Goldman Sachs Investor Research - Discovery Metals Limited

Goldman Sachs Investor Research - Discovery Metals Limited

Goldman Sachs Investor Research - Discovery Metals Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INITIATION<br />

7 October 2010<br />

<strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Initiating Coverage<br />

Materials | <strong>Metals</strong> & Mining | Australia<br />

*A full version of this document is available*<br />

Event:<br />

• We are initiating coverage of <strong>Discovery</strong> <strong>Metals</strong> Ltd (DML).<br />

Key take Outs:<br />

• DML is developing the Boseto copper project in Botswana and has<br />

extensive exploration tenements for both copper and nickel in<br />

Botswana.<br />

• To date DML has only completed exploration on sufficient strike extent<br />

of the known mineralisation to underpin a 3mtpa mine to produce c.<br />

36kt of copper and 1.1moz of silver per annum.<br />

• The bankable feasibility study (BFS) contemplates a US$175m capital<br />

investment for an open pit operation over a 5-year mine life with C1<br />

cash costs of US$1.28/lb but the Development Plan incorporates both<br />

open pit and underground operations at the same throughput rate to<br />

produce a similar level of copper and silver, but over a 15-year mine life<br />

at a marginally lower cash cost of US$1.23/lb.<br />

• Our estimates assume the same capital costs and production at similar<br />

levels but with higher unit mining costs resulting in higher cash costs of<br />

US$1.60/lb (LOM) but lower in the early years (driven by a lower strip<br />

ratio in the Zeta Pit).<br />

• DML plans funding through a combination of 60% debt and 40% equity<br />

funding with first production in early 2012.<br />

Earnings and Valuation Impact:<br />

• Prior to the commencement of production in FY12, earnings are not<br />

relevant. Our valuation ranges from a base of $0.91/share to upside<br />

of$1.20/share which is lower than the BFS (which assumes lower cost, a<br />

higher copper price and cost savings coming from the adoption of a new<br />

coal-fired power station).<br />

Investment View:<br />

• We are commencing coverage with a HOLD recommendation and a 12-<br />

month target price of $1.50.<br />

HOLD<br />

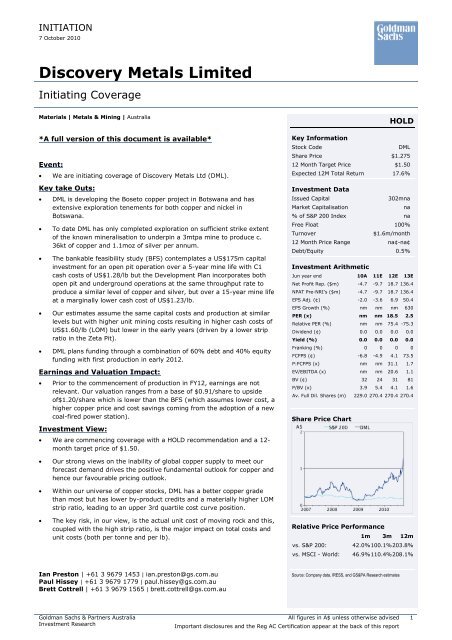

Key Information<br />

Stock Code<br />

DML<br />

Share Price $1.275<br />

12 Month Target Price $1.50<br />

Expected 12M Total Return 17.6%<br />

Investment Data<br />

Issued Capital<br />

302mna<br />

Market Capitalisation<br />

na<br />

% of S&P 200 Index na<br />

Free Float 100%<br />

Turnover<br />

$1.6m/month<br />

12 Month Price Range na¢-na¢<br />

Debt/Equity 0.5%<br />

Investment Arithmetic<br />

Jun year end 10A 11E 12E 13E<br />

Net Profit Rep. ($m) -4.7 -9.7 18.7 136.4<br />

NPAT Pre-NRI's ($m) -4.7 -9.7 18.7 136.4<br />

EPS Adj. (¢) -2.0 -3.6 6.9 50.4<br />

EPS Growth (%) nm nm nm 630<br />

PER (x) nm nm 18.5 2.5<br />

Relative PER (%) nm nm 75.4 -75.3<br />

Dividend (¢) 0.0 0.0 0.0 0.0<br />

Yield (%) 0.0 0.0 0.0 0.0<br />

Franking (%) 0 0 0 0<br />

FCFPS (¢) -6.8 -4.9 4.1 73.5<br />

P:FCFPS (x) nm nm 31.1 1.7<br />

EV/EBITDA (x) nm nm 20.6 1.1<br />

BV (¢) 32 24 31 81<br />

P/BV (x) 3.9 5.4 4.1 1.6<br />

Av. Full Dil. Shares (m) 229.0 270.4 270.4 270.4<br />

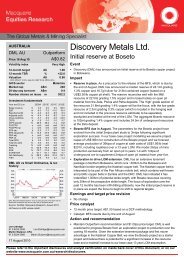

Share Price Chart<br />

• Our strong views on the inability of global copper supply to meet our<br />

forecast demand drives the positive fundamental outlook for copper and<br />

hence our favourable pricing outlook.<br />

• Within our universe of copper stocks, DML has a better copper grade<br />

than most but has lower by-product credits and a materially higher LOM<br />

strip ratio, leading to an upper 3rd quartile cost curve position.<br />

• The key risk, in our view, is the actual unit cost of moving rock and this,<br />

coupled with the high strip ratio, is the major impact on total costs and<br />

unit costs (both per tonne and per lb).<br />

Relative Price Performance<br />

1m 3m 12m<br />

vs. S&P 200: 42.0% 100.1%203.8%<br />

vs. MSCI - World: 46.9% 110.4%208.1%<br />

Ian Preston | +61 3 9679 1453 | ian.preston@gs.com.au<br />

Paul Hissey | +61 3 9679 1779 | paul.hissey@gs.com.au<br />

Brett Cottrell | +61 3 9679 1565 | brett.cottrell@gs.com.au<br />

Source: Company data, IRESS, and GS&PA <strong>Research</strong> estimates<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised<br />

Important disclosures and the Reg AC Certification appear at the back of this report<br />

1

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

RECOMMENDATION - Our Thinking<br />

RECOMMENDATION:<br />

HOLD<br />

Stock Code: DML Rationale: -ve Neut +ve<br />

Share Price: $ 1.28 Industry Structure: <br />

Valuation: $ 0.91 EVA Trend: <br />

Earnings Momentum:<br />

Catalysts:<br />

Price / Valuation:<br />

<br />

<br />

<br />

We are initiating coverage with a neutral recommendation and a 12-month target price of<br />

$1.50.<br />

Our positive view of copper is driven by our view that the market is moving to an ongoing<br />

deficit which will require a higher copper price, both to allow lower grade and less profitable<br />

greenfield projects to be developed over time and to destroy some demand from those areas<br />

where substitution can take place.<br />

DML controls a significant area of copper mineralisation within the Botswana Kalahari<br />

Copperbelt which is thought to be a continuation of the renowned Zambian Copperbelt.<br />

The geology appears to be well understood and DML is proposing a combined open pit and<br />

underground mining operation and, given the extensive strike continuity of the orebody,<br />

should be able to extend the mine life by progressively adding to the strike extent of mining.<br />

Whilst there has been only limited deeper drilling to date, the nature of the orebody (sharp<br />

geological cut-offs on the F/W and some mineralisation into the H/W) suggest that it will be<br />

amenable to mechanised underground mining at similar (or better) grade than the open pit.<br />

The two key operational risks that we can identify are the average strip ratio 15.9:1 (LOM) in<br />

the development case and the percentages of oxide and transition ore versus sulphide ore<br />

which will impact overall recoveries.<br />

We can identify with a strategy of limiting the open pit depth of mining to lower the waste<br />

stripping and thus LOM strip ratio (but this does mean that there will be a higher percentage<br />

of oxide and transition ore) and increasing the strike extent of the open pit, or more<br />

accurately strip mine, to maintain the overall open pit tonnage.<br />

The second key risk is the cost of actually moving a tonne of material. DML has synthesised a<br />

material movement cost of US$1.35/tonne which we find extremely low but acknowledge<br />

that the strip mining may allow less waste handling, leading to a lowering of waste haul<br />

distances, etc. Nonetheless, this unit cost/tonne is significantly lower than that of any of the<br />

other companies we cover.<br />

Corporate Structure<br />

• <strong>Discovery</strong> <strong>Metals</strong> is listed on the following markets:<br />

• Australian Stock Exchange (ASX: DML) - December 2003<br />

• Botswana Stock Exchange (BSE: DML) - December 2006<br />

• Alternative Investment Market (AIM: DME) - June 2007<br />

• The company has a June year-end and reports in AUD.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 2

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Botswana Background (Snowden Technical Report)<br />

Background<br />

• Botswana was formerly a British Colony (Bechuanaland) which gained independence<br />

from Britain in 1966. Since then, Botswana has enjoyed consistent economic growth<br />

based principally on diamond mining (also potash, copper, iron ore, nickel, salt and<br />

silver) and tourism.<br />

• Similarly to both Zambia and Senegal, Botswana has had civilian governments since<br />

Independence without any coup d'etat.<br />

• Botswana occupies a land mass of ~587,000km 2 which is relatively flat (lowest point the<br />

junction of the Limpopo and Sashe rivers (513m) and the highest point the Tsodilo Hills<br />

in the extreme north west of the country (1,489m). The country has a semi-arid climate<br />

with warm winters and hot summers.<br />

• Botswana is land locked with Namibia to the west, Angola and Zambia to the north,<br />

Zimbabwe to the east and South Africa to the south.<br />

• Botswana is a parliamentary republic with an elected President (Head of State) and<br />

Government and a cabinet appointed by the President. Elections are for 5-year terms<br />

with the HOS able to be re-elected for a second term.<br />

• The economy is dominated by diamond mining, accounting for >33% of GDP and 70% -<br />

80% of export earnings. Other mining, tourism, financial services, subsistence farming<br />

and cattle raising provide the balance of the economy.<br />

• Botswana's GDP of US$10.94bn (official exchange rate) or US$26bn at purchasing power<br />

parity breaks down as:<br />

Industry ............. 52.6%<br />

Services ............. 45.8%<br />

Agriculture ............ 1.6%<br />

• Prior to the Global Financial Crisis (GFC), Botswana had enjoyed strong GDP growth of<br />

5.2% 2009; 2.9% 2008 and 4.4% 2007.<br />

• As with much of Africa, unofficial unemployment is ~40%, although official<br />

unemployment is much lower at 7.5% (2007) with HIV a major issue in the country and<br />

reportedly the 2nd highest in the world.<br />

• The official currency is the Pula which is essentially fixed to the South African Rand and<br />

the country has public debt of 17.9% of GDP (2009) up from 5.9% (2008); foreign debt<br />

of US$1.65bn but also foreign reserves of US$9.575bn (2009).<br />

• The Botswana legal system is based on Roman Dutch law but also includes local<br />

customary law with judicial review limited to matters of interpretation.<br />

Botswana Mining Code<br />

• Mining legislation in Botswana is covered by the Mines and Minerals Act, 1999 - based<br />

generally on Australian and Canadian models. Mineral rights are therefore vested in the<br />

Republic of Botswana.<br />

• The Act provides security of tenure and, although the previous right to free equity for the<br />

government has been abolished, it retains the right to earn up to 15% as a minority<br />

interest, with the government paying a pro-rata share for its interest.<br />

• Mining attracts a variable income tax rate (with the exception of diamonds - which have<br />

a separate agreement) which is typically 25%, but slides up to a maximum of 50%<br />

determined annually by reference to the company's profit ratio.<br />

• Royalties are calculated as a percentage of the gross market value of the mineral and<br />

are 3% for copper and 5% for silver.<br />

• Applications for mineral rights are made directly to the Minister of Mineral Resources and<br />

Water Affairs. There are four types of mineral rights in Botswana: a prospecting licence,<br />

a retention licence, a mining lease and a mineral permit and these can be granted to an<br />

individual or a company.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 3

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Prospecting licence<br />

• A single prospecting licence is restricted to a maximum area of 1,000km 2 and confers<br />

exclusive rights on the holder over the mineral applied for as specified in the licence. If<br />

further minerals are discovered during prospecting, the prospecting licence may be<br />

amended accordingly to include the mineral concerned.<br />

• A prospecting licence is granted for a term of up to three years, renewable for two<br />

further periods of two years each. A reduction by 50% of the licence area is required at<br />

each renewal. Prospecting licences are transferable with the consent of the Minister.<br />

Among the obligations under the licence are scheduled exploration expenditures,<br />

reporting requirements and scheduled payments per square kilometre for exploration<br />

right (i.e. rentals).<br />

Retention licence<br />

• Retention licences are granted where minerals have been found during prospecting, but<br />

are not economically viable to mine in the short term. A retention licence must be<br />

applied for not less than three months prior to the expiry of the prospecting licence<br />

concerned. The applicant must show that it has carried out a feasibility study on the<br />

deposit and demonstrate that it cannot be mined on a profitable basis at the time of the<br />

application. A retention licence is granted for a three-year period and may be renewed<br />

only once for a further three-year period. The retention licence must be maintained in a<br />

safe condition and, within two months of expiry of the licence, all equipment and<br />

infrastructure must be removed. Quarterly reports of any prospecting activities on the<br />

retention licence must be filed to the Minister.<br />

• A person or company holding a retention licence is entitled to apply for a mining lease<br />

over that retention area. The retention licence is transferable, subject to the approval of<br />

the Minister.<br />

Mining lease<br />

• A mining lease is only issued to a prospecting licence or retention licence holder over the<br />

ore deposit in question. An application for a mining lease may only be made by a<br />

company incorporated in Botswana. A mining lease is granted subject to specified<br />

conditions, and the proposed financing plan submitted as part of the feasibility study<br />

must provide for a debt to equity ratio of no more than 3:1. The lease is valid for a 25-<br />

year term and may be renewed for another period not exceeding 25 years. Mining leases<br />

are transferable with the approval of the Minister. The proposed mining area should only<br />

cover that area reasonably required for surface mining and treatment facilities and also<br />

to cover the Measured, Indicated and Inferred Mineral Resources.<br />

• The holder of a mining lease has the right to conduct operations in accordance within the<br />

area and time limit specified in the licence, including acquiring the necessary land use<br />

rights, constructing facilities and carrying out work on the lease area and selling the<br />

mineral products resulting from its work. Among other requirements, the applicant for a<br />

mining lease must present and have approved a plan for developing and utilising the<br />

mineral resources and an environmental impact assessment.<br />

• The environmental impact assessment must consider the following issues:<br />

−<br />

−<br />

−<br />

−<br />

−<br />

−<br />

−<br />

−<br />

−<br />

an overview of the project and motivation;<br />

description of the pre-mining environment (geology, climate, topography, soil, land<br />

use);<br />

ecology, animal life, former and current mining operations, surface water, ground<br />

water, air;<br />

quality, noise and vibration, archaeological and cultural aspects, sensitive<br />

landscapes;<br />

protected areas, visual aspects, regional and socio-economic infrastructure);<br />

detailed project description;<br />

environmental impact assessment (separated by phase – construction, operational,<br />

decommissioning, residual impacts);<br />

environmental management programme; and<br />

consultation process.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 4

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

DML has an approved EIA for a 2mtpa process plant and has applied to increase the<br />

annual throughput rate to 3mtpa. This approval is expected in CY10.<br />

Minerals permit<br />

• A person wishing to conduct small-scale mining operations (over an area not exceeding<br />

0.5km 2 ) may apply for a minerals permit, subject to the written permission of the land<br />

owner, land board or the holder of any other mineral concession over the land applied<br />

for. Permits for industrial minerals shall only be granted to citizens of Botswana or<br />

companies incorporated therein. A minerals permit is valid for 5 years, renewable for<br />

further periods of 5 years. A minerals permit is transferable subject to the approval of<br />

the Minister.<br />

Botswana Royalty and Taxation<br />

Royalty<br />

The royalty is 3% ad valorem for copper and 5% ad valorem for silver.<br />

Taxation<br />

Botswana allows 100% write-off of capital expenditure and pre-production capital before tax<br />

becomes payable.<br />

The minimum tax rate is 25% and there is in addition a sliding-scale tax rate that is based on<br />

the profitability of the operation according to the formula:<br />

Y = 70 – (1500/X) Y is the tax rate (minimum 25%); X is the profitability ratio.<br />

On our estimates, in the period to 2015 in an elevated copper price environment, we<br />

calculate a total tax rate of ~27.5%, ie. A 2.5% variable tax in addition to the 25% base tax<br />

rate.<br />

Botswana Government Option<br />

The Government has a one-off statutory option to acquire at market price (bankable<br />

feasibility study (BFS) valuation) up to 15% of the project at the time of granting the mining<br />

licence. Should this option be exercised, the Botswana Government becomes a direct<br />

shareholder in the company (project) with a requirement to contribute a share of capital and<br />

in return receive a share of dividends and distributions, etc.<br />

However, since the introduction of this legislation in 1999, the Government has not exercised<br />

this option in any mining development.<br />

Botswana Infrastructure<br />

Botswana is well-serviced by road, rail and power reticulation and has international air links<br />

to neighbouring countries.<br />

However, the net power demand exceeds in-country power generation and thus Botswana is<br />

an importer of power, mainly from South Africa. Currently Botswana Power Corporation<br />

(BPC) generates ~80% of required power with the balance of power imported from the<br />

Southern African Power Grid. There are plans for additional coal-fired power generation<br />

plants in Botswana which should result in Botswana becoming power self-sufficient by 2013.<br />

Specifically, expansion of the Morupule Power Plant, Mmamabula and the potential<br />

Independent Power Plant – Mookane – may see Botswana becoming a net exporter of power<br />

to the grid.<br />

With respect to water, Botswana is an arid country with limited water resources. However,<br />

there are a number of known aquifers which can be tapped into and provide sufficient water<br />

for all DML’s needs.<br />

<strong>Discovery</strong> Minerals<br />

DML currently has two assets in Botswana. The primary focus of its activities is the Boseto<br />

Copper Project, for which DML has recently concluded a BFS. This project contains several<br />

lenses of mineralisation, with the first, Zeta, due to commence production in Q4CY11.<br />

The second project, Dikoloti Nickel, is less advanced and currently undergoing further<br />

exploration in order to increase the resource base. We have included a map of DML's<br />

properties below.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 5

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Source: Company data<br />

Boseto Copper Project (BCP)<br />

Highlights<br />

• Located in north-west Botswana, DML commenced a pre-feasibility study in August 2007<br />

and announced the outcomes of the BFS at the end of August 2010. A summary of the<br />

project is included below:<br />

− Extended Pre-Feasibility Study update in January 2009.<br />

− Definitive Feasibility Study and Development Plan September 2010.<br />

−<br />

−<br />

−<br />

−<br />

Open pit mine with 15-year mine life through a combination of open pit and<br />

underground mining.<br />

3mtpa conventional flotation concentrator-Recoveries of 83.6% Cu and 61% Ag.<br />

To produce 36.4kt Cu and 1.1moz Ag per annum (in concentrate 41% Cu grade).<br />

CAPEX of US$175m and net cash cost US$1.23/lb.<br />

− NPV of US$375m at a copper price of US$3.00lb and US$17/oz silver at a 10%<br />

discount rate and inclusive of coal-fired power.<br />

• Three strike zones containing 102.8mt of Mineral Resources:<br />

− Zeta: 35.4mt @ 1.4% Cu and 22.3g/t Ag<br />

− Plutus: 22.6mt @ 1.5% Cu and 15.3g/t Ag<br />

− Plutus (NE): 14.9mt @ 1.2% Cu and 12.5g/t Ag<br />

− Petra: 12.7mt @ 1.3% Cu and 15.0g/t Ag<br />

− Petra (SW): 17.2mt @ 1.4% Cu and 17.3g/t Ag<br />

Introduction<br />

<strong>Discovery</strong> <strong>Metals</strong>' Boseto Copper Project (100% owned) is located in north-west Botswana,<br />

approximately 80km south-west of the town of Maun, within the district of Namaqualand. A<br />

seven-tenement package was granted to <strong>Discovery</strong> <strong>Metals</strong> in September 2005 and fieldwork<br />

on this tenement package commenced in October 2005. The Government of Botswana<br />

approved the company's renewal of these tenements in September 2008 and all prospective<br />

areas were retained by the company.<br />

In June 2008, <strong>Discovery</strong> <strong>Metals</strong> was granted an additional seven tenements extending from<br />

the south-west boundary of the original 2005 granted tenements through to the Namibian<br />

border, adding 5,700km 2 to the area held under prospecting licences, to bring the total<br />

tenement area to 10,100km 2 . In September 2010, DML relinquished 444km 2 as required to<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 6

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

have a current exploration tenement package of 9,656km 2 . The outer limit of the exploration<br />

licence area starts approximately 60km south-west of Maun and stretches in a south-westerly<br />

direction for approximately 300km to the Namibian border.<br />

The Boseto Copper Project is located within a belt of significant copper-silver mineralisation<br />

that extends from the well known and more highly developed Zambian Copperbelt across<br />

north-west Botswana and into Namibia. The poorly explored and undeveloped portion of this<br />

belt in north-west Botswana is known as the Kalahari Copperbelt.<br />

Copper in the Boseto Project area occurs predominantly in chalcocite, with minor amounts of<br />

bornite and other copper sulphides present. At shallow depths, malachite and chrysocolla<br />

exist in significant proportions within some areas of the mineral resource.<br />

Resources and Reserves<br />

Both the current resources and reserve estimates for Boseto have been used as a base input<br />

for the completion of recent studies by DML. The BFS has taken into account the reserves,<br />

with the development plan utilising additional material in the mineral resource category.<br />

Resources<br />

This resource has been generated from infill drilling associated with the BFS and is current as<br />

at 31 August 2010. We have reproduced the resource below:<br />

Boseto Mineral Resource<br />

Tonnes Grade Metal<br />

Zeta mt Cu (%) Ag (g/t) Cu kt Ag moz<br />

Measured 3.9 1.6 23.0 62.4 2.9<br />

Indicated 7.0 1.5 23.8 105.0 5.4<br />

Inferred 24.5 1.4 21.8 343.0 17.2<br />

Total 35.4 1.4 22.3 510.4 25.4<br />

Plutus and Petra<br />

Measured 0.1 1.3 11.4 1.3 0.0<br />

Indicated 11.5 1.4 14.1 161.0 5.2<br />

Inferred 55.8 1.4 14.8 781.2 26.6<br />

Total 67.4 1.4 14.7 943.5 31.8<br />

Total 102.8 1.4 17.3 1454 57<br />

Source: Company data<br />

Reported at a cut-off grade of 0.6% Cu<br />

Reserves<br />

Following the release of the BFS on 31 August 2010, we have included the resultant ore<br />

reserves. Key assumptions used by DML include:<br />

‣ Copper price US$3.00/lb<br />

‣ Silver price: US$17/oz<br />

‣ Copper cut-off grade of 0.6% Cu<br />

‣ Only those portions of the resource amenable to open pit mining have been included in<br />

the ore reserve statement.<br />

The ore reserve statement is:<br />

Boseto Ore Reserve<br />

Tonnes<br />

Grade<br />

Metal<br />

Zeta mt Cu (%) Ag (g/t) Cu kt Ag moz<br />

Proved 4 1.6 22.1 64 3<br />

Probable 6.5 1.5 23.6 98 5<br />

Total 10.5 1.5 23.0 158 8<br />

Plutus and Petra<br />

Proved 0.2 1.3 11 3 0<br />

Probable 11.1 1.36 14.5 151 5<br />

Total 11.3 1.3 14.5 147 5<br />

Total 21.8 1.4 18.5 305 13<br />

Source: Company data<br />

Reported at a cut-off grade of 0.6% Cu<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 7

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Mine Plan<br />

• The BFS released in late August 2010 outlines a mine plan for BCP, which will see it<br />

commence production as an open pit in late 2011. In conjunction with this, DML also<br />

released a development plan, which incorporates additional mineralised material which is<br />

not of sufficient confidence to be promoted to reserves. We have, where applicable,<br />

assumed some material outlined in the development plan as part of our base case. In<br />

effect, we have modelled both open pit and underground mining in our base estimate.<br />

• Our current base case for DML assumes the construction and operation of Boseto open<br />

pit for the initial 3 years followed by the addition of an underground mine from 2015.<br />

Combined production would remain at 3mtpa, increasing to 3.5mtpa (GS&PA estimates)<br />

as operations are optimised with ore being sourced initially equally from the two<br />

operations, but at the expanded rate 2mtpa (open pit) and 1.5mtpa (underground).<br />

• Our key production assumptions compared to the BFS are shown below:<br />

GS&PA<br />

DML<br />

Production Metrics<br />

Annual Production mtpa 3.0 3.0<br />

Strip Ratio waste:ore 15 15<br />

Cu feed grade % 1.5 1.5<br />

Cu recovery % 84.0 84.0<br />

Cu production kt Cu 36.4 36.4<br />

Ag feed grade g/t 20.2 20.2<br />

Ag recovery % 61.0 61.0<br />

Ag production moz 1.1 1.1<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

Capital Cost<br />

DML's pre-feasibility study capital estimate for a 2mtpa plant was US$185m which was<br />

updated in September 2009 to US$150m. More recently, DML has increased the planned<br />

throughput rate from 2mtpa to 3mtpa and advised that the contracted capital cost for the<br />

plant to be ~US$91m and that the total capital cost of construction of the operation at<br />

Boseto will be in the order of US$175m (including contingencies).<br />

A breakdown of these capital costs is included below.<br />

Capital Items<br />

US$m<br />

Process plant - fixed price EPCM 91.2<br />

First fills and spares 10.3<br />

Tailings storage facility 2.7<br />

Diesel power generators 10.7<br />

Roads, offices, workshope, land compensation 13.1<br />

Process and mine control systems 8.0<br />

Village infrastructure 15.5<br />

Temp. Infrastructure 8.7<br />

Owners Team 3.6<br />

Subtotal 163.8<br />

Contigency & escalation 11.2<br />

Total 175.0<br />

Source: Company data<br />

Operating Cost<br />

DML has provided guidance as to its expected operating cost of BCP during the initial start-up<br />

when the project will still have a debt repayment requirement. We have adjusted these as we<br />

see fit. A summary of the operating costs we have used in our estimates versus the BFS is<br />

included below. The key difference that we have allowed for is a higher unit cost for moving<br />

material.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 8

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

GS&PA<br />

DML<br />

Production Costs<br />

Mining cost - Open Pit US$/t ore 21.0 21.6<br />

Mining cost - Underground US$/t ore 37.5 37.5<br />

Processing cost US$/t 10.35 10.34<br />

G&A cost US$/t 2.75 2.74<br />

Average Site Cost US$/t 43.3 34.68<br />

TC/RC^ $t, ¢/lb $53, 5.3¢ $45, 4.5¢<br />

Transport US$/t 180.0 180.0<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

^average FY12-FY15<br />

Mining Costs<br />

DML has provided a breakdown of the major costs. In our view, the US$1.35/tonne of<br />

material mined is low in comparison with other operations that we cover. We have used a<br />

more conservative US$1.50/t.<br />

In the early stages we have assumed a strip ratio of 13:1 and a cost of material movement<br />

of US$1.50/t. This translates to a unit cost for the period FY12 - FY14 of US$1.50/lb including<br />

the ramp-up stage.<br />

Once both the underground and open pit operations are operational we assume a 15:1 strip<br />

ratio with 2mtpa of open pit and 1.5mtpa from underground with an overall cash cost of<br />

US$1.74/lb (and assumes the LT TC/RC of US$90/t and US 9c/lb).<br />

Underground<br />

An addition to the BFS is the anticipation of the commencement of underground mining from<br />

~FY15. The need for this method has arisen due to the increasing strip ratio required to<br />

extract the relatively thin seam of ore in each of the lenses at greater depths. To date, the<br />

underground component has only been assessed as a development plan, given there is<br />

currently insufficient indicated and measured resources available for conversion to ore<br />

reserves (as a result of economic feasibility). We have, however, assumed some of this<br />

material is mined in our base case. The large resource base (>100mt) has led to the increase<br />

in the proposed capacity of the processing plant (along with an ever-expanding resource<br />

base) from 2mtpa to 3mtpa (we assume that the plant will operate above nameplate capacity<br />

at 3.5mtpa once limited debottlenecking is carried out).<br />

The underground development plan (scoping study) is focussed only on the Zeta zone on the<br />

higher grade copper zone (Cu >1.5% Cu) over 2,000 metres on strike and to a depth which<br />

varies between 100m and 650m depth. The scoping study evaluated the 25mt @ 1.4% Cu<br />

and 23.1g/t Ag to a maximum depth of 360m. DML estimated a low capital cost of US$10m.<br />

DML evaluated some 2,000m of strike broken into two operating sections each serviced by a<br />

separate decline. The design is based on a total of 13 strike drives situated some 20m<br />

vertically apart to a depth of ~360m although the deposit remains open below this depth.<br />

DML envisage a conventional uphole retreat mining method using a top-down mining system<br />

which limits the ongoing development requirements. DML does not envisage using any backfill<br />

in order to lower the costs, with the geotechnical stability thus dependent upon rib and sill<br />

pillars. DML reports that the H/W is competent but does contain mineralisation and thus any<br />

dilution does carry some grade.<br />

Bogging will be with remote or tele-remote loaders.<br />

We note that the oxide ore goes to a depth of 10m to 25m, transition ore from 25m to ~35m<br />

before moving into sulphide ore. The underground operation will thus increase the<br />

percentage of sulphide ore reporting to the plant.<br />

DML anticipates unit costs ~US$37/t off ore with decline costs of US$3,200/metre and<br />

US$2,900/metre for the strike development. Capital costs were estimated at US$5m at each<br />

decline and sustaining capital of US$3.5m/annum. We believe that these costs are realistic<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 9

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

and may perhaps be considered conservative once full steady-state operations are<br />

established.<br />

DML assumed mining recovery rates of 68% and unplanned dilution of 5% in the scoping<br />

study.<br />

We have included the proposed underground mining operation into our base case, as we<br />

think it is highly likely that this will proceed.<br />

Processing<br />

DML proposes a conventional copper concentrator plant incorporating 3-stage crushing and<br />

single-stage milling (and a regrind milling circuit) followed by two separate concentrate<br />

circuits. DML plans to first float the sulphide material with the tails (including oxide material)<br />

then reporting to an oxide circuit. Each concentrate circuit incorporates 3-stage concentrator;<br />

rougher, secondary and cleaner circuits.<br />

Recoveries will vary from ~60% in oxide to +92% - 95% for the sulphide to give the overall<br />

~84% recovery. Given the mineralogy (chalcocite and bornite), DML anticipates producing a<br />

very high grade concentrate grading ~41% copper.<br />

Timeline<br />

DML anticipates completing the project finance in 2010 with construction to commence<br />

shortly thereafter and 1st production early in 2012.<br />

Source: Company data<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 10

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Boseto Headline Outcomes<br />

DML released the outcome from the BFS and Development plan in late August 2010 with the<br />

key parameters as follows:<br />

Source: Company data<br />

DML has entered into an offtake agreement with Transamine for 100% of the concentrate<br />

produced for the first five years, based on normal arms length terms. In return for the<br />

offtake agreement, DML undertook a share placement to Transamine of 25m shares at<br />

A$0.76/share ( a 11% premium to the 4-week VWAP share price at the time) to raise A$18m<br />

in March 2010.<br />

DML plans to truck the concentrate to Gobabis in neighbouring Namibia (520km) then rail to<br />

the port of Walvis Bay (650km).<br />

DML has provided a table of the key sensitivities for the development, which is included<br />

below. In our view, the key issue for this development is the actual mining cost per tonne<br />

and, coupled with this, the strip ratio. Whilst we see some upside risk to the planned<br />

US41.35/t mining costs, we do see the ability for DML to limit the strip ratio with more ore<br />

being mined from underground and, given the strike extent of the ore zones, the ability to<br />

replace deeper open pit ore with additional shallower ore for the open pit mining.<br />

Source: Company data<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 11

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

GS&PA Boseto Copper Profile<br />

Base Case<br />

• Our current base case for DML assumes the construction and operation of Boseto open<br />

pit, with a contribution from the underground operation commencing approximately 3<br />

years later. We allow for a mine life out to 2026 initially at 3mtpa throughput rate<br />

increasing to 3.5mtpa from 2018.<br />

• We have not made any allowances for the mix of debt:equity funding, and have assumed<br />

a flat grade, tonnage and cost profile for both underground and open pit operations.<br />

• We note that DML is proposing a 60%:40% debt:equity split. We view this as too<br />

aggressive and believe that at most 50% debt should be contemplated and preferably<br />

30%:70% as more appropriate for a single-mine, single-commodity development<br />

company. This should also ensure that any hedging requirement from the banks is<br />

minimised. In addition, it means that DML will have funds available to continue with the<br />

exploration programme during the construction phase of Boseto.<br />

• We have also not allowed for the potential cost reduction that can be achieved from the<br />

building and operating of a coal-fired power station to replace the diesel power<br />

generation included in the BFS.<br />

• We have taken the detail of the BFS and incorporated that into our model for Boseto,<br />

and, as it stands, the production profile we have considered in our base case is as<br />

follows:<br />

>>Forecasts<br />

>> Long Term Pricing<br />

Boseto Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15 Jun-16 Jun-17 Jun-18 Jun-19 Jun-20<br />

Open Pit<br />

Tonnes mt 0.0 0.0 0.6 3.0 3.0 2.0 1.5 1.8 2.0 2.0 2.0<br />

Grade - Cu (%) 1.46 1.49 1.50 1.50 1.50 1.47 1.46 1.46 1.46 1.46 1.46<br />

Grade - Ag (g/t) 20.2 21.8 22.3 22.3 22.3 20.7 20.2 20.2 20.2 20.2 20.2<br />

Cost/t Ore US$/t 0 0 21 21 21 25 22 22 22 22 22<br />

Underground<br />

Tonnes mt 0.0 0.0 0.0 0.0 0.0 1.1 1.5 1.5 1.5 1.5 1.5<br />

Grade - Cu (%) 1.60 1.60 1.60 1.60 1.60 1.60 1.60 1.60 1.60 1.60 1.60<br />

Grade - Ag (g/t) 1.6 1.6 10.8 20.0 20.0 20.0 20.0 20.0 20.0 20.0 20.0<br />

Cost $/t Ore US$/t 0 0 38 38 38 38 33 33 33 33 33<br />

Processing<br />

Tons Milled (Mt) 0.00 0.00 0.60 3.00 3.00 3.00 3.00 3.25 3.50 3.50 3.50<br />

Grade - Cu (%) 0.00 0.00 1.50 1.50 1.50 1.52 1.53 1.52 1.52 1.52 1.52<br />

Grade - Ag (g/t) 0.0 0.0 11.2 22.3 22.3 20.6 20.1 20.1 20.1 20.1 20.1<br />

Production Copper (kt) 0 0 6 37 38 38 39 42 45 45 45<br />

Production Silver (koz) 201 1307 1312 1209 1183 1282 1381 1381 1381<br />

Costs (A$/t) 0 0 41 42 44 57 55 54 52 52 52<br />

Cash Costs (US¢/lb) 0 0 171 139 139 178 179 179 172 172 172<br />

CAPEX (US$m) 0.9 37.0 141.2 16.3 26.5 8.5 8.2 8.8 9.0 9.0 9.0<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

Upside Case<br />

In our upside case, we have assumed there is some potential for exploitation of the Cu and<br />

Ni (+/- PGE) ore at Dikoloti as well as a further 10-year mine life at Boseto (out to FY36) as<br />

a combined underground and open pit operation.<br />

Dikoloti Nickel Project (DNP)<br />

Highlights<br />

• Located in north-east Botswana.<br />

• DML farmed into the project in July 2004 and has since acquired 85.3% of the project<br />

from Xstrata which retains the remaining 14.7%.<br />

• Marginally economic using conventional processing techniques but heap leach biooxidation<br />

provides a more feasible option.<br />

• Entire project is within 45km of BCL's concentrating and smelter facility, the largest<br />

nickel processing facility in Africa.<br />

• Resource of 4.1mt @ 0.7% Ni, 0.5% Cu and 1.2g/t PGE.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 12

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Introduction<br />

• The Dikoloti Nickel Project comprises four prospecting licences covering an area of<br />

612km 2 , surrounding the three nickel deposits of BCL <strong>Limited</strong> in the Selebi-Phikwe region<br />

of NE Botswana. The entire project is within 45km of BCL's concentrating and smelter<br />

facility, which is the largest nickel processing facility in Africa. Outside of the immediate<br />

environment of BCL's operating mines, little to no modern exploration had been<br />

conducted prior to the exploration activities of <strong>Discovery</strong> <strong>Metals</strong>.<br />

Resource<br />

• The current resource is early-stage, and DML has indicated it will be continuing<br />

exploration around this mineralised zone in order to increase the tonnage and<br />

confidence, before commencing any further economic studies.<br />

• This resource includes drilling which was completed historically as well as by DML in its<br />

JV with Falconbridge in 2004 and 2005. The defined limits of this resource cover<br />

approximately 2.4km strike length, and a maximum depth of around 100m.<br />

• Estimation was undertaken using ordinary kriging methods, which were constrained by<br />

wireframes constructed using a 0.3% Ni envelope as well as geological interpretation.<br />

Block sizes were based on drilling density, leading to a size of 20m x 40m x 10m (width<br />

x length x depth) which would seem appropriate at this stage of investigation, and an<br />

inferred resource category.<br />

• The resource also assumes a density of 3.72 t/m 3 for mineralised material and 2.85 t/m 3<br />

for waste.<br />

We have included a table outlining the existing resource for Dikoloti below:<br />

Dikoloti Mineral Resource (100%) Grade Metal<br />

mt Ni (%) Cu (%) Pt + Pd g/t Ni kt Cu kt Pt + Pd koz<br />

Measured - - - - - - -<br />

Indicated - - - - - - -<br />

Inferred 4.1 0.7 0.5 1.2 28.7 20.5 158.2<br />

Total 4.1 0.7 0.5 1.2 28.7 20.5 158.2<br />

Source: Company data<br />

Reported at a cut-off grade of 0.5% Ni<br />

Scoping Study<br />

Snowden completed a scoping level study on Dikoloti in 2006 for the likely economic benefit<br />

of operating an open pit, underground mine and a combined operation, with ore toll treated<br />

at the nearby BCL smelter. The study provided a range of outcomes, the greatest of which<br />

was an NPV of A$57m (100%) for a combined underground and open pit operation. We<br />

stress that the key assumptions used in this study may now be out of date, and have<br />

determined our own upside potential for this project (US$48m).<br />

Investment Case<br />

• DML uses AUD as a functional currency, although we expect the project in Botswana to<br />

operate in USD. The financial year-end is June.<br />

Earnings<br />

Our current earnings forecasts are based on a combination of both the BFS (which comprises<br />

open pit mining) and the introduction of underground ore from FY15 (outlined in the<br />

development plan). We have included this material as we believe the underground operation<br />

is highly likely, and has been excluded from the BFS because there has been insufficient<br />

drilling to prove the resource up to a level which can support an economic evaluation (as a<br />

reserve). The geology appears relatively simple and we feel that this upgrade is a matter of<br />

when and not if.<br />

Given the BFS project outline, and our inclusion of some underground material included in<br />

the development plan, our forecast earnings are shown below:<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 13

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Profit & Loss<br />

(A$m)<br />

Year end June 2010a 2011e 2012e 2013e 2014e<br />

Sales Revenue 0 0 63 420 445<br />

Operating costs 5 11 39 175 181<br />

Operating EBITDA -5 -11 24 245 264<br />

D&A 0 0 4 27 29<br />

Operating EBIT -5 -11 19 218 236<br />

EBIT -5 -11 19 218 236<br />

Boseto 0 0 27 221 237<br />

Other -5 -11 -8 -3 -2<br />

Net Interest Exp./(Rev) -1 -1 -12 -24 -31<br />

PreTax Profit (pre ab's) -5 -10 32 242 267<br />

Tax Expense (pre abs) 0 0 13 106 119<br />

OEI 0 0 0 0 0<br />

NET PROFIT (Pre NRI's)1 -5 -10 19 136 148<br />

Abnormal Items (after Tax) 0 0 0 0 0<br />

Reported NPAT (post ab's) -5 -10 19 136 148<br />

Sales Growth (%) -100% 567% 6%<br />

Op. EBITDA Growth (%) N/A N/A N/A 933% 8%<br />

NPAT (Adj.) Growth (%) N/A N/A N/A 629% 8%<br />

EPS (Adj.) Growth (%) 629 8<br />

Op.EBITDA Margin (%) 37.7% 58.4% 59.4%<br />

Interest Cover - EBITD (X) 7.8 8.4 -1.9 -10.0 -8.4<br />

Return on Equity 5 (%) -6% -15% 23% 62% 39%<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

The investment arithmetic is shown below:<br />

Investments Statistics<br />

Year end June 2010a 2011e 2012e 2013e 2014e<br />

Net Profit (Reported) (A$m) -5 -10 19 136 148<br />

- EPS (Reported) 1 (¢) -2.0 -3.6 6.9 50.4 54.7<br />

- PER (Reported) 1 (X) -63.1 -35.9 18.6 2.5 2.3<br />

NET PROFIT (Adj.) 2 (A$m) -5 -10 19 136 148<br />

- EPS (Adj.) 2 (¢) -2.0 -3.6 6.9 50.4 54.7<br />

- EPS Growth (%) -62 77 -293 629 8<br />

- PER (Adj.) 2 (X) n.a n.a 18.6 2.5 2.3<br />

Dividend (¢) 0.0 0.0 0.0 0.0 8.0<br />

- Yield (%) 0.0% 0.0% 0.0% 0.0% 6.2%<br />

- Franking (%) 0% 0% 0% 0% 0%<br />

Free Cash Flow (A$m) -16 -13 11 199 135<br />

- P/FCF 4 (X) -18.8 -26.2 31.7 1.7 2.6<br />

EV(Adj.)/EBITDA 3 (X) -48.7 -33.0 20.8 1.1 0.5<br />

Avg. Shares (diluted) (mill) 229 270 270 270 270<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

Earnings sensitivity to moves in copper price and exchange rate<br />

Given the project is early-stage, we do not have any relevant sensitivity analysis to the<br />

project until FY13. The table below indicates that both currency and metal price fluctuations<br />

have a material impact on earnings.<br />

Sensitiity Analysis<br />

Year End Dec 2010a 2011e 2012e 2013e 2014e<br />

Currency +1¢ n.a n.a n.a -2.1 -2.4<br />

Copper US5¢/lb n.a n.a n.a 2.5 2.4<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

Balance Sheet<br />

DML has outlined its intention to finance the Boseto project with 60% debt. We believe that<br />

this level of debt is too aggressive for a single-mine development company. When the final<br />

financing arrangements are completed we will adjust the financials for the actual debt:equity<br />

mix.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 14

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

For the purposes of our analysis, at this stage we simply assume full debt funding for the<br />

purposes of Income Statement and B/S evaluation. Our current estimates of peak debt<br />

funding are shown below in the B/S.<br />

Balance Sheet<br />

(A$m)<br />

Year end June 2010a 2011e 2012e 2013e 2014e<br />

Cash 39 14 14 237 372<br />

Property, Plant, Equip 35 38 38 38 38<br />

Other Assets 0 0 0 0 0<br />

Debt 0 30 161 161 161<br />

Shareholders Equity 74 64 83 220 378<br />

NET Debt/EBITDA (%) 751% -141% 617% -31% -80%<br />

Net Debt / Equity (%) -53% 24% 176% -35% -56%<br />

Net Debt / (D+E) (%) -113% 19% 64% -53% -127%<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

Cash Flow<br />

As is normal for a development company, operating cash flow is currently negative and<br />

remains so until production commences in FY12 and, on our estimates, DML generates<br />

positive cash flow after all capital in FY13. We include both the initial US$175m capital<br />

expenditure and the underground development ~US$20m in our estimates in FY14.<br />

Our cash flow estimates, as they stand, are included below.<br />

Cash Flow Analysis (A$m)<br />

Year end June 2010a 2011e 2012e 2013e 2014e<br />

Operating EBITDA -5 -11 24 245 264<br />

change in working cap. 0 2 2 2 2<br />

Gross Cashflow -5 -9 26 247 266<br />

Net Interest Paid 1 0 -11 -12 -5<br />

Tax Paid (inc. abs) 0 0 0 -27 -116<br />

Exploration -11 -5 -2 -2 -2<br />

Operating Cash Flow -15 -13 12 207 143<br />

Maintenance Capex 0 0 -1 -8 -8<br />

FREE CASH FLOW -16 -13 11 199 135<br />

Dividends Paid 0 0 0 0 -11<br />

Expansionary Capex -1 -43 -166 -12 -26<br />

Acquisitions 0 0 0 0 0<br />

Asset Sales 1 0 0 0 0<br />

Dividends Received/Other. 2 0 0 0 0<br />

Share Issues/Repurchases 44 0 0 0 0<br />

Increase in Net Cash/(Debt) 30 -56 -155 187 98<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 15

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Valuation<br />

• As stated previously, we have included the commencement of open pit mining in FY12<br />

and underground mining in FY15. Our base case assumes combined production from<br />

these two sources at a rate of 3mtpa increasing to 3.5mtpa for 15 years out to the<br />

conclusion of FY26. This base case also includes $65m in exploration assets, which is<br />

included to approximate the likelihood of further resource upgrades.<br />

• For our upside case, we have included a 10-year extension to Boseto, which, given the<br />

size of the current resource is feasible, as well as some benefit from a project<br />

development at Dikoloti. This project is clearly early-stage and not the primary focus of<br />

DML at present.<br />

• We have included a summary of our valuation below:<br />

<strong>Discovery</strong> <strong>Metals</strong><br />

DISCOUNTED CASH FLOW VALUATION<br />

Discount Rate Used % 11.7%<br />

Issued Shares millions 313.9<br />

Mines<br />

A$m<br />

$ per share<br />

Boseto (15 Year Mine Life) 385 $1.23<br />

- $0.00<br />

Sub Total Mines 385 $1.23<br />

Exploration Assets 65 $0.21<br />

NPV of Tax (188) ($0.60)<br />

NPV of Hedge Book – $0.00<br />

Net Cash 39 $0.13<br />

Corporate (36) ($0.11)<br />

Franking Credits 7 $0.02<br />

Option Dilution 15 $0.05<br />

Other – $0.00<br />

Sub Total Corporate/Other (98) ($0.31)<br />

NET PRESENT VALUE 287 $0.91<br />

Upside Options<br />

Boseto Extension of Life (10 Years) - post tax 41 $0.13<br />

Dikoloti Ni Project - attributable and post tax 48 $0.15<br />

UPSIDE VALUATION 377 $1.20<br />

Source: GS&PA <strong>Research</strong> estimates<br />

Financing<br />

DML is yet to complete the funding arrangements for the development of Boseto. However,<br />

the company has articulated the desire to use a maximum amount of debt (as high as 60%).<br />

We see some risk to this high level of debt given the experience of a number of junior<br />

development companies that have not only been forced into excessive hedge positions but<br />

have also been precluded from accessing the project cash flow to fund any exploration or<br />

other developments until the debt has been reduced following the commissioning and<br />

financial closure of the project.<br />

We further note that, on our estimates, DML is currently trading above our base NPV and<br />

thus any equity raising (above NPV) is accretive for shareholders.<br />

Based on the current share price and assuming an equity raising of $121m (gross) 40%<br />

debt: 60% equity (a 7.5% discount to the current share price $1.28/share) our base case<br />

valuation increases to $1.01/share.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 16

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

At the proposed 60% debt, an equity raising of $78m (gross) would see an increase in the<br />

valuation to $1.09/share and if we then lower the WACC accordingly this increases further to<br />

$1.12/share for the base case valuation.<br />

We assume off-balance sheet finance of US$80m for the mining fleet.<br />

Comparisons to PEER group<br />

Earnings Multiples<br />

DML can clearly be viewed as an emerging copper producer, with all earnings derived from<br />

the project at Boseto for at least the next 5-10 years. As a result, we have chosen to<br />

compare the company with other base metal producers of varying scale and commodity.<br />

Positively, though, DML has a significant copper resource, which should allow either a further<br />

expansion or an extension to the mine life of Boseto. We further note that copper is our<br />

preferred base metal.<br />

PER<br />

In FY11, DML has no earnings and therefore no PE multiple. In FY13, however, the earnings<br />

multiple looks inexpensive in comparison to many of its peers including the most direct<br />

comparison, CGG, which has a developing project in Saudi Arabia.<br />

FY13 PER Comparison<br />

GS&PA Investment <strong>Research</strong><br />

20.0<br />

18.0<br />

16.0<br />

14.0<br />

12.0<br />

(x)<br />

10.0<br />

8.0<br />

6.0<br />

4.0<br />

2.0<br />

0.0<br />

OZL<br />

EQN<br />

ABY<br />

PNA<br />

CGG<br />

SFR<br />

DML<br />

MRE<br />

WSA<br />

IGO<br />

KZL<br />

ILU<br />

Source: GS&PA <strong>Research</strong> Estimates, Company Data<br />

PE (x) Price 2010e 2011e 2012e 2013e 2014e 2015e<br />

OZL 1.54 13.1 11.5 9.6 10.0 10.0 55.5<br />

EQN 5.75 18.2 10.0 7.4 7.4 7.8 60.0<br />

ABY 1.24 6.3 4.5 3.1 2.6 2.3 3.5<br />

PNA 0.71 17.0 12.1 8.0 7.4 7.1 43.7<br />

CGG 0.42 n.a. n.a. 17.6 2.4 2.2 3.2<br />

SFR 6.92 n.a. n.a. 0.5 0.5 0.4 0.6<br />

DML 1.30 n.a. n.a. 21.0 2.6 2.4 4.3<br />

MRE 0.82 11.2 20.3 21.4 6.5 5.2 4.9<br />

WSA 6.29 76.8 10.5 16.9 7.4 4.6 4.4<br />

IGO 6.33 24.6 20.7 39.2 18.7 13.9 14.4<br />

KZL 0.68 122.7 6.7 4.0 5.3 2.9 6.3<br />

ILU 6.48 127.4 14.2 11.4 9.0 7.8 6.8<br />

Average 40.4 11.8 12.8 7.3 6.3 16.8<br />

Copper Average 13.6 9.5 9.6 4.7 4.6 24.4<br />

Source: GS&PA <strong>Research</strong> estimates<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 17

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

P/FCF<br />

On this measure, DML appears to be quite highly priced at present, particularly in comparison<br />

to its nearest peers, CGG and SFR. In our view, this is a direct result of the higher unit<br />

mining costs combined with the strip ratio in our estimates for BCP.<br />

FY13 P/FCF Comparison<br />

GS&PA Investment <strong>Research</strong><br />

75.0<br />

65.0<br />

55.0<br />

45.0<br />

(x)<br />

35.0<br />

25.0<br />

15.0<br />

5.0<br />

-5.0<br />

OZL<br />

EQN<br />

ABY<br />

PNA<br />

CGG<br />

SFR<br />

DML<br />

KZL<br />

Copper<br />

Average<br />

Source: GS&PA <strong>Research</strong> Estimates, Company Data<br />

P/FCF (x) Price 2010e 2011e 2012e 2013e 2014e 2015e<br />

OZL 1.54 7.6 8.9 7.3 7.1 6.8 24.0<br />

EQN 5.75 8.8 5.4 5.7 6.8 7.3 69.7<br />

ABY 1.24 3.7 3.0 2.5 2.4 2.3 5.3<br />

PNA 0.71 24.7 16.1 9.4 9.2 8.8 42.7<br />

CGG 0.42 n.a. n.a. 17.3 2.4 2.3 3.4<br />

SFR 6.92 n.a. n.a. 4.1 3.9 2.4 3.8<br />

DML 1.30 n.a. n.a. 4.0 71.9 48.7 12.2<br />

KZL 0.68 139.4 5.1 3.6 4.8 2.4 6.0<br />

Copper Average 11.2 8.3 7.2 14.8 11.2 23.0<br />

Source: GS&PA <strong>Research</strong> estimates<br />

EV/EBITDA<br />

ON this basis, DML appears more favourably valued, although still more expensive than a<br />

number of the alternative copper investment opportunities.<br />

FY13 EV/EBITDA Comparison<br />

GS&PA Investment <strong>Research</strong><br />

(x)<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

OZL<br />

EQN<br />

ABY<br />

PNA<br />

CGG<br />

SFR<br />

DML<br />

KZL<br />

Copper<br />

Average<br />

Source: GS&PA <strong>Research</strong> Estimates, Company Data<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 18

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

EV/EBITDA (x) Price 2010e 2011e 2012e 2013e 2014e 2015e<br />

OZL 1.54 5.1 4.2 3.1 2.9 2.3 7.5<br />

EQN 5.75 15.0 6.3 2.9 1.7 1.2 0.8<br />

ABY 1.24 n.a. 2.8 1.5 0.4 -0.4 -0.9<br />

PNA 0.71 11.9 3.1 2.3 1.0 0.1 -0.6<br />

CGG 0.42 n.a. n.a. 10.9 1.3 0.5 1.5<br />

SFR 6.92 n.a. n.a. 1.7 0.2 -0.8 -1.8<br />

DML 1.30 n.a. n.a. 14.9 1.4 1.3 2.7<br />

KZL 0.68 n.a. 7.0 1.6 0.5 0.3 -0.4<br />

Copper Average 10.7 4.1 4.2 1.4 0.8 1.7<br />

Source: GS&PA <strong>Research</strong> estimates<br />

EV/Production ($lb)<br />

On this comparison, DML appears attractive, more in line with a developing operation.<br />

FY13 EV/Production Comparison ($/lb)<br />

GS&PA Investment <strong>Research</strong><br />

10.0<br />

6.0<br />

2.0<br />

-2.0<br />

OZL<br />

EQN<br />

ABY<br />

PNA<br />

CGG<br />

SFR<br />

DML<br />

KZL<br />

Copper<br />

Average<br />

Source: GS&PA <strong>Research</strong> Estimates, Company Data<br />

EV /Production ($/lb) Price 2010e 2011e 2012e 2013e 2014e 2015e<br />

OZL 1.54 13.4 12.3 10.6 9.5 7.5 7.2<br />

EQN 5.75 11.4 8.1 5.8 4.2 2.9 2.9<br />

ABY 1.24 3.0 1.8 0.6 -0.8 -2.1 -3.0<br />

PNA 0.71 14.0 13.3 11.2 8.3 6.2 6.3<br />

CGG 0.42 n.a n.a 37.5 5.4 2.4 4.7<br />

SFR 6.92 n.a n.a 26.4 9.2 3.0 1.0<br />

DML 1.30 n.a n.a 37.4 3.3 1.6 2.7<br />

KZL 0.68 9.0 6.8 3.7 2.9 0.0 -1.0<br />

Copper Average 10.1 8.4 16.6 5.3 2.7 2.6<br />

Source: GS&PA <strong>Research</strong> estimates<br />

EV/Resource (lbs)<br />

DML is attractively priced on this measure, given the significant resource base.<br />

EV/Resource (c/lb) Resources 2010e 2011e 2012e 2013e 2014e 2015e<br />

OZL 4059 36.2 32.3 27.7 23.6 18.9 18.4<br />

EQN 6440 25.7 20.3 15.5 11.3 7.3 6.6<br />

ABY 1762 9.7 6.3 1.9 -2.6 -6.8 -8.8<br />

PNA 2164 40.7 39.9 34.3 26.6 19.9 20.1<br />

CGG 700 19.8 62.8 69.8 45.9 21.8 41.5<br />

SFR 600 52.0 71.2 72.8 55.2 24.7 8.0<br />

DML 1474 8.2 11.5 15.6 8.7 4.6 7.5<br />

KZL 73 247.3 209.3 136.5 97.9 1.8 -25.9<br />

Copper Average 55.0 56.7 46.8 33.3 11.5 8.4<br />

Source: GS&PA <strong>Research</strong> estimates<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 19

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

FY13 EV/Resource Comparison (C/lb)<br />

GS&PA Investment <strong>Research</strong><br />

40.0<br />

35.0<br />

30.0<br />

25.0<br />

20.0<br />

15.0<br />

10.0<br />

5.0<br />

0.0<br />

-5.0<br />

-10.0<br />

-15.0<br />

-20.0<br />

OZL<br />

EQN<br />

ABY<br />

Source: GS&PA <strong>Research</strong> Estimates, Company Data<br />

PNA<br />

45.9<br />

CGG<br />

55.2<br />

SFR<br />

DML<br />

97.9<br />

KZL<br />

Copper<br />

Average<br />

Valuation<br />

• On an NPV basis, DML is trading well above its base valuation at 1.42x as opposed to the<br />

average of 0.99x.<br />

• The upside for DML appears to be slightly higher than the average of this peer group at<br />

1.08 but, given the method of calculation (DCF), does not fully encapsulate the value of<br />

the 100mt+ resource base.<br />

P/NPV - Base Comparison<br />

GS&PA Investment <strong>Research</strong><br />

1.60<br />

1.40<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

0.00<br />

OZL<br />

EQN<br />

ABY<br />

PNA<br />

CGG<br />

SFR<br />

DML<br />

MRE<br />

WSA<br />

IGO<br />

KZL<br />

ILU<br />

Average<br />

Source: GS&PA <strong>Research</strong> Estimates, Company Data. * not rated<br />

P/NPV (x) Price P / Base NPV P/ Upside NPV<br />

OZL 1.54 0.94 0.90<br />

EQN 5.75 1.45 1.01<br />

ABY 1.24 0.80 0.47<br />

PNA 0.71 1.13 0.64<br />

CGG 0.42 0.95 0.90<br />

SFR 6.92 0.96 0.85<br />

DML 1.30 1.42 1.08<br />

MRE 0.82 0.57 0.34<br />

WSA 6.29 1.07 0.61<br />

IGO 6.33 1.10 0.73<br />

KZL 0.68 0.58 0.41<br />

ILU 6.48 0.85 0.79<br />

Average 0.99 0.73<br />

Source: GS&PA <strong>Research</strong> estimates<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 20

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Risks<br />

Country Risk<br />

We consider the country risk of Botswana to be somewhat lower in comparison to other Sub-<br />

Saharan African peers. We have reproduced a subsection of the recent survey of mining<br />

company executives which places Botswana 5th overall in terms of low-risk mining<br />

destinations. We do note, in the table below, that we have not reproduced all factors. With<br />

this in mind, we see very low risk in mining investment, with the country being known for<br />

having a favourable attitude towards mining activities. The primary area of risk appears to be<br />

infrastructure.<br />

Country Risk<br />

Overall Country Financial Risk Sovereign Risk Land Access Social Risk Infrastructure Labour Relations<br />

1 Canada 0 0 2 1 1 1<br />

2 Sweden 1 1 1 2 1 2<br />

3 Chile 1 1 1.5 1.5 1 2<br />

4 Greenland 1 1 2 2 4 1<br />

5 Botswana 2 1 1 2 4 1<br />

6 United States 2 2 2 2 2 2<br />

7 Laos 2.5 3.5 1 2 3.5 0.5<br />

8 Kazakhstan 3 2 2 1 2 1<br />

9 China 3 3 1 0 2 2<br />

10 Ivory Coast 2 2 2 2 2 2<br />

26 Australia 3 4 3 2 2 1<br />

Source: Resourcestocks World Risk Survey 2010. (this list does not include all survey categories)<br />

Product Risk<br />

We see limited risk for DML on the product side, as the copper fundamentals are the<br />

strongest of the base metals with the market forecast to be in deficit from 2011 onwards.<br />

Whilst copper is not geologically scarce worldwide, future projects are of lower quality than<br />

the best current producers and, when coupled with the falling grades of current global<br />

producers, suggest new large-scale producers will take some years to be brought into<br />

production and require significant capital investment - all in all, not the outlook for easy<br />

supply additions. We further note that many of the easier opportunities for substitution have<br />

already been taken. As a result, there is a high degree of demand inelasticity, which is also<br />

favourable for the metal price.<br />

Land Owners<br />

It is our understanding that DML is still required to negotiate with local land holders, who run<br />

subsistence farming ventures over the potential mining area. Anecdotally this should not be a<br />

problem, with compensation available to claimants. Given DML is domiciled in Australia, it will<br />

be bound by acceptable stakeholder practices to our country (as shareholders become more<br />

interested in companies adopting best practice globally). As mentioned previously, the<br />

government is also proactive in this area to ensure that developments do take place and it is<br />

therefore our opinion that this should not present a significant issue.<br />

Government Legislation<br />

DML has submitted the Environmental Impact Assessment for public comment and has<br />

applied for the mining licence but this has not yet been approved. However, given the strong<br />

pro-mining focus of the authorities we do not believe that this is a major risk.<br />

Clearly there are some regulatory risks from changes to royalty rates, taxation, etc.<br />

However, the current royalty rates are globally competitive and the taxation includes a profit<br />

share based on individual mine level profitability. We thus view any increases in either of<br />

these parameters as relatively low risk.<br />

Botswana does have the right to an equity participation in any mining development.<br />

However, this right is for a direct equity contribution by the Government, it is funded by<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 21

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Government (not through any future cash flow, etc.) and could thus justifiably be considered<br />

as almost advantageous for DML.<br />

Funding<br />

DML has yet to complete the funding package for Boseto and, in our view, is looking to too<br />

large a debt component. That said, in the current investment climate we do not envisage any<br />

material difficulty in raising the majority of the required funding package from the equity<br />

markets.<br />

We further note that a significant negative to debt funding is the inevitable requirement to<br />

institute a large hedge programme and the lack of access to cash flows once production<br />

commences due to the ring-fencing of cash flow until debt closure is made, thus inhibiting<br />

the ability to conduct an aggressive (or limited) exploration programme at the same time.<br />

Single-Commodity, Single-Mine Company Risk<br />

As with all companies moving from explorer to producer status, DML has single-mine risks.<br />

We see the risks to DML as no greater than the other companies in our coverage universe<br />

that have successfully transitioned. In our view, the board and management have the<br />

necessary skill set for this transition and there is a history of mining in Botswana which<br />

provides further comfort on the overall skills required for this development.<br />

Operational Risks<br />

We see the greatest risk as the actual unit cost of moving rock. Given the high strip ratio of<br />

15.9:1, this can materially impact the mining cost on a per-tonne-of-ore-treated basis. That<br />

said, given the nature of the orebody and the ability to be treated as a strip mine with waste<br />

removal ahead of mining being dumped into the mined-out area, the cost of waste transport<br />

is likely to be low and there is no need to build a waste dump as such.<br />

Power<br />

Botswana is a net importer of electric power and, as such, DML is proposing to use a dieselfired<br />

power plant for the operation replaced in later years by a dedicated coal-fired power<br />

plant. Whilst DML is able to access grid power, the lack of reliability of the grid power is<br />

being addressed by the use of diesel power and the costs assume diesel power generation.<br />

HIV<br />

The country has an estimated adult HIV prevalence of 24.6%, the second highest in the<br />

world after Swaziland. The impact from this epidemic has been a shortening in the life<br />

expectancy estimated by the United Nations Agency for adults from 65 years (in 2000) to<br />

less than 40 years (current).<br />

The obvious impact of this high level of AIDS infection is the loss of skilled workers and the<br />

costs to both individuals and companies from providing appropriate levels of medical care.<br />

Board of Directors and Senior Management<br />

Chairman: GORDON GALT (Date of Appointment 9 May 2007)<br />

• Gordon Galt is a senior mineral resources executive and an experienced director with<br />

international mineral industry experience.<br />

• In recent years Mr Galt has held the following listed company directorships:<br />

−<br />

−<br />

Aquila Resources <strong>Limited</strong> from August 2007 to present<br />

Navigator Resources <strong>Limited</strong> from August 2008 to present<br />

− Gloucester Coal <strong>Limited</strong> from April 2004 to August 2007<br />

− Magnesium International <strong>Limited</strong> from August 2002 to January 2006<br />

CEO: STUART BRADLEY SAMPSON (Date of Appointment 1 February 2008)<br />

• Brad Sampson has over 20 years Australian and International experience as a mining<br />

engineer. He has worked extensively in open cut and underground mine operations and<br />

developments in Southern Africa, Australia and the Pacific.<br />

Non-Executive Director: MORRICE CORDINER (Date of Appointment 30 May 2003)<br />

• Mr Cordiner is a corporate lawyer by training and has in excess of 15 years' experience<br />

in the finance and resources industries.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 22

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

• Mr Cordiner is also currently a non-executive director of the ASX and TSX dual-listed<br />

gold explorer, Andean Resources <strong>Limited</strong> (Dec 2003 to present) and the ASX-listed zinc<br />

explorer, Meridian Minerals <strong>Limited</strong> (July 2008 to present).<br />

Non-Executive Director: JOHN SHAW (Date of Appointment 14 November 2006)<br />

• John Shaw has over 40 years experience in exploration, development and operations of<br />

open cut and underground mines. He was previously Vice President of the Australian<br />

Operations of Placer Dome Asia Pacific <strong>Limited</strong> and Managing Director of Kidston Gold<br />

Mines. In recent years he has held the following listed company directorships:<br />

−<br />

IAMGOLD Corporation from March 2006 to present<br />

− Albidon <strong>Limited</strong> from February 2008 to April 2009<br />

− Tri Origin Minerals <strong>Limited</strong> from October 2003 to February 2008<br />

− Lodestone Exploration <strong>Limited</strong> from May 2002 to November 2007<br />

− Gallery Gold <strong>Limited</strong> from November 2003 to March 2006<br />

− Kingsgate Consolidated <strong>Limited</strong> from September 2000 to March 2005<br />

Non-Executive Director: JEREMY READ (Date of Appointment 1 February 2008)<br />

• Jeremy Read has 22 years' domestic and international minerals exploration experience<br />

and was previously the Manager of BHP Minerals Australian Exploration Team. He has<br />

extensive exploration experience for gold, nickel sulphides and base metals. He was the<br />

founding Managing Director of <strong>Discovery</strong> <strong>Metals</strong> from its incorporation in May 2003 until<br />

his appointment as a non-executive director on 1 February 2008.<br />

Non-Executive Director: RIBSON GABONOWE (Date of Appointment 30 May 2008)<br />

• Ribson Gabonowe is a well known Mining Engineer with over 25 years' experience in the<br />

mining industry. For twelve years to Dec 2006, he was the Director of Mines of<br />

Botswana, responsible for administering the legal and fiscal framework governing<br />

mineral exploitation. During the past five years he held directorships in the following<br />

companies:<br />

−<br />

−<br />

−<br />

Morupule Colliery (Pty) Ltd<br />

Botswana Diamond Valuing Company (Pty) Ltd<br />

BCL <strong>Limited</strong> (Pty) Ltd<br />

• Mr Gabonowe is currently a director of Kukama Mining and Exploration, African Coal<br />

(Pty) Ltd, Atlas Minerals (Pty) Ltd and Gabor Consulting (Pty) Ltd. He is also the director<br />

of all <strong>Discovery</strong> <strong>Metals</strong> subsidiaries registered in Botswana.<br />

CFO: PAUL FULTON<br />

• Paul Fulton is a highly experienced CFO who has more than 35 years' experience in<br />

broad commercial management, accounting and Chief Financial Officer roles within the<br />

resource industry.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 23

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Financial Summary | DML<br />

<strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

Current Price A$: $1.29 Mkt Cap. :<br />

$355m<br />

GS&PA DCF: $0.91 ASX Code:<br />

DML<br />

Industry: Materials T/O (mth):<br />

$43m<br />

Free Float 95%<br />

Recommendation:<br />

Price Target:<br />