Zimbabwe Platinum Mines - Imara

Zimbabwe Platinum Mines - Imara

Zimbabwe Platinum Mines - Imara

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NATURE OF OPERATIONS<br />

Zimplats Holdings Limited is a mining group which explores for<br />

and produces platinum group metals (PGMs) in <strong>Zimbabwe</strong>. The<br />

company's exploration projects include Ngezi South and North,<br />

Hartley <strong>Platinum</strong> and Selous. It is a company incorporated in<br />

Guernsey, British Isles and is listed on the Australian Stock Exchange<br />

(ASX). Zimplats is 87% owned by Impala <strong>Platinum</strong> Holdings (IMP: SJ)<br />

of South Africa. It operates from two main sites (Ngezi and Selous)<br />

and employs underground mining techniques (board and pillar<br />

method) to extract PGMs. We note that six metals (<strong>Platinum</strong>,<br />

Palladium, Gold, Rhodium, Nickel and Lithium) contribute c99% of<br />

total revenues whilst other metals contribute 1.0%.<br />

Zimplats has a vision to be the leading platinum company in<br />

<strong>Zimbabwe</strong>, producing 1.0m platinum oz per annum. In line with its<br />

vision the company has embarked on a phased expansion drive to<br />

ramp up production levels. For example, the Phase II project which<br />

is currently underway is the second stage in a series of planned<br />

expansions to grow the business.<br />

Zimplats currently has three underground mines. It is worth noting<br />

that Zimpats has shifted away from open pit mining and now employs<br />

underground mining through its three mines (Ngwarati, Rukodzi and<br />

Bimha Mine). Ngwarati and Rukodzi Mine have a combined capacity<br />

in the region of 2.2mtpa whereas the new Bimha Mine has a capacity<br />

of around 2.0mtpa. This implies that the group currently has an<br />

estimated capacity of 4.2m tonnes of ore per annum. However, the<br />

Phase II expansion project is expected to add another 2.0mtpa<br />

through the Mupfuti Mine (Portal 3).<br />

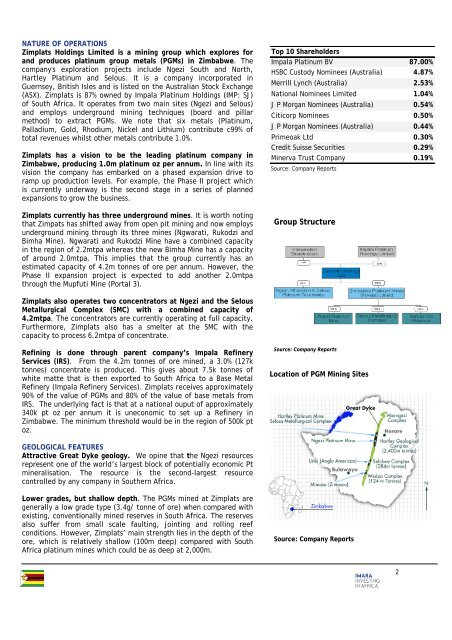

Top 10 Shareholders<br />

Impala <strong>Platinum</strong> BV 87.00%<br />

HSBC Custody Nominees (Australia) 4.87%<br />

Merrill Lynch (Australia) 2.53%<br />

National Nominees Limited 1.04%<br />

J P Morgan Nominees (Australia) 0.54%<br />

Citicorp Nominees 0.50%<br />

J P Morgan Nominees (Australia) 0.44%<br />

Primeoak Ltd 0.30%<br />

Credit Suisse Securities 0.29%<br />

Minerva Trust Company 0.19%<br />

Source: Company Reports<br />

Group Structure<br />

Zimplats also operates two concentrators at Ngezi and the Selous<br />

Metallurgical Complex (SMC) with a combined capacity of<br />

4.2mtpa. The concentrators are currently operating at full capacity.<br />

Furthermore, Zimplats also has a smelter at the SMC with the<br />

capacity to process 6.2mtpa of concentrate.<br />

Refining is done through parent company’s Impala Refinery<br />

Services (IRS). From the 4.2m tonnes of ore mined, a 3.0% (127k<br />

tonnes) concentrate is produced. This gives about 7.5k tonnes of<br />

white matte that is then exported to South Africa to a Base Metal<br />

Refinery (Impala Refinery Services). Zimplats receives approximately<br />

90% of the value of PGMs and 80% of the value of base metals from<br />

IRS. The underlying fact is that at a national ouput of approximately<br />

340k pt oz per annum it is uneconomic to set up a Refinery in<br />

<strong>Zimbabwe</strong>. The minimum threshold would be in the region of 500k pt<br />

oz.<br />

Source: Company Reports<br />

Location of PGM Mining Sites<br />

GEOLOGICAL FEATURES<br />

Attractive Great Dyke geology. We opine that the Ngezi resources<br />

represent one of the world’s largest block of potentially economic Pt<br />

mineralisation. The resource is the second-largest resource<br />

controlled by any company in Southern Africa.<br />

Lower grades, but shallow depth. The PGMs mined at Zimplats are<br />

generally a low grade type (3.4g/ tonne of ore) when compared with<br />

existing, conventionally mined reserves in South Africa. The reserves<br />

also suffer from small scale faulting, jointing and rolling reef<br />

conditions. However, Zimplats’ main strength lies in the depth of the<br />

ore, which is relatively shallow (100m deep) compared with South<br />

Africa platinum mines which could be as deep at 2,000m.<br />

Source: Company Reports<br />

2