchandise ($770 million) categories all contribute more than 11% of total<br />

state sales tax receipts.<br />

S<strong>in</strong>ce 1999, the Food category has <strong>in</strong>creased at the fastest rate. From 1999-2009, the<br />

Food category grew an average of 4.4% per year. Drugs & Misc. Retail was the<br />

second fastest grow<strong>in</strong>g sector at 4.2%. Two categories actually had decl<strong>in</strong><strong>in</strong>g sales tax<br />

receipts. The Agriculture and All Other category decl<strong>in</strong>ed 0.2% per year, while sales<br />

tax revenue from Manufacturers dropped an average of 2.9% per year.<br />

In exam<strong>in</strong><strong>in</strong>g the composition of the sales tax base of 1999 and 2009, a few changes<br />

were apparent, though <strong>in</strong> general the composition was much the same <strong>in</strong> both years.<br />

The Automotive and Fill<strong>in</strong>g Stations category was the largest portion <strong>in</strong> both years but<br />

accounted for approximately 1.5% less of the total <strong>in</strong> 2009. The largest change <strong>in</strong> the<br />

sales tax base could be found <strong>in</strong> the Agriculture and All Others category which went<br />

from over 21% <strong>in</strong> 1999 to 17.1% of the sales tax base <strong>in</strong> 2009. These decl<strong>in</strong>es <strong>in</strong><br />

proportion of the sales tax base can be accounted for by the approximate <strong>in</strong>crease of 3%<br />

by both the Dr<strong>in</strong>k<strong>in</strong>g and Eat<strong>in</strong>g Places and Drugs & Misc. Retail categories. In fact<br />

these two categories surpassed <strong>General</strong> Merchandise between 1999 and 2009 to become<br />

the third and fourth largest contributors to state sales tax receipts.<br />

A break down of the categories by SIC Code can be obta<strong>in</strong>ed at<br />

https://www.revenue.state.il.us/app/kob/terms.jsp.<br />

-16-

Table 8. SALES TAX RECEIPTS BY SECTOR<br />

Sector<br />

<strong>Sales</strong> Tax Receipts<br />

Average Growth % of Total<br />

($Million)<br />

Rate<br />

1999 2009 1999 2009<br />

Difference<br />

Automotive & Fill<strong>in</strong>g Stations $1,387.1 $1,414.2 1.5% 22.44% 20.94% -1.51%<br />

Agriculture & All Others $1,306.5 $1,153.6 -0.2% 21.14% 17.08% -4.06%<br />

Dr<strong>in</strong>k<strong>in</strong>g and Eat<strong>in</strong>g Places $603.0 $854.9 3.9% 9.76% 12.66% 2.90%<br />

Drugs & Misc. Retail $598.7 $845.1 4.2% 9.69% 12.51% 2.82%<br />

<strong>General</strong> Merchandise $718.1 $770.1 1.5% 11.62% 11.40% -0.22%<br />

Lumber, Bldg, Hardware $384.2 $436.4 2.6% 6.22% 6.46% 0.24%<br />

Furniture & H.H. & Radio $426.7 $428.0 1.8% 6.90% 6.34% -0.57%<br />

Food $244.6 $336.8 4.4% 3.96% 4.99% 1.03%<br />

Apparel $236.0 $284.5 2.4% 3.82% 4.21% 0.39%<br />

Manufacturers $275.3 $231.5 -2.9% 4.46% 3.43% -1.03%<br />

TOTAL $6,180.2 $6,755.1 1.7% 100.0% 100.0% 0.00%<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

To exam<strong>in</strong>e the geographic locale of the sales tax base, the Commission analyzed state<br />

sales tax receipts at the county and municipality level for calendar year 2009. The<br />

Commission first looked at 2009 state sales tax revenue by county. Cook County and<br />

the downstate area each accounted for approximately 36% of the sales tax base, while<br />

the collar counties contributed for just over 28%. The largest 20 counties accounted<br />

for 86% of the sales tax base, while the rema<strong>in</strong><strong>in</strong>g 82 counties contributed only 14%.<br />

Table 9 shows the results of this analysis. Appendix 6 conta<strong>in</strong>s state sales tax data for<br />

all 102 Ill<strong>in</strong>ois counties.<br />

At the municipality level of government, Chicago had the largest portion account<strong>in</strong>g for<br />

just fewer than 14% (or $819 million) of the $5.9 billion dollars <strong>in</strong> state sales taxes.<br />

N<strong>in</strong>e other municipalities raised more than $70 million <strong>in</strong> state sales taxes. These<br />

<strong>in</strong>cluded Schaumburg ($114M), Spr<strong>in</strong>gfield ($99M), Naperville ($99), Kankakee<br />

($85M), Peoria ($84M), Rockford ($82M), Aurora ($74M), Orland Park ($72M), and<br />

Bloom<strong>in</strong>gton ($70M). The 20 highest gross<strong>in</strong>g municipalities contributed just over<br />

35% of local sales taxes. As seen <strong>in</strong> Table 10, the top twenty consists of Chicago (1 st ),<br />

followed by the bigger suburbs and downstate cities (2 nd -10 th ), and end<strong>in</strong>g with more<br />

Chicago area suburbs (11 th -20 th ).<br />

Based on this analysis, the majority of the sales tax base is located with<strong>in</strong> Cook and the<br />

Collar County areas with pockets of sales tax revenue com<strong>in</strong>g from the larger<br />

downstate cities.<br />

-17-

Table 9. 2009 STATE SALES TAX RECEIPTS BY<br />

COUNTY<br />

County Total % of Total Rank<br />

Cook $2,131,006,758 35.87% 1<br />

DuPage $646,406,595 10.88% 2<br />

Lake $400,057,346 6.73% 3<br />

Will $281,994,362 4.75% 4<br />

Kane $212,539,371 3.58% 5<br />

W<strong>in</strong>nebago $141,986,261 2.39% 6<br />

Kankakee $126,910,084 2.14% 7<br />

McHenry $126,371,789 2.13% 8<br />

St. Clair $124,949,800 2.10% 9<br />

Madison $119,142,631 2.01% 10<br />

Rest of State $1,629,924,497 27.43% N/A<br />

State Total $5,941,289,493 100.0% N/A<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

Table10. 2009 STATE SALES TAX REVENUE BY<br />

MUNICIPALITY<br />

Rank Municipality Total %ofTotal<br />

1 Chicago $ 818,783,117 13.74%<br />

2 Schaumburg $ 114,136,419 1.92%<br />

3 Spr<strong>in</strong>gfield $ 99,215,667 1.67%<br />

4 Naperville $ 99,168,385 1.66%<br />

5 Kankakee $ 85,019,823 1.43%<br />

6 Peoria $ 83,962,775 1.41%<br />

7 Rockford $ 82,103,896 1.38%<br />

8 Aurora $ 74,367,226 1.25%<br />

9 Orland Park $ 72,353,182 1.21%<br />

10 Bloom<strong>in</strong>gton $ 70,205,572 1.18%<br />

11 Joliet $ 69,768,978 1.17%<br />

12 Champaign $ 58,458,463 0.98%<br />

13 Sycamore $ 49,354,205 0.83%<br />

14 Skokie $ 49,235,390 0.83%<br />

15 Glenview $ 48,411,098 0.81%<br />

16 Gurnee $ 46,541,385 0.78%<br />

17 Vernon Hills $ 46,307,551 0.78%<br />

18 Downers Grove $ 46,267,905 0.78%<br />

19 Niles $ 45,244,293 0.76%<br />

20 Oak Brook $ 44,994,598 0.76%<br />

N/A All Others $ 3,853,950,958 64.7%<br />

N/A Total $ 5,957,850,883 100.0%<br />

Source: Ill<strong>in</strong>ois Department of Revenue<br />

-18-

Internet Taxation<br />

Several issues surround the topic of Internet taxation; however, the primary focus is<br />

whether to collect sales and use taxes on goods and services sold over the Internet.<br />

Contrary to what some believe, sales and use taxes for sales made on the Internet would<br />

not be a new tax. <strong>Sales</strong> taxes are already <strong>in</strong> place <strong>in</strong> most state and local governments<br />

and, when the tax is not collected by the <strong>in</strong>ternet retailer, it should be reported by the<br />

purchaser on his or her State tax returns.<br />

Due to the US Supreme Court National Bellas Hess case <strong>in</strong> 1967 and the Quill decision<br />

<strong>in</strong> 1992, it is not required for a seller who does not have a nexus <strong>in</strong> a state to collect<br />

sales taxes because it is considered an undue burden on the seller. Therefore, Internet<br />

retail<strong>in</strong>g companies only pay sales taxes <strong>in</strong> the state <strong>in</strong> which they have a physical<br />

presence. For example, Amazon.com (who has a nexus <strong>in</strong> the State of Wash<strong>in</strong>gton)<br />

primarily sells books and CD’s, pays sales taxes to Wash<strong>in</strong>gton for only those sales<br />

made to Wash<strong>in</strong>gton residents. The company is not obligated to charge sales taxes on<br />

sales made to non-residents. This provides Amazon.com with a tax advantage over<br />

ma<strong>in</strong> street merchandise stores such as Barnes and Noble, who also sell books via the<br />

Internet, but has a nexus <strong>in</strong> virtually every state. Barnes and Noble must comply with<br />

all of the states complicated sales tax regulations, which <strong>in</strong> itself is costly to adm<strong>in</strong>ister.<br />

Opponents to Internet taxation believe that forc<strong>in</strong>g onl<strong>in</strong>e retailers to collect sales taxes<br />

will stunt the development of the Net economy. However, other political leaders have<br />

become <strong>in</strong>creas<strong>in</strong>gly concerned over the fact that these companies cut <strong>in</strong>to the profits of<br />

constituents’ ma<strong>in</strong> street stores. In addition, it is believed that the tax-free environment<br />

of the onl<strong>in</strong>e retailer is hurt<strong>in</strong>g state tax revenues which are becom<strong>in</strong>g more scarce due<br />

to the lagg<strong>in</strong>g economy.<br />

A recent study conducted by the Ill<strong>in</strong>ois Department of Revenue estimated that $143<br />

million <strong>in</strong> sales and use taxes due from onl<strong>in</strong>e sales went unpaid <strong>in</strong> FY 2008. The<br />

department estimated that this number would grow to $153 million and $163 million <strong>in</strong><br />

fiscal years 2009 and <strong>2010</strong>. The report, titled “A New Method for Estimat<strong>in</strong>g Ill<strong>in</strong>ois’s<br />

E-Commerce Losses,” can be found at:<br />

http://www.revenue.state.il.us/AboutIdor/TaxResearch/Internet<strong>Sales</strong>TaxLosses.pdf<br />

Streaml<strong>in</strong>ed <strong>Sales</strong> Tax Project<br />

The Streaml<strong>in</strong>ed <strong>Sales</strong> and Use Tax (SST) Agreement was a reaction by the States to<br />

attempts by Congress to prohibit states from collect<strong>in</strong>g taxes on on-l<strong>in</strong>e sales <strong>in</strong> early<br />

2000. Tax collections from on-l<strong>in</strong>e sales were seen as not required due to the<br />

complexity of do<strong>in</strong>g so as outl<strong>in</strong>ed <strong>in</strong> a 1992 Supreme Court rul<strong>in</strong>g (Quill Corp. V.<br />

North Dakota, 504 U.S. 298) related to mail order sales.<br />

-19-

As described by the Streaml<strong>in</strong>ed <strong>Sales</strong> Tax Govern<strong>in</strong>g Board, the purpose of the<br />

Streaml<strong>in</strong>ed <strong>Sales</strong> and Use Tax Agreement (SST) is to provide a road map for states<br />

who want to simplify and modernize sales and use tax adm<strong>in</strong>istration <strong>in</strong> the member<br />

states <strong>in</strong> order to substantially reduce the burden of tax compliance. The Agreement<br />

focuses on improv<strong>in</strong>g sales and use tax adm<strong>in</strong>istration systems for all sellers and for all<br />

types of commerce through all of the follow<strong>in</strong>g:<br />

A. State level adm<strong>in</strong>istration of sales and use tax collections.<br />

B. Uniformity <strong>in</strong> the state and local tax bases.<br />

C. Uniformity of major tax base def<strong>in</strong>itions.<br />

D. Central, electronic registration system for all member states.<br />

E. Simplification of state and local tax rates.<br />

F. Uniform sourc<strong>in</strong>g rules for all taxable transactions.<br />

G. Simplified adm<strong>in</strong>istration of exemptions.<br />

H. Simplified tax returns.<br />

I. Simplification of tax remittances.<br />

J. Protection of consumer privacy.<br />

In short, the SST agreement is a voluntary sales and use tax collection system that<br />

allows sellers to collect the required taxes on their sales based on a dest<strong>in</strong>ation based<br />

sourc<strong>in</strong>g scheme. The agreement was to take affect <strong>in</strong> member states once ten states<br />

had passed laws to come <strong>in</strong>to compliance with the agreement. The SST agreement<br />

went <strong>in</strong>to affect <strong>in</strong> October of 2005.<br />

The SST agreement essentially does three th<strong>in</strong>gs that simplify the collection of sales and<br />

use tax from sellers.<br />

1). The SST conta<strong>in</strong>s thorough tax base def<strong>in</strong>itions that makes these def<strong>in</strong>itions uniform<br />

from state to state.<br />

2). The SST sets up three technology models us<strong>in</strong>g certified sales tax adm<strong>in</strong>istration<br />

software with which sellers can pay required taxes to all the member states <strong>in</strong> the<br />

SST. The three technology models are:<br />

Model 1<br />

A certified Service Provider performs all the seller’s sales and use tax functions.<br />

The Streaml<strong>in</strong>ed <strong>Sales</strong> Tax Govern<strong>in</strong>g Board lists four companies as Certified<br />

Service Providers. These providers <strong>in</strong>clude Avalara, Exactor, ADP Taxware, and<br />

SpeedTax.<br />

Model 2<br />

A Certified Automated System which uses third party sales tax software that is<br />

certified under the SST that allows sellers to remit sales and use tax on their own.<br />

-20-

Model 3<br />

The f<strong>in</strong>al model allows sellers to develop their own sales and use tax software<br />

which is certified by the SST.<br />

3). The SST requires registered sellers to source sales of property, services and digital<br />

goods on a dest<strong>in</strong>ation basis. This means that tax revenue would be remitted to the<br />

local and state tax districts where the property is delivered or where a service is<br />

performed, not where the seller is located.<br />

Accord<strong>in</strong>g to the Streaml<strong>in</strong>ed <strong>Sales</strong> Tax Govern<strong>in</strong>g Board, there are n<strong>in</strong>eteen full<br />

member states and three associate member states. A full member state is a state that is<br />

<strong>in</strong> compliance with the Streaml<strong>in</strong>ed <strong>Sales</strong> and Use Tax agreement through its laws,<br />

rules, regulations, and policies.<br />

An associate member state is either (a) a state that is <strong>in</strong> compliance with the<br />

Streaml<strong>in</strong>ed <strong>Sales</strong> and Use Tax Agreement except that its laws, rules regulations and<br />

policies to br<strong>in</strong>g the state <strong>in</strong>to compliance are not <strong>in</strong> effect but are scheduled to take<br />

effect on or before July 1, 2009, or (b) a State that has achieved substantial compliance<br />

with the terms of the Streaml<strong>in</strong>ed <strong>Sales</strong> and Use Tax Agreement taken as a whole, but<br />

not necessarily each provision, and there is an expectation that the state will achieve<br />

compliance by July 1, 2009.<br />

The National Conference of State Legislatures (NCSL) states that six other states have<br />

had legislation <strong>in</strong>troduced to come <strong>in</strong>to compliance with the Streaml<strong>in</strong>ed <strong>Sales</strong> and Use<br />

Tax Agreement <strong>in</strong> recent years. These states were Florida, Ill<strong>in</strong>ois, Hawaii,<br />

Massachusetts, Missouri, and Wiscons<strong>in</strong>. The recent <strong>in</strong>clusion of certa<strong>in</strong> candies,<br />

groom<strong>in</strong>g and hygiene products, and soft dr<strong>in</strong>ks <strong>in</strong>to the category of fully taxed items<br />

under the sales tax as part of Public Act 096-0034 was one step by Ill<strong>in</strong>ois to more fully<br />

conform to the SST.<br />

Table 11, on the follow<strong>in</strong>g page, lists all the full and associate members of the SST.<br />

-21-

Table 11. STREAMLINED SALES TAX PROJECT<br />

STATES<br />

Full Member States<br />

Arkansas<br />

North Carol<strong>in</strong>a<br />

Indiana<br />

North Dakota<br />

Iowa<br />

Oklahoma<br />

Kansas<br />

Rhode Island<br />

Kentucky<br />

South Dakota<br />

Michigan<br />

Vermont<br />

M<strong>in</strong>nesota<br />

Wash<strong>in</strong>gton<br />

Nebraska<br />

West Virg<strong>in</strong>ia<br />

Nevada<br />

Wyom<strong>in</strong>g<br />

New Jersey<br />

Associate Member States<br />

Ohio<br />

Tennessee<br />

Utah<br />

Source: Streaml<strong>in</strong>ed <strong>Sales</strong> Tax Govern<strong>in</strong>g Board<br />

-22-

Flow Chart for <strong>Sales</strong> <strong>Taxes</strong><br />

The flow chart provided on the next page is an attempt to provide some organizational<br />

review of Ill<strong>in</strong>ois sales taxes and the distribution of funds. As the chart depicts, after<br />

an item is purchased, one must determ<strong>in</strong>e if it subject to sales taxation. Many items are<br />

exempt for sales taxation <strong>in</strong> Ill<strong>in</strong>ois and Appendix 1 provides a list of such items and<br />

the dates <strong>in</strong> which the exemption was enacted. If it is determ<strong>in</strong>ed that an item is subject<br />

to sales taxation, then one must ascerta<strong>in</strong> if it was purchased <strong>in</strong> Ill<strong>in</strong>ois. If the item is<br />

purchased from a vendor with a nexus <strong>in</strong> Ill<strong>in</strong>ois, it is subject to an Occupation Tax. If<br />

it is purchased from a vendor that does not have a physical presence with<strong>in</strong> Ill<strong>in</strong>ois, the<br />

consumer is responsible to pay a Use Tax.<br />

Additional considerations must be made <strong>in</strong> order to determ<strong>in</strong>e the f<strong>in</strong>al sales tax. One<br />

must decide whether the item is considered a qualified food, drug, or medical<br />

appliance. These items are taxed at 1%, which is forwarded to local governments.<br />

Also, many local government units have additional home-rule taxes. These units are<br />

provided <strong>in</strong> Table 6 and Appendix 5.<br />

F<strong>in</strong>ally, once the sales tax is paid by either the retailer (Occupation Tax) or purchaser<br />

(Use Tax), the funds must be distributed between the State and local governments.<br />

Funds received by the State are primarily deposited <strong>in</strong>to the <strong>General</strong> Revenue Fund.<br />

However, some money is given to the Build Ill<strong>in</strong>ois Fund, the Ill<strong>in</strong>ois Tax Increment<br />

Fund, the Capital Projects Fund, and the Common Schools Special Account Fund.<br />

All of the previous considerations, plus some additional issues are depicted <strong>in</strong> the<br />

follow<strong>in</strong>g Ill<strong>in</strong>ois <strong>Sales</strong> Tax Flowcharts.<br />

-23-

CHART 2<br />

Ill<strong>in</strong>ois <strong>Sales</strong> Tax Flowchart<br />

See Appendix 1 for<br />

a list of sales tax<br />

exempt items<br />

Is the item<br />

exempt from<br />

sales taxes?<br />

Yes<br />

0% <strong>Sales</strong> Tax<br />

Service Occupation Tax<br />

No<br />

Service Use Tax<br />

A<br />

No<br />

Is the item<br />

purchased from<br />

a retailer?<br />

Yes<br />

Is the item<br />

purchased <strong>in</strong><br />

Ill<strong>in</strong>ois?<br />

No<br />

Is the item<br />

purchased from<br />

a retailer?<br />

No<br />

B<br />

Yes<br />

Retailers’<br />

Occupation Tax<br />

Use Tax<br />

Yes<br />

1% <strong>Sales</strong><br />

Tax to Local<br />

Government<br />

No<br />

Is the item a<br />

qualify<strong>in</strong>g food,<br />

drug, or medical<br />

device?<br />

Is the item a<br />

qualify<strong>in</strong>g food,<br />

drug, or medical<br />

device?<br />

Consumer pays<br />

1% tax or the<br />

difference of<br />

Ill<strong>in</strong>ois tax and tax<br />

paid<br />

Yes<br />

No<br />

See Table 6 and Appendix<br />

5 for a list of home-rule<br />

jurisdictions<br />

Does a Home-Rule<br />

Tax apply?<br />

Does a Home-Rule<br />

Tax apply?<br />

Yes<br />

No<br />

Yes<br />

No<br />

Appropriate<br />

Home-rule<br />

tax is paid by<br />

Retailer<br />

Appropriate<br />

Home-rule<br />

tax is paid by<br />

Consumer<br />

Retailer forwards<br />

6.25% Tax to the<br />

Dept. of Revenue<br />

Consumer pays 6.25%<br />

Tax or the difference of<br />

Ill<strong>in</strong>ois tax and tax paid<br />

C<br />

D<br />

Flowchart cont<strong>in</strong>ued on next page<br />

-24-

CHART 2 (cont<strong>in</strong>ued)<br />

Ill<strong>in</strong>ois <strong>Sales</strong> Tax Flowchart<br />

(cont<strong>in</strong>ued)<br />

A<br />

B<br />

0% sales tax<br />

on services<br />

No<br />

Is the item<br />

purchased from<br />

a serviceman?<br />

Is the item<br />

purchased from<br />

a serviceman?<br />

No<br />

0% sales tax<br />

on services<br />

Yes<br />

Yes<br />

Appropriate<br />

Home-rule<br />

tax is paid by<br />

Retailer<br />

Yes<br />

Does a Home-Rule<br />

Tax apply?<br />

Does a Home-Rule<br />

Tax apply?<br />

Yes<br />

Appropriate<br />

Home-rule<br />

tax is paid by<br />

Consumer<br />

C<br />

Retailer forwards<br />

6.25% Tax to the<br />

Dept. of Revenue<br />

Consumer pays 6.25%<br />

tax or the difference of<br />

Ill<strong>in</strong>ois tax and tax paid<br />

D<br />

See Table 6 and Appendix<br />

5 for a list of home-rule<br />

jurisdictions<br />

Distribution<br />

C<br />

D<br />

80% to State<br />

Government<br />

16% to Local<br />

Government Tax Fund<br />

4% to County and<br />

Mass Transit Fund<br />

80% to State<br />

Government<br />

20% to State and Local<br />

Tax Reform Fund<br />

E<br />

1.75% to Build<br />

Ill<strong>in</strong>ois Fund<br />

3.8% to Build<br />

Ill<strong>in</strong>ois fund to<br />

retire bonds<br />

0.27% to Ill<strong>in</strong>ois<br />

Tax Increment<br />

Fund<br />

25% to Common<br />

Schools Special<br />

Account Fund<br />

Revenues from certa<strong>in</strong><br />

items to Capital<br />

Projects Fund<br />

Rema<strong>in</strong>der to <strong>General</strong><br />

Revenue Fund with 2<br />

transfers out<br />

3/32 from downstate counties and<br />

municipalities with mass transit<br />

districts to the Downstate Public<br />

Transportation Fund<br />

3/32 from Madison, Monroe,<br />

and St. Clair Counties to the<br />

Downstate Public<br />

Transportation Fund<br />

-25-

APPENDIX 1: ILLINOIS SALES TAX EXEMPTIONS<br />

Exemption<br />

Year Enacted<br />

Feed and Seed Exemption 1933<br />

Occasional <strong>Sales</strong> 1933<br />

Charitable, Religious, Governmental, and Educational Exemption 1953<br />

Demonstration Use Prior to Resale 1955<br />

Interim Use Prior to Sale Exemption 1955<br />

Property Acquired by Non-Resident before Relocat<strong>in</strong>g <strong>in</strong> Ill<strong>in</strong>ois Exemption 1955<br />

Traded-In Property Exemption 1955<br />

Use by Nonresidents While Temporarily Pass<strong>in</strong>g Through Ill<strong>in</strong>ois Exemption 1955<br />

Retailer’s Discount 1960<br />

<strong>Sales</strong> by Exempt Organizations 1961<br />

Newspr<strong>in</strong>t and Ink to Newspapers and Magaz<strong>in</strong>es Exemption 1965<br />

<strong>Sales</strong> of Fuel to Vessels on Border<strong>in</strong>g Rivers 1968<br />

Roll<strong>in</strong>g Stock Exemption 1968<br />

Pollution Control Facilities Exemption 1970<br />

<strong>Sales</strong> Through Penny Bulk Vend<strong>in</strong>g Mach<strong>in</strong>es 1972<br />

<strong>Sales</strong> of Motor Vehicles to Non-Residents Exemption 1974<br />

Farm Chemicals Exemptions 1975<br />

Nutrition Program for the Elderly Exemption 1975<br />

Manufactur<strong>in</strong>g and Assembl<strong>in</strong>g Mach<strong>in</strong>ery and Equipment Exemption 1979<br />

Farm Mach<strong>in</strong>ery and Equipment Exemption 1980<br />