Strategic IPO underpricing, information momentum, and lockup ...

Strategic IPO underpricing, information momentum, and lockup ...

Strategic IPO underpricing, information momentum, and lockup ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

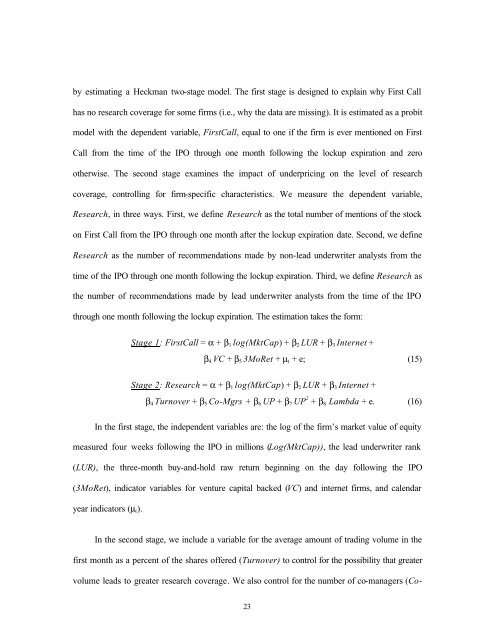

y estimating a Heckman two-stage model. The first stage is designed to explain why First Call<br />

has no research coverage for some firms (i.e., why the data are missing). It is estimated as a probit<br />

model with the dependent variable, FirstCall, equal to one if the firm is ever mentioned on First<br />

Call from the time of the <strong>IPO</strong> through one month following the <strong>lockup</strong> expiration <strong>and</strong> zero<br />

otherwise. The second stage examines the impact of <strong>underpricing</strong> on the level of research<br />

coverage, controlling for firm-specific characteristics. We measure the dependent variable,<br />

Research, in three ways. First, we define Research as the total number of mentions of the stock<br />

on First Call from the <strong>IPO</strong> through one month after the <strong>lockup</strong> expiration date. Second, we define<br />

Research as the number of recommendations made by non-lead underwriter analysts from the<br />

time of the <strong>IPO</strong> through one month following the <strong>lockup</strong> expiration. Third, we define Research as<br />

the number of recommendations made by lead underwriter analysts from the time of the <strong>IPO</strong><br />

through one month following the <strong>lockup</strong> expiration. The estimation takes the form:<br />

Stage 1: FirstCall = α + β 1 log(MktCap) + β 2 LUR + β 3 Internet +<br />

β 4 VC + β 5 3MoRet + µ t + e; (15)<br />

Stage 2: Research = α + β 1 log(MktCap) + β 2 LUR + β 3 Internet +<br />

β 4 Turnover + β 5 Co-Mgrs + β 6 UP + β 7 UP 2 + β 8 Lambda + e. (16)<br />

In the first stage, the independent variables are: the log of the firm’s market value of equity<br />

measured four weeks following the <strong>IPO</strong> in millions (Log(MktCap)), the lead underwriter rank<br />

(LUR), the three-month buy-<strong>and</strong>-hold raw return beginning on the day following the <strong>IPO</strong><br />

(3MoRet), indicator variables for venture capital backed (VC) <strong>and</strong> internet firms, <strong>and</strong> calendar<br />

year indicators (µ t ).<br />

In the second stage, we include a variable for the average amount of trading volume in the<br />

first month as a percent of the shares offered (Turnover) to control for the possibility that greater<br />

volume leads to greater research coverage. We also control for the number of co-managers (Co-<br />

23