UNITED STATES SECURITIES AND EXCHANGE ... - Imperial Oil

UNITED STATES SECURITIES AND EXCHANGE ... - Imperial Oil

UNITED STATES SECURITIES AND EXCHANGE ... - Imperial Oil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

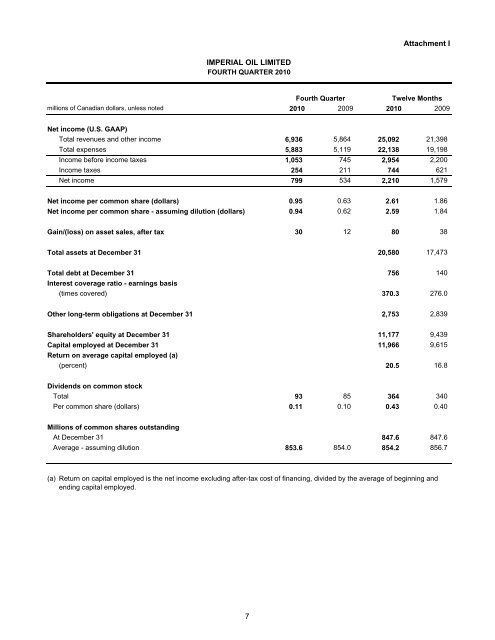

Attachment I<br />

IMPERIAL OIL LIMITED<br />

FOURTH QUARTER 2010<br />

Fourth Quarter Twelve Months<br />

millions of Canadian dollars, unless noted 2010 2009 2010 2009<br />

Net income (U.S. GAAP)<br />

Total revenues and other income 6,936 5,864 25,092 21,398<br />

Total expenses 5,883 5,119 22,138 19,198<br />

Income before income taxes 1,053 745 2,954 2,200<br />

Income taxes 254 211 744 621<br />

Net income 799 534 2,210 1,579<br />

Net income per common share (dollars) 0.95 0.63 2.61 1.86<br />

Net income per common share - assuming dilution (dollars) 0.94 0.62 2.59 1.84<br />

Gain/(loss) on asset sales, after tax 30 12 80 38<br />

Total assets at December 31 20,580 17,473<br />

Total debt at December 31 756 140<br />

Interest coverage ratio - earnings basis<br />

(times covered) 370.3 276.0<br />

Other long-term obligations at December 31 2,753 2,839<br />

Shareholders' equity at December 31 11,177 9,439<br />

Capital employed at December 31 11,966 9,615<br />

Return on average capital employed (a)<br />

(percent) 20.5 16.8<br />

Dividends on common stock<br />

Total 93 85 364 340<br />

Per common share (dollars) 0.11 0.10 0.43 0.40<br />

Millions of common shares outstanding<br />

At December 31 847.6 847.6<br />

Average - assuming dilution 853.6 854.0 854.2 856.7<br />

(a)<br />

Return on capital employed is the net income excluding after-tax cost of financing, divided by the average of beginning and<br />

ending capital employed.<br />

7