Goldman Sachs Investor Research - Discovery Metals Limited

Goldman Sachs Investor Research - Discovery Metals Limited

Goldman Sachs Investor Research - Discovery Metals Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

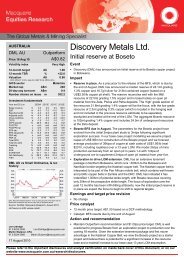

7 October 2010 <strong>Discovery</strong> <strong>Metals</strong> <strong>Limited</strong><br />

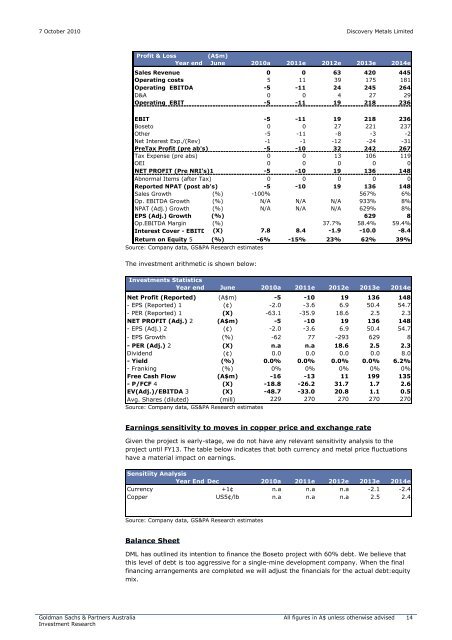

Profit & Loss<br />

(A$m)<br />

Year end June 2010a 2011e 2012e 2013e 2014e<br />

Sales Revenue 0 0 63 420 445<br />

Operating costs 5 11 39 175 181<br />

Operating EBITDA -5 -11 24 245 264<br />

D&A 0 0 4 27 29<br />

Operating EBIT -5 -11 19 218 236<br />

EBIT -5 -11 19 218 236<br />

Boseto 0 0 27 221 237<br />

Other -5 -11 -8 -3 -2<br />

Net Interest Exp./(Rev) -1 -1 -12 -24 -31<br />

PreTax Profit (pre ab's) -5 -10 32 242 267<br />

Tax Expense (pre abs) 0 0 13 106 119<br />

OEI 0 0 0 0 0<br />

NET PROFIT (Pre NRI's)1 -5 -10 19 136 148<br />

Abnormal Items (after Tax) 0 0 0 0 0<br />

Reported NPAT (post ab's) -5 -10 19 136 148<br />

Sales Growth (%) -100% 567% 6%<br />

Op. EBITDA Growth (%) N/A N/A N/A 933% 8%<br />

NPAT (Adj.) Growth (%) N/A N/A N/A 629% 8%<br />

EPS (Adj.) Growth (%) 629 8<br />

Op.EBITDA Margin (%) 37.7% 58.4% 59.4%<br />

Interest Cover - EBITD (X) 7.8 8.4 -1.9 -10.0 -8.4<br />

Return on Equity 5 (%) -6% -15% 23% 62% 39%<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

The investment arithmetic is shown below:<br />

Investments Statistics<br />

Year end June 2010a 2011e 2012e 2013e 2014e<br />

Net Profit (Reported) (A$m) -5 -10 19 136 148<br />

- EPS (Reported) 1 (¢) -2.0 -3.6 6.9 50.4 54.7<br />

- PER (Reported) 1 (X) -63.1 -35.9 18.6 2.5 2.3<br />

NET PROFIT (Adj.) 2 (A$m) -5 -10 19 136 148<br />

- EPS (Adj.) 2 (¢) -2.0 -3.6 6.9 50.4 54.7<br />

- EPS Growth (%) -62 77 -293 629 8<br />

- PER (Adj.) 2 (X) n.a n.a 18.6 2.5 2.3<br />

Dividend (¢) 0.0 0.0 0.0 0.0 8.0<br />

- Yield (%) 0.0% 0.0% 0.0% 0.0% 6.2%<br />

- Franking (%) 0% 0% 0% 0% 0%<br />

Free Cash Flow (A$m) -16 -13 11 199 135<br />

- P/FCF 4 (X) -18.8 -26.2 31.7 1.7 2.6<br />

EV(Adj.)/EBITDA 3 (X) -48.7 -33.0 20.8 1.1 0.5<br />

Avg. Shares (diluted) (mill) 229 270 270 270 270<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

Earnings sensitivity to moves in copper price and exchange rate<br />

Given the project is early-stage, we do not have any relevant sensitivity analysis to the<br />

project until FY13. The table below indicates that both currency and metal price fluctuations<br />

have a material impact on earnings.<br />

Sensitiity Analysis<br />

Year End Dec 2010a 2011e 2012e 2013e 2014e<br />

Currency +1¢ n.a n.a n.a -2.1 -2.4<br />

Copper US5¢/lb n.a n.a n.a 2.5 2.4<br />

Source: Company data, GS&PA <strong>Research</strong> estimates<br />

Balance Sheet<br />

DML has outlined its intention to finance the Boseto project with 60% debt. We believe that<br />

this level of debt is too aggressive for a single-mine development company. When the final<br />

financing arrangements are completed we will adjust the financials for the actual debt:equity<br />

mix.<br />

<strong>Goldman</strong> <strong>Sachs</strong> & Partners Australia<br />

Investment <strong>Research</strong><br />

All figures in A$ unless otherwise advised 14