Unit 6 - Kaplan University | KU Campus

Unit 6 - Kaplan University | KU Campus

Unit 6 - Kaplan University | KU Campus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

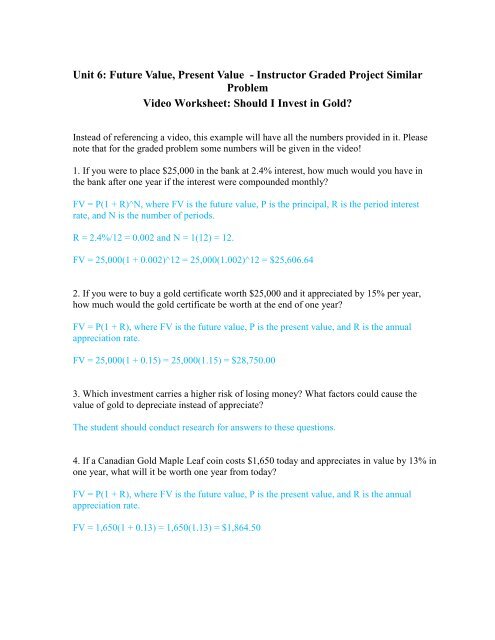

<strong>Unit</strong> 6: Future Value, Present Value - Instructor Graded Project Similar<br />

Problem<br />

Video Worksheet: Should I Invest in Gold?<br />

Instead of referencing a video, this example will have all the numbers provided in it. Please<br />

note that for the graded problem some numbers will be given in the video!<br />

1. If you were to place $25,000 in the bank at 2.4% interest, how much would you have in<br />

the bank after one year if the interest were compounded monthly?<br />

FV = P(1 + R)^N, where FV is the future value, P is the principal, R is the period interest<br />

rate, and N is the number of periods.<br />

R = 2.4%/12 = 0.002 and N = 1(12) = 12.<br />

FV = 25,000(1 + 0.002)^12 = 25,000(1.002)^12 = $25,606.64<br />

2. If you were to buy a gold certificate worth $25,000 and it appreciated by 15% per year,<br />

how much would the gold certificate be worth at the end of one year?<br />

FV = P(1 + R), where FV is the future value, P is the present value, and R is the annual<br />

appreciation rate.<br />

FV = 25,000(1 + 0.15) = 25,000(1.15) = $28,750.00<br />

3. Which investment carries a higher risk of losing money? What factors could cause the<br />

value of gold to depreciate instead of appreciate?<br />

The student should conduct research for answers to these questions.<br />

4. If a Canadian Gold Maple Leaf coin costs $1,650 today and appreciates in value by 13% in<br />

one year, what will it be worth one year from today?<br />

FV = P(1 + R), where FV is the future value, P is the present value, and R is the annual<br />

appreciation rate.<br />

FV = 1,650(1 + 0.13) = 1,650(1.13) = $1,864.50

5. How much would the same coin be worth after 5 years if the appreciation rate averages<br />

13%? Assume that the appreciation would be compounded annually and use the Future<br />

Value Formula for Simple Interest.<br />

FV = P(1 + R)^N, where FV is the future value, P is the present value, R is the annual<br />

appreciation rate, and N is the number of years.<br />

FV = 1,650(1 + 0.13)^5 = 1,650(1.13)^5 = $3,040.02<br />

6. What would a gold Krugerrand coin be worth in one year if its current value is $1,500 and<br />

it appreciates at 11% over the year?<br />

FV = P(1 + R), where FV is the future value, P is the present value, and R is the annual<br />

appreciation rate.<br />

FV = 1,500(1 + 0.11) = 1,500(1.11) = $1,665.00<br />

7. What would the value of the same gold Krugerrand coin be after 10 years if the average<br />

annual appreciation rate is 11%?<br />

FV = P(1 + R)^N, where FV is the future value, P is the present value, R is the annual<br />

appreciation rate, and N is the number of years.<br />

FV = 1,500(1 + 0.11)^10 = 1,500(1.11)^10 = $4,259.13.<br />

8. How much has an American Gold Eagle coin appreciated based upon its original value of<br />

$10 and its current value of $1,600?<br />

FV = P(1 + R), where FV is the current value, P is the original value, and R is the amount of<br />

appreciation.<br />

1,600 = 10(1 + R)<br />

1,600/10 = 1 + R<br />

160 = 1 + R<br />

R = 159 = 159 x 100% = 15,900%<br />

9. If a 1922 gold certificate is currently worth $84,000 and it increases at a rate of 17½%,<br />

how much will it be worth next year?<br />

FV = P(1 + R), where FV is the future value, P is the present value, and R is the annual<br />

appreciation rate.

FV = 84,000(1 + 0.175) = 84,000(1.175) = $98,700.00<br />

10. Sharon collects gold coins. She had several gold coins that she originally wanted $12,000<br />

for. She agreed to sell them for $10,000. Why would she agree to lower her price by $2,000?<br />

The student should consider the possible reasons Sharon would lower her price.<br />

11. If the price paid for the gold coins increases in value at an overall rate of 15% next year,<br />

what will this investment be worth next year?<br />

FV = P(1 + R), where FV is the future value, P is the present value, and R is the annual<br />

appreciation rate.<br />

FV = 10,000(1 + 0.15) = 10,000(1.15) = $11,500.00<br />

12. Do you think that investing in gold is a good investment? Why or why not?<br />

The student should research the pros and cons of investing in gold.