Strategic IPO underpricing, information momentum, and lockup ...

Strategic IPO underpricing, information momentum, and lockup ...

Strategic IPO underpricing, information momentum, and lockup ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

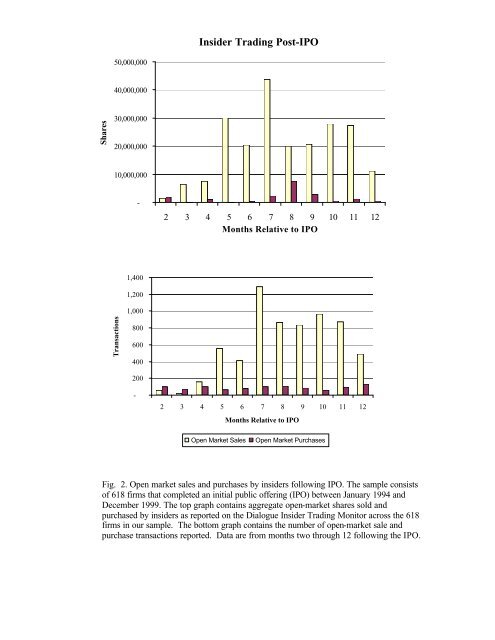

Insider Trading Post-<strong>IPO</strong><br />

50,000,000<br />

40,000,000<br />

Shares<br />

30,000,000<br />

20,000,000<br />

10,000,000<br />

-<br />

2 3 4 5 6 7 8 9 10 11 12<br />

Months Relative to <strong>IPO</strong><br />

1,400<br />

1,200<br />

1,000<br />

Transactions<br />

800<br />

600<br />

400<br />

200<br />

-<br />

2 3 4 5 6 7 8 9 10 11 12<br />

Months Relative to <strong>IPO</strong><br />

Open Market Sales<br />

Open Market Purchases<br />

Fig. 2. Open market sales <strong>and</strong> purchases by insiders following <strong>IPO</strong>. The sample consists<br />

of 618 firms that completed an initial public offering (<strong>IPO</strong>) between January 1994 <strong>and</strong><br />

December 1999. The top graph contains aggregate open-market shares sold <strong>and</strong><br />

purchased by insiders as reported on the Dialogue Insider Trading Monitor across the 618<br />

firms in our sample. The bottom graph contains the number of open-market sale <strong>and</strong><br />

purchase transactions reported. Data are from months two through 12 following the <strong>IPO</strong>.