Macquarie Equities Research - Discovery Metals Limited

Macquarie Equities Research - Discovery Metals Limited

Macquarie Equities Research - Discovery Metals Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

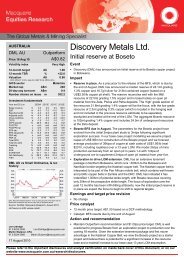

AUSTRALIA<br />

DML AU<br />

Price 2 Jun 10<br />

Outperform<br />

A$0.76<br />

Relative to ex 100<br />

Volatility index<br />

12-month target A$ 1.00<br />

12-month TSR % +31.6<br />

Valuation A$<br />

- DCF (WACC 12.0%, beta 2.0, ERP 5.5%, RFR 6.0%)<br />

0.99<br />

GICS sector<br />

Materials<br />

Market cap A$m 227<br />

30-day avg turnover A$m 0.8<br />

Number shares on issue m 298.6<br />

Investment fundamentals<br />

Year end 30 Jun<br />

2009A 2010E 2011E 2012E<br />

Sales revenue m 0.0 0.0 0.0 88.7<br />

EBIT m -5.0 -7.5 -11.0 18.4<br />

Reported profit m -4.4 -5.4 -9.5 8.3<br />

Adjusted profit m -4.4 -5.4 -9.5 8.3<br />

Gross cashflow m -3.7 -2.9 -4.5 24.7<br />

CFPS ¢ -1.9 -1.0 -1.0 5.8<br />

CFPS growth % 28.5 48.2 -6.8 nmf<br />

PGCFPS x nmf nmf nmf 13.2<br />

PGCFPS rel x nmf nmf nmf nmf<br />

EPS adj ¢ -2.3 -1.7 -2.2 1.9<br />

EPS adj growth % 14.5 27.9 -31.7 nmf<br />

PER adj x nmf nmf nmf 39.1<br />

PER rel x nmf nmf nmf nmf<br />

Total DPS ¢ 0.0 0.0 0.0 0.0<br />

Total div yield % 0.0 0.0 0.0 0.0<br />

Franking % nmf nmf nmf nmf<br />

ROA % -20.8 -15.4 -6.8 7.0<br />

ROE % -19.7 -11.6 -8.7 5.4<br />

EV/EBITDA x -34.1 -52.7 -51.4 8.9<br />

Net debt/equity % -28.2 -45.9 53.1 54.0<br />

P/BV x 5.2 4.4 2.1 2.2<br />

Source: FactSet, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

(all figures in AUD unless noted)<br />

Len Eldridge<br />

61 8 9224 0838 Len.Eldridge@macquarie.com<br />

Martin Stulpner, CFA<br />

61 8 9224 0866 Martin.Stulpner@macquarie.com<br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

A copper producer in the making<br />

<strong>Discovery</strong> <strong>Metals</strong> (DML) is an emerging copper producer focused on developing<br />

the Boseto copper project in Botswana. DML acquired its tenement package in<br />

Botswana in 2005 and has delineated an aggregate resource of 102mt at 1.4%<br />

copper for 1.42mt contained copper.<br />

Boseto to generate early cashflow. DML is due to deliver the Boseto BFS in<br />

July 2010, based on a 3mpta plant. The parameters for the Boseto project have<br />

evolved from the initial 2mtpa plant study following significant exploration<br />

success in the drilling campaign over the past 12 months. We have assumed<br />

project capex of US$185m for construction of the Boseto project and we forecast<br />

average production of 36ktpa copper at cash costs of US$1.56/lb (real $2010,<br />

including royalties) over a 13 year LOM. We have modelled 3mtpa mine<br />

production exclusively from an open pit in years 1-4 with 1mtpa of underground<br />

ore to supplement 2mtpa open pit material from year five.<br />

Our base case 13 year LOM assumption appears to be conservative as we have<br />

modelled the open pit on M&I resources only and not included the ~50mt of open<br />

pit material in the inferred category. Subject to the prevailing copper price<br />

environment (given the grade and high strip ratio of deposits at Boseto) we see<br />

significant upside to our LOM forecast.<br />

A significant exploration footprint. DML has an extensive tenement package<br />

in Northern Botswana, which runs ~300km to the Botswana and Namibian<br />

border targeting the Kalahari copper belt. The Kalahari copper belt is interpreted<br />

to be part of the Pan African mobile belt, which contains well known and prolific<br />

copper belts in Zambia and the DRC. DML has indicated it has indentified<br />

1,300km of potential strike length, with Boseto resources covering only 30km of<br />

the prospective strike length. The focus of exploration over the past 12 months<br />

has been infill drilling at Boseto; now the resources are in place to underpin the<br />

BFS we expect the focus to begin to shift to regional targets.<br />

Risks. Taking a project from the exploration phase through funding, construction<br />

and ultimately production is inherently challenging. DML is set to complete the<br />

Boseto BFS in July, which will then see DML move to secure project funding (we<br />

have assumed 50:50 debt to equity mix). The construction phase of the project<br />

does not appear to present many technical challenges with major sealed<br />

highways providing site access; however, the risk of equipment delivery delays<br />

and capex over-runs is ever present. Once operational, project specific risks<br />

include the floating of oxide copper which is prevalent in the upper parts of the<br />

ore body (though makes up only 5% of mined material over LOM) and a narrow<br />

ore body leading to a high strip ratio.<br />

Action and recommendation. We initiate coverage with an Outperform<br />

recommendation and A$1.00ps price target. DML is well positioned to progress<br />

Boseto from an exploration project to production over the coming 18 months.<br />

Given the extensive tenement package and first mover advantage in the Kalahari<br />

Copper Belt, we view the Boseto project as a starter project and believe there is<br />

potential for a significant increase in the resource base and a material increase<br />

to our base case 13 year LOM assumption.<br />

3 June 2010<br />

Please refer to the important disclosures and analyst certification on page 2 and the inside back cover of this<br />

document, or on our website www.macquarie.com.au/research/disclosures.

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Inside<br />

A copper producer in the making 3<br />

Financials 10<br />

Risks 12<br />

Boseto overview 13<br />

Mining in Botswana 26<br />

Botswana country profile 30<br />

Copper 31<br />

Board & Management 34<br />

<strong>Discovery</strong> <strong>Metals</strong><br />

Company profile<br />

• <strong>Discovery</strong> <strong>Metals</strong> (DML) is an emerging copper producer focused on<br />

developing the Boseto copper project in Botswana. DML acquired its<br />

tenement package in Botswana in 2005 and has delineated an aggregate<br />

resource of 102mt at 1.4% copper for 1.42mt contained copper.<br />

• The Boseto Copper project is located in the northwest corner of Botswana,<br />

~80km from the town of Maun. DML acquired a seven tenement package from<br />

the Government of Botswana in 2005, and the tenement package was<br />

renewed in 2008. DML secured a further seven tenements to the southwest of<br />

the original package in 2008. DML‟s tenement package covers 10,100km 2 ,<br />

starting ~60km southeast of Maun and stretching ~300km to the Namibian<br />

boarder.<br />

• DML is due to deliver the Boseto BFS in July 2010, based on a 3mpta plant<br />

footprint. The parameters for the Boseto project have evolved from the initial<br />

2mtpa plant study following significant exploration success in the drilling<br />

campaign over the past 12 months. We have assumed project capex of<br />

US$185m for construction of the Boseto project and we forecast average<br />

production of 36ktpa copper at cash costs of US$1.56/lb (real $2010,<br />

including royalties) over a 13 year LOM. We have modelled 3mtpa mine<br />

production exclusively from an open pit in years 1- 4 with 1mtpa of<br />

underground ore to supplement 2mtpa open pit material from year five.<br />

• Now that the initial Boseto project has sufficient resources to underpin a 13<br />

year LOM, DML will begin to refocus its exploration efforts on regional<br />

exploration targets in an attempt to define a “Boseto 2” project, now that<br />

sufficient resources have been indentified to underpin at least a 13 year LOM<br />

at Boseto. At present only 328km of the prospective 1,300km of indentified<br />

strike length has been explored by a soil sampling program, with only 67km of<br />

the 1,300km drilled to date. DML collected soil samples covering 108km of<br />

prospective strike in the March quarter with the results undergoing quality<br />

control checks prior to release.<br />

Fig 1<br />

DML AU vs Small Ordinaries<br />

Source: FactSet, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

(all figures in AUD unless noted)<br />

3 June 2010 2

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

A copper producer in the making<br />

We have assumed a<br />

50:50 debt:equity<br />

funding package<br />

We initiate coverage of <strong>Discovery</strong> <strong>Metals</strong> (DML) with an Outperform recommendation and<br />

A$1.00ps price target. Our price target is based on our funded DCF valuation, assuming<br />

50:50 debt/equity funding, with equity raised at the current share price of A$0.77ps; however,<br />

we have considered a number of ranges (-20% to +30%) for the pricing of an equity raising.<br />

Fig 2 Unfunded <strong>Discovery</strong> <strong>Metals</strong> NPV valuation<br />

Segment A$m A$ps<br />

Boseto 233 0.78<br />

Exploration 60 0.17<br />

G&A -32 -0.11<br />

Net cash/(debt) 34 0.12<br />

DML NPV 295 0.99<br />

Shares on issue ($m) 299<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

Our Boseto project valuation is based on a 3mtpa plant as guided by the BFS update<br />

released in May 2010. The Boseto project has been upgraded from the initial scope of the<br />

BFS which was based on a 2mtpa plant. The BFS for the 3mtpa project is due to be released<br />

in July. DML has not provided formal production, capex or cost guidance for the 3mtpa<br />

project, which is understandable as work is ongoing to determine appropriate mine schedules<br />

and fleet configuration for the accelerated open pit mining rate.<br />

Boseto modelling<br />

based on 3mtpa<br />

plant over an initial<br />

13 year LOM<br />

We have based our project modelling on the open pit M&I resource base as of April 2010 and<br />

the underground mining inventory used in the underground scoping study released in March<br />

2010. Based on the key mine parameters set out in Fig 3 we are forecasting average copper<br />

production of 36ktpa and silver of 1,054moz at US$1.56/lb (real $2010) over a 13 year LOM.<br />

Fig 3 Key Boseto mine assumptions<br />

Parameter Year 1-4 Years 4-13<br />

Open pit mined tonnes mt 3.0 2.0<br />

Strip ratio X 10 10<br />

Underground mined tonnes mt 0.0 1.0<br />

Milled tonnes mt 3.0 3.0<br />

Copper grade % 1.4 1.5<br />

Copper recoveries % 81.0 86.0<br />

Copper production kt 27.1 35.7<br />

Silver grade g/t 18.7 18.7<br />

Silver recoveries % 60 60<br />

Silver production koz 945.6 1097<br />

Copper/silver revenue % 93 94<br />

Concentrate grade Cu % 40 40<br />

Concentrate produced kt 67 82<br />

Cash costs (real $2010) US$/lb 1.35 1.68<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

Our base case 13 year LOM assumption appears to be conservative as we have modelled<br />

the open pit on M&I resources only and not included the ~50mt of open pitable material in the<br />

inferred resource category. Subject to the prevailing copper price environment (given the<br />

grade and high strip ratio of deposits at Boseto), we see significant upside to our LOM<br />

forecast and subsequent asset valuation.<br />

3 June 2010 3

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 4<br />

Boseto base case production profile (FY’s)<br />

Copper (kt)<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

(US$/lb)<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0<br />

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026<br />

Copper Total costs (inc credits real 2010$)<br />

0.00<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

Copper is our<br />

preferred base<br />

metals exposure<br />

We are bullish on the outlook for the copper market and foresee a deficit in 2011. We find it<br />

difficult, even in a poorer than expected European and Chinese growth scenario, to model<br />

copper in anything other than deficit in 2011. Currently our forecast is for a 570kt deficit next<br />

year (downside with poor Europe scenario and slow Chinese growth is balance / very small<br />

deficit). All of the main end use markets in China still look set to grow in line with our forecasts<br />

in 2010 and 2011 and our ex-China numbers still look moderate.<br />

Fig 5 Our price deck<br />

Spot 2010 2011 2012 2013 2014 2015<br />

LT<br />

(real<br />

2010$)<br />

Copper (US$/lb) 3.13 3.40 3.50 3.00 2.70 2.70 2.60 2.20<br />

Silver (US$/oz) 18.53 17.30 16.90 15.40 14.60 13.80 14.20 14.00<br />

AUD/USD 0.85 0.91 0.86 0.80 0.80 0.80 0.80 0.80<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

Valuation is highly<br />

leveraged to our<br />

copper price<br />

assumption<br />

With copper accounting for ~94% of our forecast DML revenue, our DCF valuation is<br />

particularly sensitive to our copper price assumption. Operating costs also have the potential<br />

to have a material impact on project economics, as with cash costs of US$1.56/lb, we expect<br />

Boseto to be in the top half of the cost curve. Given the relatively low capital intensity of the<br />

Boseto project (~US$5,000/t) our valuation is not overly sensitive to capex.<br />

Fig 6 DML unfunded valuation sensitivity<br />

$ps<br />

2.50<br />

2.00<br />

1.50<br />

1.00<br />

0.50<br />

0.00<br />

-0.50<br />

-30% -20% -10% 0% 10% 20% 30%<br />

Copper price Opex Capex Discount rate Share price<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

3 June 2010 4

C1 Cash Cost (c/lb Cu)<br />

C1 Cash Cost (c/lb Cu)<br />

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Boseto will not be a<br />

low cost producer…<br />

Average LOM cash costs of US$1.56/lb have DML straddling the boundary between the 3rd<br />

and 4th quartile of the 2010 copper cost curve. However, we note that Boseto costs in the<br />

first four years will be below the LOM average as ore will be sourced solely from the open pit.<br />

Fig 7 2010 Brook Hunt copper cost curve<br />

250<br />

2010 C1 Composite Cost Curve For Copper Mines - By Minesite<br />

225<br />

200<br />

175<br />

Boseto LOM<br />

average position<br />

150<br />

125<br />

100<br />

75<br />

50<br />

25<br />

0<br />

0 4000 8000 12000 16000 20000 24000 28000 32000<br />

Cumulative Production (Paid Mlbs Cu)<br />

Source Brook Hunt - A Wood M ackenzie Company<br />

Source: Brook Hunt, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

However, Boseto is<br />

likely to become<br />

more competitive<br />

as the cost curve<br />

shifts upwards<br />

Looking forward, we expect the Boseto project to increase in competitiveness, as the cost<br />

curve shifts upwards over the next 3-5 years. The upwards shift in the copper cost curve<br />

reflects our (and many in the market‟s) bullish view on copper, with costs to be driven higher<br />

by declining grade profiles, the start-up of lower grade mines with large capex requirements<br />

and the increasing percentage of greenfield projects in countries with a higher level of<br />

geopolitical risk which will a higher returns on capital to justify investment.<br />

Fig 8 2015 Brook Hunt copper cost curve<br />

250<br />

2015 C1 Composite Cost Curve For Copper Mines - By Minesite<br />

225<br />

200<br />

175<br />

150<br />

125<br />

Boseto LOM<br />

average position<br />

100<br />

75<br />

50<br />

25<br />

0<br />

0 4000 8000 12000 16000 20000 24000 28000 32000 36000 40000<br />

Cumulative Production (Paid Mlbs Cu)<br />

Source Brook Hunt - A Wood M ackenzie Company<br />

Source: Brook Hunt, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

3 June 2010 5

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

The peer group comparisons<br />

Potential for a re<br />

rating as DML<br />

becomes a producer<br />

First mover<br />

exploration upside<br />

in Northern<br />

Botswana<br />

DML is the fifth pure copper play under our coverage; of the five, three are producers and two<br />

are developers.<br />

Fig 9 ASX copper producers and near term developers<br />

Company Code<br />

Price<br />

(A$ps)<br />

Market<br />

cap<br />

(A$ps)<br />

Net<br />

cash/(debt)<br />

(A$m)<br />

EV<br />

(A$m) Status Project Location<br />

<strong>Discovery</strong> DML 0.77 229 34 195 E&D Boseto Botswana<br />

OZ<br />

Minerals OZL 1.06 3,308 971 2,337 Producer<br />

Prominent<br />

Hill Australia<br />

Equinox EQN 4.13 2,920 -430 3,350 Producer Lumwana Zambia<br />

PanAust PNA 0.48 1,418 -38 1,456 Producer Phu Kham Laos<br />

Indophil IRN 1.14 480 27 453 E&D Tampakan Philippines<br />

Citadel* CGG 0.32 468 26 442 E&D<br />

Jabal<br />

Sayid Saudi Arabia<br />

Sandfire* SFR 3.26 421 52 369 E&D Degrussa Australia<br />

*CGG & SFR not under research coverage<br />

Price as at 1 June 2010<br />

Source: IRESS, Company Data, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

On the current Boseto project resource, DML lacks the scale of the three pure copper<br />

producers on the ASX. However, DML has an exciting exploration program which appears to<br />

be at least the equal of the three producers‟. Given the potential for near mine resource<br />

conversion (to add material tonnes to our base case Boseto LOM assumption) and the<br />

regional potential of the largely unexplored tenement package, we believe DML has the<br />

potential to add significant value through the drill as well as the potential for a re-rating as it<br />

progresses from explorer to producer.<br />

Fig 10 Relative investment metrics for our ASX pure copper universe<br />

Share price<br />

(A$ps)<br />

NPV<br />

($ps)<br />

PER<br />

EV/EBITDA<br />

P/NPV 2010 2011 2012 2013 2010 2011 2012 2013<br />

<strong>Discovery</strong>* 0.77 0.98 0.79 nmf nmf 39.50 6.00 nmf nmf 13.8 2.9<br />

OZ<br />

Minerals** 1.06 1.32 0.80 8.54 7.85 8.69 12.21 2.72 1.87 1.71 1.73<br />

Equinox 4.13 4.37 0.95 6.97 6.04 7.78 10.34 6.35 3.29 3.25 3.51<br />

PanAust 0.48 0.47 1.02 5.98 6.43 7.33 9.99 3.49 2.50 2.16 2.19<br />

Indophil 1.14 0.94 1.21 nmf nmf nmf nmf nmf nmf nmf nmf<br />

*DML has a June year end, **OZL valuation is not adjusted for potential Australian RSPT impact<br />

Price as at 1 June 2010<br />

Source: IRESS, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

With the exception of EQN, our pure play copper universe is largely at steady state<br />

production rates and we do not forecast material increases in mine production between now<br />

and 2014. In addition to DML, we see the potential for two other ASX explorers to join the<br />

ranks of pure copper producers over the next 18-24 months - Citadel Resource Group and<br />

Sandfire Resources.<br />

3 June 2010 6

Equniox<br />

Indophil<br />

PacMag<br />

Ivanhoe<br />

OZ Minerals<br />

Marengo<br />

Pan Aust<br />

Aditya Birla<br />

<strong>Discovery</strong><br />

Anvil Mining<br />

Universal<br />

Blackthorn<br />

Citadel<br />

Tiger<br />

Cudeco<br />

Avalon<br />

Exco<br />

Sandfire<br />

Havilah<br />

Hillgrove<br />

Finders<br />

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 11 <strong>Macquarie</strong>’s ASX copper universe production profile<br />

kt copper<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Equinox OZ Minerals PanAust <strong>Discovery</strong> Kagara Straits<br />

2010 2011 2012 2013 2014<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

Citadel Resource Group (CGG.AU)<br />

CGG is focused on the Jabal Sayid project in Saudi Arabia, in which it currently has a 70%<br />

interest. Jabal Sayid is an underground project with a reserve of 24.4mt at 2.2% copper and<br />

0.25g/t gold to support production of ~57ktpa copper at cash costs of US$0.97/lb over an<br />

initial ten year LOM. CGG has recently received the mining licence for the Jabal Sayid and<br />

expects to commence construction of the US$280m project immediately with a target of<br />

project commissioning in 3Q11.<br />

Sandfire Resources (SFR.AU)<br />

SFR is focused on the Doolgunna project in Western Australia. The Degrussa deposit (7.13mt<br />

at 5.2% copper & 1.9g/t gold) is arguably the most exciting discovery by an ASX listed copper<br />

producer in recent times. Degrussa is a VMS style system and SFR is understandably excited<br />

by the potential for further discoveries at the broader Doolgunna project. SFR is currently<br />

completing a pre-feasibility study with a target of first production in mid 2012. SFR‟s major<br />

shareholder is POSCO which has a 17% interest.<br />

Fig 12 ASX copper resource bases<br />

kt copper<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Source: Company data, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

3 June 2010 7

Sandfire<br />

OZ Minerals<br />

Cudeco<br />

Pan Aust<br />

Equinox<br />

Citadel<br />

Straits<br />

Anvil<br />

Ivanhoe<br />

Finders<br />

<strong>Discovery</strong><br />

Aditya Birla<br />

Tiger<br />

Hillgrove<br />

Exco<br />

Blackthorn<br />

Indophil<br />

Havilah<br />

Redbank<br />

Avalon<br />

PacMag<br />

Universal<br />

Marengo<br />

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 13 EV/Resource metrics<br />

A$/t copper<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Source: IRESS, Company data, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

3 June 2010 8

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Share register<br />

The DML share register is relatively concentrated with the six largest shareholders accounting<br />

for ~47% of register.<br />

Fig 14 DML share register<br />

Shareholder %<br />

<strong>Macquarie</strong> Bank 11.5<br />

Taurus Fund 11.1<br />

Transamine 8.3<br />

Citi Group Global Markets 7.1<br />

Investec (Botswana) 5.2<br />

BIFM (Botswana) 3.6<br />

Source: DML, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

<strong>Macquarie</strong> Bank. The <strong>Macquarie</strong> Bank holding is held by the <strong>Metals</strong> and Energy Capital<br />

division which specialises in early stage resource project funding. <strong>Macquarie</strong>‟s initial<br />

investment was a placement of 5m shares at A$0.23ps in August 2006.<br />

Taurus Fund. Taurus is an Australian based investment fund manager which<br />

specialises in investment products based on the natural resources industry.<br />

Transamine. In March 2010, DML entered into an offtake agreement with metals trader<br />

Transamine for 100% of Boseto concentrate for a minimum of five years. As part of the<br />

offtake agreement DML placed 25m shares (9.8% of DML shares) to Transamine at A$0.76ps<br />

(to raise A$19m) which was an 11% premium to the four week VWAP at the time of<br />

placement.<br />

Investec Asset Management & Fleming Asset Management Botswana. DML placed<br />

8.89m shares to Investec and Fleming in March 2007<br />

Citi Group Global Markets. This holding represents the shareholding sold by Resource<br />

Capital Funds to Soros in April 2010.<br />

3 June 2010 9

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Financials<br />

The historical DML financial statements are reflective of a metals exploration company in the<br />

feasibility study phase of its initial project. The last reported cash balance was A$34m as at<br />

31 March with ~A$10m of cash inflows expected during the June quarter due to option<br />

exercises.<br />

Exploration budget<br />

of A$10m over the<br />

coming 8 months<br />

The current cash balance will see DML through to completion of the BFS in July and is likely<br />

to allow DML to place orders for long lead time items prior to the completion of debt/equity<br />

finance. The exploration budget for the coming eight months is A$10m.<br />

Capital raising history<br />

DML listed on the ASX in December 2003 with an A$8m IPO. The most recent capital raising<br />

was the placement to Transamine as part of the offtake agreement for the first five years of<br />

Boseto production.<br />

Fig 15 DML capital raising history<br />

Placement month Price (A$ps) Shares issued (m) Net proceeds (A$m)<br />

Jun-07 $0.26 3.5 $0.90<br />

Aug-07 $0.36 34.3 $11.30<br />

Aug-08 $0.42 20.0 $8.00<br />

Feb-09 $0.18 12.8 $2.30<br />

Apr-09 $0.18 9.0 $1.50<br />

Jun-09 $0.18 22.2 $4.00<br />

Oct-09 $0.45 29.1 $13.10<br />

Nov-09 $0.45 5.9 $2.68<br />

Mar-10 $0.76 25.0 $19.00<br />

Source: DML, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

Project funding scenarios<br />

We have assumed<br />

capex of US$185m<br />

with 50:50<br />

debt:equity funding<br />

A formal capex forecast for the 3mtpa project is yet to be released. The capex forecast for the<br />

2mtpa was US$150m, which was last updated in October 2009. With the release of the<br />

decision to upgrade the project scope to 3mtpa, DML awarded the EPC contract for plant<br />

construction to Sedgman <strong>Limited</strong> for a „maximum price‟ of US$85m. The plant capex for a<br />

2mtpa plant was estimated at A$70m, meaning the US$19m contingency estimate for plant<br />

capex in the US$150m for the 2mtpa project has essentially been consumed by the increase<br />

in plant capacity.<br />

The final structure of a finance package is yet to be determined; however, with the first five<br />

years production sold to Transamine the project appears to lend itself to traditional project<br />

debt and equity financing.<br />

To get a feel for how a funded and operational DML valuation looks we have assumed a<br />

target debt to equity funding ratio of 50:50. We have included a number of equity raising<br />

scenarios in order to provide a conceptual per share valuation once Boseto is developed. The<br />

table below is broken out into our project valuation at 1 July 2011, a net debt balance equal to<br />

a project finance facility and number of shares dependent on a range of equity raising<br />

scenarios. We have then discounted this valuation back to today at a rate of 10% pa to reflect<br />

the opportunity cost of capital. We have not taken into account any potential hedging<br />

requirements as part of a project debt facility.<br />

Fig 16<br />

DML funded valuation scenarios under various equity raising pricing<br />

$m -20% -10% 0.77 10% 20% 30%<br />

Shares on issue 297 297 297 297 297 297<br />

Shares issued for equity fudning 152 135 121 110 101 93<br />

Shares on issue post funding 449 432 419 408 398 391<br />

Boseto at 1 July 2011 517 1.15 1.20 1.24 1.27 1.30 1.32<br />

G&A -32 -0.07 -0.07 -0.08 -0.08 -0.08 -0.08<br />

Exploration 60 0.13 0.14 0.14 0.15 0.15 0.15<br />

Net Debt -78 -0.17 -0.18 -0.19 -0.19 -0.19 -0.20<br />

NPV at 1 July 2011 1.04 1.08 1.12 1.15 1.17 1.20<br />

Discount factor 1.10 1.10 1.10 1.10 1.10 1.10<br />

NPV discount back to today 0.95 0.98 1.02 1.04 1.07 1.09<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

3 June 2010 10

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 17 <strong>Discovery</strong> financial summary<br />

<strong>Discovery</strong> <strong>Metals</strong> (DML) Share price 0.77<br />

Y/E 30 June<br />

Profit & Loss 2010 2011 2012 2013 2014 2015 Production and price assumptions<br />

Total revenue A$m 0 0 89 250 276 271 Production 2010 2011 2012 2013 2014 2015<br />

Mine costs A$m 0 0 -48 -131 -150 -177 Copper (kt) 0.0 0.0 10.2 30.7 35.7 35.7<br />

Corporate cost A$m -5 -6 -6 -6 -6 -6 Silver (koz)<br />

Exploration A$m -3 -5 -5 -10 -8 -5 Costs 2010 2011 2012 2013 2014 2015<br />

EBITDA A$m -7 -11 30 102 112 83 Cash costs (US$/lb) 0.00 0.00 1.45 1.27 1.22 1.44<br />

Depreciation A$m 0 0 -11 -29 -29 -29<br />

Underlying EBIT A$m -7 -11 18 73 83 54 Prices 2010 2011 2012 2013 2014 2015<br />

Non recurring EBIT A$m 0 0 0 0 0 0 Copper (US$/lb) 3.13 3.55 3.15 2.85 2.70 2.65<br />

Total EBIT A$m -7 -11 18 73 83 54 Silver (US/oz) 0.17 0.17 0.16 0.15 0.14 0.14<br />

Net interest A$m 0 -3 -7 -5 -3 0 AUD:USD 0.89 0.92 0.82 0.80 0.80 0.80<br />

Pre-tax profit A$m -7 -14 12 68 81 54<br />

Underlying tax expense A$m 2 4 -4 -20 -24 -16<br />

Non recurring tax expense A$m 0 0 0 0 0 0<br />

Minority Interest A$m 0 0 0 0 0 0 Net Present Value @ 12% A$m A$ps<br />

Reported profit A$m -5 -9 8 47 56 38 Boseto 233 0.78<br />

Adjusted profit A$m -5 -9 8 47 56 38 G & A -32 -0.11<br />

EPS adjusted Acps -2.2 -2.4 1.9 11.0 13.2 8.8 Net cash/(debt) 34 0.11<br />

EPS growth % nmf 10% -181% 468% 19% -33% Exploration 60 0.17<br />

DPS Acps 0 0 0 0 0 0 Shares on issue 299<br />

Payout ratio % 0% 0% 0% 0% 0% 0% Ungeared NPV 295 0.99<br />

Weighted average diluted shares m 238 396 429 429 429 429<br />

Cashflow 2010 2011 2012 2013 2014 2015<br />

Net cash inflow from operating activities A$m -8 -11 30 102 112 83 Key investment ratios 2010 2011 2012 2013 2014 2015<br />

Net interest A$m 0 -3 -7 -5 -3 0 Adjusted PER -35.5 -32.2 39.6 7.0 5.8 8.7<br />

Tax paid A$m 0 0 0 0 0 -25 EV/EBITA -21.6 -35.2 13.8 3.4 2.9 4.0<br />

Other A$m 0 0 0 0 0 0 P/FCF -10.45 -1.43 24.69 4.03 3.39 9.85<br />

Net operating cashflow A$m -8 -14 23 97 110 58<br />

Capital expenditure A$m 0 -195 -5 -5 -5 -20 Balance sheet 2010 2011 2012 2013 2014<br />

Exploration A$m -10 -5 -5 -10 -8 -5 Cash A$m 29 17 31 98 173<br />

Proceeds from sale of PP&E A$m 0 0 0 0 0 0 Other current assets A$m 1 1 1 1 1<br />

Net cashflow from investing A$m -10 -200 -10 -15 -13 -25 P,P & E A$m 1 196 189 165 141<br />

Debt drawdown/(repayment) A$m 0 98 0 0 0 0 Other non-current assets A$m 34 43 50 60 67<br />

Dividends paid A$m 0 0 0 0 0 0 Total assets A$m 64 257 271 324 382<br />

Share capital A$m 34 104 0 0 0 0 Current liabilities A$m 2 2 2 2 2<br />

Net financing cashflow A$m 34 202 0 0 0 0 Total liabilities A$m 2 102 119 125 127<br />

Net cashflow A$m 17 -11 13 82 97 33 Shareholder equity A$m 62 155 151 199 255<br />

Free cashflow A$m -18 -214 13 82 97 33 Total debt A$m 0 100 113 113 113<br />

FCFPS Acps -7.4 -54.0 3.1 19.1 22.7 7.8 Net debt A$m 29 -83 -82 -15 60<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

3 June 2010 11

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Taking a project<br />

from exploration to<br />

production carries<br />

inherent risks<br />

Risks<br />

Permitting. DML is in the process of applying for a mining licence for Boseto. DML has<br />

submitted the Environmental Impact Assessment and the public consultation period has been<br />

completed. Other than the approval of the EIA, the completion of the BFS is the major<br />

outstanding item required prior to the granting of a mining licence. We note that in 2008 DML<br />

renewed its initial tenement package and was granted a further seven tenements.<br />

Capital & timing. As with all greenfield mining projects DML is exposed to the challenges<br />

associated with progressing a project from the exploration to development phase. Risks to<br />

project timing include availability of capital items and skilled labour. Feasibility studies<br />

typically are based on an accuracy of +/-10%.<br />

Funding. DML is yet to complete a BFS into the Boseto project and subsequently yet to<br />

secure project funding. The BFS is due to be completed in July. While recent BFS updates<br />

point to a bankable project, there is no guarantee or a commitment to provide debt funding;<br />

such an agreement will be dependent on a number of factors, including the results of the BFS<br />

and the prevailing state of capital markets.<br />

Commodity forecasts. The forecasting of commodity prices carries inherent risk, material<br />

changes to our view on industry structure and price drivers have the potential to materially<br />

alter our commodity forecasts.<br />

Single asset risk. Boseto will be DML‟s sole operating asset under its control once in<br />

production. Any disruptions to the mine plan have the potential to materially affect DML‟s<br />

financial position and its ability to meet any potential project funding obligations.<br />

Operational risk. The ramp-up and operation of any mining project carries an inherent level<br />

of risk, including building sufficient ROM stocks in both grade and ore types to maintain a<br />

consistent feed to mill. Major operational risks to Boseto are recoveries, particularly in the<br />

upper sections of the deposit where oxidised ore is prevalent and the narrow nature of the ore<br />

body results in a high strip ratio. Looking to the potential underground development at Zeta,<br />

the grade is relatively low for underground mining outside of bulk underground mining<br />

operations.<br />

Exploration risk. By nature, exploration is inherently uncertain and while the current project<br />

resource appears to confirm economic mineralisation to support a ~35kt pa copper operation<br />

for 10-15 year LOM there is no guarantee DML will discover further economic resources in its<br />

tenement package.<br />

Regulatory risk. Mining in all jurisdictions in both developing and developed economies is<br />

subject to regulatory risks. Typical regulatory risks include: changes to tax and royalty<br />

regimes, tenure of assets and environment issues such as the implementation of a carbon<br />

tax/emission trading scheme.<br />

Power. Botswana is a net importer of power and has traditionally relied on Eskom as a main<br />

source of power supply. To mitigate the risk of a potentially unreliable power supply from the<br />

grid, DML will use heavy fuel oil generators during the construction phase and will construct<br />

an onsite coal fired power station. DML had initially considered putting in place an 80km<br />

transmission line to link the site to Maun and link into the grid.<br />

3 June 2010 12

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

An extensive<br />

tenement package<br />

in Northern<br />

Botswana<br />

Boseto overview<br />

The Boseto Copper project is located in the northwest corner of Botswana, ~80km from the<br />

town of Maun. DML acquired a seven tenement package from the Government of Botswana<br />

in 2005, the tenement package was renewed in 2008. DML secured a further seven<br />

tenements to the southwest of the original package in 2008. DML‟s tenement package<br />

covers 10,100km 2 , starting ~60km southeast of Maun and stretching ~300km to the Namibian<br />

border.<br />

Fig 18 Boseto project location<br />

Source: DML, June 2010<br />

Geology and resources<br />

The Boseto project is hosted in the Kalahari Copper Belt. The Kalahari Copper Belt forms part<br />

of the late Proterozic Pan African Mobile Belt which contains well-known and prolific copper<br />

belts in Zambia and the DRC. The Kalahari copper belt extends south-westwards into<br />

Namibia and north-eastwards into Zambia, with known deposits sediment hosted.<br />

The Kalahari Copper<br />

Belt is interpreted<br />

as an extension of<br />

the Pan African<br />

Mobile Belt<br />

Mineralisation at Boseto typically outcrops or is covered by a thin layer of sand, which<br />

extends to 10m below surface at the deepest point. The majority of the Boseto copper occurs<br />

in sulphide mineralisation (90%); the dominant sulphide is chalcoite with minor amounts of<br />

bornite. Oxide ore is dominant in the top 20m of the ore body with copper hosted in malachite<br />

and chrysocolla; smaller amounts of oxide material are found along fractures of the ore body.<br />

3 June 2010 13

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 19<br />

The Pan African Mobile Belt<br />

Source: GeoLogix, Hana Mining, September 2007<br />

Boseto project has<br />

1.42mt of contained<br />

copper in resources<br />

DML published an updated resource estimate for Boseto in April 2010. The drilling program<br />

between the previous resource estimate published in October 2009 and April 2010 resulted in<br />

a 68% increase in contained copper to 1.42mt.<br />

Fig 20 Boseto resource as at April 2010<br />

M&I Inferred M&I + I<br />

tonnes<br />

(mt)<br />

Copper<br />

(%)<br />

Silver<br />

(g/t)<br />

tonnes<br />

(mt)<br />

Copper<br />

(%)<br />

Silver<br />

(g/t)<br />

tonnes<br />

(mt)<br />

Copper<br />

(%)<br />

Silver<br />

(g/t)<br />

Petra 3.6 1.3 14.2 9.1 1.3 15.4 12.7 1.3 15.1<br />

Southwest<br />

Petra 17.2 1.4 15.4 17.2 1.4 15.4<br />

Northeast<br />

Plutus 14.9 1.2 12.5 14.9 1.2 12.5<br />

Plutus 8 1.4 14 14.6 1.5 16.1 22.6 1.5 15.4<br />

Zeta 10.9 1.6 23.5 24.5 1.4 21.8 35.4 1.5 22.3<br />

Total 22.5 1.5 18.6 80.3 1.4 16.9 102.8 1.4 17.3<br />

Source: DML, <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

The initial open pit operation will focus on mining on the Zeta and Plutus areas. The<br />

measured and indicated portion of the resource represents open pitable material under a<br />

2mtpa mining rate at a 10:1 strip ratio. DML has engaged Snowden to remodel the mine<br />

schedule to allow for accelerated open pit mining to support the 3mtpa. The combined Plutus<br />

and Petra resource (inc Northeast Plutus and Southwest Petra extensions) now stretches<br />

over a continuous 25km strike length and remains open to the North East.<br />

The inferred resources at Southwest Petra and Northeast Plutus are only drilled to a depth of<br />

160m at wide spacing of 1,000m. DML has conducted infill drilling at 500m spacing. As DML<br />

completes further infill drilling it should provide confidence in the ability of Southwest Petra<br />

and Northeast Plutus to extend the open pit LOM.<br />

The inferred portion of the Zeta resource (24.5mt @ 1.4% copper) is below 160m, extending<br />

to 360mbs, and formed the basis of the underground scoping study released in April 2010.<br />

The resource remains open below 360m and DML continues to progress exploration to<br />

confirm the continuation of mineralisation to a depth of 650m.<br />

3 June 2010 14

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Near mine exploration<br />

Near mine<br />

exploration target<br />

has potential for a<br />

material LOM<br />

extension<br />

The focus of the near mine exploration program will be on upgrading the Zeta underground<br />

resource and delineating an initial underground resource at Plutus. DML will also begin to drill<br />

targets (Nexus, Nyx, Quirinus and Plutus extensions) that have the potential to provide open<br />

pitable resources within trucking distance of the concentrator<br />

Plutus and Petra<br />

The combined Plutus and Petra resource covers a continuous strike length of 25km and is<br />

open to the northeast and at depth over the entire strike length. At Northeast Plutus a series<br />

of diamond drill holes were completed in April to infill the existing data which underpins the<br />

current 14.9mt @ 1.2% copper inferred resource. The results of these holes are yet to be<br />

released.<br />

The Southwest Petra resource appears to join up with the Nexus prospect at a fold nose.<br />

There is 3m of strike between the boundary of the Southwest Petra resource and the<br />

indentified fold nose, where a fault zone has vertically displaced mineralisation.<br />

Zeta underground<br />

At Zeta DML has completed a series of five drill holes to test the down dip extension of the<br />

Zeta deposit. The current Zeta inferred resource includes mineralisation to a depth of<br />

360mbs, the five hole program was designed to test for mineralisation to a depth of 650mbs.<br />

While these holes were completed in late 2009 the data has not been released and is being<br />

reviewed and quality assured.<br />

Nexus<br />

The Nexus prospect is an 11km copper anomaly running parallel to (~2km west of) the Zeta<br />

deposit. Drilling at Nexus has not been a priority of the drilling to sure up the initial resource<br />

base to underpin the BFS. Looking forward DML will carry out drilling on the Nexus target to<br />

examine the potential for economic mineralisation at Nexus. We note initial drill results point<br />

to relatively thin copper mineralisation at Nexus. We understand this is not a high priority<br />

target and is likely to be followed up once the initial project is up and running as the current<br />

M&I resource supports at least a ten year LOM.<br />

Nyx<br />

Nyx is a geochemical anomaly located ~10km south-southeast of the Zeta deposit. The<br />

prospect is positioned on the northwest dipping limb of a synclinal structure trending in the<br />

same direction as Zeta and Plutus. Initial recognisance work using a Niton XRF machine<br />

confirmed the presence of the anomaly and nine holes (550m) were completed in March<br />

2010, with six holes spaced on a 1km line spacing. Assay results are expected in the June<br />

quarter with DML indicating that the holes intersected similar stratigraphy.<br />

Quirinus<br />

The Quirinus prospect is located 15km from the proposed Boseto concentrator site. Three<br />

anomalous copper zones were initially defined by soil geochemistry, with the anomalies<br />

stretching over a 13.4km strike length. Seven drill holes have been completed which have<br />

confirmed the presence of copper mineralisation. No drilling was conducted as part of Boseto<br />

BFS, with further drilling to be carried out in 2Q10 as part of a broader regional exploration<br />

program.<br />

3 June 2010 15

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 21 Boseto resource areas<br />

Source: DML, June 2010<br />

Regional exploration<br />

With sufficient<br />

resources in place<br />

to underpin 13 years<br />

of production, the<br />

focus will shift to<br />

regional targets to<br />

find a Boseto 2 style<br />

project<br />

DML will begin to refocus its exploration efforts on regional exploration targets in an attempt<br />

to define a “Boseto 2” project, now that sufficient resources have been indentified to underpin<br />

at least a 13 year LOM at Boseto. At present only 328km of the prospective 1,300km of<br />

indentified strike length has been explored by a soil sampling program, with only 67km of the<br />

1,300km drilled to date. DML collected soil samples covering a108km of prospective strike in<br />

the March quarter with the results undergoing quality control checks prior to release.<br />

The initial regional soil sampling work will utilise a Niton XRF machine to indentify soil<br />

geochemical anomalies. Work during 1Q10 focused on the Gaia and Notus targets which are<br />

located southwest of the Boseto plant site along the same structures which host the Zeta and<br />

Plutus deposits. Notus is the closest of the two targets located 48km from Boseto with Gaia<br />

located 100km away. DML has also begun sampling at Maia, an area located 44km north of<br />

the plant site.<br />

3 June 2010 16

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 22 Regional targets<br />

Source: DML, June 2010<br />

Permitting<br />

Mining licence<br />

expected post BFS<br />

DML has submitted the Environmental Impact Assessment and the public consultation period<br />

has been completed. Other than the approval of the EIA, the completion of the BFS is the<br />

major outstanding item required prior to the granting of a mining licence.<br />

Mining<br />

The initial focus of the feasibility study was for a 2mtpa open pit mining operation; however,<br />

the large increase in the resource base and the definition of significant resources below the<br />

160m open pit floor (depth of pit floor at a 10:1 strip) has led to DML pursuing an increased<br />

mining rate of 3mtpa. The mining schedules are being revised as part of the BFS due in July.<br />

Conceptually the first three years of mining will see the open pit mining rates accelerated with<br />

ore exclusively from open, underground mining expected to commence in 2014 and we have<br />

modelled 1mtpa from the Zeta underground commencing 2014 to 2025.<br />

Our mine model assumes 27mt of open pit ore mined over a 13 year period, which is<br />

moderately above the 22.5mt measured and indicated resource for Zeta, Plutus and Petra. In<br />

our view this is relatively conservative as it does not include any ore from Southwest Petra<br />

and Northeast Plutus (32mt at 1.31% copper), which has the potential to materially increase<br />

the LOM.<br />

In terms of underground ore production we have assumed ore production of 1mpta over a<br />

nine year LOM for total ore production of 9mt. Our underground ore mined assumptions are<br />

marginally below the 9.5mtpa mining inventory used in the underground scoping study<br />

released in April 2010. As the deposit is open at depth once the underground infrastructure is<br />

in place our LOM may prove to be conservative (albeit subject to the prevailing copper price<br />

environment)<br />

3 June 2010 17

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 23 <strong>Macquarie</strong>’s ore source assumptions (FY’s)<br />

kt<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028<br />

Open pit<br />

Underground<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

Open pit<br />

Mining at Boseto will be by traditional open pit drill and blast methods. The sand cover to a<br />

depth of up to 10m will be free dig. The relatively narrow widths (average 6m) and steeply<br />

dipping geometry of the ore body results in a strip ratio of around 10:1. DML has indicated<br />

that the current economics of the pit under an US$2.00/lb copper price want to push the pit to<br />

higher strip ratios.<br />

Owner operator<br />

mining at Boseto<br />

Total material movements are not of the scale we would consider to be a large earth moving<br />

operation, with average LOM material movements of 30 to 33mtpa. Under the initial 2mtpa<br />

mine schedule the 10:1 strip ratio included 1.8mt of low grade ore, which is classed as waste<br />

and will be expensed through the P&L, however, will be separately stockpiled and maybe<br />

treated subject to the prevailing copper price environment. DML has engaged Snowden to<br />

review the mine schedule to allow for accelerated open pit mining to support the 3mtpa.<br />

The 3mtpa feasibility study will be based on owner operator mining fleet. The initial 2mtpa<br />

feasibility study assumed a fleet of 2 * 250t excavator s and 12*100t trucks for waste<br />

movement movements and 1*120 excavator and 9*100t trucks for ore mining. We have<br />

assumed mining costs of US$2.20/t material in our modelling (including an equipment finance<br />

charge).<br />

3 June 2010 18

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 24 Zeta and Plutus cross sections<br />

Source: DML, June 2010<br />

Underground<br />

In April, DML released the results of a scoping study carried out by Snowden into an<br />

underground operation below the Zeta open pit. The study was based on the inferred<br />

resource below the Zeta open pit from a depth of 160mbs to 360mbs and allowed for a 10m<br />

crown pillar. The Zeta resource below 160m is 25mt @ 1.4% copper and the scoping study<br />

assumed a recoverable mining inventory of 9.5mt @ 1.4% copper. The mining inventory is<br />

based on an uphole retreat stoping mining method. The study considered a backfill stoping<br />

mining method however; the costs outweighed the increase in recoverable ore.<br />

Shallow<br />

underground mining<br />

potential at Zeta<br />

The mining inventory is defined over 2km and was divided into two separate areas accessed<br />

by separate declines, with a maximum rate of 0.8mtpa. Development capex for the<br />

underground was estimated at US$10m or US$5m per area, based on decline development<br />

capex of US$3,200/m (a quick back of envelope calculation assuming a 7:1 decline leads to<br />

decline development of capex of US$3.5m per area to reach the top of the underground<br />

mining area, leaving ~US$1.5m per area for ventilation). Mining costs used in the study were<br />

US$37/t ore (we have assumed US$46/t for underground mining costs).<br />

3 June 2010 19

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 25 Zeta open pit and underground<br />

Source: DML, June 2010<br />

Processing<br />

The 3mtpa Boseto process plant will be based on a conventional copper flotation circuit. The<br />

initial project study was focused on a 2mtpa process plant, and the study was formally<br />

upgraded to 3mtpa in May 2010 following material exploration success in 1H10.<br />

Recoveries to be<br />

lower in early stage<br />

of the pit due to<br />

higher levels of<br />

oxide ore<br />

While the majority of the Boseto resource (90%) is sulphide ore, recoveries in the early parts<br />

of the ore body will be impacted by the presence of oxide ore from surface to around 35mbs.<br />

Once below 35 metres the ore body is predominantly chalcoite with minor amount of bornite.<br />

While the presence of oxide ore will impact recoveries (oxide ore is typically recovered via a<br />

leaching process), a number of operations with small amounts of oxide in proportion to<br />

sulphides use flotation to recover copper from oxide ore. DML has indicated targeted average<br />

recoveries of 82.5% over the open pit LOM.<br />

Initial work on a standalone underground ore has indicated recoveries of 92% based on the<br />

assumption that all material is sulphide with no oxide material. Under a blended open<br />

pit/underground ore feed post year four, we would expect recoveries to be above the 82.5%<br />

open pit average and closer to the 92% underground target as DML will be through the<br />

heavily oxidised zones.<br />

The front-end of the Boseto plant ore will incorporate a three stage crushing and ball mill<br />

circuit. The plant will have two flotation circuits. Sulphide mineralisation will be separated first<br />

with tailings from the sulphide roughers sent to an oxide circuit. Concentrates are filtered to<br />

recover excess process water, as are tailings.<br />

Tailings will be dry stacked. Water recovered in the dewatering stages will be recycled to the<br />

various parts of the plant as process water.<br />

3 June 2010 20

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 26 Boseto flowsheet<br />

Source: DML, June 2010<br />

Production and cost targets<br />

Formal targets due<br />

with the release of<br />

the BFS in July<br />

The increase in the mineral resources at Boseto has led to DML announcing an increase in<br />

the scope of the BFS to support a 3mtpa plant throughput rate in May. No formal production<br />

and cost targets for the 3mtpa project have been released. We have based our underlying<br />

mine and plant assumptions from the 2mtpa study and have set out our physical parameters<br />

in Fig 27.<br />

3 June 2010 21

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 27 Boseto mine and plant physical assumptions<br />

Operational parameters 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020<br />

Open pit ore mined - 950 2,700 3,000 2,500 2,000 2,000 2,000 2,000 2,000<br />

Strip ratio N/A 10 10 10 10 10 10 10 10 10<br />

Waste mined 0 10,450 29,700 33,000 27,500 22,000 22,000 22,000 22,000 22,000<br />

Total open pit material movements 0 11,400 32,400 36,000 30,000 24,000 24,000 24,000 24,000 24,000<br />

Underground ore mined 0 - - - 500 1,000 1,000 1,000 1,000 1,000<br />

Ore milled - 950 2,700 3,000 3,000 3,000 3,000 3,000 3,000 3,000<br />

Copper grade 0.0% 1.4% 1.4% 1.4% 1.4% 1.4% 1.4% 1.4% 1.4% 1.4%<br />

Copper recovery 0.0% 74.0% 81.0% 85.0% 85.0% 85.0% 86.0% 87.0% 87.0% 87.0%<br />

Silver grade 0.0 18.7 18.7 18.7 18.7 18.7 18.7 18.7 18.7 18.7<br />

Silver recovery 0% 65% 65% 65% 65% 65% 65% 65% 65% 65%<br />

Copper production 0 10 31 36 36 36 36 37 37 37<br />

Silver production 0 372 1058 1176 1176 1176 1176 1176 1176 1176<br />

Copper concentrate grade 0% 40% 40% 40% 40% 40% 40% 40% 40% 40%<br />

Concentrate produced 0 25 74 86 86 86 87 88 88 88<br />

Copper payability 0% 97% 97% 97% 97% 97% 97% 97% 97% 97%<br />

Pricing<br />

Copper price (US$/lb) 3.55 3.15 2.85 2.70 2.65 2.61 2.69 2.81 2.85 2.94<br />

Silver price (US$/oz) 17.12 16.15 15.00 14.23 14.02 14.27 14.66 15.33 15.55 16.02<br />

AUD/USD 0.92 0.82 0.80 0.80 0.80 0.80 0.80 0.80 0.80 0.80<br />

Cost base<br />

Open pit mining (US$/t) 2.3 2.7 2.3 2.4 2.5 2.6 2.6 2.8 2.8 2.9<br />

Underground mining (US$/t) 46.0 47.4 48.8 50.2 51.7 53.3 54.9 57.4 58.2 60.0<br />

Processing (US$/t) 6.5 8.4 6.9 7.2 7.4 7.6 7.8 8.2 8.3 8.5<br />

Administration costs 1.1 2.1 1.2 1.3 3.4 5.6 5.8 6.1 6.1 6.3<br />

Cash cost (US$/lb) 0 1.69 1.51 1.49 1.77 2.07 2.11 2.17 2.20 2.27<br />

Silver credits (US$/lb) 0 0.25 0.23 0.20 0.20 0.21 0.21 0.21 0.22 0.23<br />

Royalities (US$/lb) 0 0.10 0.10 0.09 0.09 0.09 0.09 0.09 0.10 0.10<br />

Cash costs inc royalties (US$/lb, real 2010$) 0 1.45 1.27 1.22 1.44 1.64 1.62 1.63 1.60 1.60<br />

Capex (US$m)<br />

Plant capex 85 0 0 0 0 0 0 0 0 0<br />

Site capex 100 0 0 0 0 0 0 0 0 0<br />

Underground development capex 0 0 0 0 12 4 4 4 4 4<br />

Sustaining plant capex 0 4 4 4 4 4 4 4 4 4<br />

Mining fleet 45 0 0 0 20 0 0 0 0 0<br />

*material movements exclude pre production stripping<br />

Source: <strong>Macquarie</strong> <strong>Research</strong>, June 2010<br />

We have assumed<br />

capex of US$185m<br />

<strong>Metals</strong> trader<br />

Transamine will take<br />

100% of production<br />

for the first five<br />

years<br />

A formal capex forecast for the 3mtpa project is yet to be released. The capex forecast for the<br />

2mtpa was US$150m, which was last updated in October 2009. With the release of the<br />

decision to upgrade the project scope to 3mtpa, DML awarded the EPC contract for plant<br />

construction to Sedgman <strong>Limited</strong> for a „maximum price‟ of US$85m. The plant capex for a<br />

2mtpa plant was estimated at US$70m, meaning the US$19m contingency estimate in the<br />

US$150m for the 2mtpa project has essentially been exhausted. Other areas of movement in<br />

capex estimate are likely to be the mine fleet (not included in the US$185m capex and is<br />

likely to be part of equipment lease), which was previously estimated in the range of US$35-<br />

US$40m and the construction of an onsite coal fired power station (the initial study included<br />

US$10m for a transmission line to Maun compared to the preliminary cost estimate of<br />

~US$25m for an onsite plant).<br />

Offtake<br />

In March 2010, DML entered into an offtake agreement with metals trader Transamine for<br />

100% of Boseto concentrate for a minimum of five years. As part of the offtake agreement<br />

DML placed 25m shares (9.8% of DML shares) to Transamine at A$0.76ps (to raise A$19m)<br />

which was an 11% premium to the four week VWAP at the time of placement.<br />

3 June 2010 22

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

The terms of the off take agreement have not been released. DML has guided to a shorter<br />

quotational period than the industry standard (which appears reasonable given the customer<br />

is a trader not an end user), with product to be sold on a landed basis. The export route for<br />

Boseto concentrate will be a truck haul to Gobabis (520km) then railed to Walvis Bay<br />

(650km).<br />

Transamine has been an active player in the ASX base metals universe and has equity<br />

investments and offtake agreements with Kagara and Citadel.<br />

Transamine has<br />

been an active<br />

investor in the<br />

Australian resource<br />

sector<br />

In August 2009, Transamine subscribed for A$25m in Citadel equity (5% of CCG<br />

equity) with an offtake agreement to purchase 50ktpa concentrate (~20% of forecast<br />

production) for the first five years of production from the Jabal Sayid project in Saudi<br />

Arabia.<br />

Transamine subscribed for A$10m of Kagara equity in February 2009; the placement<br />

represented 11.5% of Kagara shares at the time of placement. Transamine‟s current<br />

holding in KZL is 3.5%.<br />

Fig 28 Boseto to Walvis Bay route (presentation dated 6 October 2009)<br />

Source: DML, June 2010<br />

Botswana tax structure<br />

Botswana mining<br />

tax is based on ad<br />

valorem royalty with<br />

a sliding tax rate<br />

The principals of the Botswana mining tax system are based on ad valorem royalty with a<br />

sliding tax rate. For royalty purposes, gross revenue is defined as the „sale value receivable<br />

at the mine gate in an arm‟s length transaction without discounts, commissions or deductions<br />

for the mineral or mineral product on disposal‟.<br />

Under our production, costs and copper price assumptions, we expect DML‟s tax rate to vary<br />

between 30-35% and we expect the capital shield to give DML a tax holiday of two years<br />

Key features of the tax regime are listed below<br />

100% deductibility of capex & pre-production spend before tax is payable<br />

200% employee training cost deduction<br />

3% ad valorem copper royalty<br />

5% ad valorem silver royalty<br />

Mining companies are taxed in accordance with the provisions of the Twelfth Schedule<br />

to the Income Tax Act. The tax rate is determined by the formula<br />

Annual tax rate = 70 – (1,500/X)<br />

Where “X” is the profitability ratio defined as taxable income as a percentage of gross<br />

income, provided that the tax rate is not less than the company tax rate of 25%.<br />

3 June 2010 23

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Botswana is a net<br />

importer of power<br />

Infrastructure<br />

Power<br />

Botswana is a net importer of power. Internal power generation comes from the Morupule<br />

coal fired power station, which generates 120MW. Electricity is imported from Eskom; 350MW<br />

was imported in 2009, with this figure expected to decline to ~150MW by 2012.<br />

Fig 29 Botswana Power Corporation forecast supply/demand balance<br />

Source: Botswana Power Corporation, June 2009<br />

DML is planning to<br />

construct an onsite<br />

coal fired power<br />

plant<br />

DML is planning to use diesel power for the construction phase and first year of operation,<br />

through a mixture of purchased and rented gen sets. The longer term power solution at<br />

Boseto is the construction of an onsite coal fired power station. A full feasibility study into the<br />

cost of the onsite power station is yet to be completed, with preliminary work indicating capex<br />

of US$25m. The alternative to an onsite power station is the installation of a transmission line<br />

to Maun, which would cost ~ US$12m and provide access to the national gird.<br />

Fig 30 Botswana Power consumption<br />

Source: Botswana Power Corporation, June 2009<br />

3 June 2010 24

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Water<br />

DML has defined<br />

sufficient water<br />

resources to<br />

support the Boseto<br />

project<br />

DML intends to tap into ground water resources, through the Ecca Aquifer located ~15km<br />

from Boseto. Five ground water resource areas within the Ecca Aquifer have been identified,<br />

with two areas “GRA 5” and “GRA 1” to be tapped for the initial project. The water from the<br />

aquifer has a relatively high saline content and is currently not being utilised. DML has<br />

indicated that it expects the “GRA 5” and “GRA 1” areas can provide 12ml pa of water over a<br />

15 year period. This is well in excess of the expected 2.5ml pa requirement for a 2mtpa<br />

flotation plant. DML has used water from the Ecca Aquifer in its metallurgical test work.<br />

Fig 31 Boseto site layout<br />

Source: DML, June 2010<br />

Project timeline<br />

DML is targeting<br />

first production in<br />

4Q11<br />

The next project milestone for DML at Boseto is the delivery of the BFS in July 2010. The<br />

delivery of the BFS is a key milestone as it is a requirement for the granting of a mining<br />

licence and will also be required for the securing of project finance. The construction timeline<br />

is expected to be 12-15 months with first production targeted in 4Q CY11.<br />

Fig 32 Boseto project timeline<br />

Source: DML, June 2010<br />

3 June 2010 25

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Diamond mining is<br />

the mainstay of the<br />

Botswana economy<br />

Mining in Botswana<br />

Mining activities in Botswana are governed by the Ministry of Minerals, Energy and Water<br />

Resources (MMEWR), with the Department of Mines the responsible department. A<br />

presentation given by MMEWR in June 2009 commented that “mining contributes more than<br />

a third of GDP and about half of government revenues”.<br />

Fig 33 Breakup of Botswana mineral revenue 2008/2009<br />

Source: Botswana Department of Mines, 2008<br />

Debswana is a 50:50<br />

JV between<br />

DeBeers and the<br />

Government of<br />

Botswana<br />

The mining sector employed 18,830 people in 2008 which represents ~2.7% of the estimated<br />

labour force (based on CIA World Factbook estimates). Expatriate employment in the mining<br />

sector represented ~4.77% of mining employees at the end of 2008.<br />

Fig 34 Employment trends in the Botswana mining industry<br />

Source: Botswana Department of Mines, 2008<br />

Mining in Botswana is dominated by diamond mining with Debswana the dominant player.<br />

Debswana was founded in 1969 as a 50:50 JV between DeBeers and the Government of<br />

Botswana. Debswana operates four mines in Botswana (Jwaneng, Orapa, Letlhakane and<br />

Damtshaa).<br />

3 June 2010 26

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 35<br />

Global rough diamond supply<br />

Source: Allan Hochreiter, Capital Resources Botswana, June 2009<br />

Tati Nickel is the<br />

main nickel<br />

producer<br />

Base metal mining in Botswana has been relatively consistent with Tati Nickel the mainstay.<br />

Norilsk Nickel acquired an 85% interest in Tati Nickel as a result of the takeover of LionOre in<br />

2007, and the Botswana Government owns the remaining 15% interest in Tati Nickel. Tati<br />

Nickel owns the Phoenix open pit sulphide mine in northeast Botswana, which has a 5mtpa<br />

onsite concentrator.<br />

Fig 36 Historical Botswana nickel/copper production<br />

kt metal<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008<br />

Nickel Copper<br />

Source: Botswana Department of Mines, 2008<br />

Traditionally mining and exploration hve focused on the eastern parts of Bostwana and not<br />

the northwest part of the country. This has provided DML and Hana Mining with a first mover<br />

advantage in the Kalahari copper belt.<br />

3 June 2010 27

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 37 Botswana mines and infrastructure<br />

Source: Hana Mining, May 2010<br />

Hana Mining<br />

Hana Mining has<br />

ground adjacent to<br />

the south of DML<br />

Hana Mining is<br />

targeting a resource<br />

increase before<br />

progressing project<br />

studies<br />

Hana Mining (HMG) is a TSX-V listed explorer focused on the Ghanzi Copper-Silver project in<br />

Botswana. The Ghanzi project is located to the south of DML‟s tenement package. HMG<br />

currently owns 70% of the Ghanzi project and can acquire a further 20% for US$9m following<br />

the completion of a BFS, the final 10% (for a 100% interest) may be acquired through the<br />

issue of 4m warrants exercisable at C$2.00ps (share price at 1 June: C$1.40ps).<br />

HMG has indicated the project has 600km of potential strike length, and the current focus is<br />

the Banana Zone which covers 64km of strike. The Ghanzi copper project (100%) has a<br />

resource of 93mt grading 1.51% copper and 17.5g/t silver for 1.4mt and 52.5moz contained<br />

copper and silver respectively (under a 0.75% copper cut-off and excluding the low grade<br />

zone).<br />

HMG is around 18-24 months behind DML in terms of bringing their respective projects into<br />

production. HMG‟s strategy appears to differ from DML, in that DML is targeting an initial<br />

3mpta project in order to generate cashflow, while it continues to drill out Boseto and its<br />

broader tenement holding. HMG on the other hand is pursing an aggressive drilling program<br />

over 2010 to increase the resource base, with a follow-up program in 2011 to increase the<br />

confidence in the resource base and a BFS to be completed by 2012 for targeted first<br />

production in 2H 2014.<br />

3 June 2010 28

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Fig 38 Ghanzi project location relative to Boseto<br />

Source: Hana Mining, June 2010<br />

African Copper<br />

African Copper (ACU) is an AIM listed copper play focused on restarting Mowana. The<br />

Mowana mine was commissioned in 2008; however, was placed on care and maintenance in<br />

February 2009 and restarted in January 2010.<br />

Mining and<br />

exploration activity<br />

in Botswana<br />

increasing<br />

ACU‟s major shareholder is JSE listed Zambia Copper Investments (ZCI), which owns ~82%<br />

of ACU, following the recapitalisation of ACU in 2009. The ACU shareholding is ZCI‟s sole<br />

material asset. KCI was suspended from trading on the JSE following the sale of its remaining<br />

interest (28.4%) in Konkola Copper mines to Vedanta for US$213m in May 2009. ZCI relisted<br />

on the JSE in January 2010 following shareholder approval for the acquisition of the interest<br />

in ACU which ended ZCI‟s classification as a listed cash shell.<br />

The Mowana operation was negatively impacted by low availability of the tertiary crushing<br />

plant in 1Q10.<br />

A Cap Resources<br />

A Cap Resources (ACB) is an ASX listed uranium explorer focusing on the Letlhakane<br />

Uranium project in west Botswana. The project has a resource of 463mt grading 154ppm<br />

uranium for 158m contained pounds of uranium. A scoping study in 2009 (conducted by SRK)<br />

indicated potential for production of 2.2mlbs pa of uranium over a 7-11 year LOM with cash<br />

costs of US$33/lb and capex of US$170m. ACB is currently completing a feasibility study into<br />

the Letlhakane project.<br />

Aviva Corporation<br />

ASX listed Aviva Corporation (AVA) announced an 895 thermal coal reserve at its<br />

Mmamantswe Coal project, located on the Botswana and South African border. A scoping<br />

study completed by SRK indicated the reserve has the potential to support 2000MW of power<br />

generation for 40 years. AVA plans to submit an application to register the Mmamantswe<br />

project as a sub project of the Botswana Power Corporation - this is required for access to the<br />

Southern African Power Pool.<br />

3 June 2010 29

<strong>Macquarie</strong> <strong>Research</strong><br />

<strong>Discovery</strong> <strong>Metals</strong> Ltd.<br />

Botswana is<br />

regarded by many<br />

as the most stable<br />

country in Africa<br />

Botswana country profile<br />

Botswana is a landlocked country in southern Africa. Botswana was granted independence in<br />

1966 (prior to independence Botswana was a British protectorate called Bechuanaland) and<br />

the government today operates in three parts: the executive, legislature and judiciary. The<br />

head of state is the president, who is appointed by the National Assembly and can serve a<br />

maximum of two five-year terms. The last election was held in October 2009 and was classed<br />

as free and fair, with the Botswana Democratic Party (which has held government for 43<br />

years) winning 45 of the 57 seats.<br />

Fig 39 Botswana GDP per capita growth<br />

Source: DeBeers, June 2010<br />

Diamond mining has<br />

driven GDP growth<br />

Botswana has maintained one of the world's highest economic growth rates since<br />

independence in 1966, though growth fell below 5% in 2007-08, and turned sharply<br />

negative in 2009, with industry falling nearly 30%. Through fiscal discipline and sound<br />

management, Botswana transformed itself from one of the poorest countries in the world<br />

to a middle-income country with a per capita GDP of $14,100 in 2008.<br />

Two major investment services rank Botswana as the best credit risk in Africa. Diamond<br />

mining has fuelled much of the economic expansion and currently accounts for more<br />

than one-third of GDP, 70-80% of export earnings, and about half of the government's<br />

revenues. Botswana's heavy reliance on a single luxury export was a critical factor in the<br />

sharp economic contraction of 2009. Tourism, financial services, subsistence farming,<br />

and cattle raising are other key sectors. Although unemployment was 7.5% in 2007<br />

according to official reports, unofficial estimates place it closer to 40%.<br />

Fig 40 Botswana at a glance<br />

Population m 2.00 Unemployment % 7.5<br />

GDP (PPP) US$bn 26 Inflation % 7.3<br />

GDP growth<br />

% -5.2 (2009) Interest Rate % 15<br />

2.9% (2008) Urban population % 60<br />

GDP per capita US$m 13,100<br />

GDP sectors<br />

Language English (official), Setswana Industry % 52.6<br />

Capital city Gaborone Services % 45.8<br />

Currency Pula Agriculture % 1.6<br />

Source: CIA World Fact Book, June 2010<br />

3 June 2010 30

1975<br />

1978<br />

1981<br />

1984<br />

1987<br />

1990<br />

1993<br />

1996<br />

1999<br />

2002<br />

2005<br />

2008<br />

2011<br />