Zimbabwe Platinum Mines - Imara

Zimbabwe Platinum Mines - Imara

Zimbabwe Platinum Mines - Imara

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EQUITY RESEARCH<br />

17 MAY 2012<br />

ZIMBABWE<br />

MINING<br />

All Sharks want a bite of the “value”…<br />

In recent years, we have witnessed Implats going full<br />

steam ahead with its expansion at Zimplats in the face<br />

of looming indigenisation demands. Most analysts<br />

(including ourselves) were of the opinion that Implats<br />

was managing this threat through various agreements<br />

that were entered into with the government of<br />

<strong>Zimbabwe</strong> in yester-years. However, what seemingly<br />

began as a threat is now being executed. Besides<br />

demanding a 51.0% stake in foreign owned mines,<br />

<strong>Zimbabwe</strong>an authorities have also raised taxation and<br />

royalty fees. Simply put, <strong>Zimbabwe</strong>’s indigenisation<br />

legislations imply that its shareholders (Implats and<br />

other minorities) must reduce their stakes to a<br />

combined 49.0%.<br />

• The share price has suffered significantly. Clearly,<br />

Zimplats has been tainted by the country’s political<br />

problems. Of course, political actors and the media<br />

can be held accountable here. The share price has derated<br />

to about AUD 10.00 from historic highs of AUD<br />

13.00.<br />

• Uncertainty persists but the stock remains<br />

fundamentally undervalued. We have valued<br />

Zimplats using a DCF approach which yielded a target<br />

price of USD 15.00, indicating 46.1% potential upside.<br />

On the other hand, our comparative analysis shows<br />

that Zimplats is trading on a stand-out mark to market<br />

5.7x 2013 PER. This represents a significant discount<br />

to peers (average of 20.7x). We are still convinced<br />

that Zimplats has the potential to create material<br />

additional value for shareholders in the long term.<br />

BUY<br />

BLOOMBERG:ZIM:AU<br />

BUY<br />

Current price (AUD) 10.27<br />

Current price (USD) 10.41<br />

Target price (USD) 15.0<br />

Upside/Downside 46.1%<br />

Liquidity<br />

Market Cap (USDm) 1,120.4<br />

Shares (m) 107.6<br />

Free float (%) 11%<br />

Ave. daily vol ('000) 14.0<br />

Share Price Performance<br />

6 Months (%) 11.40 -9.9%<br />

Relative change (%)* -6.9%<br />

12 Months (%) 12.45 -17.5%<br />

Relative change (%)* -0.8%<br />

*Relative to MSCI Frontier Market Index<br />

Financials (USDm)-FY 30 June 2011 2012F 2013F<br />

Revenue 527.4 515.0 631.5<br />

EBITDA 278.2 253.4 309.0<br />

Attributable earnings 200.4 159.6 197.2<br />

EPS (USD) 1.9 1.5 1.8<br />

DPS (USD) - - -<br />

NAV/share (USD) 6.9 8.7 10.2<br />

Ratios 2011 2012F 2013F<br />

Gearing 5.1% 4.1% 3.5%<br />

RoaA 22.4% 14.7% 15.3%<br />

RoaE 31.4% 19.0% 19.3%<br />

EV/EBITDA (x) 3.1 3.1 2.3<br />

EV/4E oz(USD) 2,351.8 2,102.3 1,531.5<br />

PBV (x) 1.5 1.2 1.0<br />

PER (x) 5.6 7.0 5.7<br />

Earnings Yield 18% 14% 18%<br />

Dividend Yield - - -<br />

EBITDA Margin 52.8% 49.2% 48.9%<br />

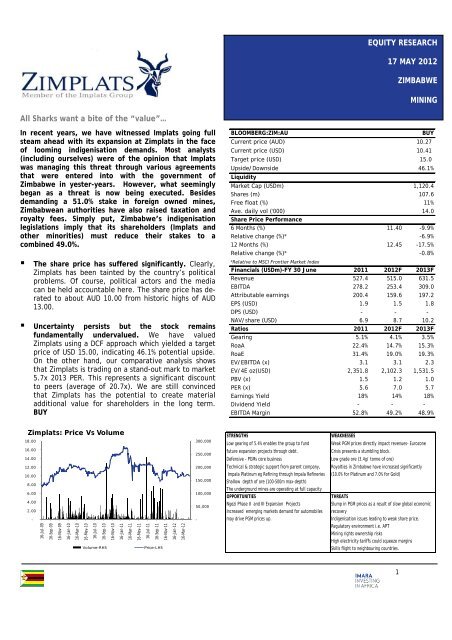

Zimplats: Price Vs Volume<br />

18.00<br />

300,000<br />

STRENGTHS<br />

Low gearing of 5.4% enables the group to fund<br />

WEAKNESSES<br />

Weak PGM prices directly impact revenues- Eurozone<br />

16.00<br />

14.00<br />

250,000<br />

future expansion projects through debt.<br />

Defensive - PGMs core business<br />

Crisis presents a stumbling block.<br />

Low grade ore (3.4g/ tonne of ore)<br />

12.00<br />

200,000<br />

Technical & strategic support from parent company,<br />

Royalties in <strong>Zimbabwe</strong> have increased significantly<br />

10.00<br />

8.00<br />

6.00<br />

4.00<br />

2.00<br />

150,000<br />

100,000<br />

50,000<br />

Impala <strong>Platinum</strong> eg Refining through Impala Refineries<br />

Shallow depth of ore (100-500m max-depth)<br />

The underground mines are operating at full capacity<br />

OPPORTUNITIES<br />

Ngezi Phase II and III Expansion Projects<br />

Increased emerging markets demand for automobiles<br />

(10.0% for <strong>Platinum</strong> and 7.0% for Gold)<br />

THREATS<br />

Slump in PGM prices as a result of slow global economic<br />

recovery<br />

-<br />

16-Jul-09<br />

16-Sep-09<br />

16-Nov-09<br />

16-Jan-10<br />

16-Mar-10<br />

16-May-10<br />

16-Jul-10<br />

16-Sep-10<br />

16-Nov-10<br />

Volume-RHS<br />

16-Jan-11<br />

16-Mar-11<br />

16-May-11<br />

16-Jul-11<br />

16-Sep-11<br />

16-Nov-11<br />

Price-LHS<br />

16-Jan-12<br />

16-Mar-12<br />

-<br />

may drive PGM prices up.<br />

Indigenisation issues leading to weak share price.<br />

Regulatory environment i.e. APT<br />

Mining rights ownership risks<br />

High electricity tariffs could squeeze margins<br />

Skills flight to neighbouring countries.<br />

1